[ad_1]

Bitcoin Worth jumped 0.34% through the Sunday buying and selling session, showcasing its sustainability above the $60000 psychological degree. The bullish momentum is fueled by whale/establishment accumulation and market anticipation of a 0.5% rate of interest minimize within the September FOMC assembly.

Will Whale Accumulation Drive Bitcoin Worth to New ATH?

In line with on-chain information tracker Spotonchain, an enormous whale has been actively accumulating Bitcoin since August twenty ninth. To date, the massive holder has purchased round 3,933 BTC (price $234 Million) from the crypto alternate Binance with the most recent withdrawal occurring earlier as we speak at an approximate value of $59,591 per BTC.

At the moment, this whale holds 10,491 BTC (valued at roughly $630 million). Sometimes, such giant transactions boast market confidence, as a value rally follows whales/good cash shopping for.

Nonetheless, the identical whale allegedly dumped 7,790 BTC (round $467 million) round June 27 and July 8, 2024, to Binance at ~$59,953, contributing to a pointy 14% lower in Bitcoin value.

This big whale retains withdrawing $BTC from Binance as #Bitcoin broke $60K!

Since Aug 29, the whale has withdrawn a internet 3,933 $BTC ($234M) from #Binance at ~$59,591, with the most recent withdrawal solely 4 hours in the past.

Be aware that this accumulating wave got here after the whale had… https://t.co/GBhH2gDT1V pic.twitter.com/yQ6gnqvjpS

— Spot On Chain (@spotonchain) September 15, 2024

Anyhow, the enterprise intelligence firm Microstrategy has not too long ago elevated its Bitcoin holding by buying 18,300 BTC price $1.11 billion. This buy brings the corporate’s complete Bitcoin holdings to 244,800 BTC, as Govt Chairman Michael Saylor revealed.

Together with whale/institutional shopping for, the Bitcoin value rally to $60000 is extra possible pushed by market anticipation of the September charge minimize.

Following the current cooling of US CPI and PPI inflation figures, hypothesis is rising over a possible 50 bps charge minimize by the US Fed on the upcoming FOMC assembly. In line with the CME FedWatch Instrument, there’s a 50% chance of a 0.5% charge minimize by the US Federal Reserve and the identical guess for a 0.25% charge minimize.

Sometimes, a charge minimize would permit banks to borrow cash extra simply for operations, boosting capital circulation available in the market and inspiring elevated funding in riskier property like cryptocurrency.

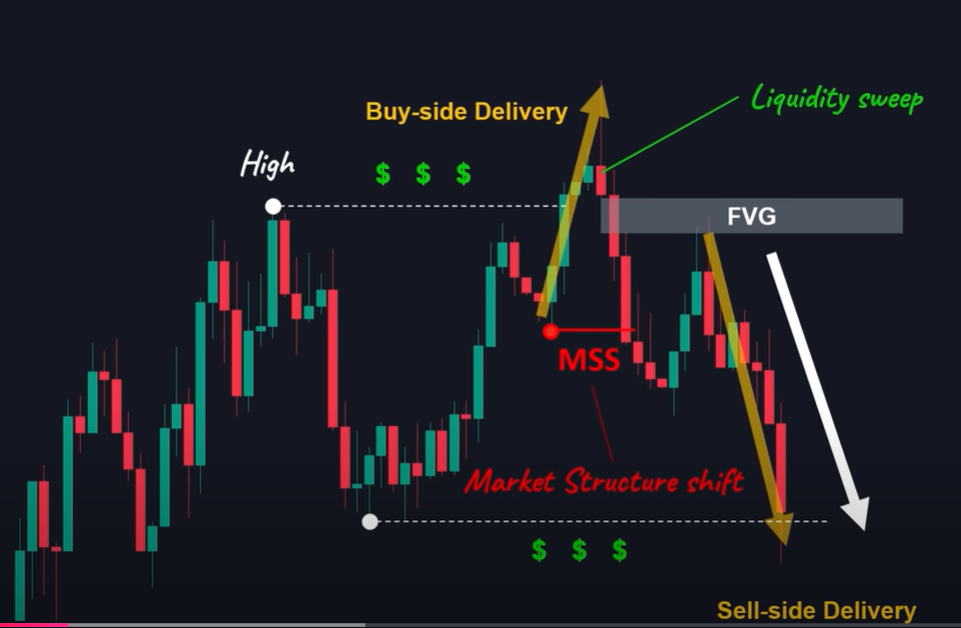

BTC Worth Poised For Main Breakout

The Bitcoin value at $60174 is simply 1% away from a significant breakout of the downsloping trendline. The dynamic resistance intact since late July drives the present correction pattern, and a possible breakout will enhance the bullish momentum.

If the consumers flip overhead resistance into potential assist, the BTC value may goal $68000, adopted by an all-time excessive resistance of round $73777.

Quite the opposite word, the Bitcoin value prediction reveals a notable resistance on the $65800 mark as over 6.84 Million addresses maintain roughly 3.1M BTC.

Due to this fact, if the potential rebound faces provide strain at this resistance, the sellers may drive an prolonged comfort section for Bitcoin.

Incessantly Requested Questions (FAQs)

The rally is being fueled by whale and institutional accumulation, together with market anticipation of a 0.5% rate of interest minimize on the upcoming September FOMC assembly.

The opportunity of a 50 foundation level charge minimize has boosted market confidence, encouraging elevated funding in riskier property like Bitcoin

Bitcoin faces key resistance ranges at $65,800, the place 6.84 million addresses maintain 3.1 million BTC,

Disclaimer: The offered content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link