[ad_1]

N Rotteveel/iStock Editorial by way of Getty Pictures

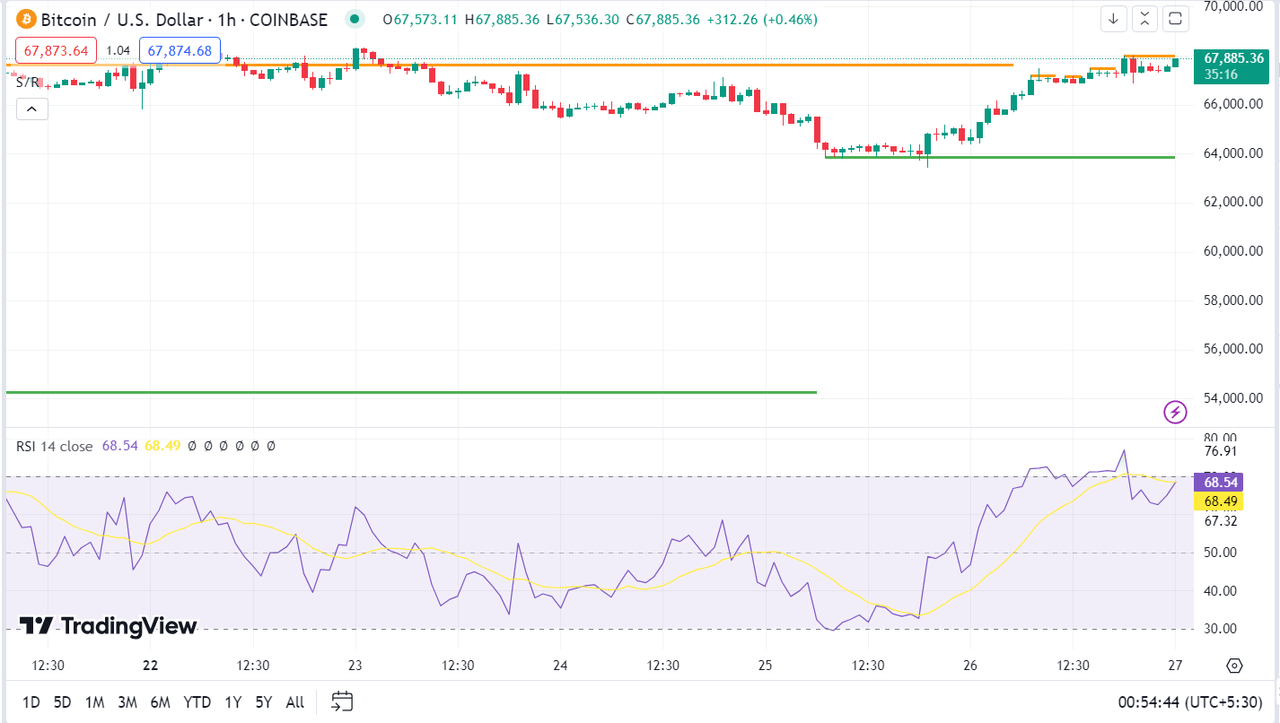

Bitcoin (BTC-USD) is ready to rise barely by 1.6% on a weekly foundation, because the cryptocurrency is anticipated to cap off the eventful week by sitting firmly on the ~$67K mark.

The week was an eventful one, with U.S. President Joe Biden dropping out of the presidential race, spot Ether ETFs going dwell, and a tech sell-off impacting the broader market.

“Bitcoin’s resilience stands out amid current market shifts, together with President Biden’s withdrawal and Thursday’s tech sell-off. The underperformance of the spot ETH ETF signifies the market understands Bitcoin is really distinctive, providing utility, stability, and a confirmed monitor document in unsure occasions,” mentioned Cory Klippsten, CEO of Swan, a Bitcoin monetary companies agency.

“As conventional markets face volatility, Bitcoin continues to claim its function as a dependable retailer of worth and hedge in opposition to financial fluctuations,” mentioned Klippsten.

The world’s oldest cryptocurrency, noticed restricted strikes after Biden mentioned on Sunday he is stepping down from the presidential race. BTC had initially fallen after the announcement, however then regained its floor quickly after.

The week additionally noticed the spot Ether ETFs go dwell on Tuesday. The 9 freshly launched spot Ether (ETH-USD) exchange-traded funds had seen web inflows of $106.8M on their first day of buying and selling.

BTC noticed its largest stoop of the week on Thursday, because it fell round 4% in intraday buying and selling, pushed by weakening investor sentiment for danger property attributable to a wider stock-market rout.

The retreat, which led to a whole lot of thousands and thousands of {dollars} value of bullish bets being liquidated, coincides with a notable drop in equities amid tumbling megacap tech shares. Danger aversion, due to this fact, unfold to the crypto market.

BTC merchants can even hold their eyes peeled for Republican presidential nominee Donald Trump’s keynote tackle on the Bitcoin 2024 conference on Saturday, a three-day occasion that is touted because the world’s largest BTC convention.

Crypto sentiment has been on the rise this month, particularly after the assassination try on Trump that raised his odds of successful the election and drove the so-called ‘Trump Commerce’.

Notable Information

Stifel analyst Invoice Papanastasiou began protection on Riot Platforms (RIOT) with a Speculative Purchase ranking on the view that the market is failing to totally respect its evident trajectory in the direction of turning into the foremost chief in Bitcoin (BTC-USD) mining. The rollout of spot Ether (ETH-USD) exchange-traded funds earlier this week has been “surprisingly profitable” within the wake of seasonally decrease buying and selling exercise, CoinShares Analysis mentioned. CB Funds (CBPL), a cost processor linked to cryptocurrency alternate Coinbase World (COIN), has been fined 3.5M kilos ($4.5M) by the Monetary Conduct Authority for repeatedly violating a requirement that prevented the e-money establishment from providing companies to high-risk prospects, the U.Ok. regulator mentioned. Digital asset know-how firm Marathon Digital (MARA) mentioned on Thursday that it bought $100M value of Bitcoin (BTC-USD) and is adopting a BTC Purchase-and-Maintain technique. Coinbase’s (COIN) asset-management arm is making a tokenized money-market fund, following the footsteps of BlackRock’s (BLK) profitable tokenized treasury product, in response to a Wednesday media report.

Bitcoin, Ether costs

Bitcoin (BTC-USD) rose 4.6% to $67.8K at 3:26 pm on Friday, Ether (ETH-USD) elevated ~4.5% to $3.3K.

[ad_2]

Source link