[ad_1]

Igors Aleksejevs

The Blackrock Sources & Commodities Belief’s (NYSE:BCX) main purpose is to realize excessive present revenue whereas its secondary goal is to realize capital appreciation. The Belief makes an attempt to realize these goals by investing 80% of property into equities and derivatives throughout the Sources & Commodities Sector. The Belief presently provides a comparatively engaging 6.7% yield. Nonetheless, as I described in one among my highest learn Looking for Alpha articles – Retirees Beware: Dividend Investing Is Overrated – many investments centered on yield could be value-traps that considerably lag the whole returns that the broad market averages (i.e. the DJIA, S&P500, and Nasdaq-100) are greater than prepared to offer buyers if they’d merely select to be uncovered to them. Immediately, I’ll take an in depth take a look at the BCX Belief to see if it could be a superb addition to your portfolio.

Funding Thesis

My followers know that I counsel them to construct a well-diversified portfolio, to carry it by way of the markets up-and-down cycles, and heart it on a basis of a superb low-cost S&P500 ETF. That stated, in addition they know that I allocate a share of capital such a portfolio within the “dividend revenue” classes (amongst others). There are clearly a lot of selections for producing revenue, and inside my very own private portfolio, my “dividend revenue” choices are largely O&G firms that pay comparatively robust dividends and ship respectable dividend progress. That is as a result of O&G firms – along with offering revenue – additionally defend buyers from surges in inflation and from numerous geopolitical dangers.

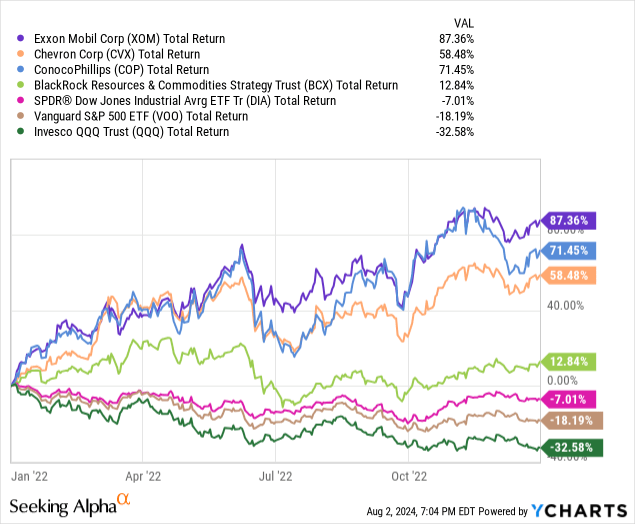

Putin’s resolution to invade Ukraine in 2022 (which took oil to ~$130/bbl and jump-started the worldwide surge in inflation), mixed with the bear-market within the know-how sector in that very same yr, confirmed simply how useful such a technique could be with regards to smoothing-out a portfolio’s general volatility. That is demonstrated within the chart beneath, which compares the whole returns of the three main U.S. O&G firms with that of the broad market averages for full-year 2022:

As could be seen by the graphic, in 2022 the whole returns of ExxonMobil (XOM), Chevron (CVX), and ConocoPhillips (COP) simply crushed the broad market averages (i.e. the DJIA, the S&P500, and the Nasdaq-100) as represented by the (DIA), (VOO), and (QQQ) ETFs, respectively. Nonetheless, additionally word that the BCX Sources & Commodities Belief didn’t do practically as nicely (lime inexperienced line). That is not a superb signal, however let’s take a more in-depth take a look at BCX and see if I’m lacking one thing.

Prime-10 Holdings

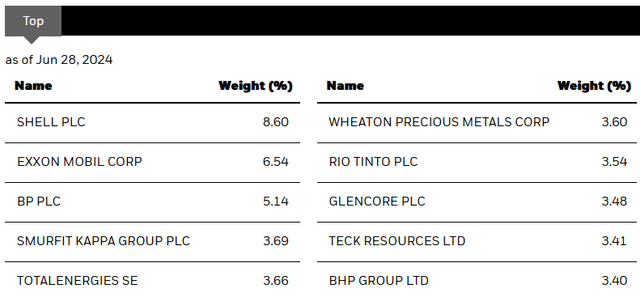

The highest-10 holdings within the Blackrock Sources & Commodities Belief are proven beneath and had been take instantly from the Blackrock BCX webpage, the place buyers can discover extra data on the fund:

Blackrock

The highest-10 holdings equate to a comparatively concentrated 45% of your entire 47-company portfolio.

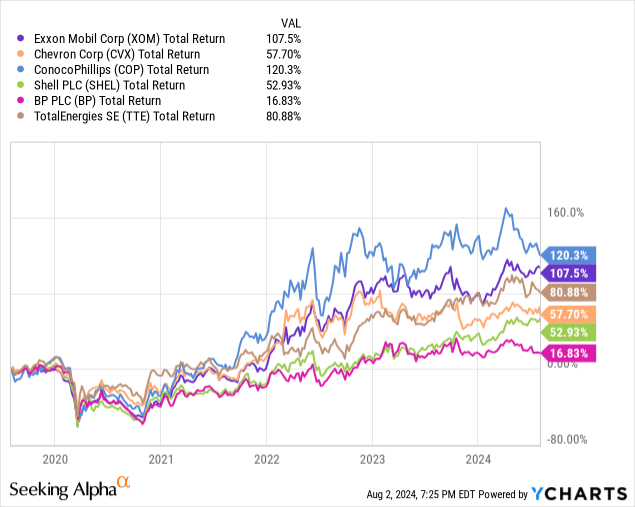

In combination, O&G firms Shell PLC (SHEL), Exxon Mobil (XOM), BP PLC (BP), and TotalEnergies (TTE) – all within the top-5 holdings – equate to 24% of the portfolio. Whereas worldwide O&G firms do are likely to pay larger yields than their American counterparts, the 5-year chart beneath exhibits that their whole returns efficiency typical and considerably lag that of the U.S. “massive three”.

Certainly, as you’ll be able to see within the chart, two of BCX’s O&G holdings (the #1 and #3 holdings) are considerably laggards as in comparison with Exxon, Chevron, and ConocoPhillips. As identified in my latest Looking for Alpha article on ConocoPhillips – the top-performer within the chart above – has a TTM yield of three.5% and is notable for its absence in BCX’s top-10 holdings (as is Chevron, which yields 4.27%).

The #5 through #10 holdings within the BCX Belief are all miners. The #5 holding is Canadian miner Wheaton Treasured Metals (WPM) with a 3.6% weight. In response to Looking for Alpha, Wheaton presently yields only one.06% however the inventory is +36% over the previous 12-months. Wheaton produces and sells gold, silver, palladium and cobalt.

Rio Tinto (RIO) is the #6 holding with a 3.5% weight. RIO inventory is flat over the previous yr however yields 6.85%. RIO is without doubt one of the largest international miners and produces all the things from iron, aluminum, and bauxite to copper, gold, and silver.

Rounding out the top-10 holdings is BHP Group (BHP) with a 3.4% weight. BHP is headquartered in Australia and whereas the inventory yields 5.6%, it’s down -9.5% over the previous yr.

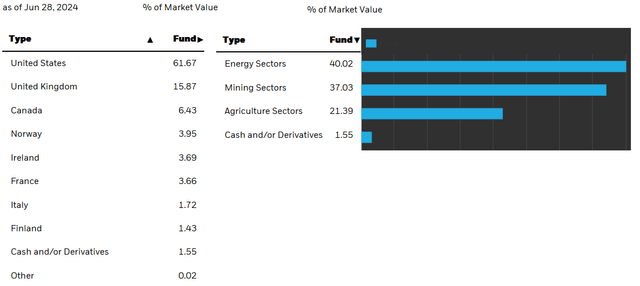

From a complete portfolio perspective, the BCX Belief’s geographic and sector publicity is proven beneath:

Blackrock

As you’ll be able to see, the Belief has important diversification (38.33%) exterior of america. That is good from a forex diversification standpoint, however funds that spend money on worldwide shares usually have a considerably larger expense ratio as in comparison with domestically centered funds, and that’s the definitely the case with BCX: the fund’s 1.06% expense payment could be very excessive and, in consequence, detracts from efficiency.

Given the top-10 holdings already lined, it isn’t shocking that the BCX fund has 77% allotted to the Vitality & Mining Sectors. Funding in Agriculture Sectors equate to 21.4%, with only one.55% allotted to money and/or derivatives.

Efficiency

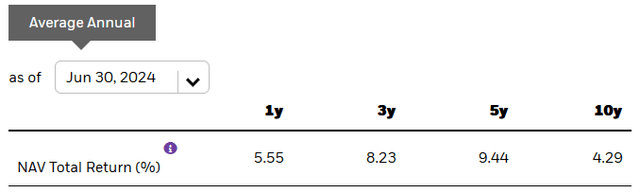

The chart beneath exhibits the long-term efficiency of the BCX Belief:

Blackrock

As you’ll be able to see from the graphic, the BCX Belief’s 10-year common annual whole return of 4.3% is, in a phrase, merely abysmal.

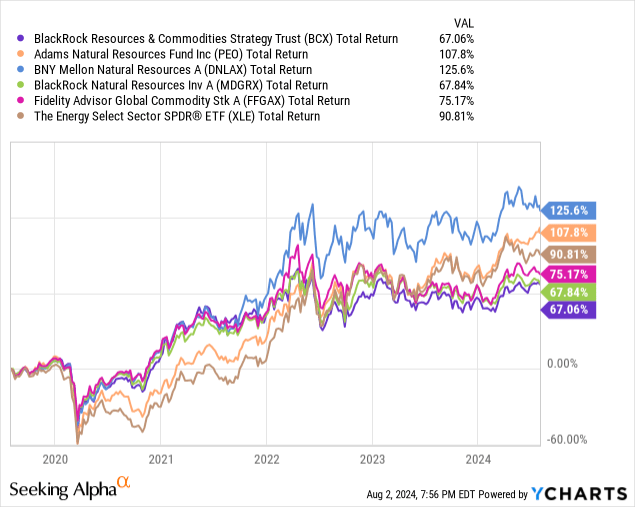

The chart beneath compares the 5-year whole returns of the BCX fund with a few of its rivals – (PEO), (DNLAX), (MDGRX), (FFGAX), and the Vitality Choose SPDR ETF (XLE).

As could be seen within the graphic, the BCX fund is the laggard of all these funds (which had been chosen at random by the writer), and was virtually doubled by the BNY Mellon Pure Sources A fund. The XLE Vitality Sector ETF outperformed BCX by 23% over the previous 5-years, and presently yields 4.27%.

Dangers

Vitality and commodity shares could be considerably impacted by the macro international financial setting. As an example, on Friday, BCX traded -2.6% after U.S. employment knowledge got here in weaker than anticipated – growing the percentages of a recession. Recessions and slower progress can negatively impression international oil and gasoline demand and, in consequence, the earnings and efficiency of BCX’s O&G holdings.

Geopolitically, Putin’s invasion of Ukraine, which broke the worldwide vitality & meals provide chains, benefited the fund’s holdings. Alternatively, U.S. Presidential candidate Trump has vowed to impose 60-100% tariffs on China. That may very probably not solely negatively impression China’s economic system, however would probably trigger extreme collateral injury to the U.S. economic system as nicely. This jogs my memory of the unilateral commerce warfare Trump began with China throughout his first time period, which resulted in driving hundreds of U.S. small farmers out of business. Backside line: slower international progress and dangerous political and financial coverage initiatives negatively impression the useful resource, mining, and agricultural sectors which the BCX Belief is invested in.

Abstract & Conclusion

The Blackrock Sources and Commodities Belief is strictly the kind of funding that I warned retirees about within the beforehand referenced “Retirees Beware”. It provides a brilliant shiny object (i.e. excessive yield), whereas considerably under-performing the market over the medium and long-term. I counsel buyers to SELL this fund, and divide the proceeds amongst Exxon and ConocoPhillips. That can present them with respectable revenue and dividend progress whereas on the similar time giving them the potential for superior long-term capital appreciation.

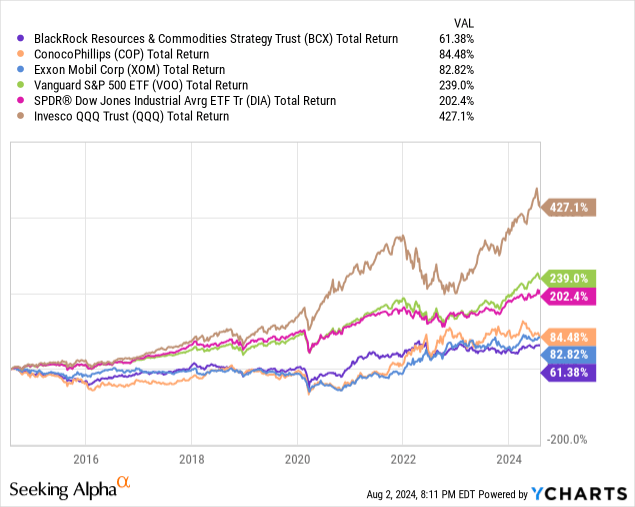

I will finish with a 10-year whole returns chart that demonstrates the numerous alternative prices of investing the BCX fund vs Exxon or COP, and the large alternative prices versus investing within the broad market averages just like the DJIA, S&P500, and the Nasdaq-100:

[ad_2]

Source link