[ad_1]

By Davide Barbuscia, Suzanne McGee and Matt Tracy

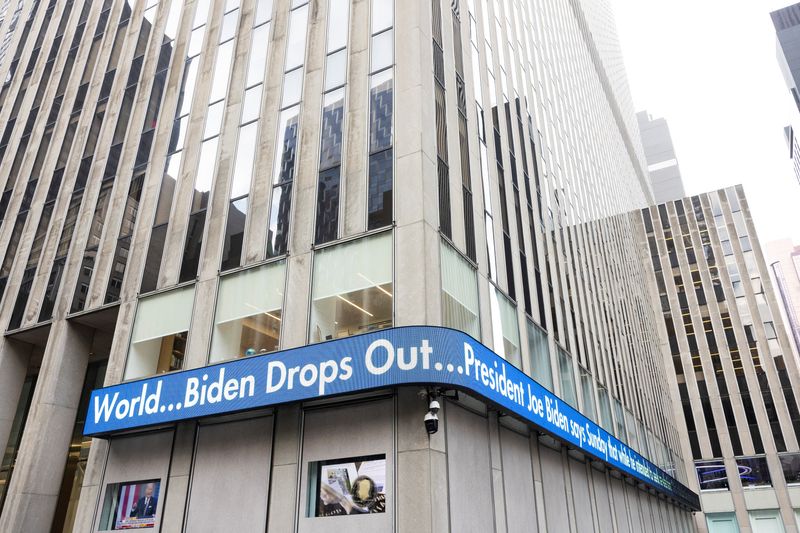

(Reuters) – U.S. President Joe Biden’s exit from the presidential race on Sunday may immediate traders to unwind trades betting {that a} Republican victory would improve U.S. fiscal and inflationary pressures, whereas some analysts stated markets may gain advantage from an elevated probability of divided authorities underneath the subsequent administration.

The so-called Trump-trade, which presumes the previous president’s tax insurance policies will carry company earnings, whereas undermining the nation’s long-term finances well being, gained floor following Biden’s disastrous TV debate final month.

It was particularly seen in U.S. authorities bonds, with long-dated Treasury yields – which transfer inversely to costs – briefly rising on elevated expectations that Republican presidential nominee Donald Trump would regain the White Home after the talk and final weekend’s assassination try.

Though yields shortly retreated on indicators of financial weakening, the transfer mirrored traders’ perception {that a} Trump presidency may result in inflationary insurance policies and a extra fiscally expansive stance. However Biden’s determination to step apart and endorse Vice President Kamala Harris to exchange him because the Democratic candidate casts doubt over a Trump victory and can probably immediate traders to pare these bets.

Trump’s staff has stated his pro-growth insurance policies would deliver down rates of interest and shrink deficits. Many market contributors imagine deficits will preserve deteriorating underneath a second Biden administration as nicely.

“It does take a number of the wind out of the sails of the Trump Commerce,” stated Cameron Dawson, CIO of NewEdge Wealth in New York, though she stated markets can be ready for extra readability about who the nominee can be.

“That is after we may search for the reversal of the Trump Commerce and different kinds of actions,” stated Dawson.

A Reuters/Ipsos ballot that closed on Tuesday discovered Trump had a marginal lead amongst registered voters – 43% to 41% – over Biden.

When accepting the Republican nomination on Thursday, Trump once more pledged to chop company taxes and reduce rates of interest. Analysts additionally anticipate a Trump presidency would make for more durable commerce relations, which may end in inflationary tariffs.

Decrease tax revenues may widen the U.S. federal authorities’s finances deficit, which has risen steadily for a lot of the previous decade, together with underneath Trump’s earlier 2017-2020 presidency, though a spike in 2020 was principally pushed by COVID-19 authorities reduction.

Many traders imagine the deficit will preserve deteriorating underneath a second Democratic administration too, however a extra balanced election outcome may cut back the chance of the extreme fiscal stimulus anticipated if Republicans sweep Washington.

DIVIDED OR CLEAN SWEEP?

Congress is at the moment divided, with the Home of Representatives narrowly managed by Republicans and the Senate by Democrats. A divided authorities is usually seen by traders as constructive for markets, as a result of it makes it more durable for both occasion to power by way of dramatic coverage adjustments.

A number of Democrats had warned that Biden’s preliminary refusal to step apart, which led some Democratic donors to close the spigots, would wipe out Democrats in Home and Senate races too. Biden’s exit, nonetheless, would improve Democrats’ probabilities of controlling a minimum of a type of chambers, stated Brij Khurana, fastened earnings portfolio supervisor at Wellington Administration Firm, talking forward of the announcement.

“A divided authorities, if it does materialize, would imply a lot decrease yields than we at the moment have,” stated Khurana, as bonds would replicate a doubtlessly extra benign final result for presidency debt issuance.

Jamie Cox, Managing Associate of Harris Monetary Group, stated markets may now reprice what had beforehand been anticipated to be a sweep of Congress.

“The Senate may be very prone to go Republican however the Home of Representatives may be very susceptible to a Democrat takeover,” stated Cox.

Jack McIntyre, portfolio supervisor, international fastened earnings, Brandywine World Funding Administration additionally referred to a divided authorities as a possible final result and “a constructive for the market.”

VOLATILITY EXPECTED

Traders stated that market volatility may improve because the uncertainty over the election continues.

“Biden stepping down is a complete new degree of political uncertainty,” stated Gina Bolvin, President of Bolvin Wealth Administration Group. “This can be the catalyst for market volatility that’s overdue.”

Swathes of the equities market, specifically small caps, have reacted favorably in latest weeks to the prospect of a Trump win. Cryptocurrencies have additionally rallied on inflation bets.

The Cboe Volatility index – Wall Avenue’s “worry gauge” – touched its highest degree since late April on Friday.

“The market doesn’t like uncertainty, and the added factor of an unknown Democratic nominee will definitely add to investor discomfort,” stated Rafia Hasan, Chief Funding Officer, Perigon Wealth in Chicago. “We don’t know what the market will do tomorrow and into the approaching weeks with this information, so traders ought to sit tight.”

[ad_2]

Source link