[ad_1]

picturegarden/DigitalVision by way of Getty Pictures

Among the many largest items of reports to return out of Berkshire Hathaway Inc.’s (BRK.A, BRK.B) earnings is the announcement that the corporate bought half of its stake in Apple Inc. (NASDAQ:AAPL) inventory over the previous a number of months, or roughly $80 billion with (greater than 2.5% of the corporate). After Apple’s latest fiscal Q3 earnings announcement, we perceive why Berkshire Hathaway bought its stake.

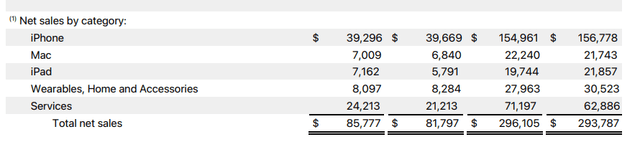

Apple Section Efficiency

Apple noticed robust efficiency in sure segments, however progress remained modest.

Apple Press Launch

The corporate noticed $39.3 billion in iPhone gross sales displaying a 2% YoY decline, because the section seems to steadiness out. Mac noticed 2% progress, because it stays a dominant computing platform. iPad particularly outperformed with double-digit progress, not stunning given the shortage of latest iPad launches in 2023.

It is also price noting that for the final 3 quarters, iPad continues to underperform versus the prior yr. General, for the previous 9 months, the corporate’s income has solely elevated by lower than 1%.

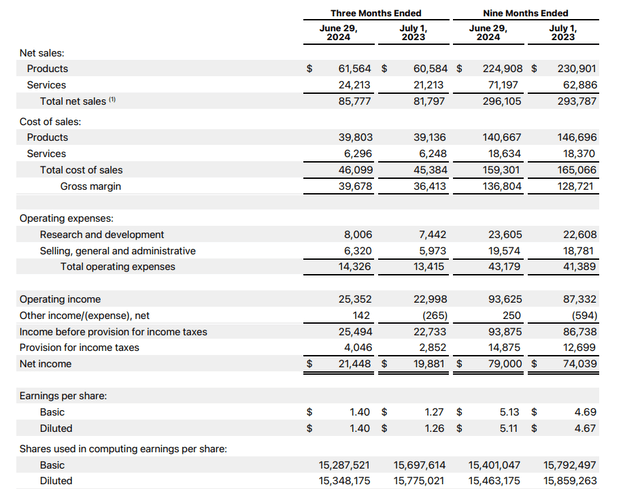

Apple Monetary Outcomes

The corporate’s monetary outcomes present it has a robust enterprise producing large earnings, however with out the earnings to justify its valuation.

Apple Press Launch

Particularly, the corporate’s price of internet gross sales has managed to go down even whereas income has grown as the corporate has improved its margins. Income went down by 1% whereas the price of gross sales went down by roughly 3.5%. Whereas it is nice the corporate can hold lowering prices, these low single-digit actions present how optimized the corporate’s present enterprise is.

The corporate additionally did see some enhance in working expenditures, because it’s persevering with to speculate each normally and administrative capabilities and analysis and improvement. The expansion in these segments elevated by roughly 5% for the corporate, it is the most important supply of pricy progress. Nonetheless, reducing the price of merchandise helped it internet total.

On the finish of the day, the corporate stays a worthwhile powerhouse with an working revenue of $94 billion (annualized at $120 billion accounting for the vacation quarter). That is annualized EPS for the corporate of ~$6.5 up from ~$6, which does seem like a reasonably spectacular 8% progress. Nonetheless, it is price noting that this comes with a 3% discount in excellent shares.

The corporate continues to spend just about all of its money movement on lowering shares excellent, which drives EPS progress, however is synthetic because it’s successfully your shareholder returns from present years being reinvested.

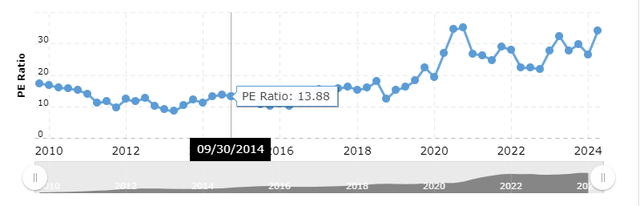

Apple Valuation

Apple has generated robust returns just lately. Nonetheless, most of that has been an enlargement within the firm’s multiples.

Macrotrends

The corporate spent a lot of 2010 to 2020 buying and selling at a P/E ratio of ~13. Since then, the corporate’s P/E ratio has expanded to greater than 30 (~34). That implies that the corporate is buying and selling at a 3% FCF from historic buying and selling of ~8-9%. That is high-quality if the corporate is rising, however as progress slows down, we count on the corporate’s valuation to contract.

That is a threat as a result of it reveals how the corporate’s share worth can decline considerably with out its earnings altering, simply from a shift within the opinion of the market. It is a threat that is price paying shut consideration to.

Apple’s Conundrum

On the finish of the day, Apple’s earnings present why Berkshire Hathaway bought.

Berkshire Hathaway and its famed investor CEO have lengthy mentioned their curiosity in investing in a beautiful firm at a good worth. Nonetheless, Apple has been buying and selling above a good worth. The corporate, at a P/E of ~34, is buying and selling at a 3% yield. That money goes to a paltry 0.5% dividend and share buybacks.

The corporate’s dimension means it might announce document buybacks, like its $110 billion share buyback, nonetheless, that is nonetheless only a few %, and it now not has the huge money place to purchase again shares at a bigger scale. The corporate managed to develop internet revenue supported by decrease product prices, however we do not see prices as having the ability to be diminished endlessly.

Buying and selling at a 3% yield with mid-single digit progress is not an interesting funding versus the S&P 500.

Thesis Danger

The most important threat to our thesis is that Apple is a robust and secure big. The corporate continues to generate large money movement, enhance its operations, and develop. In a market with concern, the corporate represents a secure alternative. That might consequence within the firm’s share worth remaining increased for longer and driving robust shareholder returns.

Conclusion

We’re not stunned that Berkshire Hathaway took the chance to promote Apple. At at this time’s market costs, you may earn a better return in your money by investing in U.S. Treasury bonds versus investing in Apple with its paltry dividend and share buybacks. The corporate has continued to develop earnings, however they do not justify its lofty valuation.

We’re not stunned that Berkshire Hathaway bought, and it is clear why Berkshire Hathaway did. The corporate is elevating money in an costly market. We mentioned right here its success with that money place and skill to drive ensuing returns. In consequence, we suggest towards investing in Apple presently and valuation.

[ad_2]

Source link