[ad_1]

imantsu

Artesian Sources (NASDAQ:ARTNA) is a small water utility with respectable progress potential. Additionally, it’s a regulated monopoly. Therefore, it could generate sluggish and regular progress, translating to constant dividend progress. Presently, the share value has fallen considerably, however it’s poised for future progress. The inventory is undervalued, the yield is the best in a few years, and security is suitable. The corporate can also be a Dividend Champion. I view Artesian Sources as a long-term purchase for dividend progress buyers.

Overview of Artesian Sources

Artesian Sources Company was based over 100 years in the past in 1905. It gives water and wastewater providers in elements of Delaware, Maryland, and Pennsylvania. The utility’s working subsidiaries embrace Artesian Water, Artesian Water Maryland, Artesian Water Pennsylvania, Artesian Wastewater, Artesian Wastewater Maryland, Artesian Utility Growth, Artesian Growth Firm, and Artesian Storm Water.

The water utility has grown appreciably since 2020. It now serves 301,000 folks, delivering 8.8 billion gallons of water yearly by 1,470 miles of water mains, 75 remedy amenities, and 177.5 million gallons of storage.

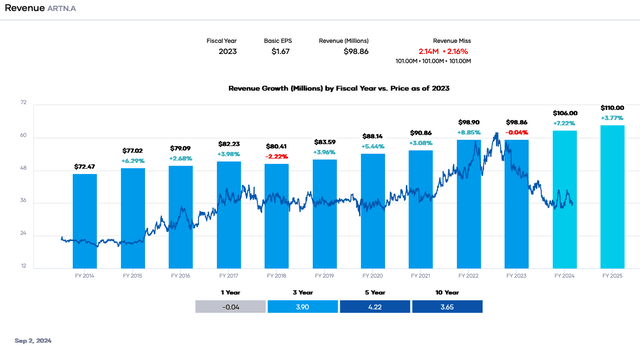

Complete income was greater than $98.9 million in 2023 and $103.1 million within the final twelve months (“LTM”).

Income and Earnings Development

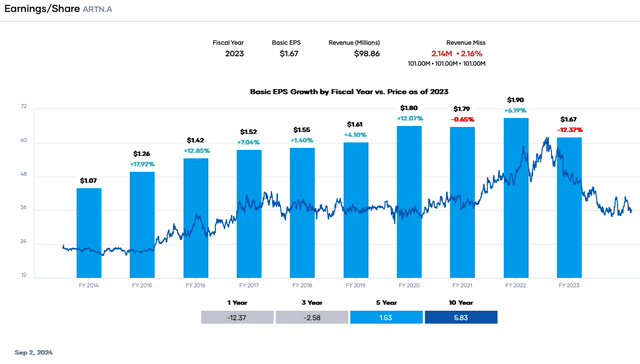

Artesian Water Sources income and earnings per share (“EPS”) have trended up up to now decade with minor downturns. Nevertheless, income and EPS have recovered following every downturn.

Income reached a report $98.9 million in 2022, declining to $98.86 million in 2023. Natural progress, partnerships, tuck-in acquisitions, and value will increase have elevated income. Income usually rises within the low-to-mid single digits.

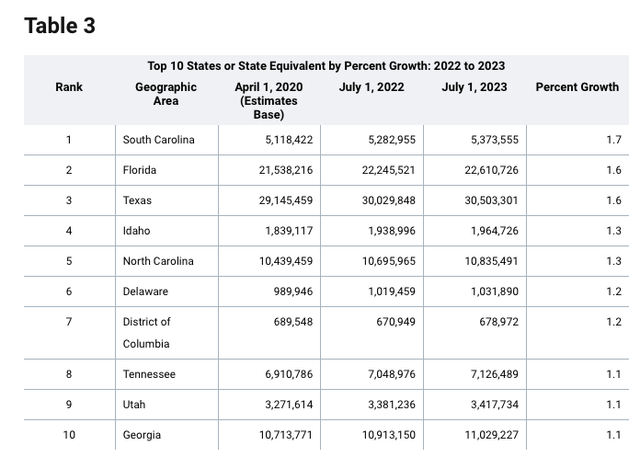

Portfolio Perception

Delaware is a comparatively fast-growing state. The inhabitants will increase about 1% to 1.5% yearly. Though the speed doesn’t seem to be a lot, the state was the sixth fastest-growing state in America in 2023. Inhabitants progress will improve the shopper base. As well as, the agency has a strong capital funding program that can end in future growth inflicting income to climb.

The utility additionally establishes partnerships with municipalities, including to their buyer base. Since our final article, it has additionally engaged in periodic M&A. Artesian Sources has acquired the City of Frankford’s water system and Tidewater Environmental Providers from Middlesex Water. Lastly, the corporate utilized for a price improve for the primary time in 9 years in late 2023. Artesian Sources charged larger charges briefly till the Delaware Public Service Fee authorized. The Fee authorized 15% larger charges in June 2024.

US Census Bureau

Equally, EPS fell barely in the course of the pandemic in 2021 earlier than bouncing again. In addition they declined in 2023. Nevertheless, this drop was extra substantial at 12.4% due to larger bills, extra curiosity expenses, and a better variety of shares. The water utility issued 700,00 shares for compensation of debt and capital funding. That stated, consensus EPS is anticipated to bounce again to $1.92 per share in 2024.

Portfolio Perception

Regardless of the normally constructive traits, the share value peaked in January 2023 and has fallen considerably since then. It’s down ~12.9% this yr and ~21.8% up to now twelve months. The share value is flat within the final 5 years. Moreover decrease EPS, the principle purpose was that larger rates of interest make utilities much less enticing to buyers. Moreover, Artesian Sources had a modest yield on the time.

Current Challenges

Artesian Sources’ challenges are associated to Delaware’s restricted progress potential. Though Delaware is a fast-growing state, the preliminary inhabitants is small and solely simply crossed the a million mark. This can preserve a cap on progress. Additionally, the utility has restricted M&A alternatives after increasing quickly.

The agency faces dangers revolving round cyber-attacks. Oil pipelines have been focused up to now, and water utilities might face comparable assaults. One other threat is pure disasters. Nevertheless, since water and wastewater pipelines are primarily underground, they could have a restricted scope.

Aggressive Benefits

Artesian Sources’ foremost benefit is its standing as a regulated monopoly. Consequently, it faces no competitors however has regulatory oversight into pricing and charges of return. This truth additionally leads to steady however steadily rising income, EPS, and money stream.

Lastly, the water utility is comparatively recession-resistant. Water and wastewater remedy are a necessity. Income and EPS grew in the course of the COVID-19 pandemic in 2020 when many firms skilled declines.

Dividend Evaluation

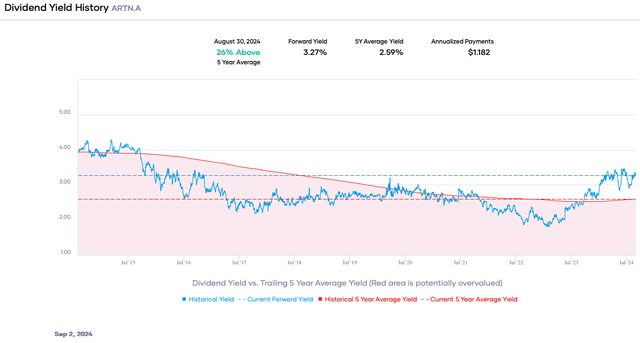

Artesian Sources’ share value decline has brought about the dividend yield to climb to three.27%. The worth is larger than the 5-year common of two.59%. That stated, the yield was roughly 4% in 2015. I don’t anticipate it to return to this worth, particularly if the U.S. Federal Reserve cuts charges. Nevertheless, the current worth is suitable for a water utility. For perspective, it’s greater than most of its friends.

Portfolio Perception

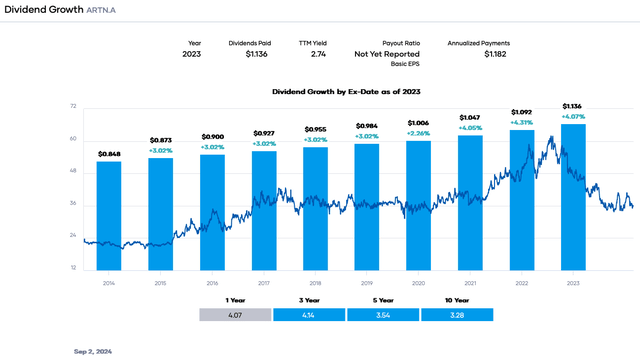

Moreover, Artesian Sources is a Dividend Champion with a 32-year streak of will increase. The annual progress price is about 3% to 4% yearly. We don’t anticipate this to alter due to historical past, the payout ratio, and leverage.

Portfolio Perception

The dividend is supported by acceptable security. The payout ratio is 65% primarily based on an estimated 2024 EPS of $1.92. This worth is exactly at our threshold. Working money stream (“OCF”) of $32 million supported the dividend requirement of $11.24 million in 2023. The dividend-to-FCF ratio of 35% is effectively beneath our goal worth of 70% or higher. Furthermore, we anticipate FCF to extend in 2024 due to the speed improve. Lastly, Artesian Sources receives an ‘A+’ dividend high quality grade from Portfolio Perception, a measure of earnings efficiency, income efficiency, dividend efficiency, profitability, and monetary energy. The online end result must be investor confidence about dividend security.

Valuation

The share value has dropped to the place it was from mid-2017 to late-2020. It’s down about 0.8% up to now 5 years. Despite the fact that the agency is positioned for progress, larger rates of interest and share issuance in all probability brought about buyers to promote or not less than choose U.S. Treasuries. Nonetheless, the result’s a decrease price-to-earnings (P/E) ratio of 18.8X, beneath the trailing five- and ten-year ranges.

Analysts estimate the water utility will earn $1.92 per share in 2024, which is $0.02 greater than in 2022 and far larger than in 2023. We are going to use 20X because the truthful worth a number of in the midst of the 5-year vary. Consequently, our truthful worth estimate is $38.40. The current share value is ~$36.11, suggesting that Artesian Sources is barely undervalued.

Making use of a sensitivity calculation utilizing P/E ratios between 19X and 21X, we get hold of a good worth vary from $36.48 to $40.32. Therefore, the inventory value is roughly 90% to 99% of the truthful worth estimate.

Estimated Present Valuation Based mostly On P/E Ratio

P/E Ratio

19

20

21

Estimated Worth

$36.48

$38.40

$40.32

% of Estimated Worth at Present Inventory Worth

99%

94%

90%

Click on to enlarge

Supply: Dividend Energy Calculations

How does this calculation evaluate to different valuation fashions? Portfolio Perception’s blended truthful worth mannequin, combining the P/E ratio and dividend yield, estimates a good worth of $46.72 per share. The 2-model common is ~$42.56, indicating that Artesian Sources is undervalued on the present value.

Last Ideas

Water utilities are a wonderful alternative for dividend progress buyers. Actually, there are three on the Dividend King checklist. They have a tendency to own traits that permit for slow-and-steady dividend will increase. The share value is probably going down due to larger rates of interest, share issuance, and decrease EPS in 2023. That stated, we anticipate a rebound in 2024 due to price will increase and potential rate of interest cuts by the Fed. The mixture of undervaluation, dividend security, and regulatory benefits is enticing. I view Artesian Sources as a long-term purchase.

[ad_2]

Source link

![The Full List of Stocks That Pay Dividends in September [Free Download] The Full List of Stocks That Pay Dividends in September [Free Download]](https://www.suredividend.com/wp-content/uploads/2022/11/August-Dividend-Stocks-1-e1667945763898.png)