[ad_1]

Hiroshi Watanabe

The AllianceBernstein World Excessive Earnings Fund Inc. (NYSE:AWF) is a closed-end fund, or CEF, that yield-hungry buyers should purchase as a technique of incomes a really excessive degree of earnings from the property of their portfolios whereas having some publicity to overseas credit score markets. This second merchandise may very well be pretty necessary from a diversification perspective because of the easy incontrovertible fact that overseas markets are inclined to have completely different rates of interest than the US. As such, it could be doable to earn a better degree of earnings by parking cash in another country than the identical principal can earn at dwelling.

As well as, many overseas international locations, notably rising market ones, have considerably decrease ranges of debt relative to their economies. In principle, that improves buyers’ security because it makes it simpler for the overseas nation to hold the debt. Whereas a authorities can theoretically print cash, a non-public firm can’t, so decrease debt ranges might be fascinating. The AllianceBernstein World Excessive Earnings Fund doesn’t make investments solely in authorities debt, and firms in less-indebted international locations are inclined to have decrease ranges of debt than corporations in additional extremely indebted international locations.

Lastly, this fund contains bonds that pay coupons in currencies other than the U.S. greenback, so there’s the potential to revenue from a declining U.S. greenback. That is undoubtedly an intriguing proposal for anybody who’s frightened in regards to the enormous fiscal deficits that the US Federal authorities is anticipated to run over the approaching years, as these deficits will stress the worth of the U.S. greenback relative to different currencies.

Traders on this fund may additionally admire its engaging 7.16% present yield. It is a very cheap yield, however it’s a good suggestion to remember that it isn’t as excessive as a number of the fund’s friends. We will see this right here:

Fund Title

Morningstar Classification

Present Yield

AllianceBernstein World Excessive Earnings Fund

Mounted Earnings-Taxable-Excessive Yield

7.16%

Allspring Earnings Alternatives Fund (EAD)

Mounted Earnings-Taxable-Excessive Yield

8.99%

Credit score Suisse Excessive Yield Bond Fund (DHY)

Mounted Earnings-Taxable-Excessive Yield

8.90%

Neuberger Berman Excessive Yield Methods Fund (NHS)

Mounted Earnings-Taxable-Excessive Yield

13.47%

Western Asset World Excessive Earnings Fund (EHI)

Mounted Earnings-Taxable-Excessive Yield

11.76%

PGIM World Excessive Yield Fund (GHY)

Mounted Earnings-Taxable-Excessive Yield

10.08%

Click on to enlarge

That is fairly disappointing for income-focused buyers. In any case, we ordinarily want to earn the best quantity of earnings that we probably can from our portfolios, and having a fund with a a lot decrease yield than its friends makes that tough. The truth that this one has a considerably decrease yield than both the Western Asset World Excessive Earnings Fund or the PGIM World Excessive Yield Fund is much more disappointing. Nevertheless, the decrease yield of this fund could be an indication that the market believes that this fund has a extra sustainable distribution than both of these, so that may be a constructive signal.

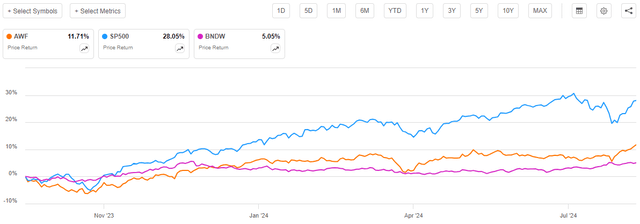

As common readers would possibly bear in mind, we beforehand mentioned the AllianceBernstein World Excessive Earnings Fund in late September 2023. As such, practically a yr has handed since our final dialogue. The fairness market has usually been sturdy since my earlier article was revealed, though it did decline via the tip of October 2023. Nevertheless, the home bond market was pretty weak till very lately as a lot of this yr noticed the market understand that the Federal Reserve was not prone to minimize rates of interest by 150 to 200 foundation factors in 2024, as was predicted at the beginning of this yr. Nevertheless, international bond markets have been blended, as some international locations have already began to cut back their benchmark rates of interest and thus offered a tailwind for bond costs in these international locations. As such, we’d count on that the AllianceBernstein World Excessive Earnings Fund has delivered a considerably blended efficiency over the intervening interval since our final dialogue.

This assumption shouldn’t be precisely right, nevertheless. In truth, shares of the AllianceBernstein World Excessive Earnings Fund have risen by 11.71% since our earlier dialogue:

Searching for Alpha

As we will see right here, the fund considerably underperformed the S&P 500 Index (SP500) over the interval. That’s to be anticipated, nevertheless, because of the easy incontrovertible fact that bonds seldom outperform widespread shares outdoors a recession or crisis-driven flight-to-safety. Nevertheless, this fund did handle to outperform the Vanguard Complete World Bond ETF (BNDW), which purports to trace an index consisting primarily of developed market bonds. That is pretty good to see. It is usually commonplace, as closed-end funds often ship bigger worth appreciation than bonds during times of falling rates of interest attributable to their leverage.

In truth, although, the chart above is deceptive because it understates the returns that buyers on this fund truly acquired. As I defined in a current article:

A easy take a look at a closed-end fund’s share worth efficiency doesn’t essentially present an correct image of how buyers within the fund did throughout a given interval. It’s because these funds are inclined to pay out all of their internet funding income to the shareholders, reasonably than counting on the capital appreciation of their share worth to supply a return. That is the rationale why the yields of those funds are typically a lot increased than the yield of index funds or most different market property.

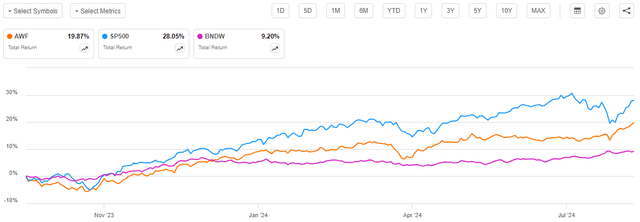

Once we embody the distributions paid out by the AllianceBernstein World Excessive Earnings Fund, in addition to the indices, over the interval in query, we get this different chart:

Searching for Alpha

This did little to vary the final place order when it comes to returns. The S&P 500 Index nonetheless outperformed this fund, in addition to the world bond index. It did present a little bit of an additional increase for each fixed-income funds, although, which is smart since they each have considerably increased yields than widespread shares. That is notably true for the AllianceBernstein World Excessive Earnings Fund, which noticed its funding return improve from 11.71% to 19.87% as soon as we think about the distributions that it pays out. That is clear proof that buyers mustn’t merely overlook a fund simply because its share worth motion shouldn’t be as excessive as one thing else available in the market.

As absolutely eleven months have handed since we final mentioned this fund, an incredible many issues have modified. Most of the issues that modified may have a direct affect on this fund or its investments, so it’s value revisiting and reviewing right this moment. This text will focus particularly on this process and supply an up to date evaluation of the fund’s funds.

About The Fund

In accordance with the fund’s web site, the AllianceBernstein World Excessive Earnings Fund has the first goal of offering its buyers with a excessive degree of present earnings. This makes plenty of sense for a bond fund, as I defined in a earlier article:

Bonds by their very nature are earnings securities, as they don’t ship any internet capital features over their lifetimes. This is smart, as an investor will buy a bond at face worth and obtain the face worth again when the bond matures. The one funding return for a bond held over its whole lifetime is the coupon funds made to the bond’s proprietor. Thus, bonds don’t ship capital appreciation over their lifetimes.

As bonds are earnings autos, nearly any bond fund could have present earnings as its main goal. As we have now seen from our discussions about a number of bond funds over time, most of them do. Thus, there’s nothing actually novel or distinctive right here.

As we noticed within the earlier article, the fund’s funding technique is nothing actually novel or distinctive both, however there are one or two issues that set the AllianceBernstein World Excessive Earnings Fund other than different international bond funds. That is most noticeable after we take a look at the fund’s technique description from its most up-to-date annual report:

The Fund’s Funding Administration Workforce seeks to generate excessive present earnings and, secondarily, capital appreciation. The Fund is a globally diversified portfolio that takes full benefit of the Workforce’s greatest analysis concepts by pursuing excessive earnings alternatives throughout all fixed-income sectors. The Fund invests primarily (and with out restrict) in company debt securities from US and non-US issuers, in addition to authorities bonds from each creating and developed international locations, together with the US. Beneath regular market situations, the Fund invests considerably in lower-rated bonds, however may spend money on investment-grade and unrated debt securities.

The truth that this fund invests primarily in company bonds reasonably than authorities bonds is engaging to yield-seeking buyers. As we have now seen from our discussions of another international or worldwide bond funds, authorities bonds are typically the traditional investments within the portfolios. This will have sure benefits, as authorities bonds are nominally safer than company bonds. In any case, a authorities can tax its residents to no matter extent is critical to cowl its bond funds, no less than in principle. In follow, there’s a restrict to how a lot cash a authorities can elevate via taxation earlier than its citizenry begins making efforts to keep away from taxation. Nevertheless, authorities bonds are nonetheless usually thought-about to be “secure” investments, notably when the federal government issuing them is a developed market and the bonds are denominated in a foreign money that the federal government controls the provision of.

In distinction, company bonds are inclined to have increased yields than authorities bonds from the identical nation. That is partly due to the perceived dangers of those bonds. An organization can’t often power individuals to pay it as a authorities can, in any case. The truth that this fund invests primarily in company bonds thus ought to end in it incomes extra earnings than a government-bond fund investing in the identical areas of the world. Any earnings investor ought to admire this.

The fund’s portfolio holdings largely match what we’d count on from a fund claiming to speculate primarily in company bonds. The annual report gives the next asset allocation as of March 31, 2024:

Asset Kind

% of Web Belongings

Corporates – Non-Funding Grade

56.7%

Corporates – Funding-Grade

19.1%

Rising Markets – Company Bonds

5.4%

Collateralized Mortgage Obligations

4.2%

Financial institution Loans

3.2%

Collateralized Mortgage Obligations

3.2%

Rising Markets – Sovereigns

2.5%

Governments – Treasuries

1.9%

Quasi-Sovereigns

1.1%

Industrial Mortgage-Backed Securities

0.4%

Native Governments – U.S. Municipal Bonds

0.4%

Inflation-Linked Securities

0.3%

Governments – Sovereign Bonds

0.2%

Widespread Shares

0.2%

Most well-liked Shares

0.1%

Asset-Backed Securities

0.1%

Cash Market Fund

1.2%

Click on to enlarge

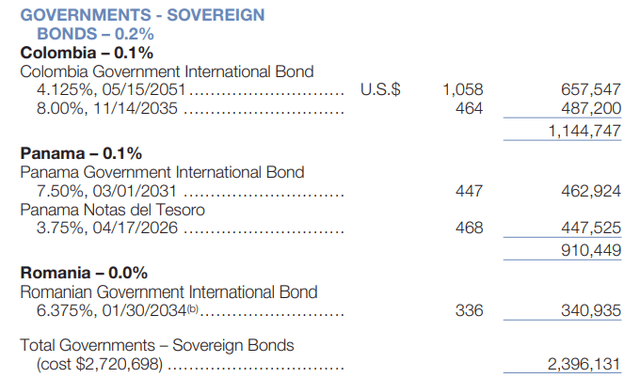

There seems to be some overlap between sure classes right here. For instance, the “Governments – Treasuries” class consists of each U.S. Treasury securities (as anticipated) in addition to Colombian authorities bonds:

Fund Annual Report

But, there are additionally some Colombian authorities bonds listed below the “Governments – Sovereign Bonds” class:

Fund Annual Report

It’s tough to inform what determines the class that the fund’s administration locations a given authorities bond in (it doesn’t have this difficulty with corporates). Nevertheless, one factor that we discover from the screenshots above is that the bonds listed below the “Governments – Treasuries” class are denominated within the foreign money of the issuing nation. Nevertheless, the bonds listed below the “Governments – Sovereign Bonds” class are all worldwide bonds. Typically talking, after we see one thing particularly referred to as an “worldwide bond,” it’s a Eurobond. Investopedia has a great definition of Eurobonds:

Eurobonds are issued in a foreign money aside from the native foreign money of the company or different issuer.

Within the case of the bonds listed as “Governments – Sovereign Bonds” within the fund’s portfolio which can be screenshotted above, we’re speaking about Eurodollar bonds, that are bonds issued by a non-U.S. entity which can be denominated in and pay their coupons with U.S. {dollars}. Thus, the overseas authorities has to acquire U.S. {dollars} by some means (often via commerce) after which use these to pay as an alternative of paying the bonds with their foreign money. That is carried out as a result of overseas buyers often favor to obtain funds in a foreign money that they belief, comparable to U.S. {dollars}, Japanese yen, Swiss francs, British kilos, or euros. U.S. {dollars} are the commonest, however this fund does have some bonds in its portfolio which can be paying coupons in euro, British kilos, South African rand, Colombian pesos, and some different currencies. Nevertheless, it seems that something paying in a foreign money moreover U.S. {dollars}, euro, or British kilos was issued by a company or authorities that’s situated within the nation that points the identical foreign money. The one bonds within the fund which can be supposed particularly for buyers out of the country have been issued in a kind of exhausting currencies.

The annual report doesn’t particularly break down the foreign money publicity right here, which is unlucky. Traders who’re particularly seeking to get publicity to overseas foreign money actions would have appreciated that data. I rely myself amongst that group, as common readers are probably conscious. In a earlier article, I outlined the core tenets of my thesis, detailing why buyers ought to have publicity to foreign currency, shares, and different property. A overview of the AllianceBernstein World Excessive Earnings Fund’s newest Schedule of Investments, which is offered within the annual report, leaves one with the impression that many of the property held on this fund are denominated in and pay their coupons with U.S. {dollars}, whatever the precise nation that the bond’s issuer is situated in.

There are lots of bonds denominated in euros as properly, however they don’t seem as quite a few. All the opposite currencies represented within the portfolio look to be such a small proportion that their actions relative to the U.S. greenback in all probability is not going to have a noticeable affect on the fund’s efficiency. Thus, this fund could not present as a lot safety in opposition to the probably long-term decline within the worth of the U.S. greenback. Nevertheless, aside from maybe the PGIM World Excessive Yield Fund, I can’t consider one other international bond fund that has any important publicity to overseas foreign money bonds.

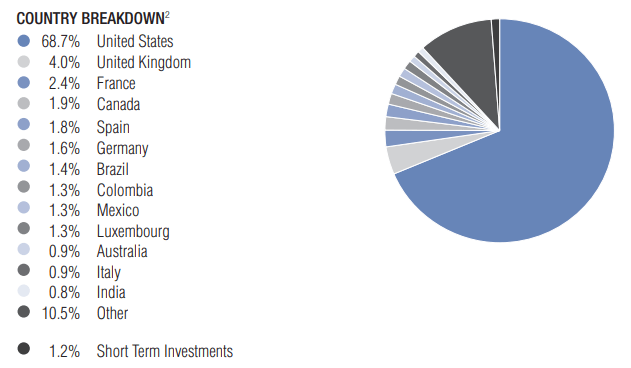

The fund’s annual report gives the next nation allocation as of March 31, 2024:

Fund Annual Report

It is very important notice that this chart solely exhibits the international locations during which the issuers of the securities within the portfolio are listed. It doesn’t have any relation to the currencies that the fund’s property are denominated in or make funds in.

In accordance with the World Financial Discussion board, the worldwide bond market has a complete market worth of $133 trillion as of 2022. That’s, admittedly, two-year-old knowledge, however it’s the greatest that we have now at the moment. Of that, the US accounted for $51.3 trillion, which is 38.57%. Thus, we will see that this fund is considerably overweighted to the US relative to its precise illustration within the international bond market. Nevertheless, that is hardly a shock as a result of most international funds are obese to this nation. One doable purpose is that they’re attempting to keep away from having substantial publicity to China, which is the second-largest bond market on this planet. The Chinese language bond market is $20.9 trillion in measurement primarily based on the most recent knowledge.

If we exclude China from the figures, then we have now a $112.1 trillion international bond market ex-China. Of that whole, the US accounts for 45.76%. Thus, the fund remains to be considerably obese to the US relative to its precise illustration within the international bond market. Nevertheless, it does seem that the fund’s publicity to this nation is declining. The final time that we mentioned this fund, it had a 71.06% weight to the US. The decline right here is sweet for anybody who’s seeking to enhance their general portfolio diversification, because it clearly exhibits that this fund is best at this process than it was final September. Nevertheless, I’d nonetheless prefer to see it cut back its American publicity additional, as there are only a few good bond funds accessible for American buyers who need publicity to the overseas credit score markets and the alternatives that exist outdoors the US. For instance, we have now already seen fee cuts by the European Central Financial institution and the Financial institution of Canada that can function tailwinds for the costs of bonds from their international locations. Traders who solely have publicity to the bond market of the US would haven’t any technique to make the most of that, however a fund such because the AllianceBernstein World Excessive Earnings Fund can.

Leverage

As is the case with most closed-end funds, the AllianceBernstein World Excessive Earnings Fund employs leverage as a technique of boosting the efficient yield that it earns from the bonds in its portfolio. I defined how this works in my earlier article on this fund:

In brief, the fund borrows cash after which makes use of that borrowed cash to buy bonds and different fixed-income property. So long as the bought property have a better yield than the rate of interest that the fund has to pay on the borrowed cash, the technique works fairly properly to spice up the efficient yield of the portfolio. As this fund is able to borrowing cash at institutional charges, that are significantly decrease than retail charges, this can often be the case. With that mentioned, the advantages of leverage right this moment are a lot lower than they have been a yr in the past as a result of borrowing prices are a lot increased.

Nevertheless, using debt on this style is a double-edged sword as a result of leverage boosts each features and losses. As such, we wish to make sure that a fund shouldn’t be utilizing an excessive amount of leverage as a result of that might expose us to an excessive amount of danger. I don’t prefer to see a fund’s leverage exceed a 3rd as a proportion of its property for that reason.

As of the time of writing, the AllianceBernstein World Excessive Earnings Fund has leveraged property comprising 16.76% of its general portfolio. That is considerably lower than the 23.97% leverage that the fund had the final time that we mentioned it, which is smart. In any case, as we noticed within the introduction, the fund’s share worth elevated over the eleven-month interval and usually a rise within the share worth correlates to a rise within the measurement of the fund’s portfolio. As we have now mentioned in varied earlier articles, a rise within the measurement of the fund’s portfolio reduces the leverage ratio, all else being equal.

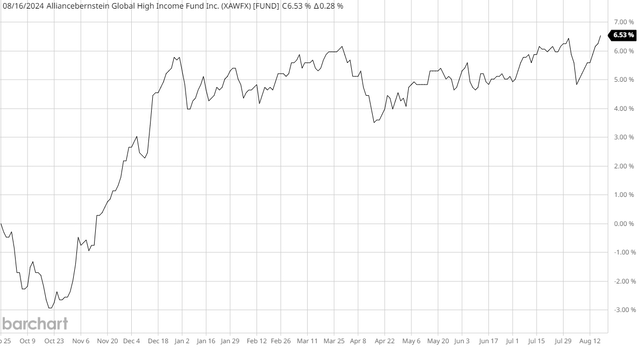

As this chart exhibits, the fund’s portfolio did certainly improve in measurement since our final dialogue. Its internet asset worth has elevated by 6.53% over the interval:

Barchart

This improve in internet asset worth meant that the fund’s leverage ought to go down so long as the fund didn’t improve its borrowings in the course of the interval. This seems to be exactly what occurred.

The fund’s leverage is pretty cheap when in comparison with its friends, as we will see right here:

Fund Title

Leverage Ratio

AllianceBernstein World Excessive Earnings Fund

16.76%

Allspring Earnings Alternatives Fund

30.80%

Credit score Suisse Excessive Yield Bond Fund

26.33%

Neuberger Berman Excessive Yield Methods Fund

27.50%

Western Asset World Excessive Earnings Fund

35.08%

PGIM World Excessive Yield Fund

21.45%

Click on to enlarge

(All figures from CEF Information.)

As we will clearly see, the AllianceBernstein World Excessive Earnings Fund has the bottom degree of leverage out of its peer group. The truth that this fund is much less leveraged than both the Western Asset World Excessive Earnings Fund or the PGIM World Excessive Yield Fund is especially good to see since each of these funds make use of related methods. It is a clear indication that this fund shouldn’t be excessively leveraged, and as such we must always not want to fret about its use of leverage. Threat-averse buyers must be moderately glad right here.

Distribution Evaluation

The first goal of the AllianceBernstein World Excessive Earnings Fund is to supply its buyers with a really excessive degree of present earnings. To that finish, the fund pays a month-to-month distribution of $0.0655 per share ($0.786 per share yearly). This offers the fund a 7.16% yield on the present share worth, which is sadly decrease than its friends.

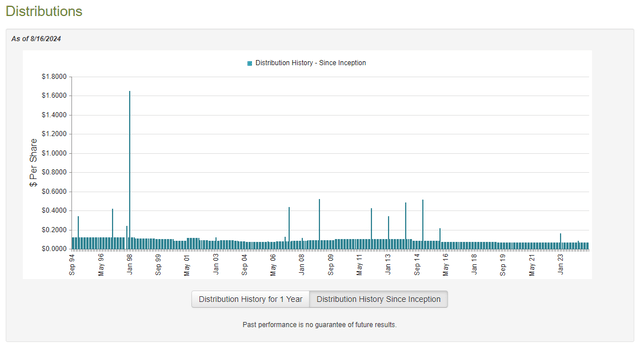

Sadly, this fund has not been particularly constant relating to its distribution over time:

CEF Join

As I acknowledged within the earlier article:

As we will see, the fund has each elevated and decreased its distribution quite a few instances because it was first conceived again in 1993. This might show to be a turn-off for these buyers who’re looking for a secure and safe supply of earnings to make use of to pay their payments or finance their existence. Nevertheless, it isn’t uncommon for a fund to range its distribution over time as the quantity that it might afford to pay out relies upon rather a lot on how accommodating the market is throughout a given time interval. Within the case of this fund, rates of interest play a big position in how a lot the fund can earn, and rates of interest are fully out of its management.

The fund’s distribution is on the identical degree because the final time that we mentioned it, which makes it one of many few bond funds that has not altered its distribution over the previous twelve months. In truth, this fund has not modified its distribution because the center of 2019, which is even rarer for a bond fund. In any case, most of those funds have been taken for a wild trip in the course of the pandemic period, which was then adopted by a fast collection of rate of interest hikes by central banks everywhere in the world. As such, we must always take an in depth take a look at the fund’s funds to make it possible for it’s dealing with the state of affairs in addition to it seems to be on the floor.

As of the time of writing, the newest monetary report that’s accessible for the AllianceBernstein World Excessive Earnings Fund is the annual report for the full-year interval that ended on March 31, 2024. A hyperlink to this doc was offered earlier on this article. That is clearly a a lot newer monetary report than the one which was accessible to us the final time that we mentioned this fund, so it ought to work fairly properly to supply us with an replace.

For the full-year interval that ended on March 31, 2024, the AllianceBernstein World Excessive Earnings Fund acquired $73,263,309 in curiosity and $870,133 in dividends from the property in its portfolio. This gave the fund a complete funding earnings of $74,133,442 for the full-year interval. The fund paid its bills out of this quantity, which left it with $64,460,613 accessible for shareholders. This was not enough to cowl the $69,578,726 that the fund paid out in distributions in the course of the interval.

Luckily, the fund was in a position to make up the distinction via capital features. For the full-year interval that ended on March 31, 2024, the AllianceBernstein World Excessive Earnings Fund reported internet realized losses of $6,534,555, however these have been greater than offset by $67,125,028 internet unrealized features. Total, the fund’s internet property elevated by $55,472,360 after accounting for all inflows and outflows. Thus, this fund was in a position to absolutely cowl its distributions, nevertheless it needed to depend on its unrealized capital features to do it.

The issue with counting on unrealized capital features to cowl a distribution is that the market can simply erase these features earlier than they’re realized. Nevertheless, on this case, that appears unlikely. The features that the fund made on bonds are largely as a result of buyers everywhere in the world expect that the central banks in most international locations will start decreasing rates of interest. Now we have already seen a number of accomplish that, and the Federal Reserve is extensively anticipated to cut back its benchmark fee subsequent month. The one actual factor that might erase these features can be if the Federal Reserve acknowledged that it will hike charges on the Jackson Gap convention later this month. That appears extraordinarily unlikely to happen, so it appears unlikely that the market will erase the fund’s unrealized features to any important diploma. As such, the distribution appears fairly secure.

Valuation

Shares of the AllianceBernstein World Excessive Earnings Fund are at present buying and selling at a 1.51% low cost to internet asset worth. That is costly after we think about that the shares have had a 5.60% low cost on common over the previous month. As such, it’s in all probability greatest to attend till a greater worth turns into accessible.

Conclusion

In conclusion, the AllianceBernstein World Excessive Earnings Fund is a world bond fund that has a portfolio to match its international nature. The fund’s portfolio contains each U.S. dollar-denominated and non-U.S. dollar-denominated bonds, which is sweet for buyers who’re looking for some overseas foreign money publicity. This fund does hedge its overseas foreign money publicity, however that doesn’t imply that buyers is not going to derive any profit from the U.S. greenback declining in opposition to a overseas foreign money. This fund is obese to the US although, which is disappointing, nevertheless it seems to have improved over the previous yr. Lastly, the truth that most central banks around the globe have both already minimize their benchmark rates of interest or are anticipated to take action shortly ought to function a tailwind for this fund.

The one actual drawback proper now’s that the present valuation is reasonably steep. Whereas AllianceBernstein World Excessive Earnings Fund Inc. is buying and selling discounted, it isn’t an enormous one traditionally, so it could be greatest to attend a bit till it will get bigger. In any other case, this fund appears good.

[ad_2]

Source link