[ad_1]

Onchain Highlights

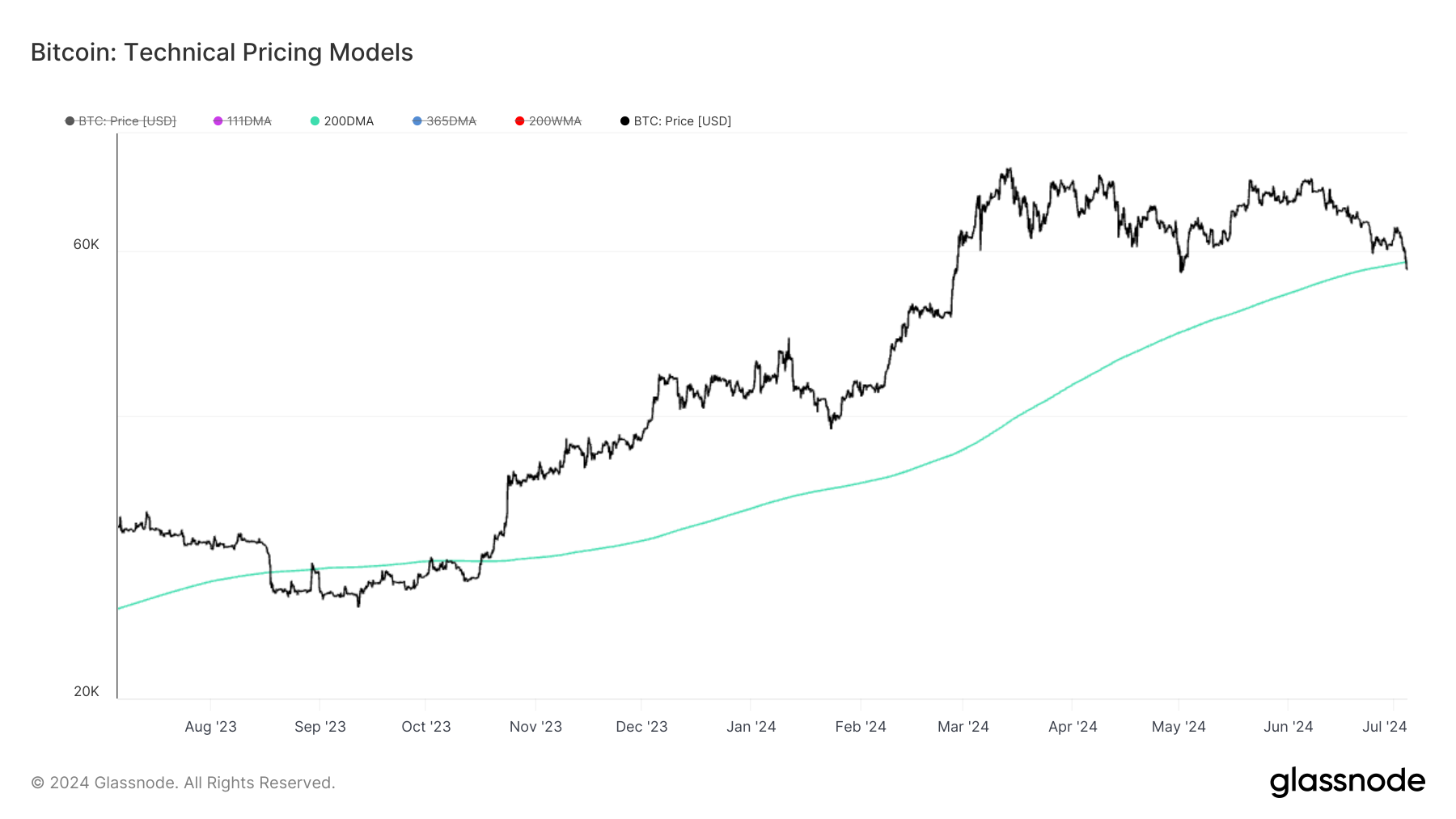

DEFINITION: The 200 Day Easy Shifting Common is a standard technical indicator in Technical Evaluation, generally related to the transition level between a Bull and Bear market.

Bitcoin value actions are influenced by varied technical fashions that present perception into market tendencies and potential future efficiency.

As of July 4, Bitcoin has fallen under the 200-day transferring common (DMA), which is at present at $58,373. The final time Bitcoin fell by this stage was in August 2023.

For the reason that starting of 2024, Bitcoin’s value has proven a sturdy upward trajectory, peaking above $70,000 in March. The chart under illustrates Bitcoin’s value repeatedly testing and, at instances, dropping under the 200 DMA, indicating intervals of market correction.

Traditionally, Bitcoin’s interplay with the 200 DMA has served as a dependable indicator of bullish or bearish tendencies. The long-term chart from 2014 to 2024 demonstrates a number of situations the place the value crossing above the 200 DMA has preceded vital upward momentum, whereas crossings under typically sign prolonged bearish phases.

Present value motion across the 200 DMA suggests warning as Bitcoin’s market dynamics regulate post-halving, doubtlessly signaling the top of the current bullish cycle.

The submit Bitcoin’s bullish cycle questioned as value falls under 200-day transferring common appeared first on CryptoSlate.

[ad_2]

Source link