[ad_1]

Robert Means

Since I final wrote in regards to the UK primarily based prescription drugs firm AstraZeneca (NASDAQ:AZN) in March, its worth is up by a big 18.4%. Even at the moment it was greater than apparent that the inventory is due an uptick this 12 months. Even the article itself was titled “5 Causes AstraZeneca Inventory Can Rise In 2024”, which have been as follows:

After its higher than anticipated ends in 2023, the income steering for this 12 months was notably wholesome. Equally, core EPS outperformance was noticed, resulting in a sturdy outlook for 2024. A spate of approvals, together with in its massive US market added to optimism on the AstraZeneca inventory. A better trailing twelve months [TTM] dividend yield than the typical for the healthcare sector. And whereas it was nonetheless low in comparison with some prescription drugs’ friends, over time, it the dividends had added considerably to whole returns from the inventory. The market multiples have been engaging too, with a ahead non-GAAP P/E of 16.3x, decrease than the 19.7x for the healthcare sector.

To date, so good. However right here’s the catch. With the value rise prior to now quarter, a lot of the upside has been exhausted. In line with my estimates for AstraZeneca’s non-GAAP ahead EPS, the ahead P/E is now at 19.4x. In the meantime, the healthcare sector’s P/E has declined to 19.2x. It’s additionally buying and selling larger than its personal 5 12 months common of 19x.

The query now could be, is there nonetheless a Purchase case for the inventory in 2024?

Outstanding outcomes encourage optimism

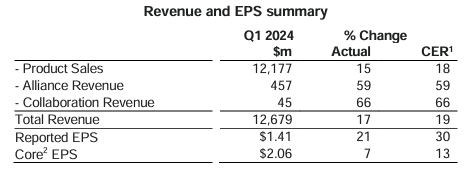

The corporate’s first quarter outcomes have been actually exceptional, leading to a 5.4% worth enhance, the largest single day rise seen prior to now 12 months. The corporate’s whole revenues grew by an enormous 19% year-on-year (YoY) at fixed alternate charges [CER], on account of superior development in its oncology and CVRM (Cardiovascular, Renal and Metabolism) divisions. The determine is larger than the “low double-digit to low teenagers share” development anticipated for the complete 12 months 2024.

Supply: AstraZeneca

The core earnings per share [EPS] quantity grew by 13% at CER, which on the larger finish of its “low double-digit to low-teens share” development steering. Apparently, the corporate mentions that core EPS development was slower than income development primarily as a result of a excessive base in Q1 2023. The bottom was elevated by a one-time acquire of USD 241 million from the sale of the US rights of its bronchial asthma therapy Pulmicort Flexhaler final 12 months. If that influence is excluded from the core EPS determine for Q1 2023, the quantity would have risen by 16.7% this quarter.

Approvals and acquisitions

The corporate’s progress on approvals is encouraging too. Most notably, Farxiga has now been authorised for Kind 2 diabetes therapy within the US. It was earlier authorised of solely along with food regimen and train. This appears like a promising improvement for AstraZeneca contemplating:

Farxiga is the only greatest income generator for the corporate, with a 15% share The US is the largest marketplace for the corporate, bringing in 40% of the revenues. Intently associated to the weight problems epidemic within the nation, diabetes is a giant well being problem for the US. Virtually one in each 10 individuals within the US endure from diabetes and ~30% of these aged over 65.

In one other notable improvement, AstraZeneca acquired Fusion Prescription drugs, a clinical-stage firm growing radiotherapy therapies. This goes to help the corporate’s quick rising Oncology phase, which contributed to 40% of the revenues in Q1 2024. The full price of acquisition can be a most of USD 2.4 billion, which quantities to 40% of the corporate’s post-tax income in 2023.

The draw back of acquisition and forecasts

With the acquisition, AstraZeneca’s earnings may be impacted going ahead. In 2023, Fusion Prescription drugs reported a USD 1.45 loss per share, which is a notable 38% of AstraZeneca’s reported EPS within the 12 months and 20% of its core EPS. This could clarify why it has saved its earnings steering unchanged to this point.

Along with this, it has additionally revealed its income goal of USD 80 billion by 2030, which represents a compounded annual development price [CAGR] of 8.3% from 2023. Whereas this is not a nasty quantity in any respect in comparison with the CAGR of 6.3% seen over the previous numbers, it’s nonetheless decrease than the present development charges. In different phrases, it signifies potential development softening from the current ranges going ahead.

Upgraded outcomes don’t transfer enhance P/E

Nonetheless, for now, I’ve additionally thought of what the outcomes for the AstraZeneca inventory may be if its core EPS development have been to rise as an alternative, going by the background for the Q1 2024 figures. These estimates assume that for the remaining three quarters of the 12 months, the determine grows at 16.7%, the identical as it could have been in Q1 2024 if it weren’t for a superior base. This ends in an EPS determine of USD 8.3, which is 2.35% larger than my earlier estimate.

The ahead P/E doesn’t change considerably consequently, although, coming in at 19.2x. It’s extra in keeping with the healthcare common and nearer to the inventory’s five-year common, although. The important thing level right here, is that even with an upgraded steering, AZN nonetheless appears pretty valued at greatest.

Dividend enhance

With the inventory worth unlikely to go anyplace quick for for much longer, then, the eye turns to dividends. The corporate lately elevated its annual dividend by 7% to USD 3.1 per share. This brings the ahead dividend yield to 1.95%. This isn’t very a lot, however it’s larger than the TTM yield of 1.82% and in addition the healthcare sector common ahead yield of 1.46%.

5y Yield on Price, AZN (Supply: Searching for Alpha)

There are in fact shares inside the healthcare set, like Bristol-Myers Squibb (BMY), with a a lot larger dividend yield. And it’s a promising inventory in its personal proper, to make certain. However a have a look at the yield on price reveals that over time traders in AZN have been virtually as nicely positioned by way of dividend revenue. Over the previous 5 years, the yield on price for AZN is at 4.9% in comparison with 5.1% for BMY, as AZN’s worth has risen whereas BMY’s has fallen. Checked out one other means, whole returns on AZN are a a lot larger 125.8% in comparison with simply 3.6%, which has seen worth weak spot.

What subsequent?

In conclusion, whereas there is not any denying the AstraZeneca remains to be a powerful inventory, the draw back is tough to overlook too. On the optimistic features, its newest numbers are exceptionally wholesome and continued approvals go in its favour. The dividend enhance provides a pleasant contact for traders too.

Nonetheless, a lot of the upside indicated the final I checked has been exhausted. In reality, its newest acquisition of Fusion Prescription drugs could be a drag on the earnings quantity going ahead. Even then, if a steering improve have been to occur going by its current sturdy figures, the market multiples don’t develop into aggressive. Its long-term development outlook isn’t sturdy sufficient to point additional upside for now both. Not less than for the rest of the 12 months, it is arduous to make a Purchase case for AstraZeneca. I’m downgrading it to Maintain.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.

[ad_2]

Source link