[ad_1]

DKosig

Overview

There are such a lot of totally different avenues that you would be able to put money into and gather a distribution from. That is why I imagine that this is without doubt one of the greatest occasions in trendy historical past to be an earnings investor. abrdn International Infrastructure Earnings Fund (NYSE:ASGI) is one in every of these comparatively new funds, with the inception relationship again to 2020. ASGI operates as a closed finish fund that goals to supply a excessive complete return whereas sustaining publicity to belongings which might be thought-about important providers to society. ASGI has belongings beneath administration totaling barely over $500M and is actively managed by abrdn’s International Fairness and Actual Belongings workforce. ASGI has a web expense ratio of 1.65%.

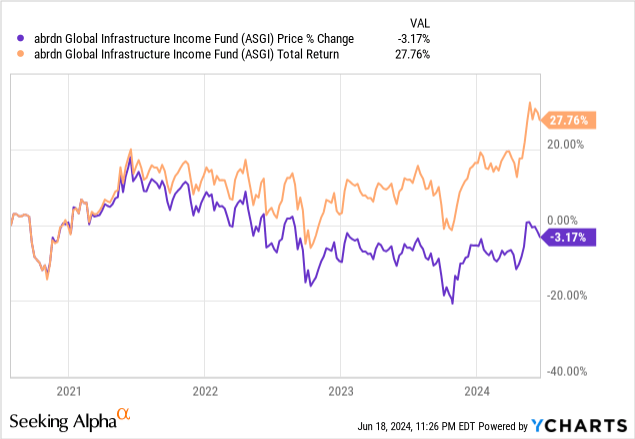

We will see that the worth stayed principally flat since inception, being down solely 3%. Nevertheless, because of the excessive distribution yield of about 12.5%, we are able to see that the overall return sits at 27%. One thing that makes this fund enticing for earnings centered buyers is the excessive yield that points its distributions out on a month-to-month foundation. Moreover, the most recent annual studies reveal that the distribution is properly supported from the web funding earnings in addition to realized positive aspects from the underlying equities inside.

Because the fund continues to be comparatively new, it hasn’t had sufficient time to ascertain sufficient of a popularity in additional typical macro environments. When the fund launched, rates of interest had been at close to zero ranges. Solely two quick years later, rates of interest had been hiked to decade highs. That is why I imagine that when the macro atmosphere begins to enhance, I imagine that there’s a good upside potential for ASGI, since a lot of the sector publicity inside the fund is ready to learn from decrease rates of interest. Moreover, the fund at present trades at an honest low cost to NAV. Nevertheless, I wish to first begin by discussing the portfolio of holdings and the technique ASGI follows.

Technique & Holding Breakdown

Since ASGI operates as a closed finish fund, we should not anticipate a lot upside potential from the fund because it primarily focuses on earnings technology. Closed finish funds have a standard flaw the place progress may be restricted as a result of underperformance of the underlying belongings. Consequently, the NAV shrinks as a result of this underperformance together with the likelihood that closed finish funds sometimes take the distribution out of the web belongings when efficiency cannot cowl it. This is a vital idea to grasp in order that expectations are reasonable.

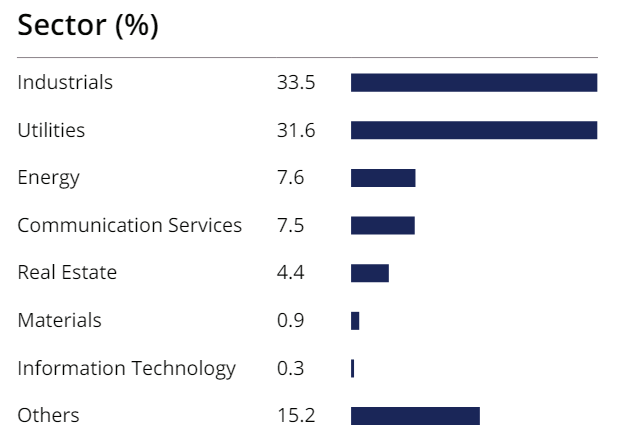

Because the fund has a concentrate on infrastructure, we are able to see that the highest sectors are in areas that we deem important to residing a top quality life. This consists of companies which might be uncovered to roadways, railways, water remedy services, and electrical energy simply to call a couple of. Industrials is main the sector publicity, accounting for 33.5%. That is intently adopted by utilities, which make up 31.6% of the fund. Industrials and utilities make up the vast majority of ASGI and all remaining sector weightings account for lower than 8%.

ASGI Factsheet

It is also value noting that ASGI invests a considerable share of its web belongings outdoors of the US. In response to probably the most up to date factsheet, North American publicity solely accounts for 54.1% of the geographic composition. The second largest geographic publicity is inside the Europe markets, accounting for 23%. ASGI additionally has various quantities of publicity to Latin America, Asian markets, Africa, and the Center East. For reference, listed below are the highest ten holdings of ASGI.

Holding Weight % NextEra Vitality 3.2% Trinity Fuel Holdings 2.8% Vinci SA 2.6% Engie SA 2.6% Aena SME SA 2.5% FERROVIAL SE 2.5% Zon Holdings 2.4% American Tower Corp 2.4% Cellnex Telecom SA 2.4% Norfolk Southern Corp 2.4% Click on to enlarge

An publicity combine like this may be seen as a double edge sword. On one hand, investing in infrastructure is one thing that may be seen as a no brainer since we’re collectively all in search of methods to enhance our society as a complete. Alternatively, the industries that infrastructure operates inside, sometimes depends on a lot of debt financing and may be very delicate to financial shifts and rates of interest.

Dividend & Financials

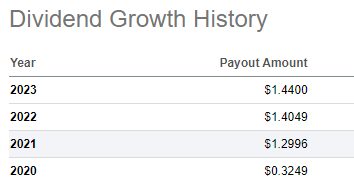

The dividend yield of ASGI at present sits at 12.5%. The distribution was lately raised in mid-June to $0.21 per share. Distributions are paid out on a month-to-month foundation, and this is without doubt one of the issues that makes ASGI such a sexy earnings centered funding. Despite the fact that the historical past of ASGI is kind of quick, we are able to already see the dividend progress going down. We will see that the annual payout quantities have step by step elevated because the fund’s inception.

Searching for Alpha

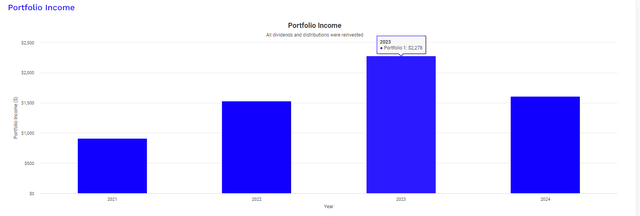

Despite the fact that the fund’s historical past is brief, buyers have had the chance to create a rising stream of dividend earnings. To be able to show this, I ran a again take a look at utilizing Portfolio Visualizer. This graph assumes an unique funding of $10,000 firstly of 2021 and features a month-to-month contribution of $500 to your funding all through the complete holding interval. As well as, it additionally assumes that each one dividends obtained had been reinvested again into ASGI to acquire extra shares and create a snowball impact.

Within the first yr of your funding, you’d have collected $909 in dividend earnings. This complete would have grown to $2,278 by the top of 2023 because of the elevated payout quantities mixed with the continued month-to-month contributions added to your place. Over the subsequent couple of years, I imagine situations can be improved for infrastructure, and now we have a strong probability of seeing bigger distribution will increase because the fund’s efficiency improves.

Portfolio Visualizer

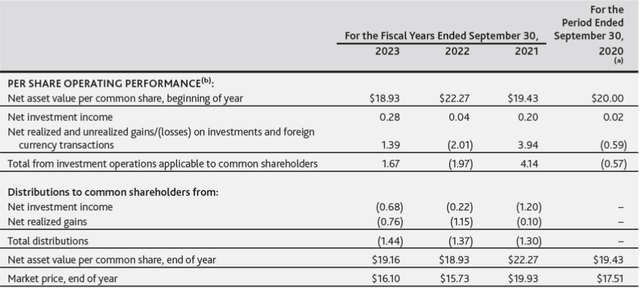

I’m basing these assumptions on ASGI’s web funding earnings and realized positive aspects efficiency thus far during the last couple of years. Looking at ASGI’s 2023 annual report, we are able to see that the distribution for 2023 was totally coated by earnings. Internet funding earnings amounted to $0.28 per share and whereas this will likely not have been spectacular, it was offset by a powerful web realized achieve complete of $1.39 per share. The mixed complete amounted to $1.67 per share, which totally coated the distribution quantity of $1.44 per share.

ASGI 2023 Annual Report

The efficiency of 2023 was a big enchancment over 2022’s efficiency. In 2022, we noticed web funding earnings solely amounting to $0.04 per share, whereas web realized losses amounted to $2.01 per share. Which means the efficiency of 2022 was not adequate sufficient to totally cowl the distribution of $1.37 per share for that yr. Nevertheless, one thing that I like about ASGI is that it retains some earnings from stronger years that can be utilized to cowl the efficiency miss of underperforming years. In 2021, the web realized positive aspects had been very sturdy at $3.94 per share. This was a big extra over the distribution quantity and because of this, the surplus was retained and used over the course of 2022.

Though it hasn’t occurred but, I assume that if we encounter a state of affairs of a number of years of underperformance in a row, ASGI might have to make use of the return of capital to fund the distribution and make up the distinction. As a fund that focuses on earnings technology and stability of distribution, I doubt that administration would lower the distribution. For now although, there’s completely nothing to fret about because the distribution is totally supported and NAV has elevated over the prior yr.

Valuation

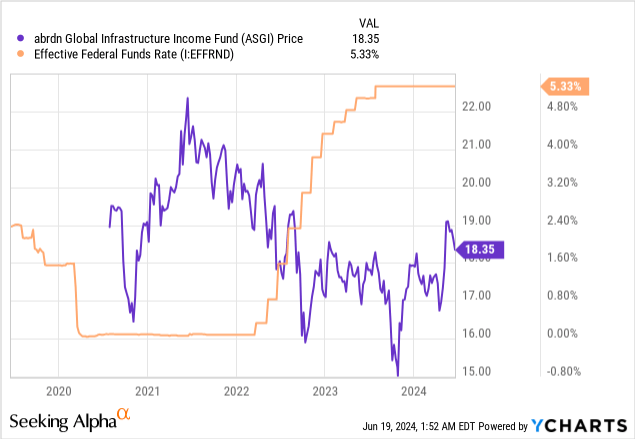

When it comes to valuation, it sits barely beneath its inception value of $20 per share, however I imagine that future rate of interest cuts might function a catalyst to the worth progress of ASGI. Despite the fact that the fund’s historical past is brief, we are able to already see the inverse relationship going down between ASGI’s value and the federal funds charge. When the fund launched in 2020, charges had been close to zero ranges and the worth accelerated to the upside. Conversely, when rates of interest had been hiked to the present decade excessive, we are able to see that ASGI’s value shortly reversed instructions and slide downward.

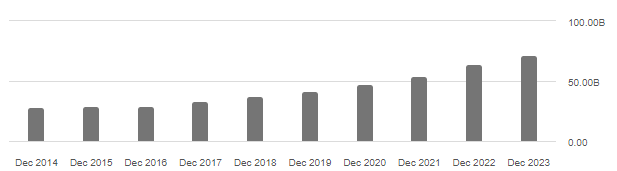

This sensitivity may be defined by the truth that ASGI’s most closely weighted sectors sometimes depend on buying low-cost debt as a approach to fund operational progress. When debt is cheaper to entry and preserve, we’re prone to see elevated progress initiatives from sectors similar to utilities, vitality, and industrials as a result of they use this debt to fund various things similar to acquisitions, plant improvement, analysis, and growth of enterprise operations. For instance, ASGI’s largest holding is NextEra Vitality (NEE) and the corporate at present sits on a big pile of debt totaling practically $80B!

NextEra Vitality Debt Whole (Searching for Alpha)

Since ASGI operates as a closed finish fund, the worth can fluctuate from the web belongings. In the mean time, ASGI trades at a reduction to NAV of seven.5% and though we are able to see that is greater than the historic common, I imagine that this nonetheless serves as an awesome entry level. For reference, ASGI has traded at a median low cost to NAV of 13.2% during the last three yr interval. As well as, I believe that rate of interest cuts could also be on the horizon regardless of the Fed leaving charges unchanged at their final assembly. Moreover, inflation has slowly began to chill and get nearer to the anticipated ranges, which is an encouraging indicator. Lastly, the unemployment charge within the US has slowly crept to the 4% degree and will find yourself peaking above this quickly.

CEF Information

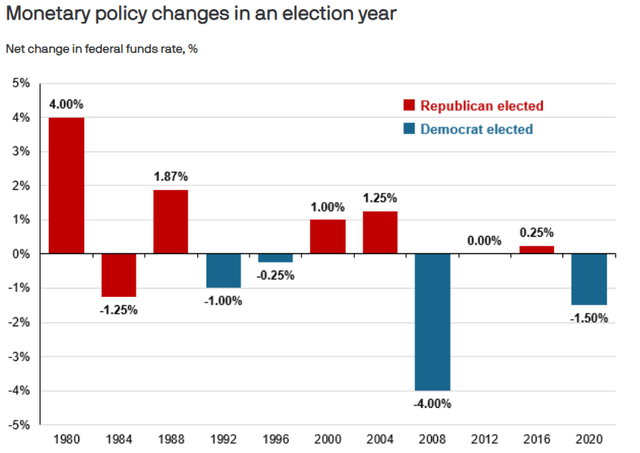

It looks as if the Fed continues to be awaiting extra financial knowledge to roll in earlier than making their choice round rates of interest. Nevertheless, one other indicator that I imagine charges are on the horizon is the truth that the US Presidential elections are arising. Traditionally, the fed has made adjustments within the financial coverage for each election yr relationship again to 1980, excluding 2012. JPMorgan compiled an superior graphic that exhibits us that charge cuts occur extra continuously on election years, regardless of which celebration is elected. There could also be an elevated degree of uncertainty and volatility within the markets round this time and this will likely encourage the Fed to provoke charge cuts.

JPMorgan

Vulnerabilities

Now that we have established that there is a clear hyperlink between rates of interest and ASGI’s major sector publicity, this reveals vulnerabilities. If we stay in an atmosphere of upper rates of interest for an extended time period, we may even see ASGI’s efficiency endure. That is seemingly within the case of extra rate of interest hikes going down as properly. If ASGI has constant intervals of underperformance as a result of these macro influences, we may even see deterioration of the NAV over time. Continued underperformance may imply that return of capital must be used to assist fund the distribution during times the place the web funding earnings or realized positive aspects are usually not adequate sufficient.

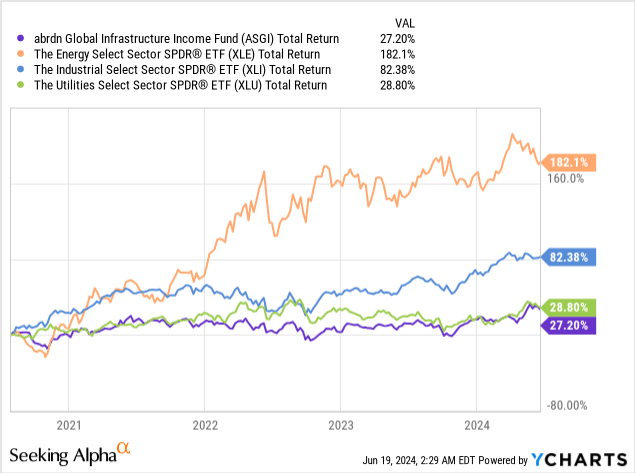

As well as, there’s seemingly little or no value upside that can be captured right here over time. Except you’re an investor that’s prioritizing earnings, you’re prone to get a greater complete return should you had been to only put money into ETFs that monitor these particular person sectors. From a complete return perspective, we are able to see that the vitality sector (XLE), industrial sector (XLI), and utilities sector (XLU) have all outperformed ASGI regardless of having a a lot decrease dividend yield.

That is only a typical symptom of closed finish funds and does not mirror something essentially fallacious with ASGI. CEFs function a bit totally different from conventional ETFs in a way that they’ve a set variety of shares, which might suppress the worth appreciation potential. Moreover, since they’re centered on distribution, closed finish funds like ASGI normally are distributing out a lot of the earnings and never retaining and reinvesting sufficient to depart a significant influence on progress.

Takeaway

In conclusion, ASGI gives publicity to a lot of infrastructure associated sectors which might be deemed to be important elements of life. Subsequently, investing in these sectors may be seen as regular, dependable, and predictable as their income streams are simpler to forecast. Nevertheless, the closed finish fund nature of ASGI might restrict progress potential, so if you’re in search of constant value appreciation, ASGI might not be the fitting selection for you. Conversely, if you’re an earnings investor that’s seeking to seize a distribution that is generated from this numerous sector combine, the excessive 12.5% yield on ASGI could also be a superb match. Financials reveal that web funding earnings and web realized positive aspects totally assist the present distribution. As well as, the worth trades at a present low cost to NAV, however I can see this low cost window get smaller as we method rate of interest cuts on the horizon. Consequently, I charge ASGI as a purchase.

[ad_2]

Source link