[ad_1]

Hiroshi Watanabe

Earlier this yr, in July, I issued a bullish thesis on Bain Capital Specialty Finance (NYSE:BCSF) indicating a transparent purchase given the sturdy state of the underlying fundamentals and a presence of a ~ 10% low cost to NAV. In different phrases, I noticed no significant justification as to why BCSF ought to commerce at such a reduction.

The one purpose what might theoretically push down the a number of right here have been the exposures past the primary lien property, which collectively accounted for roughly 33% of the entire asset base. Nevertheless, if we dissect additional the exposures that come by way of the three way partnership automobiles, we’ll arrive at a primary lien portion that explains about 84% of Bain’s property. Whereas this isn’t the very best stage what one might discover within the BDC house, it’s definitely not beneath the sector common or in any form or type a notable facet, which ought to drive down the P/NAV to 0.93x (primarily based on the present statistic).

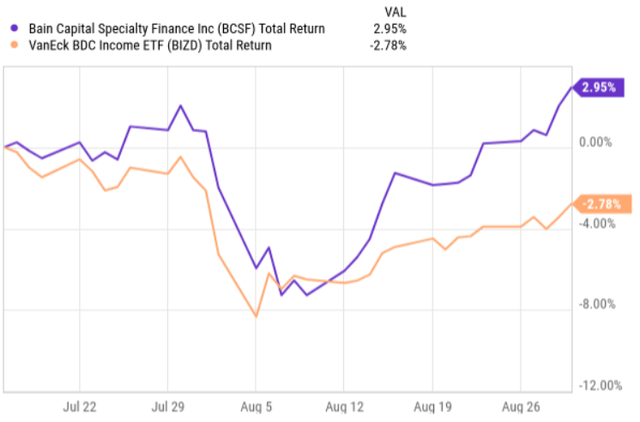

For the reason that publication of my earlier piece, BCSF has clearly outperformed the BDC index.

Ycharts

The primary purpose behind the alpha is only associated to the sturdy Q2 2024 earnings report, after which the Inventory value assumed a robust and favorable momentum.

Let’s now dissect the Q2 2024 earnings deck and see what have been the important thing knowledge factors which are price contemplating within the context of my present funding case.

Thesis overview

As acknowledged above, the Q2 2024 efficiency introduced constructive outcomes, particularly in relation to BCSF’s P/NAV metric, which continues to point a significant low cost.

The overall funding earnings for the quarter landed at $72.3 million, which marks a slight drop in comparison with $74.5 million outcome within the prior quarter. Due to this lower within the top-line determine, the online funding earnings per share contracted accordingly, reaching $0.51 per share (i.e., $0.02 per share beneath the Q1, 2024 metric). Nevertheless, right here I want to underscore the important thing purpose behind this dynamic, which was that Bain Capital recorded smaller revenues from different earnings classes that’s per definition extra unstable and never that important within the context of core underlying efficiency.

On account of the achieved NII era ranges in Q2, the bottom dividend protection remained stable at 121%, which ranks amongst one of the crucial conservative protection ranges within the BDC house. Given the excess of ~ 21%, the Administration determined so as to add supplemental dividends to the equations, thus rising the entire dividend paid for the quarter to $0.45 per share. On an annualized foundation, this interprets to a yield of ~ 10.5%, which could possibly be deemed enticing contemplating the conservative protection stage.

A further layer that renders BCSF’s enterprise comparatively secure is its leverage profile, which as of Q2 2024 stood at 1.03x (i.e., effectively beneath the sector common of 1.16x). It is usually beneath the BDC’s goal vary of 1.1x to 1.25x, implying that there’s a notable room for accommodating portfolio development. Moreover, throughout Q2 2024 interval the Administration enhanced the debt construction by rising the dedication below its secured revolving credit score facility by practically 30%, whereas on the identical time extending the maturity to mid-2029. What’s stunning right here (in a constructive means) is that even with the prolonged maturity and strengthened liquidity, the weighted common rate of interest on the excellent debt dropped by 10 foundation factors to five.1%.

A remaining factor that’s price underscoring when it comes to the enhancements in Q2 is said to BCSF’s portfolio credit score high quality. Importantly, the non-accruals decreased to 1.0% (measured on a good worth foundation), which is each considerably beneath the sector common and indicative of a wholesome portfolio (which has not been the case for a lot of BDCs in Q2 interval). Plus, Q2 2024 knowledge factors, we’ll discover that 97% of the portfolio investments proceed to carry out according to the projections that have been integrated within the underwriting course of.

Having mentioned that, there is a component of a possible concern stemming from the Q2 2024 knowledge factors. Specifically, the online funding exercise for Q2 landed at unfavourable $167 million, which is able to make it tougher for BCSF to develop and/or defend the present ranges of web funding earnings era. That is additionally the biggest drop over the previous 5-quarter interval.

Nevertheless, right here I want to emphasize a number of mitigating components.

First, the gross origination quantity throughout Q2 was $307 million, implying a rise of 55% on a year-over-year foundation. The momentum on the gross origination entrance appears to have strengthened, which sends an encouraging sign for the general transaction exercise going ahead.

Second, 86% of the brand new investments got here within the type of first lien senior secured loans and 9% was unwritten by way of joint ventures, which carry a notable bias in the direction of senior mortgage devices. Specifically, the portfolio is steadily changing into extra first lien targeted, which ought to neutralize the important thing argument for having the low cost to NAV in place.

Third, by making these investments, BCSF has maintained strict underwriting requirements with out sacrificing the yield (the weighted common yield on the investments is 11.6%). The median leverage ranges have landed at 4.6x, which together with the presence of documentation containing monetary covenants tied to administration’s forecasts (related for 95% of investments) permits to additional de-risk the portfolio.

Key dangers

From the entire prevailing headwinds within the BDC house equivalent to unfold compression, shallow M&A exercise, and elevated non-accruals, the transaction market part is one thing that we have now to be cognizant of.

As elaborated above, this quarter BCSF registered fairly a unfavourable determine on the web funding funding entrance, which implies that the asset base throughout Q3 will likely be decrease than in Q2. This, in flip, will trigger the online funding earnings to contract a bit or, in a constructive state of affairs, stay the place flat. Provided that the portfolio high quality is rock stable and the dividend protection signifies a excessive margin of security, the dangers of a dividend reduce are very restricted. Nevertheless, in case the M&A statistics proceed to return in at a unfavourable trend for a number of quarters in a row, the margin of security would clearly shortly disappear.

But, as soon as once more, trying on the broader rate of interest dynamics, the chances appear to be stacked in favor of experiencing dividend cuts within the near-term. This could stimulate consumers and sellers to transact and LBO exercise to steadily revert again to extra normalized ranges.

The underside line

All in all, the Q2 2024 earnings deck confirms that the funding case continues to be there and enticing for buyers, who search defensive earnings streams. The bottom dividend protection stays sturdy, and the portfolio high quality embodies the best dynamics which are essential to additional de-risk the enterprise profile. The one concern could possibly be associated to the depressed web funding exercise. Nevertheless, if we put issues within the perspective of the general BDC sector statistics, the place most BDCs have suffered from inactive M&A markets, this could not function a purpose to keep away from the BCSF. As a substitute, the brand new funding fundings enable Bain Capital Specialty Finance to slowly however absolutely enhance the portfolio high quality with out sacrificing the yield potential.

On account of this, I stay bullish on this BDC and proceed to imagine that the low cost to NAV of ~7% is unjustified.

[ad_2]

Source link