[ad_1]

From chapter to monetary freedom in simply ten years?! As we speak’s visitor resides proof that previous cash errors don’t disqualify you from constructing wealth with actual property. Whether or not you’re neck-deep in debt or struggling to save lots of, you’re solely ever a couple of steps away from taking management of your monetary future!

Welcome again to the Actual Property Rookie podcast! By 2014, Diem Martin had filed for chapter. Ten years later, she has achieved monetary freedom with eight doorways throughout 4 properties and has a $1.2 million web price. How did she do it? She used the identical investing technique that so many newbies use to interrupt into actual property—home hacking. Every new property allowed her to save lots of for her subsequent down cost, and in simply eight years, she had constructed her complete actual property portfolio. If she will do it, you’ll be able to too!

Keep tuned if you wish to learn to get pre-approved for a mortgage after a serious monetary incident, in addition to put money into an costly market and not using a ton of cash. You’ll additionally study why you need to at all times make certain a property will money movement as a long-term rental earlier than shopping for it. We even dive into monetary independence retire early (FIRE), figuring out your FI quantity, and attain your objective as quickly as doable by way of actual property!

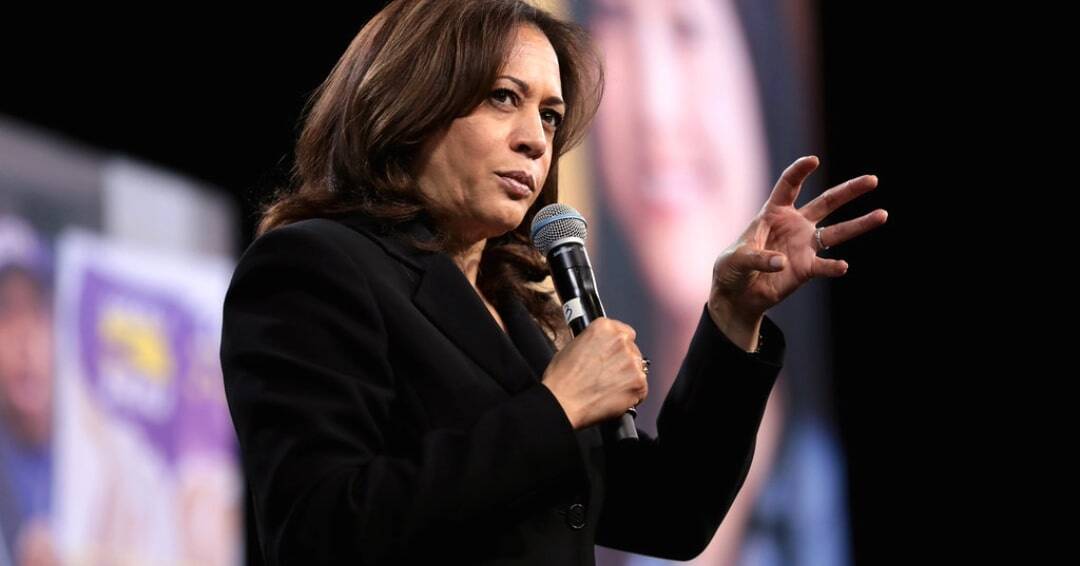

Ashley:Have you ever ever thought {that a} main hit to your funds can be the tip of your capability to take a position a divorce, unfavorable credit ratings, a missed cost, and even chapter? As we speak we’re going to hear a narrative from an investor who was within the worst case situation for his or her funds, however nonetheless discovered a solution to make investments. Welcome to the Actual Property Rookie podcast. I’m Ashley Care, and I’m right here with Tony j Robinson.

Tony:And welcome to the podcast the place each week, 3 times every week, we convey you the inspiration, motivation, and tales it is advisable hear to kickstart your investing journey. Now, right now we’ve Dia Martin who declared chapter when her home cleansing enterprise took a monetary hit and was nonetheless capable of shut in her first home hack simply two quick years later. Now she’s grown her portfolio to be price over $1 million and retired on the age of 35. Alright, cool. dm, thanks a lot for becoming a member of us right now and welcome to the Actual Property Rookie podcast.

Diem:I’m so excited to be right here, you guys. Thanks for having me.

Ashley:So dm, how lengthy have you ever been investing? I

Diem:Purchased that first home in 2016 and from the primary to the second, it took a couple of years, however then after that it was one home after one other and I’ve stopped shopping for for a few years now, having fun with the fruits of that labor. However yeah, since 2016.

Ashley:Superior. And what made you need to get began in actual property investing within the first place?

Diem:Actually, it was the teeing as much as feeling like I wanted to declare for chapter as a result of I believed to myself, how can I not discover myself again at this example once more? And having grown up in part eight housing, my dad didn’t actually know funds administration. I wasn’t capable of study that from him. And regardless that I went to varsity for enterprise, I didn’t actually know handle my enterprise. And so I believed if I used to be going to get out of this determined scenario, I actually wanted to determine a long-term plan. And that’s after I began studying and listening to podcasts. BiggerPockets being an enormous affect at the moment, and that’s why I went into actual property.

Tony:I like how we are able to take our previous experiences and use ’em as motivation to construct a greater future. So kudos you DM for following these footsteps. Proper now, I feel an enormous query that comes up for lots of rookies is the place do you go to get the capital to take a position? So what did that appear like for you? How did you get the capital union to get these first couple of offers?

Diem:I’ve at all times proprietor occupied my first few properties, and particularly with having filed for chapter, I feel it was carried out in 2014, I feel I filed in December of 2013 and it cleared in 2014. And so utilizing the FHA mortgage, you’re capable of get a mortgage for a house after two years out of your chapter file date. That’s not true with a standard mortgage. And so utilizing that mortgage product, I used to be capable of save up a really small quantity as a result of the home was 300, I’d say 350 or much less a thousand {dollars}. And so three and half p.c was, I feel it was like 11 or 13,000 that I had saved up. And I requested for the vendor to pay for closing prices. So actually that was all the one amount of cash that I needed to have out of pocket. So for those who begin with being an proprietor occupant of a house, you’ll be able to actually go in fairly low cash down.

Tony:Now we at all times discuss how investing in California doesn’t make a ton of sense and numerous instances as a result of it’s price prohibitive, however dm, you simply mentioned that it took you lower than $20,000 to get your first property right here in California. I simply need to be sure that’s not getting caught on individuals who stay in an costly market however really feel like perhaps they will’t do it in their very own yard.

Diem:And I feel even now, for those who consider all of the methods that you would be able to’t do one thing, you’ll discover a manner to not do one thing. And other people would possibly say, nicely, rates of interest are so excessive now. Properly, however that was in 2016 now costs are a lot extra. Properly, on the time, even the $335,000 home was form of out of vary for me. I needed to drive an hour north. I purchased my first home in Ukiah, and that was the sacrifice that I made for the larger image. I don’t personal that home anymore. I ultimately bought it and took $88,000 of fairness out to reinvest in numerous methods. However you’ll discover a solution to say no. What it’s a must to search for is a solution to say sure.

Ashley:So throughout that point, how have been you capable of save that capital to make your first buy? What have been a number of the belongings you did to be diligent about saving?

Diem:Yeah, it’s humorous that you simply requested that as a result of now I’m like, I don’t know if I’d advocate this for different individuals, however I learn Dave Ramsey’s e-book.

Ashley:I did the identical. That’s how I paid off all my debt.

Diem:And so I feel what Dave Ramsey is such an important start line. It’s clear your debt, be on a stricter funds with your self, with an finish objective in thoughts, saving for an emergency fund first after which taking all of these additional {dollars} and placing it in direction of an funding sooner or later. However Dave Ramsey isn’t of the mindset of leveraging debt. And in order that’s the place we needed to half methods. Thanks, Dave. It was good to know you, however that’s what it was originally. It was Okay. Properly, so ranging from scratch was getting the profitable chapter, proper, as a result of then it eradicated all of my unsecured debt, which is bank card debt. I didn’t actually have any belongings. I didn’t personal a home earlier than that, and I had some actually low cost firm automobiles that I used to be capable of hold and I used to be capable of proceed to run my enterprise. And at that time, the enterprise trajectory was lastly beginning to lookup, which is why I used to be like, okay, now’s the time to file. As a result of as I begin to really acquire an revenue, I can both spend all of it catching up from the previous or I can begin a brand new path from right here. And so any new {dollars} that got here in that was past what I wanted to completely stay, then that was financial savings in direction of the primary

Tony:Home. So for lots of people, I feel the chapter generally is a scary choice. I assume what, perhaps give us some background on what led you to make that call for your self. You,

Diem:Yeah, I checked out debt consolidation as the primary choice and doing a debt negotiation, however after I checked out that pathway, it required for me to default or cease making funds for the collectors to see that they higher negotiate a decrease quantity with me or they won’t get something in any respect that will gravely have an effect on my credit score rating. And looking out on the pathway to dwelling possession sooner or later, I in contrast that with the choice of submitting for chapter, which I later realized that for those who’re going to go that route, you should be paying on time till you really file as a result of that implies that you’ll not have any derogatory marks for late cost. You’ll solely have a derogatory mark in your credit score for the one main occasion, which is the chapter. So regardless that I had the chapter on my credit score and I had a lower in my credit score rating, it was nonetheless within the excessive six a whole lot and I used to be capable of begin instantly rebuilding after that.So after I in contrast these two choices, that’s why I filed for the chapter. I actually did numerous analysis too to know how I used to be going to get out of that proper after I leased a automobile immediately in order that I can begin having that on my credit score to rebuild. And in the end it labored out down the highway, my highest credit score rating that I used to be capable of obtain earlier than the chapter fell off, which I consider it took seven years to do. I used to be at within the mid seven a whole lot and as soon as it fell off, I used to be instantly over 800. I used to be within the low mid eight a whole lot. So in my scenario it labored out and I feel it’s as a result of I didn’t have any actual main belongings to lose on the time.

Ashley:What was form of the timeline of this? I’d like to know what was the quantity of that debt, how lengthy would it not have taken you to pay that off, and the way lengthy did it really take that point interval? I feel you had mentioned two years going to chapter and shopping for your first property. Are you able to examine the 2 completely different paths and the monetary pressure it will’ve triggered on you going the opposite manner?

Diem:I’d say 50,000 of debt. I claimed extra as a result of it was like all the pieces I wanted to place in there, I put in there, proper, as a result of I’m doing it in any case. However realistically, I feel it ended up being like perhaps 66,000 of debt that I cleared, however the 50 ish thousand chunk was what was holding me again. And when you consider the scale of the down cost, proper? I really wrote it right here. It was $11,725 to get a down cost into the primary home. That will’ve been doubtlessly six years later or six instances, I assume six instances the quantity that I’d’ve needed to first repay after which save for that down cost. Or if I used to be attempting to save lots of for an emergency fund concurrently, that will be even longer. So it was fairly clear what the choice wanted to be as soon as I checked out all of these issues.

Tony:So precisely how a lot time after the chapter and if you really purchased the primary dwelling

Diem:Two years. I purchased the primary dwelling in November, 2016, so I cleared the chapter early of 2014. So I’d say it’s most likely two and a half years

Tony:Later. Okay. So two and a half years now. You talked about standard was going to be a problem, and I feel you mentioned you went with an FHA mortgage. Possibly simply give us the POV of what it seems to be like to use for an FHA mortgage, two and a half years publish chapter. Was there extra concentrate on you as a borrowed? Had been there perhaps hoops you needed to soar by way of that another person didn’t? Simply stroll us by way of what that have regarded like out of your perspective.

Diem:Actually, there wasn’t any added pressure that was attributable to the chapter as a result of this mortgage program specifically allowed so that you can qualify with a minimal credit score rating, which I used to be handed. I feel their minimal credit score rating was within the 5 a whole lot even. Please don’t quote me on that. And mine was within the excessive six a whole lot or mid six a whole lot. So my credit score rating was wonderful. I handed the timeline necessities for the reason that chapter to qualify. The one factor that held me again was my revenue qualification as a result of as an entrepreneur, they have been going to take the typical of the final two years with a enterprise that was beginning to make a flip for the optimistic. My present yr would’ve certified for revenue, however my earlier yr didn’t. And so I needed to ask my sister and my brother-in-law to cosign for me, which they did. And with that, I introduced them with an exit technique that I’d both refinance them out or I’d promote the home, which finally I bought the home and so they have been tremendous supportive about that. They bought a really good Christmas present from me that yr. And typically it takes a village.

Tony:And D, kudos to you for taking the time to essentially map out what path makes probably the most sense for me. Like I mentioned, I feel loads individuals can be afraid of the large B phrase, however you probably did the maths, you mapped it out, you mentioned, Hey, what will give me the most effective path in direction of dwelling possession? So kudos to you for locating that proper resolution. However I feel I additionally simply need to spotlight for the rookies that we’re not essentially encouraging everybody to observe in dms footsteps. Precisely. And perhaps file for chapter. I feel what we’re telling you to do is to guage your distinctive scenario and weigh all of the choices which might be obtainable to you and see what makes probably the most sense. And perhaps it’s doing what DM did, perhaps it’s go on a special route. Possibly it’s one thing that we haven’t mentioned. However the focus right here is what’s the finest path and what makes probably the most sense in your particular scenario.

Ashley:So we do should take a fast break, however extra from DM and the way she grew her portfolio to eight properties simply with home hacking. However whereas we’re away, make certain to take a look at biggerpockets.com/agent so you could find an important deal too from an investor pleasant agent. Okay. Welcome again, dm. Stroll us by way of your first actual property deal and form of give us the breakdown of the numbers on it.

Diem:Yeah, so the primary deal was that home in Ukiah. I purchased it for $335,000. That was utilizing the FHA mortgage on the three and a half p.c required down cost. In order that was $11,725 with this explicit home and lots of the different purchases that I’ve made since then, I requested that the vendor pay for closing prices, so I didn’t should pay for any of that. This home additionally had a granny unit within the again, and I very deliberately bought it due to that. And so after I went in, there was a tenant there that was already paying lease, however she fairly shortly after that left. And I used to be glad for it as a result of I needed to check out Airbnb. And so I furnished the unit, I rented it out on Airbnb. The mortgage month-to-month was round 2200 I consider. And so the Airbnb was nearly overlaying all of that when it comes to rental. After which inside the home, it was a two bed room, one lavatory unit. So after I first moved in, it was with an ex-boyfriend on the time, which he contributed lease. After which once we parted methods, I had a roommate transfer in and he contributed lease equally. And so I used to be residing there mortgage free and utility free, and no matter I used to be saving up in lieu of that was going to be going in direction of the following home.

Ashley:That’s such an important level there of the way you’re saving cash on what you’d be paying and residing prices. As a result of numerous instances you’ll be able to have a look at it and like, nicely, I’m not money flowing, however you’re saving what you’d be paying to stay anyplace else. And that may be an enormous amount of cash. Typically that may be a large financial savings and may actually speed up your investing journey through the use of this technique. So dm, how have you ever used that first property to form of propel your self to the opposite ones?

Diem:Yeah, when you consider saving cash, the tagline is like, don’t purchase a latte. Nevertheless it’s like, what for those who worn out your complete mortgage cost as an alternative after which saved that, proper? Or don’t drive an enormous fancy automobile till you actually can. So I feel tackling these greater financial savings can be the objective. And I saved over a time frame, there was a little bit little bit of a pause in between as a result of I noticed that being in Ukiah, it was actually laborious. I’m tremendous social and I like to see my family and friends. And the one hour commute, regardless that I used to be working from dwelling, was actually laborious due to how usually I needed to see them. So over time, as I continued to save lots of for the following property, I really moved out of the Ukiah home as soon as a while has handed. And I rented a spot in Santa Rosa as a result of I didn’t fairly attain the benchmark for the down cost of the following home but. And I changed myself as a tenant of that home. I bought one other tenant to stay with my roommate on the time. And in order that revenue supplemented the lease that I used to be paying in Santa Rosa, I used to be nonetheless capable of aggressively save extra, however I additionally Airbnb bead my very own bed room in my very own condo, and I slept on the sofa at any time when I had a visitor. In order that was wild. And that additionally made courting life actually laborious.

Tony:I bought to provide you some credit score, proper? Since you supercharge the home hack technique the place the primary home that you simply purchased, you had the A DU, after which I like the hustle of renting out the bed room and the place that you simply have been renting and sleeping on the sofa. So kudos you for doing that. I assume simply perhaps give us within the listeners a way of what your portfolio really seems to be like right now.

Diem:As we speak my husband and I, we’ve two properties in Santa Rosa, California, one in all which we stay in, each of that are form of like mega properties. So we purchased them as single household leases. We added both an A DU or JADU. After which we sectioned off an space to make right into a one bed room, one lavatory Airbnb suite rented by the night time. In order that’s 5 models as a result of it’s three on the opposite one, two right here, plus the one we stay in. After which in Phoenix, Arizona, we’ve a single household dwelling with a gorgeous pool, and I want I may very well be there extra usually. That was began out as a midterm rental and midterm rental, however when the market modified there, we transformed it to a long-term rental. So now we don’t get to go to anymore. After which we’ve a home in Portland, Oregon, which has an hooked up A DU as nicely. And so in complete that’s about eight models, however solely amongst 4 properties.

Ashley:Properly, congratulations on constructing out your portfolio. One factor I actually need to dig in is that you simply have been capable of pivot and alter methods. May you perhaps give some recommendation to a listener who perhaps is utilizing one technique proper now and it’s not understanding for them, the way you have been capable of make that pivot from midterm and quick time period to a long-term tenant? And form of give us a little bit background of how that call happened. I

Diem:Undoubtedly assume this ought to be a part of the evaluation course of if you go into if a property may be just right for you, as a result of regardless that I take advantage of these properties, particularly those which might be out of state, I take advantage of them as short-term leases and midterm leases to get probably the most cashflow. I knew that if that market took a flip, I may solely get cashflow of what it regarded like at common market rents, proper? For long-term leases. And so after I regarded on the quantity to see if this was an excellent funding, I wanted it to not less than cashflow as a long-term rental earlier than transferring ahead and buying it with the concept of utilizing it as a short-term or midterm rental.

Tony:Now for Ricky’s which might be simply getting began, dm, I imply, do you’re feeling that it is a technique that also is sensible right now?

Diem:I do assume that if the numbers work, then they work interval. Now, you would possibly discover fewer choices the place the numbers work, however there’s no denying it that if the numbers make sense, you simply can pursue it. And so they’re additionally, then again, there’s what we name loads on BiggerPockets evaluation paralysis. It’s like you may overdo it and never take motion. So there’s a pair issues that I feel are essential when it comes to giving your self a way of safety. The very first thing is to be sure that the numbers make sense on a long-term rental market lease foundation. The second factor is an choice to separate up the unit. May you try this with this explicit home that you simply’re desirous about? Should you wanted to make it into two models or three models to extend the lease to be able to just remember to cowl your mortgage cost?Is that one thing that you are able to do? Is it a renter pleasant state or is it a spot that can difficulty permits extra simply for a DU conversions or reconfiguring the within of a house? After which even in my Santa Rosa, my rental property, I feel it is a nice instance of diversifying your danger. My A DU, there’s a part eight tenant. The primary a part of the home is a midterm rental that’s furnished for 30 days or extra. After which the suite that’s within the again is a by the night time Airbnb. So in that one property, there’s already a variety of danger to scale back emptiness or ever having a cut-off date the place it’s gathering zero rents.

Ashley:Di how are you managing all of those completely different leases, and what are your processes in place for this?

Diem:So I do have an app. I take advantage of guestie. There’s numerous completely different choices on the market, and that simply helps me see by way of the varied platforms like Airbnb, VBO, reserving.com, it funnels all of it into one place and even bookings the place I enable individuals to e-book direct and that helps me see who’s coming and going inside that app. You are able to do automated messages that say, Hey, welcome. Right here’s your check-in directions. After which you may as well do, even on Airbnb, you’ll be able to have pre-filled messages response. So if somebody asks me what’s round right here, that’s good, I kind it in after which I retailer that as a saved response. So the following time when somebody asks me that, my response appears real and honest as a result of it’s a response that I used at one time, however now I simply should click on a pair buttons to provide that very same long-winded reply out. Outdoors of that, my dad, my husband, we’ve a cleansing military for the native ones if we have to do cleanings. After which flats.com, I take advantage of to routinely accumulate rents for my personal leases or the long-term tenants. So simply utilizing a combination between methods and programs. What

Ashley:About if you find yourself home hacking and also you’ve had any person you shared a room? Any suggestions or methods as to when somebody’s simply beginning out home hacking of belongings you want in your lease settlement when you will be residing along with your tenant?

Diem:Properly, in case you are residing with the tenant in your house, that’s a little bit bit extra explicit. So I don’t choose having long-term roommates. In order my portfolio expanded the place I may simply stay inside the home on my own, then the secret is to have outside entry to these models and shut them off or restrict the entry within your own home. Just like the downstairs suite with the bed room and loo, they will enter by way of the aspect gate and so they have their very own door into their very own unit. They don’t come into my home. Similar factor with the ADUs or the J ADUs. So far as limiting issues that would come up as a possible downside, it at all times is about setting it on the entrance finish. So for Airbnbs having an inventory of guidelines that you simply clarify upfront. And so once they break it, even for those who’re not closely implementing it or creating issues with them, you’ll be able to simply say by staying right here, you’ve agreed to those guidelines, please ensure you respect them.And I’ve discovered that over time, that’s sufficient. As soon as I discover a new factor that I ought to put in my guidelines that I didn’t consider earlier than, I’ll achieve this. After which the remainder is form of such as you simply bought to take it with all of the successes that it comes with, proper? There’s going to be some issues and issues that it’s a must to cope with and also you don’t need to let it jade you since you don’t need to come throughout with new visitors as like, oh, you’re going to break my property as a result of final man did. It’s identical to even when I add a brand new rule, it’s with a pleasant contact. And on the finish of the day, I do know I personal the home. So if I actually should kick him out, I’ll simply try this. However haven’t needed to to date.

Tony:Properly, dm, we’re going to listen to all about the way you hit monetary freedom, which is a objective for lots of oldsters listening to this podcast. However first we’re going to take one final fast advert break. Alright, so we’re again now. dm. I need to discuss monetary independence, monetary freedom fi. So did you’ve gotten a monetary independence objective in thoughts? And I assume what did you do to achieve that quantity?

Diem:I didn’t have a quantity in thoughts. I had a way of life in thoughts as a result of the quantity can change, particularly with price of residing altering or in inflation. However in my thoughts, monetary freedom meant that the passive revenue or semi passive revenue that I earn on a month-to-month foundation is sufficient to cowl my requirements. And that additionally features a little little bit of touring after which the work that I select to do as a result of I don’t actually see myself simply not working. I like it as a result of I get to decide on what I do and I design my very own life. So in that sense, the work that I do, no matter revenue that it generates goes to be including to financial savings for the following funding, including to extra journeys that we get to take including to I get to drive a enjoyable zippy automobile. So these are the issues that I try for. And now I really feel like I’ve achieved that, however I nonetheless work as a result of I actually prefer to,

Ashley:And as you talked about, the life-style modifications, I imply, setting your quantity now may very well be good for you now, however then as you mentioned, your way of life can change as to various things that you really want. After which that’s the place it’s like, okay, I’m going to purchase one other property to really go and pay for this or no matter I would like. I need to do one other trip a yr, so I’m shopping for a cashflow property that’s going to pay for that. And that’s okay. And I feel typically you get caught up in defining an excessive amount of of a quantity after which attending to the purpose the place, okay, I’ve reached that quantity, I’m carried out. And to begin with, for those who’re an entrepreneur, that’s going to get actually boring actually quick. And so there’s the saying, hearth the place it’s monetary independence, retire early. However you’ll discover most frequently numerous entrepreneurs, particularly actual property traders, simply take the PHI portion the place it’s monetary independence as a result of they bodily simply can’t cease working.And perhaps that’s not really working for a paycheck, however perhaps that’s filling some form of ardour challenge or one thing like that. So I feel that’s an effective way to take a look at it, is to what would you like your way of life to be? But in addition having that choice of you continue to have a enterprise, you continue to have a supply of revenue, you’re nonetheless working in order that for those who resolve that you simply need to improve that wonderful variety of what you want, it’s nonetheless obtainable there. And I feel too usually the idea of economic independence means utterly not working in any respect, which is achievable, which might occur. However in actual property, there are such a lot of ups and downs. Like subsequent week I’m having a $4,000 plumbing invoice come up, and that’s hitting my cashflow on that property by a number of months. And so I feel having some form of backup or having a number of revenue streams is an effective way to achieve even sooner, however extra importantly, to maintain having that monetary independence too. So I assume dm, our form of subsequent query to that is what’s subsequent in your portfolio?

Diem:Properly, you’re proper. Referring to that final level. I bear in mind after I made my marketing strategy out of school, I mentioned, this yr I’m going to make this and this a lot. After which after I get to $150,000 a yr, I don’t know what else I’d need to do. That’s all the cash I ever must make. After which as soon as I cross that, I’m like, nicely, crap, now I’ve to have new targets. And so I’m not likely certain, however the essence of my values round monetary independence stays true. It’s that it’s a way of life that I’m pursuing, a way of peace of thoughts. And one factor I’ll contact to on with the numbers that we talked about earlier than is that with cashflow for actual property, please don’t overlook to account for emptiness and repairs as a result of it’s not likely cashflow till you’ve accounted for placing some cash apart each month for that.And that’s the form of peace of thoughts that, I imply, how may you’ve gotten, as a result of my web price is 1.2 million now, however the actual property portfolio is about 2.6 million. It’s like how are you going to have that many properties leverage that a lot debt and nonetheless sleep at night time? You get umbrella insurance coverage, you be sure that the properties are correctly insured to start with, after which you’ve gotten these financial savings that you simply proceed so as to add to and also you don’t take from, as a result of finally it’s going to be wanted and also you’re going to should deploy it. So I simply assume the following factor is like, okay, nicely, if Jake and I need to have youngsters, which we don’t know if we do or not, however we’re fascinated with that. So that will be a requirement of economic sources. What does it price to have a child? What does it price for one in all us to work a little bit bit much less? And that will be the quantity that I’d attempt to offset with the following set of investments.

Ashley:I noticed one thing the opposite day speaking about how a lot it really prices to have a child. And I don’t know the place this, it was simply on social media, so I don’t know the way correct it was, but it surely mentioned that it’s round $30,000. Your first yr that you’ve got a child is what it really prices you to have a child, which is a large chunk of cash. That’s a down cost of property relying on what market you’re in.

Diem:And I need to contact too, on the concept of getting a child within the circumstance of home hacking. One thing that I’ve considered is that solely my JADU most likely would stay in my dwelling as a rental. I feel that candy, it doesn’t have sufficient soundproofing, and I’ll even want that as an additional room for akin. And so that you get your self into a way of life of getting used to no mortgage, no utilities, after which rapidly you’ve gotten numerous payments to pay for. And in order that’s the downside, I assume, about home hacking and this concept that if I moved out at some point and needed to have a home of my very own with no renters in sight, then I must have sufficient passive revenue to cowl for that mortgage totally. And perhaps that may very well be a future objective to degree as much as the place all of my money flows between the homes pays for me to stay by myself on my own and my little household. However yeah, that’s one thing that I’ve realized alongside the way in which is I get too comfy right here.

Ashley:Properly, Deanna, I feel you form of show an important level as to, there was at all times this normal of home hacking of any person saying, I’ve a household. I can’t home hack. I can’t have any person renting a bed room, or I can’t transfer my household from the first. However there’s so many various choices now that home hacking contains, for instance, having a separate suite or a separate unit round my space in western New York, there’s numerous properties which have walkout basements the place there’s doorways and plenty of home windows on one bottom of the basement, and you may flip that into a set including an A DU, or perhaps it’s including a little bit tiny, a-frame or a cabin on a property. So many various choices to really home hack than having any person transfer in with your loved ones too.

Tony:Properly, dm, you shared a ton of nice data all through this complete podcast, and I’m hoping that you simply encourage fairly a couple of of our listeners to A, there are methods to beat some early monetary hardships. B, there’s much more worth within the hustle and the laborious work that comes together with actually focusing in in your targets. So I assume perhaps what’s the largest takeaway that you’ve got for our rookie viewers?

Diem:I’ve realized a couple of methods alongside the way in which that as a complete, one in all my largest suggestions is simply to proceed to study and take heed to podcasts like these. You simply take one nugget away and it may prevent 1000’s a yr. As I listened to extra individuals and their particular person experiences, I realized extra issues. I realized about price segregation, which is the next degree tax technique on listening to podcasts from BiggerPockets or how one can take away PMI. Even for those who put lower than a 20% down, you’ll be able to eradicate that mortgage insurance coverage over time and you may make it even sooner with sure methods. So it continues to be a passion and a studying like individuals with bank card factors, proper? That’s a complete recreation. Utilizing bank cards and utilizing factors to journey the identical may be utilized to one thing that you simply understand as complicated as actual property.It’s only one nugget at a time. And I feel that’s the entire studying that I’ve carried out over time. Lately I bought my realtor’s license, and now I’m an agent in California to assist individuals as a result of that’s that piece that I get enthusiastic about. It’s like there’s this complete arsenal of instruments that I’ve for you. Let’s deploy these and show you how to construct a legacy. As a result of I grew up in a hut. I used to be born in Vietnam, I lived on dust. There was no electrical energy, no plumbing. And now I stay within the land of the free with $2.6 million of actual property. It blows my thoughts, however it’s actually only one nugget at a time.

Ashley:Superb. Properly, dm, thanks a lot for sharing your story right now with us. We actually loved having you on and liked your own home hacking journey and the way you’ve been capable of attain monetary independence. And thanks for laying out your path for us so another person can observe up. If you wish to study extra details about dm, we’ll hyperlink her data into the present notes. Thanks guys a lot for listening or watching. Should you’re on YouTube, ensure you hit that like button. In case you are listening in your favourite podcast platform, make certain to observe the podcast so that you get alerted when new episodes are launched. I’m Ashley. And he’s Tony. And we’ll see you guys subsequent time on the Actual Property Rookie podcast.

Tony:This BiggerPockets podcast is produced by Daniel ti, edited by Exodus Media Copywriting by Calico content material.

Ashley:I’m Ashley. He’s Tony, and you’ve got been listening to Actual Property Rookie.

Tony:And if you wish to be a visitor on a BiggerPockets present, apply biggerpockets.com/visitor.

Assist us attain new listeners on iTunes by leaving us a ranking and overview! It takes simply 30 seconds and directions may be discovered right here. Thanks! We actually recognize it!

Excited by studying extra about right now’s sponsors or changing into a BiggerPockets accomplice your self? E mail [email protected].

Observe By BiggerPockets: These are opinions written by the writer and don’t essentially signify the opinions of BiggerPockets.

[ad_2]

Source link