[ad_1]

By Sinead Cruise

LONDON (Reuters) – Non-public banks and advisers to Britain’s super-rich say some purchasers might give up the nation if Labour wins subsequent month’s normal election and pushes forward with plans to abolish tax protections on offshore wealth they needed to move to future generations.

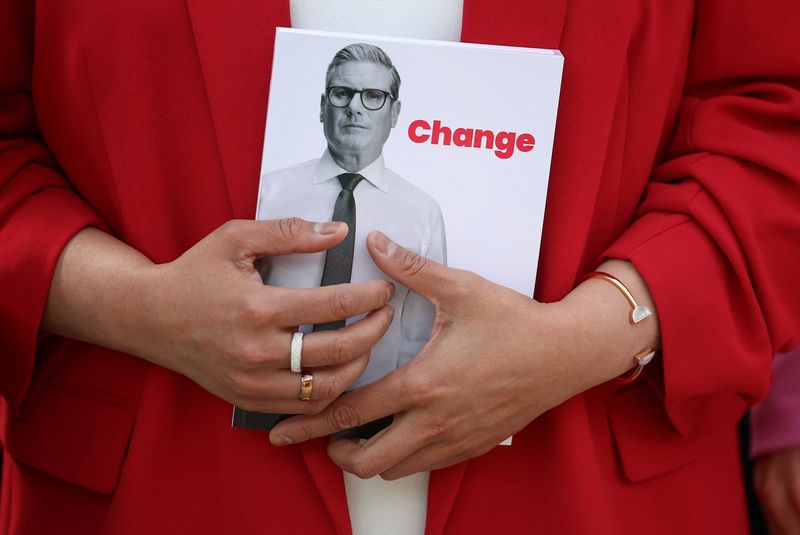

Keir Starmer’s Labour Social gathering, which leads within the opinion polls and which revealed its manifesto on Thursday, is focusing on Britain’s wealthiest folks to help a public spending programme targeted on colleges, welfare, vitality reform and the Nationwide Well being Service.

Round 70,000 individuals who dwell in Britain however pay little or no UK tax on the cash they earn abroad had been already going through larger payments after the incumbent Conservative authorities stated in March it might section out this “non-dom” standing over time.

However in proposals revealed in April, Labour stated it might transfer sooner to scrap aid on foreign-earned earnings and increase Britain’s inheritance tax regime to incorporate overseas property held in trusts designed to mitigate such levies.

Critics say the proposed modifications might do Britain’s lukewarm financial system extra hurt than good, making the nation a much less enticing place for the world’s rich to dwell and spend money on, lowering total tax revenues quite than rising them.

The Labour Social gathering didn’t instantly reply to a request for remark.

Economists say total tax ranges are more likely to strategy an all-time excessive whoever wins the election, regardless of guarantees by each essential events to not enhance main tax charges.

Labour has stated it won’t increase earnings tax or Nationwide Insurance coverage social safety contributions on working folks. However it has pledged to slim the hole between UK tax owed and tax collected, which widened by 5 billion kilos to 36 billion kilos ($46 billion) within the 2021/22 tax yr.

Catherine de Maid, associate at legislation agency Burges Salmon, stated her largest purchasers had been ready to pay larger tax on earnings and capital beneficial properties, however the inheritance obligation proposal was a “deal breaker” for a minimum of three of them.

“Inheritance tax within the UK is excessive at 40%, and (purchasers) will not be prepared to pay this price of tax on property which had been typically acquired or earned a few years earlier than they’d any reference to the UK. They would like to go away altogether,” she stated.

Spain, Italy, Switzerland, Dubai and Singapore are proving fashionable amongst rich UK households looking for a lower-tax place to dwell, stated Nigel Inexperienced, CEO of wealth adviser DeVere Group.

There isn’t any comparable inheritance tax within the United Arab Emirates, Singapore or most Swiss cantons, whereas Spain and Italy impose charges of 34% and eight% respectively, information from PWC reveals.

Historically, governments who change inheritance tax remedy of trusts haven’t utilized modifications retroactively to current buildings.

However legislation companies and advisers say Labour is unlikely to allow “grandfathering” of such schemes, citing feedback attributed to shadow finance minister Rachel Reeves in some media reviews.

STAY OR GO

Revenue tax modifications beneath a Labour authorities may also immediate 1000’s of roving worldwide entrepreneurs and financiers who’ve arrange residence in Britain to spend much less time within the nation.

Labour has pledged to reform how performance-related pay earned by personal fairness buyers is taxed as capital beneficial properties.

Most rich people had been “internationally cell” and devising methods to drop UK tax residency was excessive on their checklist of plans, based on Mark Routen, Head of Tax at UK and Dubai-based wealth supervisor Hoxton Capital Administration.

“This isn’t a drastic because it sounds, as beneath the statutory residence take a look at within the UK, it might simply imply a modest discount within the variety of days they will keep right here relying on what foundation they’re thought-about resident,” Routen stated, including that “a number of” purchasers had or had been contemplating making this transfer.

Alexandra Hewazy, Head of Key Shoppers and Resident Non Dom Wealth Advisory at Barclays Non-public Financial institution stated uncertainty was encouraging some to cut back publicity to the UK.

“This is not simply their asset base however may also be their bodily presence and the mental capital which comes with this,” she stated.

Charging capital beneficial properties tax on the similar price as earnings tax would increase 12 billion kilos a yr, whereas value-added tax (VAT) on monetary providers – largely consumed by the well-off – might additionally increase round 9 billion kilos, evaluation by Richard Murphy, political economist and professor of accounting at Sheffield College, reveals.

“Can this sector and those that earn most in it afford to pay extra tax? Sure, extra so than completely anyone else in society,” stated Murphy, a former adviser to ex-Labour chief Jeremy Corbyn.

James Whittaker, head of UK wealth administration and CEO of DB UK Financial institution, stated most extremely excessive internet value people had been holding their nerve earlier than making large selections.

“There’s an unlimited quantity to weigh up when switching from one jurisdiction to a different. We proceed to speak to individuals who wish to transfer wealth right here, significantly from the USA, however they wish to see detailed laws first,” he added.

And a few rich Britons welcome Labour’s proposed reforms.

Rebecca Gowland, govt director at Patriotic Millionaires UK, a non-partisan community of rich people who imagine the super-rich ought to pay extra tax, advised Reuters some members have had, or nonetheless have, non-dom standing however are “categorical” of their help of plans to shut the loopholes.

“Whereas this may result in a small variety of folks contemplating whether or not or not they wish to go away, the overwhelming majority of millionaires won’t be going anyplace,” Gowland stated.

($1 = 0.7827 kilos)

[ad_2]

Source link