[ad_1]

filo/iStock through Getty Photographs

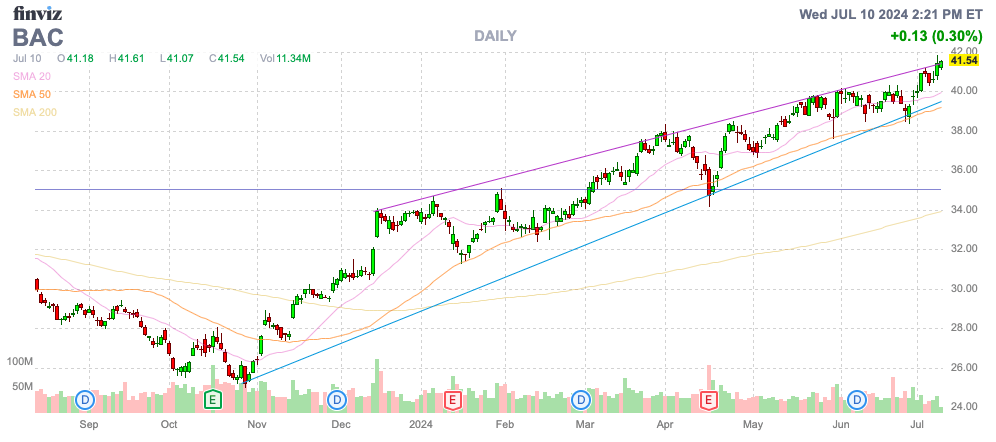

Regardless of the economic system floundering and market consultants beginning to push fee cuts, Financial institution of America (NYSE:BAC) and different giant financial institution shares commerce at multi-year highs. The sector has gotten a lift as a consequence of dips in capital necessities, however the sector faces an surroundings of decrease charges and doubtlessly greater mortgage dangers. My funding thesis is extra Impartial on the massive banking inventory of above $40 after pushing traders to repeatedly purchase the inventory down nearer to $30 and beneath within the final 12 months or so.

Supply: Finviz

Q2 ’24 Earnings Preview

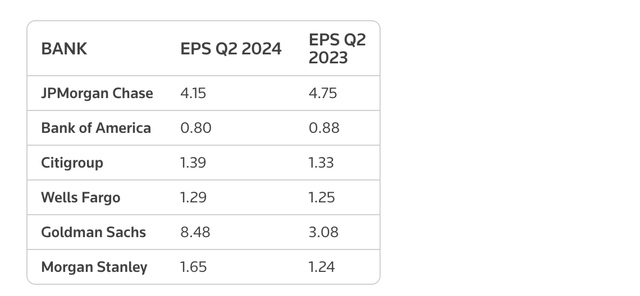

BoA heads into Q2 earnings on July 16 earlier than the market opens on Tuesday with restricted expectations. The consensus analysts’ estimates have the massive financial institution watching EPS slip within the simply ended June quarter.

The forecast is for BoA to report an EPS of $0.80 after reporting $0.88 final Q2. The outcomes seem in step with the expectations for JPMorgan Chase (JPM), whose analysts forecast EPS to dip by double-digits from final 12 months, as proven beneath.

Supply: Reuters

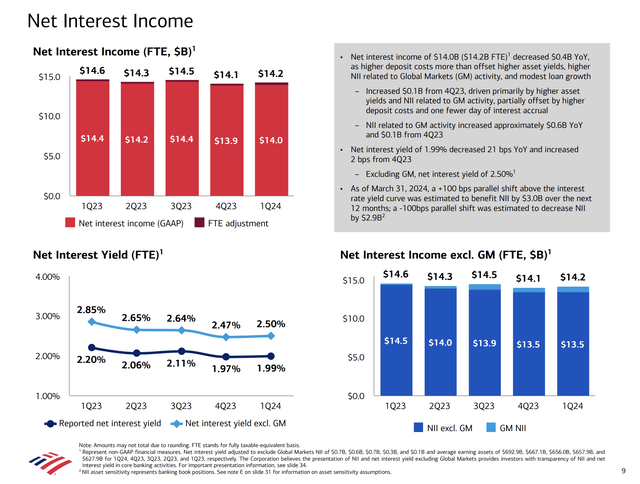

As a consequence of excessive rates of interest, BoA faces main NII headwinds and a tepid lending surroundings. NII was down $0.4 billion YoY in Q1, and Q2 is forecast to slide even additional, with web curiosity yield of simply 1.99% within the final quarter.

Supply: BoA Q1’24 presentation

The surroundings is not anticipated to enhance till the Fed cuts rates of interest later this 12 months with 1 or 2 fee cuts. The big financial institution forecasts a $3 billion affect to NII over the following 12 months primarily based on a 100 bps shift in rates of interest with a profit from a parallel shift above the rate of interest yield curve.

Piper Sandler analyst R. Scott Siefers forecast the NII bottoming at ~$13.9 billion in Q2 ’24 and reaching a stage of as much as $14.6 billion by This autumn. The prediction is for the web curiosity yield to bounce again to 2.3% to 2.4% over the approaching years, offering a tailwind to the enterprise.

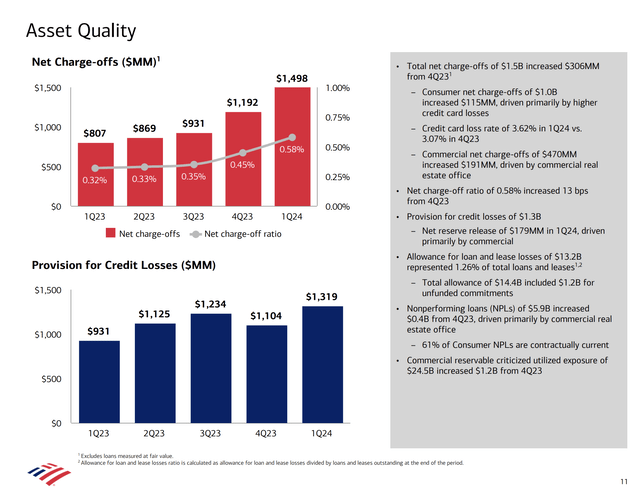

Asset High quality Focus

On the flip facet of the NII profit forward, a giant focus of the Q2 earnings report is the continuing points in asset high quality. BoA posted a soar in web charge-offs to $1.5 billion within the March quarter, almost double YoY.

Supply: BoA Q1’24 presentation

The big financial institution nonetheless has very minimal web charge-off charges of 0.58%. BoA really reported a web launch of reserves ending with an allowance for mortgage lack of simply $13.2 billion.

BoA has whole loans and leases of $1.05 trillion on the finish of Q1. The largest danger to the funding story is bigger charge-offs from weaker bank cards and industrial loans throughout a possible recession within the 12 months forward.

The big financial institution is reporting quarterly pretax revenue within the $7 to $8 billion vary, so any improve within the provision for credit score outcomes would have a considerable affect on financials. A giant motive for the decrease EPS this 12 months is the almost doubling of the web charge-offs resulting in a lot greater mortgage provisions.

BoA just lately introduced an 8% hike to the dividend after passing the stress take a look at. The corporate will begin paying a quarterly dividend of $0.26 for a dividend yield of two.5%.

The financial institution had a CETI ratio of 11.9% after Q1 earnings, and the brand new requirement for the CET1 ratio following the stress take a look at is 10.7% on October 1. The Fed is seemingly decreasing the GSIB requirement, as the massive banks have pushed again on the surplus capital necessities layered onto the massive banks over the past decade.

The inventory trades at ~12x 2025 EPS targets of $3.55, requiring ~10% development from the 2024 EPS targets. BoA could be way more interesting, if the inventory wasn’t buying and selling at multi-year highs and almost 1.7x tangible e book worth.

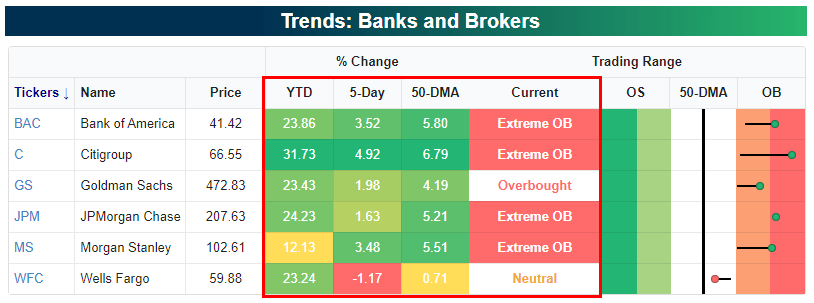

BoA has a strong dividend yield of two.5% going ahead, however the inventory value is clearly overbought after the large rally over the past 12 months. In response to Bespoke, the entire banking sector is overbought, with shares like BAC and JPM within the extraordinarily overbought space being ~6% above the 50-dma.

Supply: Bespoke

Takeaway

The important thing investor takeaway is that Financial institution of America Company inventory is much less interesting now, buying and selling close to multi-year highs, and certain going through extra mortgage provisions as a consequence of a weakening economic system. The inventory gives a strong dividend for long-term traders, however the capital returns are probably tapped out right here above $40. Buyers ought to wait earlier than a pullback to purchase extra shares.

[ad_2]

Source link