[ad_1]

As monetary providers companies scramble to maintain tempo with technological developments like machine studying and synthetic intelligence (AI), information governance (DG) and information administration (DM) are taking part in an more and more necessary function — a task that’s usually downplayed in what has develop into a know-how arms race.

DG and DM are core parts of a profitable enterprise information and analytics platform. They need to match inside a company’s funding philosophy and construction. Embracing enterprise area data, expertise, and experience empowers the agency to include administration of BD alongside conventional small information.

Little question, the deployment of superior applied sciences will drive larger efficiencies and safe aggressive benefits by way of larger productiveness, price financial savings, and differentiated methods and merchandise. However irrespective of how subtle and costly a agency’s AI instruments are, it shouldn’t overlook that the precept “rubbish in, rubbish out” (GIGO) applies to your entire funding administration course of.

Flawed and poor-quality enter information is destined to provide defective, ineffective outputs. AI fashions should be educated, validated, and examined with high-quality information that’s extracted and purposed for coaching, validating, and testing.

Getting the info proper usually sounds much less attention-grabbing and even boring for many funding professionals. In addition to, practitioners sometimes don’t assume that their job description consists of DG and DM.

However there’s a rising recognition amongst {industry} leaders that cross-functional, T-Formed Groups will assist organizations develop funding processes that incorporate AI and large information (BD). But, regardless of elevated collaboration between the funding and know-how capabilities, the important inputs of DG and DM are sometimes not sufficiently strong.

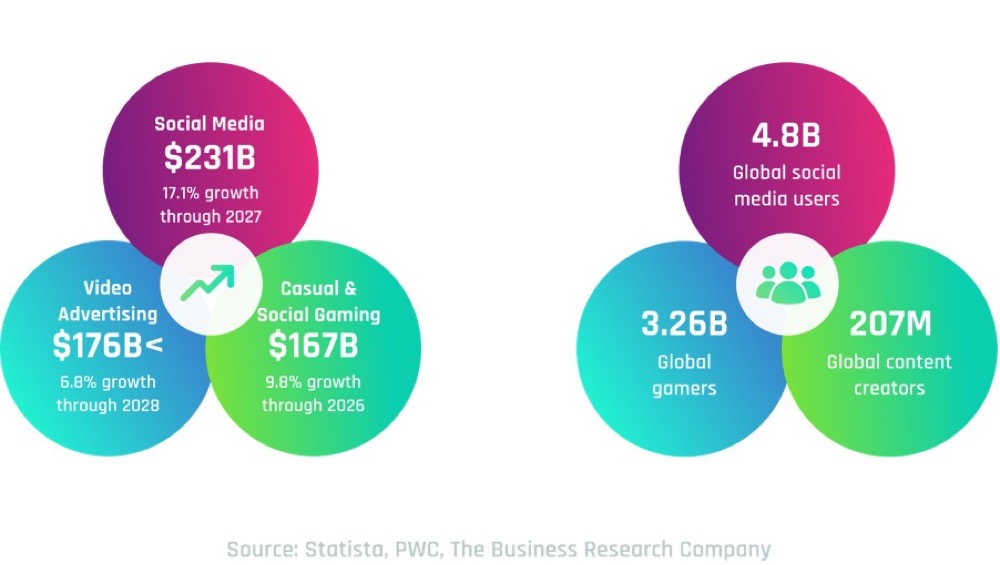

The Knowledge Science Venn Diagram

BD is the first enter of AI fashions. Knowledge Science is an inter-disciplinary subject comprising overlaps amongst math and statistics, pc science, area data, and experience. As I wrote in a earlier weblog put up, human groups that efficiently adapt to the evolving panorama will persevere. People who don’t are prone to render themselves out of date.

Exhibit 1 illustrates the overlapping capabilities. Wanting on the Venn Diagram by way of the lens of job capabilities inside an funding administration agency: AI professionals cowl math and statistics; know-how professionals deal with pc science; and funding professionals deliver a depth of information, expertise, and experience to the staff — with the assistance of knowledge professionals.

Exhibit 1.

Desk 1 offers solely with BD options. Clearly, professionals with abilities in a single space can’t be anticipated to cope with this stage of complexity.

Desk 1. BD and 5 Vs

Quantity, veracity, and worth are difficult on account of nagging uncertainty about completeness and accuracy of knowledge, in addition to the validity of garnered insights.

To unleash the potential of BD and AI, funding professionals should perceive how these ideas function collectively in observe. Solely then can BD and AI drive effectivity, productiveness, and aggressive benefit.

Enter DG and DM. They’re important for managing information safety and secured information privateness, that are areas of serious regulatory focus. That features put up world monetary disaster regulatory reform, such because the Basel Committee on Banking Supervision’s normal 239(BCBS239) and the European Union’s Solvency II Directive. Newer regulatory actions embrace the European Central Financial institution’s Knowledge High quality Dashboard, the California Client Privateness Act, and the EU’s Normal Knowledge Safety Regulation (GDPR), which compels the {industry} to raised handle the privateness of people’ private information.

Future laws are probably to provide people elevated possession of their information. Companies must be working to outline digital information rights and requirements, significantly in how they are going to shield particular person privateness.

Knowledge incorporates each the uncooked, unprocessed inputs in addition to the ensuing “content material.” Content material is the results of evaluation — usually on dashboards that allow story-telling. DG fashions may be constructed primarily based on this basis and DG practices won’t essentially be the identical throughout each group. Notably, DG frameworks have but to deal with easy methods to deal with BD and AI fashions, which exist solely ephemerally and alter regularly.

What Are the Key Elements of Knowledge Governance?

Alignment and Dedication: Alignment on information technique throughout the enterprise, and administration dedication to it’s important. Steerage from a multi-stakeholder committee inside a company is desired.From an inside management and governance perspective, a minimal stage of transparency, explainability, interpretability, auditability, traceability, and repeatability should be ensured for a committee to have the ability to analyze the info, in addition to the fashions used, and approve deployment. This perform must be separate from the well-documented information analysis and mannequin growth course of.

Safety: Knowledge safety is the observe of defining, labeling, and approving information by their ranges of danger and reward, after which granting safe entry rights to acceptable events involved. In different phrases, placing safety measures in place and defending information from unauthorized entry and information corruption. Protecting a stability between consumer accessibility and safety is essential.

Transparency: Each coverage and process a agency adopts should be clear and auditable. Transparency means enabling information analysts, portfolio managers, and different stakeholders to grasp the supply of the info and the way it’s processed, saved, consumed, archived, and deleted.

Compliance: Guaranteeing that controls are in place to adjust to company insurance policies and procedures in addition to regulatory and legislative necessities shouldn’t be sufficient. Ongoing monitoring is important. Insurance policies ought to embrace figuring out attributes of delicate info, defending privateness through anonymization and tokenization of knowledge the place attainable, and fulfilling necessities of knowledge retention.

Stewardship: An assigned staff of knowledge stewards must be established to observe and management how enterprise customers faucet into information. Main by instance, these stewards will guarantee information high quality, safety, transparency, and compliance.

What Are the Key Parts of Knowledge Administration?

Preparation: That is the method of cleansing and remodeling uncooked information to permit for information completeness and accuracy. This important first step typically will get missed within the rush for evaluation and reporting, and organizations discover themselves making rubbish choices with rubbish information.

Creating a knowledge mannequin that’s “constructed to evolve always” is way significantly better than creating a knowledge mannequin that’s “constructed to final lengthy as it’s.” The information mannequin ought to meet as we speak’s wants and adapt to future change.

Databases collected underneath heterogeneous situations (i.e., completely different populations, regimes, or sampling strategies) present new alternatives for evaluation that can’t be achieved by way of particular person information sources. On the identical time, the mix of such underlying heterogeneous environments provides rise to potential analytical challenges and pitfalls, together with sampling choice, confounding, and cross-population biases whereas standardization and information aggregation make information dealing with and evaluation easy, however not essentially insightful.

Catalogs, Warehouses, and Pipelines: Knowledge catalogs home the metadata and supply a holistic view of the info, making it simpler to search out and monitor. Knowledge warehouses consolidate all information throughout catalogs, and information pipelines robotically switch information from one system to a different.

Extract, Rework, Load (ETL): ETL means reworking information right into a format to load into a company’s information warehouse. ETLs usually are automated processes which might be preceded by information preparation and information pipelines.

Knowledge Structure: That is the formal construction for managing information circulation and storage.

DM follows insurance policies and procedures outlined in DG. The DM framework manages the total information lifecycle that meets organizational wants for information utilization, decision-making, and concrete actions.

Having these DG and DM frameworks in place is important to investigate advanced BD. If information must be handled as an necessary firm asset, a company must be structured and managed as such.

What’s extra, it’s key to grasp that DG and DM ought to work in synchronization. DG with out DM and its implementation finally ends up being a pie within the sky. DG places all of the insurance policies and procedures in place, and DM and its implementation allow a company to investigate information and make choices.

To make use of an analogy, DG creates and designs a blueprint for development of a brand new constructing, and DM is the act of developing the constructing. Though you possibly can assemble a small constructing (DM on this analogy) and not using a blueprint (DG), will probably be much less environment friendly, much less efficient, not compliant with laws, and with a larger probability of a constructing collapse when a robust earthquake hits.

Understanding each DG and DM will assist your group take advantage of the out there information and make higher enterprise choices.

References

Larry Cao, CFA, CFA Institute (2019), AI Pioneers in Funding Administration, https://www.cfainstitute.org/en/analysis/industry-research/ai-pioneers-in-investment-management

Larry Cao, CFA, CFA Institute (2021), T-Formed Groups: Organizing to Undertake AI and Large Knowledge at Funding Companies, https://www.cfainstitute.org/en/analysis/industry-research/t-shaped-teams

Yoshimasa Satoh, CFA, (2022), Machine Studying Algorithms and Coaching Strategies: A Choice-Making Flowchart, https://blogs.cfainstitute.org/investor/2022/08/18/machine-learning-algorithms-and-training-methods-a-decision-making-flowchart/

Yoshimasa Satoh, CFA and Michinori Kanokogi, CFA (2023), ChatGPT and Generative AI: What They Imply for Funding Professionals, https://blogs.cfainstitute.org/investor/2023/05/09/chatgpt-and-generative-ai-what-they-mean-for-investment-professionals/

Tableau, Knowledge Administration vs. Knowledge Governance: The Distinction Defined, https://www.tableau.com/be taught/articles/data-management-vs-data-governance

KPMG (2021), What’s information governance — and what function ought to finance play? https://advisory.kpmg.us/articles/2021/finance-data-analytics-common-questions/data-governance-finance-play-role.html

Deloitte (2021), Establishing a “constructed to evolve” finance information technique: Sturdy enterprise info and information governance fashions, https://www2.deloitte.com/us/en/pages/operations/articles/data-governance-model-and-finance-data-strategy.html

Deloitte (2021), Defining the finance information technique, enterprise info mannequin, and governance mannequin, https://www2.deloitte.com/content material/dam/Deloitte/us/Paperwork/process-and-operations/us-defining-the-finance-data-strategy.pdf

Ernst & Younger (2020), Three priorities for monetary establishments to drive a next-generation information governance framework, https://belongings.ey.com/content material/dam/ey-sites/ey-com/en_gl/matters/banking-and-capital-markets/ey-three-priorities-for-fis-to-drive-a-next-generation-data-governance-framework.pdf

OECD (2021), Synthetic Intelligence, Machine Studying and Large Knowledge in Finance: Alternatives, Challenges, and Implications for Coverage Makers, https://www.oecd.org/finance/artificial-intelligence-machine-learning-big-data-in-finance.htm.

[ad_2]

Source link