[ad_1]

WangAnQi/iStock through Getty Photographs

Funding Thesis

Firm Overview

American Superconductor Company (NASDAQ:AMSC), based in 1987 and headquarters in Ayer, Massachusetts, is a system supplier of megawatt-scale energy resiliency options on the grid™ that protects and broaden the potential of the Navy’s fleet, utilizing its proprietary “good supplies” and “good software program and controls” improve resiliency and enhance efficiency of megawatt-scale energy circulation. It has two market-facing enterprise models: Grid and Wind.

Strengths and Weaknesses

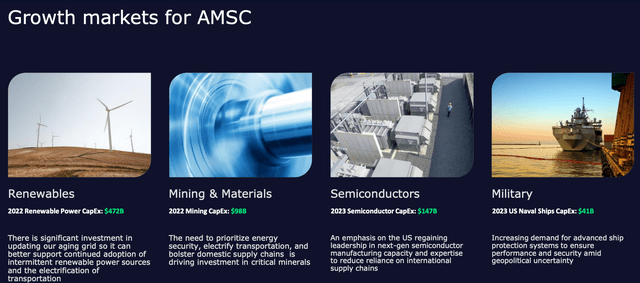

To satisfy its mission of increasing environment friendly vitality supply, American Superconductor Company is implementing transformational adjustments and system upgrades. One is to include the supply of fresh vitality, one other is to boost efficiency with proprietary merchandise, software program, and management options that use computerized methods. As the corporate serves a essential a part of the availability chain and army infrastructure, there are 4 predominant industries that rely on its providers: Renewables, Mining and Supplies, Semiconductors, and certainly, the Army.

AMSC: Development Market (Firm Presentation)

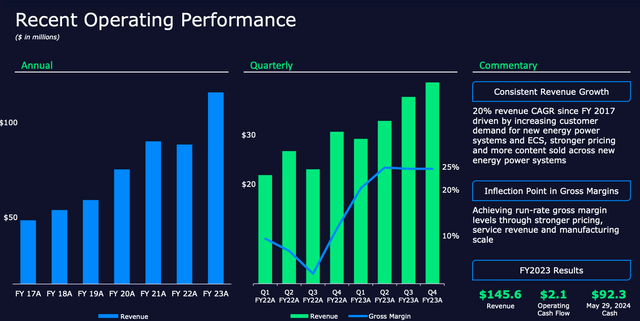

Its income grew at 20% CAGR since FY17, which it attributed to the brand new vitality energy system and ECS demand, plus stronger pricing energy amid rising gross sales throughout totally different classes.

AMSC: Current Working Efficiency (Firm Presentation)

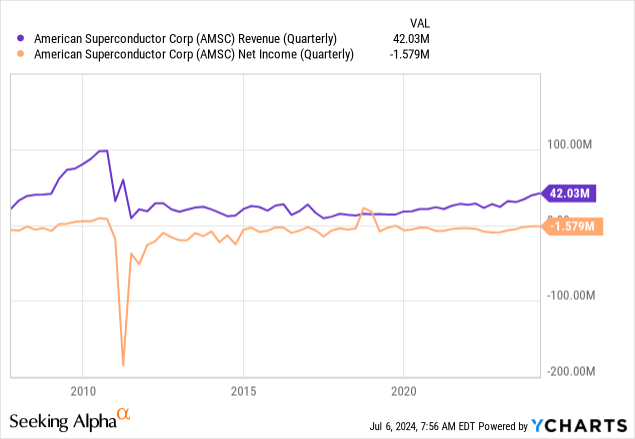

AMSC’s income has skilled speedy progress since 2020, up by greater than 100%. Since recovering from the 2008 recession, its web earnings has been hovering round break-even quite a few instances. At the moment, it’s as soon as once more on the cusp of reaching optimistic web earnings.

The corporate is increasing its income not solely from the prevailing prospects who need to improve to the dealing with of huge megawatts vitality supply, but in addition appeal to new prospects. It was snapping on common $32 million per quarter of introduced orders in FY23 in comparison with simply above $15 million in FY 2020, greater than doubling the quantity. Little question that is the pressure that was driving its web earnings near optimistic.

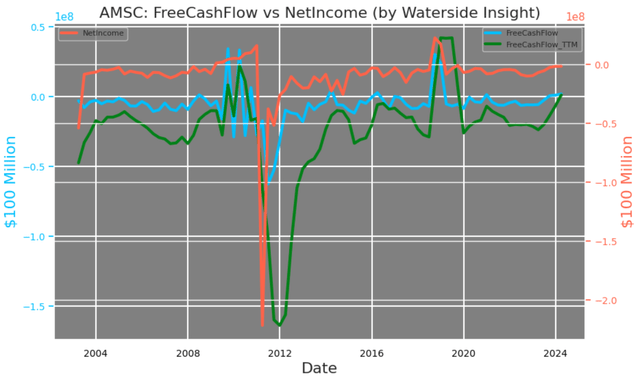

With its web earnings breaking even, additionally it is coming near free money circulation breakeven. In reality, that is the primary time its free money circulation reached non-zero on a TTM foundation since 2020. its historical past, AMSC has by no means constantly achieved optimistic free money circulation over an prolonged interval. Is it going to be totally different this time?

AMSC: Free Money Move vs Web Earnings (Calculated and charted by Waterside Perception with information from the corporate)

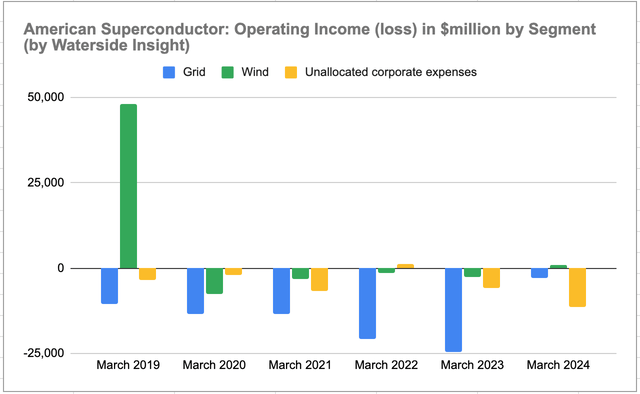

The corporate has two enterprise segments, Grid and Wind. It additionally reviews “Unallocated Company Bills (‘UCE’)”, largely consisting of stock-based compensation, as a part of its working earnings breakdown. It was the primary time since 2019 that the Wind section reported optimistic working earnings in FY 2023, whereas the loss from the Grid section was the smallest over the identical interval. If not for a loss on contingent consideration of $4.9 million that made its UCE unusually massive, it might have been the most effective outcomes. There’s a small proportion within the Wind section that delivers photo voltaic vitality as properly.

AMSC: Working Earnings by Section (Calculated and charted by Waterside Perception with information from the corporate)

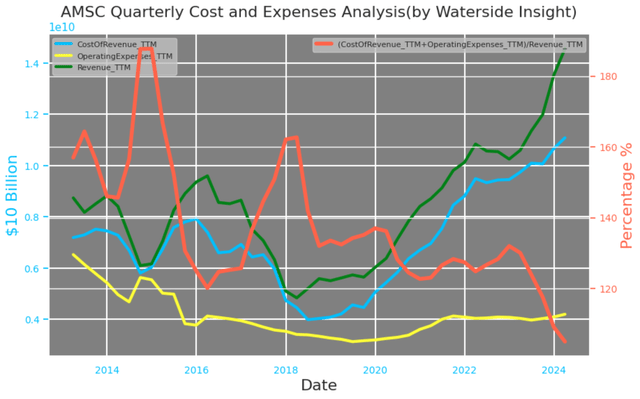

Additionally for the primary time in ten years, AMSC is reporting the bottom prices and bills with the very best income. The worth index for wind generators within the US was reduce to $0.96 million per megawatts in 2019 from about $1.58 million in 2008, virtually halved in ten years, however revived greater to about $1.2-1.3 million previously three years as a result of logistics and inflation. On the whole, having gone by value discount previously 20 years, onshore wind vitality is taken into account mature, whereas offshore has additionally been commercialized for not less than 15 years. So the long run worth fluctuation is usually as a result of logistics, value of commodity and capital, and the everyday provide and demand dynamics. It will be significant for the corporate to remain aggressive with innovation and effectivity because the predominant competitors is coming from abroad and cost-cutting was virtually a “race to the underside” in 2023. In comparison with the 2010’s when proximity mattered extra for the OEMs’ (‘Unique Tools Producers’), now it’s the core competencies that differentiate them within the enterprise, as a result of most of them already relocated the manufacturing to low-cost international locations. So getting again to our questions earlier, to sustainably obtain optimistic web earnings and maybe additionally optimistic free money circulation, AMSC must crush its prices and bills curve additional by not less than 10-20% with out compromising its high quality and innovation. That is the true problem it’s going through.

AMSC: Prices and Bills (Calculated and charted by Waterside Perception with information from the corporate)

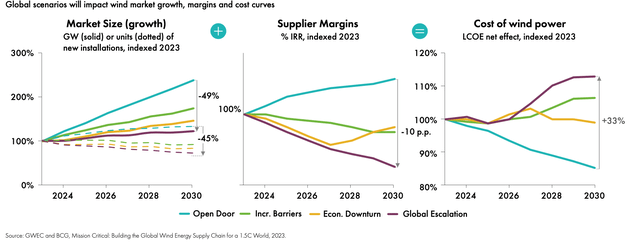

From the projection by International Wind Power Council’s International Wind Report 2024, it’s estimated that the provider margin will threat declining by 10% and the price of wind energy will enhance by 20-33% within the subsequent 5 years. AMSC has its work reduce out for it by way of sustaining a aggressive value construction.

International State of affairs for Wind Market Development (International Wind Report 2024)

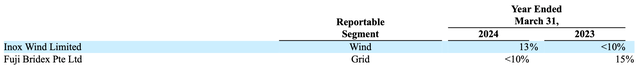

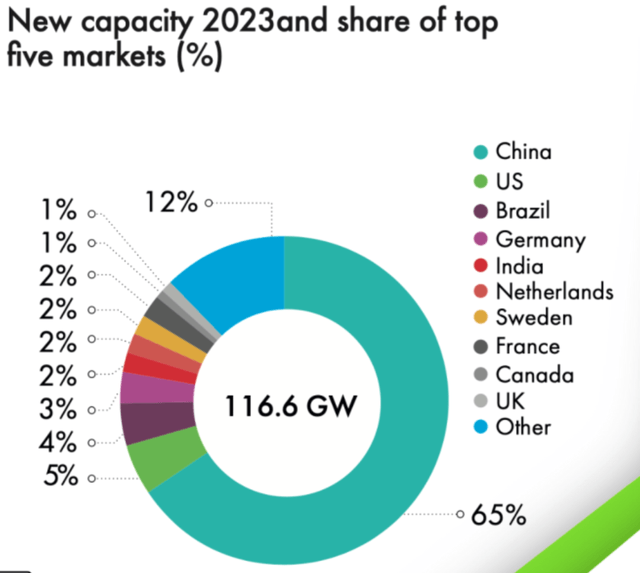

Fuji Bridex is its largest grid shopper, contributing 15% of its whole income in FY23 however dropped to lower than 10% in FY24, whereas Inox is its largest wind turbine shopper, accounting for 13% of its whole income in FY24, up from lower than 10% in FY23. No different prospects accounted for greater than 10%. Fuji Bridex, headquarters in Singapore, is without doubt one of the largest native energy and thermal vitality suppliers.

AMSC: High Shoppers (Firm 10k)

Inox in India and Doosan in South Korea are each notable purchasers within the Wind section, in line with its 10K. Inox has been lively within the new authorities public sale regime in India and the corporate reported that Inox has a cumulative order guide of over 2.6 GW by the top of 2023. The order from Inox clearly shall be associated to its success in profitable the Indian native and state auctions and the flexibility to ship its wind generators. Due to this fact, there’s a threat related to its demand from AMSC in ECS (“Electrical Management System”) shipments, simply as traditionally Inox has did not “publish letters of credit score and take supply of forecasted ECS portions”.

A good portion of our Wind section revenues have traditionally been derived from Inox and a big lower in revenues from Inox might adversely impression our Wind section

AMSC: Wind Turbine Electrical Management System (Firm Presentation)

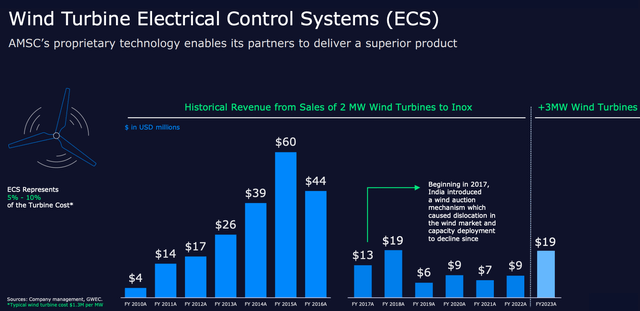

AMSC quoted from GlobalData that the wind technology capability worldwide will develop YoY from 92 GW to 102 GW in 2024. We appeared into GlobalData’s info, notably for India. Though India’s whole wind capability is rising quick, the annual wind set up, though about 10% greater than final 12 months, is anticipated to remain on the present stage marginally. There are two implications for AMSC right here. One is it’s doubtless to have the ability to keep its present gross sales and income from Inox. One other is such income could not broaden additional within the subsequent 5 years as a result of each the inherent threat of native bidding and the development of marginal progress. Additionally, ___________

India’s Photo voltaic PV & Wind Set up Development (GlobalData)

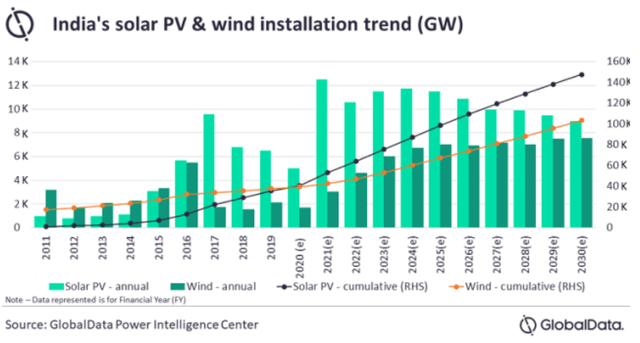

GlobalData additionally confirmed that the onshore wind technology from China might develop by 80-90% within the subsequent 5 years, though AMSC has dissolved and liquidated its Chinese language entity completely in 2022, as a result of each geopolitical tensions and fierce competitors regionally. Indian market presently ranks fourth place globally in wind vitality capability at lower than 46 GW, and its new set up in 2023 is the fifth.

New Wind Capability 2023 and share of High Markets (International Wind Report 2024)

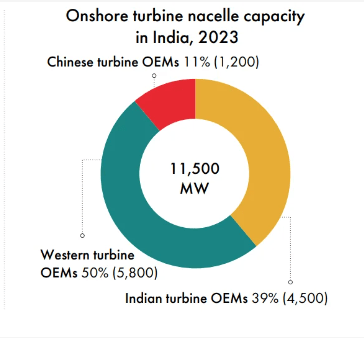

India’s onshore wind turbine nacelle market is 50% equipped by native and Chinese language OEMs, and the opposite 50% is equipped by the western corporations, AMSC included.

Onshore Turbine Nacelle Capability in India 2023 (International Wind Report 2023)

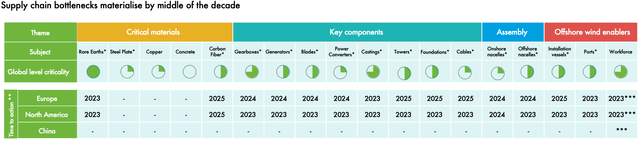

Nonetheless, a localized development is anticipated to develop in line with the International Wind Report 2024. It expects that native provide chains in China, India, and LATAM “may have sufficient nacelle manufacturing capability to accommodate demand” from 2023 to 2031, whereas the remainder of the world will want extra imports. Particularly, Europe and the US may have a bottleneck of their capability beginning in 2026. For these causes, it’s potential AMSC’s income from Inox to keep up on the present stage, however unlikely to have a serious enlargement within the subsequent 5 years.

Provide Chain BottleNeck for Wind Market by Nation (International Wind Report 2024)

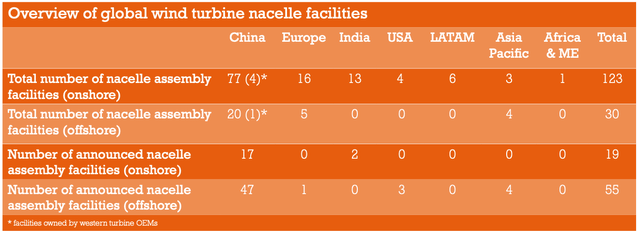

Then again, whereas going through fierce competitors abroad, AMSC’s distinctive aggressive benefit is being one of many solely 4 wind turbine nacelle amenities within the US. Given the significance of an environment friendly grid for the US to attain the inexperienced vitality future, AMSC naturally will change into the selection for native market enlargement, if legislative and business tailwinds begin to come into place within the subsequent two years. However it’ll additionally must have extra CapEx spending. It will not be a simple increase to its backside line.

Overview of International Wind Turbine Nacelle Amenities (International Wind Report 2023)

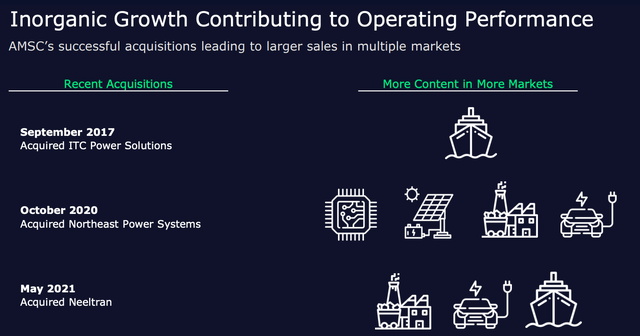

AMSC has been engaged on the transformation we alluded in the beginning for not less than 20 years. In November 2006, AMSC acquired Windtec for 1.3 million shares of AMSC widespread inventory, which was valued at round $13.1 million on the time. Quickly after, it made an acquisition of Energy High quality Techniques (PQS), a supplier of Static VAR Compensators utilizing proprietary thyristor swap expertise, in March 2007 in an all-stock transaction value round $3.8 million. Once more in September 2017, it acquired Infinia Expertise Company (‘ITC’), a cryo-cooler supplier to the Navy that strengthens the Ship Safety System, for $3.75 million. On the time of acquisition, AMSC defined the imaginative and prescient of integrating ITC’s expertise into its personal proprietary system. And 7 years later, it appeared to have helped it to win the $75 million “multi-year and multi-unit supply contract” with Canadian shipbuilder Irving Shipbuilding, the corporate that builds 80% of Canada’s navy ships.

Essentially the most vital effort is the acquisition of upstate-New York-based Northeast Energy Techniques Inc. (NEPSI), which provides medium voltage metal-enclosed capacitor banks, harmonic filters, fast-switching reactive energy options, and surge safety merchandise, in October 2020, for $26 million. NEPSI had about $5 million working earnings per 12 months on the time of acquisition. It did not appear to have improved AMSC’s working earnings within the two fiscal years instantly following the acquisition. However we just lately lined Eversource during which we mentioned its efforts and progress in constructing one of many largest offshore wind farm tasks on the East Coast of the US. There is no such thing as a point out that AMSC is taking part within the build-out of Eversource’s wind generators, NEPSI’s management place within the static voltage administration marketplace for industrial functions will assist it safe extra shares when New England plus New York got down to harvest extra wind vitality at a scale. Most just lately, it acquired Neeltran, who designs and manufactures DC energy methods, rectifiers, and transformers, for $16.4 million. On the whole, as described by its personal presentation, these acquisitions have been “resulting in bigger gross sales in a number of markets”. With its present money ratio at 1.15x, we anticipate it’ll proceed utilizing this path to strengthen its proprietary expertise and purchase further market shares.

AMSC: Inorganic Development (Firm Presentation)

2023 was the 12 months that the worldwide wind capability reached the milestone of 1TW (‘Terawatt’) on June 15, 2023, and it’s projected to succeed in 2 TW in simply seven years, in line with the International Wind Power Council. It is very important incorporate AMSC’s progress path inside the international provide and demand dynamics that may decide the place its subsequent progress engine shall be. As we mentioned above, it’ll both must proceed turning into extra environment friendly or keep its present stage of progress till the US market takes off in about two years, if all the things comes into place. In any other case, the present inflection level of optimistic web earnings may very well be a fleeting situation, because it has occurred greater than as soon as previously.

Monetary Overview & Valuation

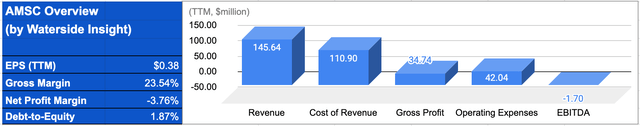

AMSC: Monetary Overview (Calculated and charted by Waterside Perception with information from the corporate)

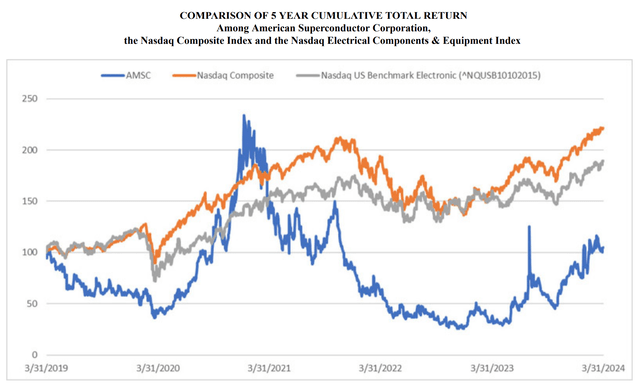

AMSC has been underperforming the benchmark and the broader marketplace for the previous 5 years. At the moment, it’s trailing by virtually 100 bps from the Nasdaq Composite and Nasdaq US Benchmark Digital. Extra notable is the volatility of its whole return previously 5 years, up and down by virtually 250 bps. On the whole, it’s a excessive beta inventory.

AMSC: Previous 5 Years Whole Return (Firm 10K)

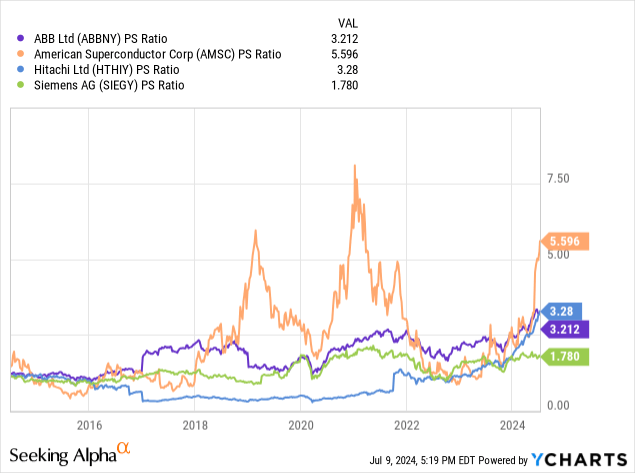

Since AMSC nonetheless has unfavourable earnings, utilizing the price-to-sales ratio could be one other approach to have a look at its valuation. At the moment, its 5.59x ratio is greater than 80% greater than the median of its friends at about 3.2x. For the previous ten years, its valuation has risen twice earlier than at a good greater ratio than now in comparison with its friends, akin to in 2019 and 2021. Every time it crashed again right down to the common vary. Though the premium could be defined by an improved elementary and bullish outlook, the next valuation than the place it’s now can be too wealthy.

Conclusion

America Superconductor’s latest fundamentals have apparent enchancment and the outlook is bullish for its income progress. Nonetheless, sustaining or crushing the fee curve continues to be a problem going ahead, which is essential to turning the present inflection level right into a sustainable progress momentum. From macro and industrial provide/demand dynamics, it’ll have problem to transcend the place it’s now. We expect for its inventory to fetch the next valuation than it’s now can be too wealthy. We suggest a maintain.

[ad_2]

Source link