[ad_1]

Leszek Kobusinski/iStock Editorial through Getty Photographs

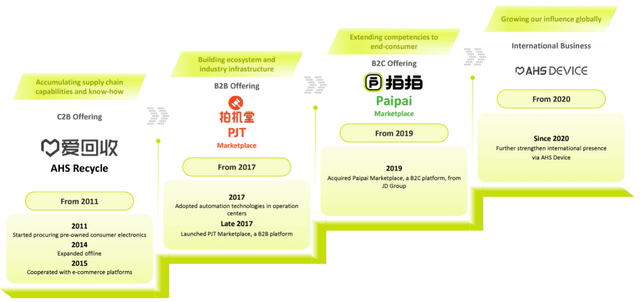

ATRenew Inc. (NYSE:RERE) operates China’s largest pre-owned shopper electronics transaction and providers platform. It owns AHS Recycle (C2B), PJT Market (B2B), and Paipai Market (B2C), and a global enterprise AHS DEVICE. Its mission is said as “to provide a second life to all idle items” (by means of recycle, refurbish, and reuse).

Firm presentation

RERE reported robust Q2 2024 outcomes. Income reached RMB3,776.7 million (+27.4% YoY) pushed by gross sales progress of pre-owned shopper electronics. GAAP Op Loss was RMB5.6 million, and non-GAAP Op Revenue was RMB94.1 million (US$12.9 million), as in comparison with RMB52.0 million in Q2’23. Margin enchancment was pushed by gross sales and advertising and marketing (7.5% as a % of income, vs 8.6% in Q2’23), success price (8.5%, vs 8.8% PY) and Tech and Contents (1.2%, vs 1.3% PY).

I preserve a purchase suggestion for RERE, supported by 1) robust demand in pre-owned market attributable to consumption downgrade in China; 2) margin enchancment benefiting from price efficiencies, notably in Gross sales and Advertising and marketing, success, and expertise; 3) progress by means of RERE’s strategic partnership with JD.com.

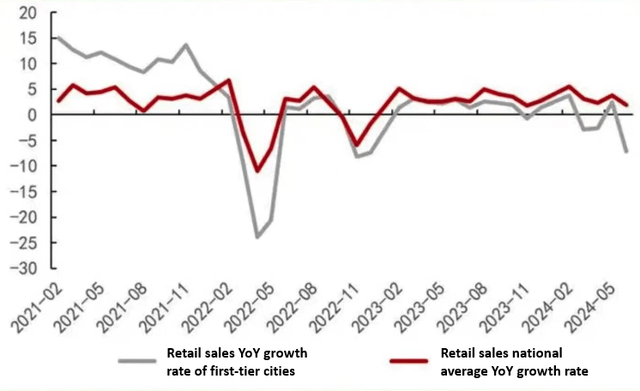

China’s authorities has been actively selling trade-ins by means of subsidies throughout varied industries, aiming to stimulate the secondary market and lift consciousness of sustainable consumption. The consumption downgrade in China, particularly in first-tier cities similar to Shanghai, Beijing, Guangzhou, and Shenzhen, has turn out to be a notable development as customers face financial pressures or prioritize financial savings over discretionary spending. As proven in Determine 1, the retail gross sales in June for these 4 first-tier cities noticed a major decline as in comparison with Could, and the drop was extra extreme than the nationwide common. This development helps the rising demand for pre-owned items, positioning RERE effectively for continued progress.

Determine 1 YoY progress fee of retail gross sales in first-tier cities drop in June

Wind, Tianfeng Securities Analysis Institute

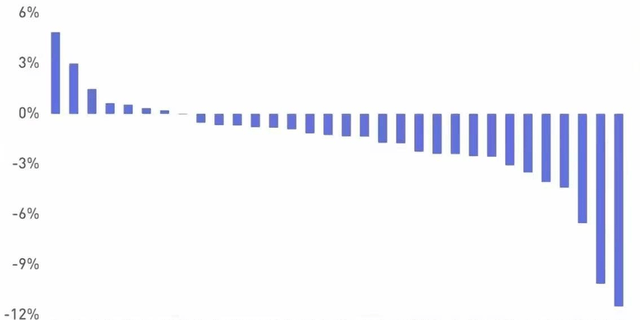

If we have a look at 32 cities in China, solely 7 cities (Hefei, Chongqing, Wenzhou, Jinan, Xuzhou, Nanning, and Nanjing) confirmed optimistic developments (consumption upgrades) in H1-24. The remaining 25 cities skilled various ranges of consumption downgrades.

Determine 2 Consumption Upgrading/Downgrading in Cities in H1-24

Metropolis Information Group

Consumption downgrade will considerably enhance the pre-owned electronics market as increasingly more price-conscious customers search for inexpensive options. As a substitute of buying new electronics, they flip to pre-owned gadgets, resulting in a sturdy secondary market. RERE, with its experience in refurbishing and reselling electronics at scale, is well-positioned to profit from this rising demand.

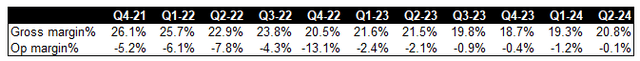

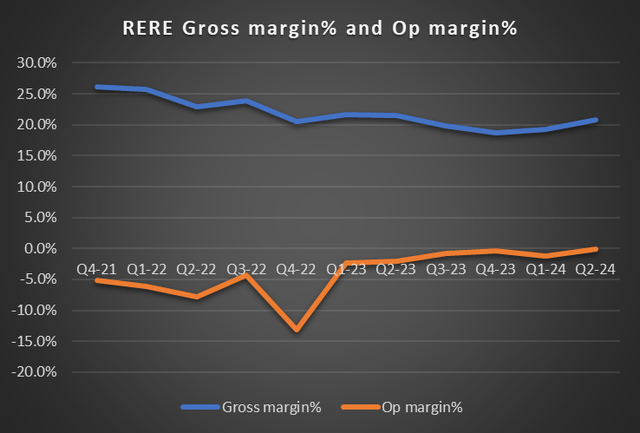

In Q2’24, RERE achieved a cloth enchancment in Op Margins YoY and QoQ. This demonstrated RERE’s efficient management of operational efficiencies, that are attributed to excessive gross sales volumes, income diversification, technological developments, and economies of scale. As proven in Determine 3, RERE’s price to serve narrowed from 31% in This autumn’21 to 21% in Q2’24, a major enchancment of 10 ppts within the final three years. With RERE’s scale and main place in China, coupled with the consumption shift to inexpensive merchandise, I anticipate RERE to show worthwhile quickly.

Determine 3 RERE Gross margin% and Op margin% This autumn’21 – Q2’24

Capital IQ Capital IQ

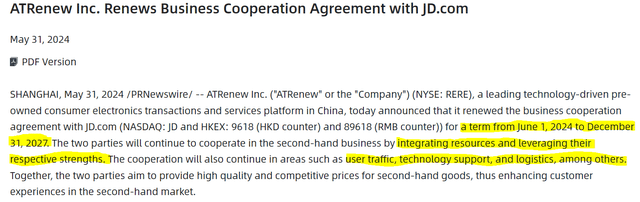

In response to RERE’s announcement on Could 31, a three-year partnering settlement with JD.com established their complete partnership together with integrating sources, cooperating on person visitors, tech help, and logistics, and so forth. It is value mentioning that in H1-24, recycling worth and gross sales by means of JD.com grew over 50% YoY. I’m optimistic that this partnership shall be a key driver of RERE’s future progress.

Firm web site

RERE is at the moment traded at $2.48, as in comparison with 52-wk excessive/low at $3.02/$1.01. My base case valuation is 11x 2025E $0.30 EPS, translating to a goal worth of $3.3 (+33% upside from present worth). $0.30 EPS relies on 2025E income progress of +26% and Op margin enchancment of +130 bps YoY. 11x P/E is half of the buying and selling a number of of RERE’s shut comp AO World plc (LSE:AO), which is at the moment traded at 22x NTM ahead P/E.

Conclusion

RERE as a sector chief in China will probably be a fundamental beneficiary of the continuing consumption downgrade developments, and thereby preserve or speed up its income progress. Its continued efforts in margin growth will result in profitability in close to workforce. Traders ought to really feel enthusiastic about its robust enterprise outlook and over 30% inventory worth upside in 12 months.

When it comes to funding dangers, though consumption downgrade favors the secondary market within the brief time period, a chronic financial downturn in China might ultimately strain the provision of electronics. As well as, traders also needs to bear in mind that the aggressive panorama is anticipated to accentuate with new entrants coming into the market, pushed by subsidies from the Chinese language authorities.

[ad_2]

Source link