[ad_1]

Quick Meals Restaurant Patio Toronto Canada benedek/iStock Unreleased through Getty Photographs

Be aware: All quantities referenced are in Canadian {dollars}. Inventory value referenced is from TSX and never the USD OTC value.

A&W Income Royalties Earnings Fund (TSX:AW.UN:CA) proudly states the raison d’etre, A.Okay.A. mission, on its webpage.

Collectively, to excite Canada’s most avid burger lovers, wherever they’re, with the most effective tasting burgers they crave, incomes much more of their visits and making A&W eating places much more profitable.

Sure, this fund is within the burger enterprise, and is a extremely profitable fast service restaurant franchise in Canada.

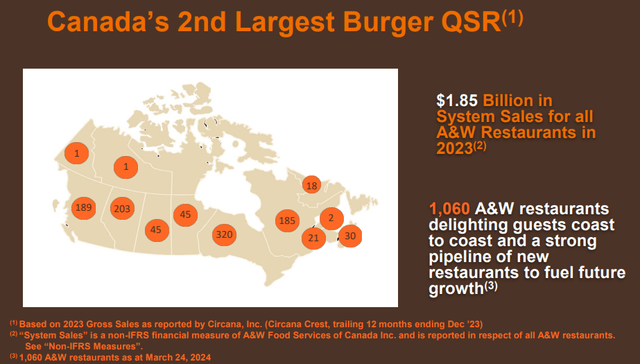

Q1-2024 Presentation

We’ve got coated this fund a number of instances on this platform and have described its income/expense/dividend setup greater than as soon as. Slightly than repeating ourselves on this article, we’ll let our readers eat this data from the fund’s not too long ago launched Q1 monetary report or assessment considered one of our prior items that has extra element.

Prior Protection

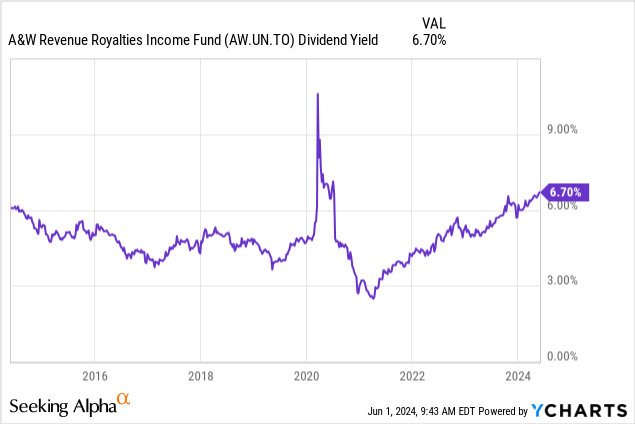

We coated this ticker earlier this yr, in March. It was yielding round 6.21% then and was buying and selling at an inexpensive valuation. On the flip aspect, the yield unfold to what the 5-year Authorities of Canada bond was paying on the time was solely round 2.58%. So whereas the valuation was compelling, it was nonetheless not precisely low cost in relation to the risk-free funding. The This autumn outcomes and the general setup nonetheless noticed us slapping a purchase on it.

Whereas speedy value will increase of 2020-2023 will not be taking place, we predict A&W can value near inflation charges in its annual value modifications. The corporate has a built-in offset and the best absolute dividend yield of the final decade is sweet sufficient to begin getting in. We may also notice right here that if it paid out every part it earned, the dividend yield would have been 6.77%. All issues thought-about, we predict this can be a good level to begin nibbling on this one as valuation compression has taken sufficient of a toll.

Supply: A&W: 6.2% Royalty Play Grows Into Valuation

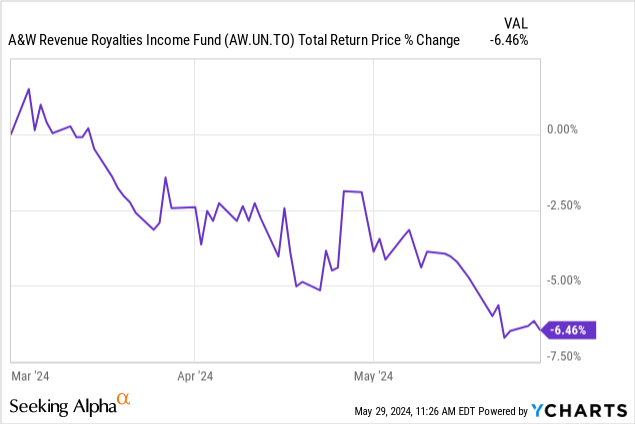

Unitholders of this revenue fund have misplaced round 6.5% since then, bearing in mind the dividends which were paid throughout this time.

We averaged into this after our final piece and have price foundation of $29.20. With pores and skin within the sport (albeit a small quantity at present), we will assessment the aforementioned Q1 outcomes and replace our thesis on this royalty play.

Q1-2024

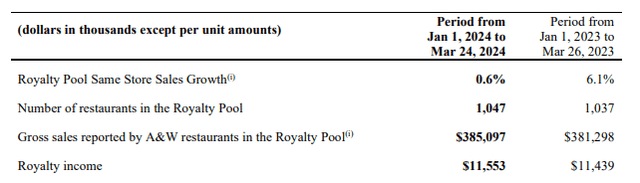

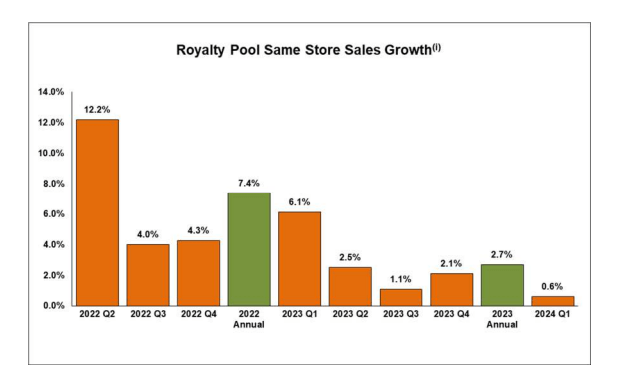

On the important thing top-line metrics, A&W managed to eke out small good points. Identical retailer gross sales have been up 0.6% and complete gross sales have been up about 1%.

Q1-2024 Financials

Let’s imagine the identical for the whole royalty revenue as nicely. Whereas not precisely a powerful endorsement for the mannequin, the numbers are an enchancment over what we noticed for Boston Pizza Royalties Earnings Fund (BPF.UN:CA) only recently. There, the gross sales really dropped by 1%. In fact, like Boston Pizza, A&W can also be elevating costs. Precise quantities should not straightforward to determine for both of those two, however we estimate it’s about 4% for each these firms. In fact, that will get us to the principle conclusion that visitors is declining.

The Q1 2024 Royalty Pool Identical Retailer Gross sales Development(i) of +0.6% was a product of a rise in common verify measurement resulting from industry-wide inflation on items, companies, and labour, partially offset by a decline in visitor visitors. Meals Providers believes that the decline in visitor visitors is primarily attributable to elevated rates of interest and inflation, which have impacted client discretionary spending. In response to those financial circumstances, Meals Providers continues to hunt new and progressive methods to supply A&W’s friends a scrumptious and inexpensive expertise and in flip improve visitor visitors.

Supply: Q1-2024 Financials

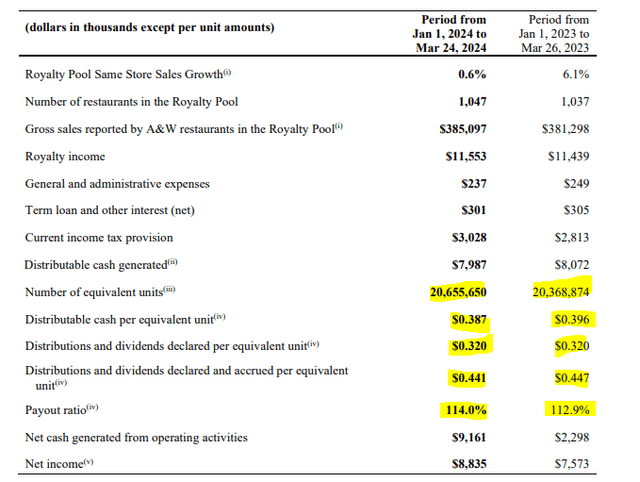

With a barely larger unit depend (for these elevated eating places), the distributable money per unit fell barely. Under that quantity, you may see two totally different distribution quantities.

Q1-2024 Financials

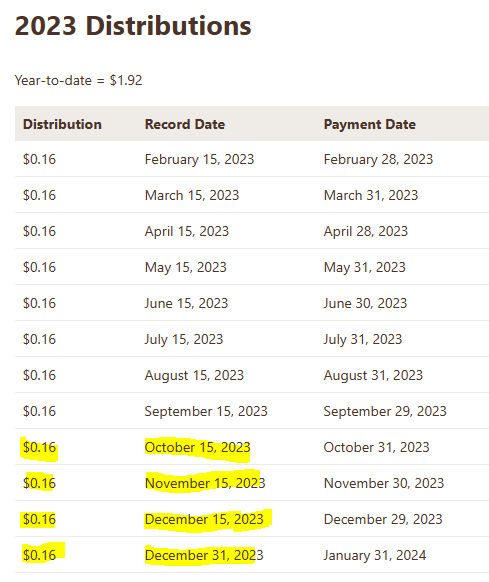

The numbers generally is a bit complicated as A&W pays its 12 distributions a bit in a different way than many month-to-month payers. There are 2 document dates/ex-distribution dates in December of every yr and none in January.

A&W Web site

The excessive payout ratio is predicted with this firm, as A&W doesn’t retain money and goals to pay every part again. There is no such thing as a capex to be performed as a royalty firm, and debt ranges are saved pretty modest.

Outlook

There is no such thing as a doubt that prospects are carried out with the upper costs for consuming out. You may see it within the royalty pool similar retailer gross sales development.

Q1-2024 Financials

It’s not simply A&W, although. Quick meals as a complete is now underneath assault as prospects brace for weaker financial system and the influence of price hikes flowing via through resetting mortgage charges. The one benefit that A&W has is that the exhaustion on “suggestions” will not be related on the drive via home windows (or inside eating places) for this firm. Nonetheless, we’re getting into a consolidation section the place we are able to anticipate flattish the distributable money stream per share for 2-3 years. The corporate is aware of this as nicely.

Marco Tang

I used to be simply questioning if I might hear any feedback you have got on visitors and what the promotional panorama seems like from competitors perspective?

Susan Senecal

I believe everyone seems to be underneath stress by way of visitors and visits simply due to affordability might be the important thing purpose. And that creates an setting the place persons are on the lookout for worth, they’re discovering worth, and I believe our major space proper now that we’re engaged on is ensuring that there is at all times that sort of worth out there at A&W from an affordability perspective which tends to get extra visits, extra visitors, and that is how we have type of positioned our promotions for the following short time is to maintain on making certain that when individuals are available, they really feel like they’ll afford it, they really feel like they need to come again.

Supply: Q1-2024 Convention Name Transcript

We observe the menu costs and promotions domestically and so they all (not simply A&W) are getting the message. Pricing is flat lining and promotions are escalating. This isn’t a giant deal for the royalty firm, as it’s a top-line play. The underlying eating places although may have a troublesome time negating the margin pressures. What we now have on our aspect is a modestly enticing valuation, with the best dividend yield exterior the COVID-19 period. That dividend yield was really an phantasm in addition to it obtained lower virtually immediately.

So we do have a lovely valuation and the query is whether or not you might be pleased with a 6.7% stream that doesn’t develop for 2-3 years. There’s some upside doable if the Pret A model is profitable nationwide.

A&W Income Royalties Earnings Fund (the “Fund”) and A&W Meals Providers of Canada Inc. (“Meals Providers”) announce that Meals Providers and Pret A Manger (Europe) Restricted (“Pret”) have agreed on a improvement plan to develop the Pret model throughout Canada following the completion of a profitable two yr trial interval first introduced on June 2, 2022. Meals Providers has unique grasp franchisor rights to Canada for the Pret model and can introduce Pret’s merchandise to Canadian shoppers in quite a lot of rigorously chosen codecs, starting with a nationwide roll out of Pret espresso in A&W eating places this fall.

The Pret model was first provided in a trial pop-up format in sure A&W eating places in 2022, and expanded to a primary standalone Pret location in downtown Toronto in 2024. The event plan requires Meals Providers persevering with to extend the variety of bodily areas providing Pret merchandise throughout Canada over an preliminary ten-year improvement time period. Gross sales of Pret merchandise inside A&W eating places within the Royalty Pool can be topic to the three% royalty paid by Meals Providers to the Fund.

Supply: Looking for Alpha

However we’re modeling flat gross sales for the following 3 years and nonetheless just like the inventory. We’ll proceed so as to add on the best way down to achieve a full place round $25.00 (assuming it will get there). We price this a Purchase and would improve to a Robust Purchase underneath $25.00.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link