[ad_1]

Justin Sullivan

Funding Thesis

Going into the occasion final week, the market had excessive expectations across the new iPhone 16 given this is among the first AI-enabled units that Apple Inc. (NASDAQ:AAPL) has ever launched.

I feel the inventory’s rally within the months main as much as the launch confirmed that buyers are betting on a wave of upgrades this cycle, notably given {that a} portion of the present put in base has not been upgraded in 4 years. Some analysts are bullish, projecting a “supercycle” that would break earlier gross sales information, with an estimated 300 million customers primed for upgrades.

What’s odd about this iPhone cycle is the division in opinions amongst buyers and analysts. Some analysts (like Dan Ives) are bullish. Nevertheless, not everybody has joined the hype and a few are usually not satisfied that this new AI cellphone cycle shall be influential.

Herein lies the chance, in my view. A variety of information headlines tout the bullish forecasts. However I feel it is clear that the general investor group shouldn’t be almost as web bullish. This represents a tranche of capital that might be unlocked and will purchase Apple shares in the event that they shock to the upside.

Though Apple shares have slumped extra just lately heading into this long-awaited product launch final week, I nonetheless assume they will exceed market expectations, and carefully mirror the success seen with the iPhone 6 in 2014. Again then, the larger-screen iPhone 6 triggered an enormous improve cycle, promoting 74.5 million units in only one quarter and efficiently pushed Apple’s earnings to report ranges on the time. Actually, the iPhone 6 has nonetheless not been handed because the best-selling touchscreen smartphone lineup ever. That’s till this newest iPhone got here out.

This yr’s launch has equally excessive expectations, with UBS just lately elevating their value goal for Apple to $236 due to the mixing of superior AI options, together with Apple Intelligence, and different options like enhanced cameras, sooner chips, and improved consumer expertise will spur demand for the brand new units.

I feel that with a consumer base of over 1.32 billion iPhones, Apple will seemingly profit from a powerful improve even when only a fraction of those customers choose to take action. With this, I feel Apple remains to be positioned as a powerful purchase. Regardless of latest slower iPhone gross sales, the potential for an additional main improve cycle offers Apple an edge within the smartphone market over their rivals, all powered by AI.

Why I am Doing Observe-Up Protection

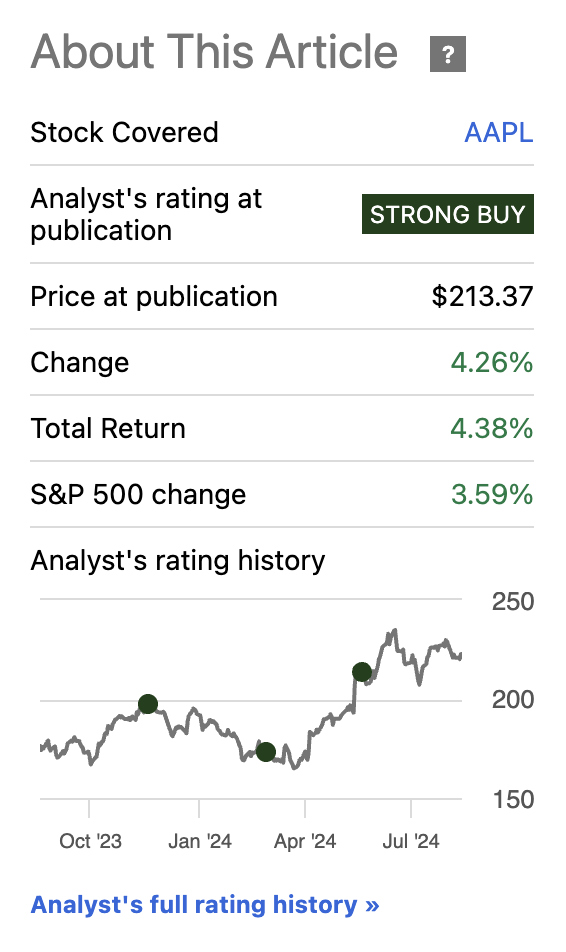

Apple’s shares have barely beat the broader market, up by 4.38% since my final protection in June, post-WWDC, the place preliminary enthusiasm centered across the AI software program updates that Apple is launching natively on their iPhone lineup.

Apple Inventory Efficiency (Looking for Alpha)

So whereas expectations have been excessive going into the occasion Monday and a number of the brand new AI options have been already identified, the brand new iPhone 16 arguably surpassed lots of these expectations for the reason that gadget’s AI-powered capabilities, akin to Apple Intelligence, transcend incremental software program upgrades and make the corporate able to capturing sturdy demand throughout their giant put in base.

Do not get me incorrect right here, I do know Apple might be probably the most effectively priced shares on the road proper now, given they’re one of many world’s largest corporations.

However regardless of being probably the most carefully monitored shares on Wall Road, most likely second solely to NVIDIA Company (NVDA) in tech circles, the market truly seems to be inefficiently pricing Apple right here as a result of the investor group is so divided on this fairness. As I discussed above, UBS’s latest value goal exhibits that the market has not totally priced within the potential affect of this launch. I feel shares stay undervalued, even after a ton of publicity after the occasion.

With their sturdy AI integrations, shopper pleasure for the brand new iPhone mannequin, and the corporate’s consumer base that’s ripe for an improve, the inventory is positioned for additional upside.

The aim of me doing follow-up protection is to point out that as a result of the investor base is so divided, buyers have a singular alternative.

What Made This Occasion So Large

Apple’s newest updates from their September ninth occasion refreshed a number of their shopper lineup (throughout their iPhone, AirPods, and Apple Watch product strains).

I feel what’s telling right here is that whereas the improvements are incremental, they’re additionally invaluable on the identical time, and present Apple’s sturdy innovation pipeline with the iPhone lineup now getting into its seventeenth yr as a product line.

The iPhone 16, which is powered by the A18 Professional chip, is designed for enhanced AI duties akin to personalised suggestions and improved digital camera efficiency. The corporate additionally claims that the gadget’s ultra-wide digital camera captures 2.6 occasions extra gentle, which is right for low-light pictures, whereas the brand new “Fusion Digicam” function permits for extra granular management over picture settings.

Together with the brand new iPhone, the Apple Watch Collection 10 bought a powerful collection of upgrades with a bigger OLED show for extra display area, and superior well being monitoring options, together with sleep apnea detection and coronary heart fee monitoring. The gadget can be thinner by 10% for higher wearability.

The AirPods 4 now function personalised spatial audio and adaptive noise cancellation, powered by the H2 chip. These options permit the gadget to regulate to environmental noise and dialog settings in real-time which, I feel, is a big improve for Apple.

I, personally, name lots of people that speak to me by their AirPods. I discover the present AirPods glorious at capturing background noise (from easy wind noises exterior to the sounds of cooking when they’re of their kitchen). As a listener, I discover this painful. These new AirPods resolve for this.

Past this, the AirPods Professional 2 introduces listening to help functionalities, which have already impacted the listening to help market by providing a extra inexpensive, over-the-counter answer for customers with delicate to average listening to loss. They just lately turned FDA-approved which is a big milestone for Apple.

The AirPods Professional replace is projected to disrupt the $13 billion listening to help market, with its added capability to function an over-the-counter listening to help for customers with delicate to average listening to loss. This function alone can improve accessibility to listening to assist, serving to to normalize listening to aids by mixing them into on a regular basis shopper tech.

Apple Has The Proper Incentives

I consider Apple’s sturdy AI integrations on the iPhone 16 will drive a collection of AI-powered software program instruments into customers’ pockets that can assist the corporate generate elevated recurring income from these providers to assist their market management past {hardware}. The brand new AI options on the iPhone are extra than simply the {hardware}. It is about Apple rising their software program enterprise.

This leads me to one of many greatest (and I feel under-discussed) footnotes from the Apple Occasion.

Apple is providing a strong iPhone trade-in program that, I feel, is essential to driving the improve cycle for the iPhone 16.

U.S. prospects buying and selling in an iPhone 12 or newer can obtain as much as $1,000 in credit score in the direction of a brand new iPhone 16 Professional when bought by main carriers like Verizon, AT&T, or T-Cellular – a transfer to encourage extra customers to undertake the most recent {hardware} whereas Apple continues to upsell by their increasing ecosystem of apps and providers. Remember that the brand new iPhones are within the $799-$999 vary. This might imply that some customers pay net-zero out of pocket for a brand new iPhone.

Who would not need to take this supply?

In essence, I feel the improve prices are going to be very low for a lot of customers. That is large.

I feel Apple is planning to hook customers with a brand new AI-enabled iPhone, however then upsell new AI options on their iPhones, particularly with the introduction of Apple Intelligence throughout WWDC this yr. Remember that Apple makes as much as 30% fee on in-app gross sales from apps listed within the Apple app retailer. Any new AI app within the App Retailer that buyers pay for (solely as a result of they’ve the brand new iPhone which was virtually zero out of pocket) has to surrender to 30% of their income to Apple.

Valuation

To be clear, Apple shares proper now are usually not a purchase after we evaluate their P/E to the sector median P/E. In any case, Apple’s ahead P/E ratio of 33.27 stays increased than the sector median of 23.53, a 41.40% premium.

However Apple isn’t any peculiar firm (no sector median firm), and I feel they need to commerce at a premium. The query is how a lot.

Apple’s administration is a wonderful capital allocator with the corporate sporting a return on fairness (ROE) of 160.58%, which outpaces the sector’s 4.65% by a whopping 3,353.03%. Though Apple is among the world’s largest corporations, it continues to search out locations the place a single greenback of fairness firstly of the yr yields roughly $1.60 in extra returns by year-end. That is unbelievable.

As the corporate dives deeper into AI with their product launches this previous week, I feel their consumer-facing focus will assist them truly do nicely in capitalizing on AI’s potential in the long run.

Analysts are at present projecting 9.11% YoY EPS progress for the fiscal yr ending this month (September 2024), and 10.83% for the yr after (FY 2025).

I feel these estimates could also be conservative, though the corporate is among the largest by income, and it is laborious to develop considerably at such a scale. The rising function of software program income in Apple’s enterprise mannequin, notably the upselling of AI-driven providers, improve margins and trigger better-than-expected EPS progress. As I discussed earlier than, the investor group is very polarized proper now on this Apple launch. I feel when the outcomes begin to are available from this AI-driven technique, many buyers shall be stunned.

I feel Apple needs to be buying and selling nearer to a 50% premium to the sector median ahead P/E to signify their distinctive enterprise mannequin that mixes {hardware} and now AI software program income. They’re determining how you can monetize AI for customers. A 50% premium to the sector median would signify roughly 6% upside from right here in shares not together with dividends, and the highly effective buyback packages that Apple has in place. A 6% upside is my conservative estimate, however I feel there may be room for lots of variance to the upside.

Dangers

Mockingly, I feel the largest threat to this thesis taking part in out shouldn’t be truly inside the firm, however truly from one in all their largest shareholders.

Warren Buffett’s latest gross sales of Apple inventory places a number of strain on shares because the market absorbs the provision, and psychological strain on the iPhone large since Warren Buffett has proclaimed beforehand that his favourite holding interval is ‘without end.’ The Oracle of Omaha, identified for his long-term investing method, has been systematically decreasing his holdings in Apple and different shares during the last a number of quarters. When Buffett begins promoting, it typically alerts his perception that future efficiency might not justify holding such a big place. This case could be the exception, nevertheless.

Buffett acknowledged these gross sales on the Berkshire Hathaway investor convention earlier this yr, which it seems was largely pushed by tax concerns fairly than a bearish outlook on Apple itself. I consider he’s aiming to capitalize on traditionally low company tax charges to appreciate good points on the extremely appreciated inventory.

In essence, promoting from Buffett is commonly a psychological and monetary pressure on an organization’s investor base. This can be a uncommon exception. I feel the basic efficiency of Apple right here will outweigh the gross sales.

Backside Line

Apple’s give attention to AI software program providers, utilizing the most recent iPhone as a high-margin product to drive shopper software program spending, presents a singular market edge, and helps resolve the division within the investor group surrounding the discharge of this product. The corporate’s means to upsell by their ecosystem, together with their extraordinarily sturdy trade-in program, helps sturdy shopper demand.

I nonetheless anticipate the iPhone 16 launch to set off an improve cycle, pushed by AI-enabled options like Apple Intelligence and a trade-in program that sweetens the supply. With an estimated 300 million customers primed for upgrades, this rollout may replicate the success of the iPhone 6 a decade in the past. With this, I feel shares are nonetheless a powerful purchase with a direct path to some upside within the close to time period, and the potential for far more over the long term.

[ad_2]

Source link