[ad_1]

Andrii Yalanskyi

AAPL inventory FY Q3 recap

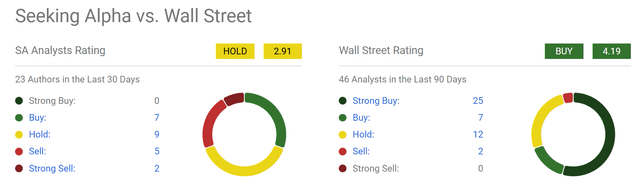

Since Apple Inc. (NASDAQ:AAPL) launched its FY Q3 earnings report (ER), the sentiment surrounding the inventory has modified considerably amongst In search of Alpha authors. As you’ll be able to see from the chart beneath, In search of Alpha authors have develop into extra cautious (say, in comparison with Wall Avenue analysts) on the inventory, with a consensus score of Maintain and a weighted common score of two.91. A complete of 23 articles had been revealed on the inventory previously 30 days (and a big proportion of them had been revealed previously few days for the reason that Q3 earnings report). Not one of the articles have given it a Sturdy Purchase. The vast majority of the scores had been both at a Maintain or beneath as seen.

In search of Alpha

Wanting by means of articles extra carefully, the cautious/bearish sentiment largely stems from 3 considerations: the slowing iPhone gross sales, the excessive valuation a number of, and the current substantial divestitures by Berkshire Hathaway of its AAPL place.

Towards this background, the objective of this text is to elucidate why all three considerations overstated the draw back dangers (or are even misplaced). I’ve touched on the primary two considerations in my earlier articles. Subsequently, I will likely be temporary with them and can principally consider the third situation right here on this article.

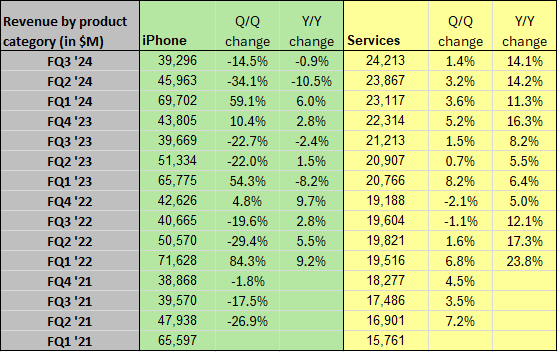

Let me begin with the iPhone gross sales. Bears have a great cause right here because the iPhone gross sales progress has been dwindling not too long ago. For instance, the chart beneath exhibits AAPL inventory’s iPhone gross sales reported in its Q3 ER. As seen, its iPhone income has certainly been struggling not too long ago. There was a pointy decline of 10.5% YOY in iPhone income in FQ2 ’24, which was adopted by one other slight decline of -0.9% FQ3 ’24. Nonetheless, my view is that buyers ought to start to pay extra consideration to its service revenues as the corporate is now not a {hardware} firm anymore. This level is the main target of my earlier article and readers can test it out for extra particulars. As seen within the chart beneath, Apple’s companies income saved posting double-digit annual progress charges in current quarters. To wit, Q3’s service revenues reached a file $24.2 billion, translating into an annual progress fee of 14.1%. Service revenues are inclined to get pleasure from larger margins and are extra recurring. I count on the expansion to persist because of AAPL’s big put in base and constant followers, which ought to offset any iPhone quantity decline – if any within the years to return.

In search of Alpha

AAPL inventory: Berkshire divestiture

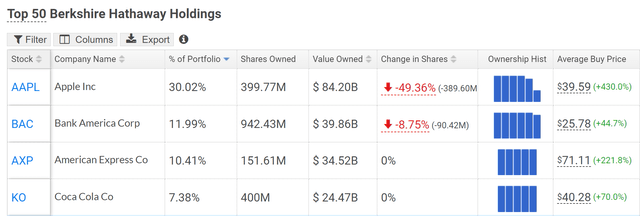

Now, let me transfer on to the principle situation right now – Berkshire’s giant divestiture of its AAPL place. The chart beneath exhibits the adjustments in Berkshire’s high fairness holdings reported in its newest disclosure. As seen, Apple stays within the largest place, although its weight has dropped considerably from 49.36% to 30.02% as Berkshire decreased its stake by nearly half (49.3% to be precise).

Supply: hedgefollow.com

The prevailing view is that such divestiture displays Buffett’s bearish view of AAPL inventory (and/or the broader fairness market). Properly, I urge to vary, for thus many causes. To chorus from rambling, I’ll restrict myself solely to the highest 3 causes on my listing.

First, the interpretation merely missed the truth that BRK nonetheless holds greater than $84 billion of AAPL shares. As seen within the chart above, the remaining AAPL place continues to be greater than 30% of its complete fairness portfolio and continues to be a concentrated wager on AAPL even by Buffett’s normal.

Second, BRK can trim its AAPL publicity (or fairness publicity) for varied causes though Buffett nonetheless has a constructive view of AAPL. These causes can embody tax concerns, the necessity for its different working segments (e.g., insurance coverage float), the potential of a large acquisition, and so forth.

Lastly and most significantly, money is far more potent within the arms of BRK than for bizarre buyers. For example BRK’s trimming of AAPL and different inventory positions certainly displays Buffett’s bearish view on these firms and the general financial system (which, keep in mind, is concept), it doesn’t imply that we must always trim our positions too. The reason being fairly easy, BRK has much more other ways to deploy its money past shopping for shares or bonds. Latest examples embody the offers it structured to spend money on Occidental Petroleum Company (OXY) and Financial institution of America (BAC). These offers supply much more favorable return/threat profiles than instantly buying the shares for my part and usually are not accessible to bizarre buyers.

As to be argued beneath, throughout the funding universe accessible to particular person buyers, I see little odds of discovering alternate options with noticeably higher return/threat ratios than AAPL.

AAPL inventory: valuation and projected return

Lastly, let me briefly deal with the valuation concern. Regardless of the worth corrections amid the market panic, the present FWD P/E is ~31.3x for AAPL. It’s definitely not low-cost in absolute or relative phrases. Nonetheless, as repeatedly argued in my earlier articles,

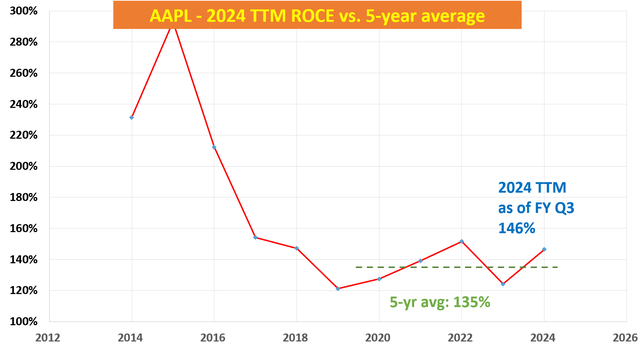

Lengthy-term buyers who suppose like enterprise house owners shouldn’t be routinely turned off by a ~30x P/E for shares like AAPL with excellent ROCE (return on capital employed). The reasoning is kind of easy and includes solely serviette math. As seen within the subsequent chart, AAPL’s ROCE is about 146% on a TTM foundation based mostly on the financials it reported in Q3 2024. With such a ROCE, a 5% funding fee would drive about 7% of natural progress (146% ROCE * 5% reinvestment fee ~ 7% progress fee). A ~30x P/E gives ~3% of earnings yield.

Contemplating AAPL’s capital-light mannequin and the rising service revenues as simply aforementioned, the house owners’ earnings yield is even larger (about 4.5% by my estimate). Thus, the whole annual return potential in the long run continues to be within the double-digits regardless of the 31x P/E, which is much better than the return I count on from the general market (about 6% below its present P/E).

Creator

Different dangers and ultimate ideas

By way of draw back dangers, AAPL, like its tech friends, faces widespread dangers comparable to financial downturns, elevated competitors, fast technological evolution, and so forth. Right here, I’ll deal with a threat that’s extra fast and specific to AAPL: the implications of the current ruling concerning Google’s (GOOG) (GOOGL) monopolistic practices. The U.S. Justice Division not too long ago dominated that GOOG’s practices surrounding its engines like google had been to be thought-about a monopolist. Apple is unlikely to see a right away affect from this ruling based on analysts from main funding teams comparable to Bernstein. Nonetheless, I believe the potential impacts may be bigger than anticipated. Apple has had profitable offers with Google previously and the deal could possibly be jeopardized by the ruling. Extra particularly, GOOG paid Apple over $20 billion a 12 months in recent times to offer Google search engine default placement at Apple gadgets’ key search entry factors. Because of the ruling, AAPL’s most definitely transfer for my part could be to open up the location for a bit amongst varied search distributors – which might trigger earnings uncertainties. As a much less seemingly transfer, AAPL might develop its personal search engine, which can be more likely to trigger near-term revenue headwinds.

All advised, my verdict is that the upside potential outweighs the negatives below present situations judging by the outcomes and enterprise fundamentals reported in its Q3 ER. Specifically, I do not recommend buyers be overly delicate to its quarterly iPhone gross sales (as an alternative, focus extra on its service revenues going ahead) or equate BRK’s discount as a bearish sign.

[ad_2]

Source link