[ad_1]

Este artículo también está disponible en español.

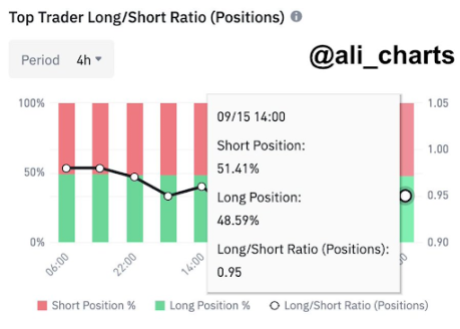

Crypto analyst Ali Martinez has revealed the bearish sentiment amongst Binance’s prime merchants in the direction of Bitcoin. This improvement means that the flagship crypto may quickly expertise vital downward stress.

Binance High Merchants Are Shorting BTC

Martinez revealed in an X (previously Twitter) put up that 51.41% of the highest merchants on Binance are shorting Bitcoin. This means that these merchants count on the flagship crypto to expertise a value decline regardless of its latest restoration above $60,000. Certainly, BTC began this week with a value correction, dropping to $58,000.

Associated Studying

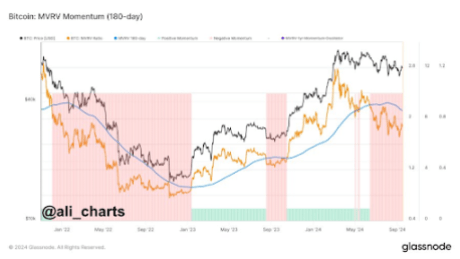

This bearish outlook for Bitcoin means that the rise to $60,000 was a reduction bounce fairly than a bullish reversal. In a latest evaluation, Martinez additionally revealed that the flagship crypto was nonetheless in a downtrend. He alluded to the Bitcoin market worth to realized worth (MVRV) momentum, which he claimed reveals that the flagship crypto has been in a downtrend since breaking under $66,750 in June. He added that the development hasn’t shifted but.

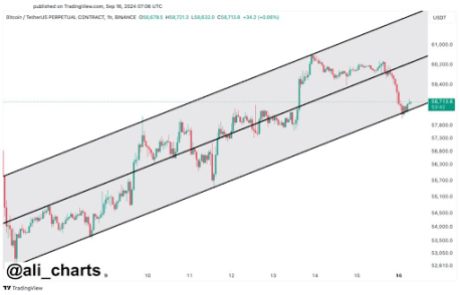

With Bitcoin nonetheless in a downtrend, the crypto dangers struggling additional declines. Martinez highlighted the $58,100 value stage as essential, noting {that a} break under might result in a drop in the direction of $55,000. Alternatively, he said that Bitcoin might rebound to the mid or higher ranges at $60,200 or $62,000 if it holds the decrease boundary of the parallel channel.

In the meantime, crypto analyst Jelle not too long ago highlighted $65,000 as the worth stage Bitcoin should reclaim to take pleasure in a bullish reversal. Nonetheless, reaching that value stage is tough for now, particularly with uncertainty across the imminent fee cuts and the US presidential elections. Bitcoin bulls look to be ready to see how the market reacts to the Fed’s rate of interest determination that can be introduced on September 18.

Additionally it is value mentioning that September is traditionally a bearish month for Bitcoin. This isn’t anticipated to be completely different as buyers look to October because the month they are going to return to the market.

Bitcoin May Nonetheless Drop To As Low As $15,000

Famend economist Peter Schiff has warned that Bitcoin might nonetheless drop to as little as $15,000. He highlighted what he believes to be a triple prime on Bitcoin’s chart. The skilled added that the chart is worse if the flagship crypto is priced in gold. On the minimal, the economist expects BTC to drop to the upward development line at about $42,000, however he doubts it would maintain that help line.

Associated Studying

As such, he predicts that Bitcoin will retest the longer-term help between $15,000 and $20,000. Whereas it stays to be seen whether or not that occurs, Schiff is thought to be a Bitcoin bear and has persistently advocated for Gold over the flagship crypto.

On the time of writing, Bitcoin is buying and selling at round $58,200, down within the final 24 hours, in line with information from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com

[ad_2]

Source link