[ad_1]

HJBC

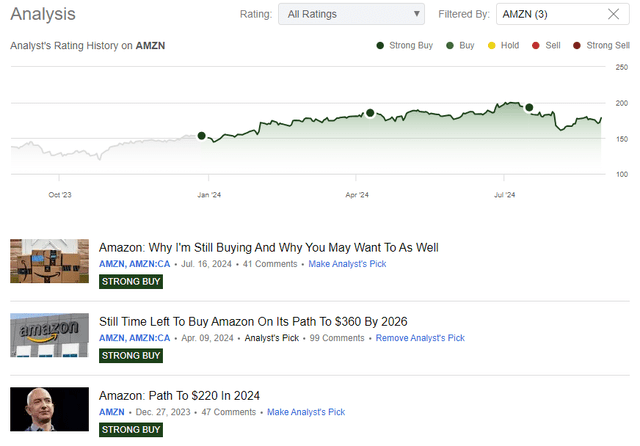

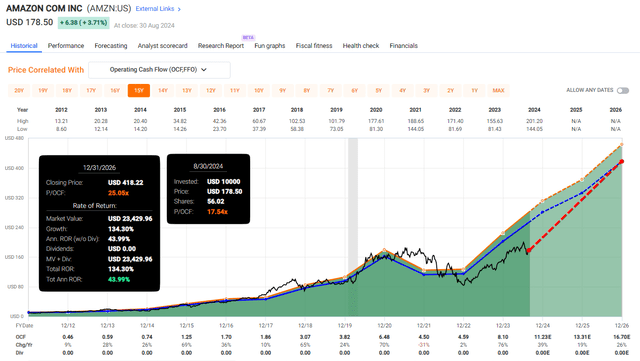

At the tip of final yr, I set an optimistic worth goal for Amazon.com, Inc. (NASDAQ:AMZN) (NEOE:AMZN:CA), anticipating the shares to hit $220 by the tip of 2024 helped by sturdy shopper spending and main revenue margin enlargement. So far, the inventory has peaked at round $200/share, adopted by a common market sell-off pushed by rising unemployment from 4.1% to 4.3% within the US, sending the shares as little as $150, earlier than settling at round $180, the place the inventory trades at the moment.

On a year-to-date foundation, the shares are up 17.5%, and on a trailing twelve-month foundation, up roughly 30%.

But, if we zoom out, Amazon’s efficiency has been trailing the opposite Mag7 firms in efficiency however not in bettering fundamentals.

Amazon entered a brand new period of effectivity, capitalizing on the investments from the prior decade into its autonomous warehouse community and last-mile supply, setting its profitability aside from brick-and-mortar retailers and never being a one-trick-pony, with AWS meaningfully contributing to the margin enlargement.

Amazon’s enterprise, with a $600 billion income run price, is in an excellent spot to proceed increasing the underside line, and that is one of many few the explanation why I constantly price the corporate as a “Robust Purchase,” which has to date confirmed to be the appropriate name.

Earlier Protection (Searching for Alpha)

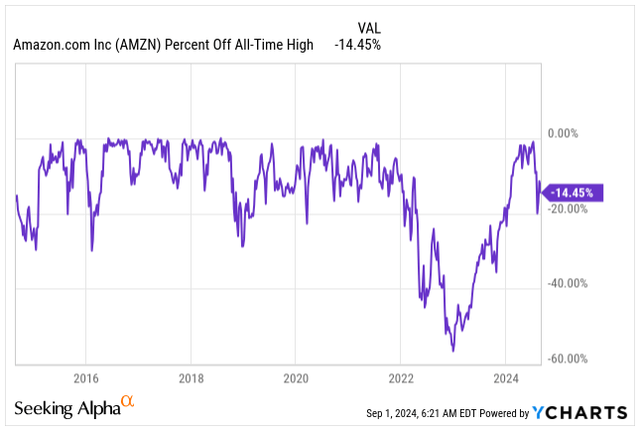

Right this moment, buyers can nonetheless purchase Amazon’s inventory at 14.5% off its all-time excessive. The inventory is buying and selling at a relative cut price in comparison with its historic valuation, and there’s no development slowdown on the horizon.

% of all-time excessive (Searching for Alpha)

These are only a few the explanation why I doubled down on Amazon’s shares throughout the August market pullback, shopping for shares at round $155, roughly doubling my place.

Now, Amazon is the single-largest holding in my private fairness portfolio.

Robust Q2 Thanks To Margin Enlargement

2024 has to date confirmed to be a really profitable yr for Amazon, with the Q2 Web Gross sales rising as a lot as 10% to $148B from a $134.4B yr prior.

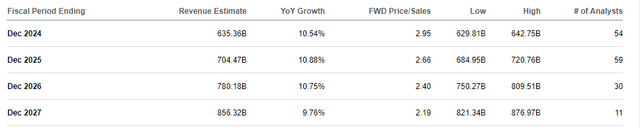

On the present run price, Amazon’s enterprise is poised to ship over $600B in income in a single yr for the primary time ever, with analysts estimating that it’ll proceed rising the highest line by round 10% yearly a minimum of till 2027.

Let that sink in. Amazon is already a $1.8T juggernaut at the moment, and anticipating 10% top-line development is just very good.

Projected Income Progress (Searching for Alpha)

Amazon’s diversified enterprise is firing on all cylinders with none indicators of slowing down. In reality, virtually all key segments of enterprise have delivered double-digit development in Q2:

North America section gross sales grew 9% YoY, reaching $90B. The worldwide section grew 7% YoY, negatively impacted by FX, topping $31.7B. On a currency-adjusted foundation, the expansion was 10% YoY. The AWS section delivered stellar 19% YoY development, reaching $26.3B. The earlier quarter, AWS grew 17%, confirming the acceleration development in Amazon’s arguably most essential enterprise section.

Naturally, a prime line is vitally essential to any enterprise; nevertheless, for Amazon, the principle story revolves round margin enlargement and changing the gargantuan income base into significant earnings.

In Q2, this narrative was confirmed, with Working Earnings reaching $14.7B, just about doubling from the prior yr. AWS stays the first revenue driver, representing 69.8% of Amazon’s working earnings, regardless of the enterprise being solely 16.5% of the overall income.

Nevertheless, it isn’t all simply AWS; regardless that the corporate’s valuation is at the moment closely intertwined and based mostly on notably this profit-driving section, Amazon’s roughly $500B retail enterprise remains to be an important half.

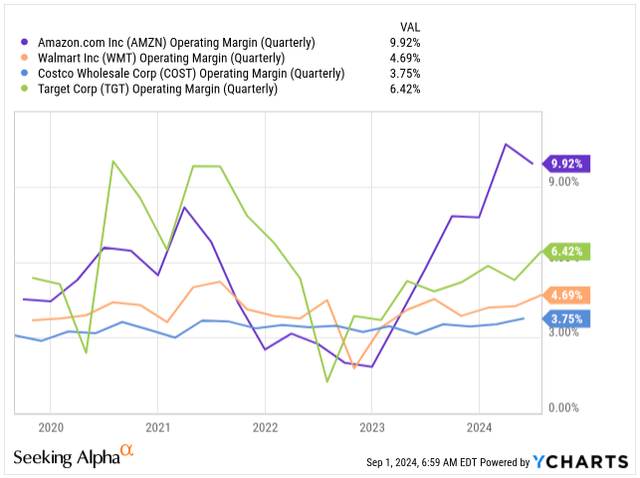

Now, let’s evaluate Amazon’s profitability to that of different main US retailers, equivalent to Costco (COST), Walmart (WMT), and Goal (TGT).

The image that emerges mechanically exhibits Amazon’s vanguard over the opposite, predominantly brick-and-mortar retailers, with Amazon’s 9.9% working margin considerably forward of the pack.

Working Margin Comparability (Searching for Alpha)

In fact, evaluating Amazon’s working margins to these of different retailers will not be essentially a like-for-like comparability, primarily because of AWS’s software-like 40% working margin; nevertheless, over the long run, I’m anticipating Amazon’s retail enterprise to realize superior revenue margins, round 6% to eight% pushed by its distinctive e-commerce mannequin, which is extra environment friendly and automatic than store-based, with AWS as a cherry on prime.

Suppose we assume no vital adjustments in every section’s weight on whole income. In that case, I assume the North American section has the potential to develop its Working Margin to 7.5% by 2027 (meaningfully greater in comparison with friends), with Worldwide nonetheless being a drag but increasing in direction of 2%.

AWS profitability has been the success story, increasing roughly 10% since 2018, and I count on steady energy, notably with AI-enabled functions leading to bigger and longer contracts. However, I’m cautious in my evaluation, anticipating its Working Margin to achieve 43% by 2027.

12 months 2024 2025 2026 2027 Income (b$) $ 635 $ 704 $ 780 $ 856 OM – North America 5.6% 6.3% 7.0% 7.5% OM – Worldwide 0.1% 0.5% 1.0% 1.7% OM – AWS 38.0% 40.0% 41.5% 43.0% OM – Mixed 9.9% 10.8% 11.5% 12.2% Working Earnings (b$) $ 62.99 $ 75.68 $ 90.00 $ 104.85 Click on to enlarge

*OM = Working Margin

As per my evaluation, Amazon’s effectivity is predicted to enhance meaningfully within the subsequent few years. I count on a mixed Working Margin to achieve as a lot as 12.2% by 2027, considerably bettering the underside line and driving the P/E valuation, which many take into account wealthy, downwards.

Since Amazon’s AWS is the corporate’s bread and butter and the principle cause why the inventory is valued as a tech firm slightly than a retail one, there is no such thing as a excuse to not look below the hood of what is taking place within the section.

To alleviate many buyers, AWS is lastly displaying indicators of reacceleration:

Q2 2024: 19% YoY Income Progress Q1 2024: 17% This autumn 2023: 13% Q3 2023: 12%

As extra cloud suppliers endorse and combine AI options into their cloud functions, giant enterprises and governments renew bigger contracts, driving accelerated development and shrugging off fears of Microsoft’s (MSFT) Azure feasting on AWS’s lunch.

To place the market share into perspective, based mostly on the information from Q2 2024:

AWS: 32% Microsoft Azure: 23% Google Cloud: 11%

The Cloud Market is predicted to develop 22% this yr, reaching $79B. This determine is especially essential as a result of, as we gauge it in opposition to Amazon’s 19% YoY development, we see that Amazon is comparatively properly retaining its market dominance, rising similarly because the market as an entire.

The cloud market total advantages from secular development attributable to industries more and more adopting cloud applied sciences as a part of their digital transformation initiatives. We will see comparable development throughout its friends, with Google’s (GOOGL) Cloud rising 29% in Q2 and Microsoft’s Azure rising 19%.

The one space of critique stays the reckless CAPEX spending aimed toward constructing state-of-the-art information facilities with NVIDIA’s (NVDA) GPUs as a part of a wider {industry} change to providing AI options to its prospects. Amazon’s CAPEX this yr is predicted to precede the 2023 determine of $48.4B.

I count on AI to be a serious enabler for Amazon to drive significant development, with billions of {dollars} of but untapped potential, as we witness main productiveness transformation over the subsequent few years. Maybe short-term AI seems to be overhyped shorter, however long-term potential is underhyped.

By shopping for Amazon’s inventory, buyers get retail enterprise with increasing profitability, industry-leading cloud platform AWS, and, extra not too long ago, Amazon’s profitable promoting section, which is now beginning to meaningfully contribute to the corporate’s success with $12.7B in gross sales, in Q2 rising 20% YoY.

Altogether, Amazon is in an excellent place to maintain rewarding shareholders, and the corporate now expects Q3 Web Gross sales to achieve $154B to $158.5B, implying a development of round 11% on the excessive finish of the vary.

Working Earnings is predicted to extend constantly, to round $11.5B to 15B, in comparison with $11.2B in Q3 2023.

The outlook is considerably cautious, with the continuing uncertainty round shopper energy within the US. We’re seeing cracks on the decrease finish of the earnings spectrum, whereas the center and higher courses proceed to spend. But, so long as the US financial system doesn’t hit a recession in H2 2024, Amazon is about to ship better-than-expected outcomes, in my view.

Valuation

178x.

That is the variety of occasions you’d multiply your preliminary funding when you invested in Amazon on its IPO day.

That is $10,000 turning into $1,780,000 in a span of lower than 30 years. Compounding at its most interesting when you ask me.

In fact, these are simply arduous figures, and personally, I have no idea a single investor who scooped up Amazon’s shares previous to the flip of the millennium. Nevertheless, I do know many individuals who’ve by no means purchased Amazon, even within the final 5-10 years, claiming the corporate’s wealthy valuation is restrictive, skipping on a serious success story and good points alike.

Should you take a look at Amazon’s valuation by means of the lens of P/E, you will notice that the corporate is certainly not low cost. The corporate is buying and selling at a blended P/E ratio of 43.5x and has traded on common at 170x its earnings within the final 15 years alone attributable to a scarcity of administration concentrate on changing income into earnings, prioritizing top-line development as an alternative.

That is a wealthy valuation, however is that this the appropriate method to have a look at it?

Inherently, P/E valuation doesn’t seize the money technology potential of firms that don’t concentrate on bottom-line enlargement. That is why I argue this metric is just incorrect to make use of within the case of companies like Amazon.

The narrative has shifted within the final 24 months, prioritizing the underside line, which is the explanation why the inventory is 75% beneath its 15Y common, nevertheless, nonetheless I favor to make use of Value to Working Money Circulation to completely seize Amazon’s potential.

The inventory is presently priced at 17.54x its Blended P/OCF, 30% beneath its 15Y common of 25.05x.

Since 2011, Amazon grew to become a cash-generating machine, delivering a 27.8% annual OCF development, and the development is predicted to hold on:

2024: OCF of $11.23E, YoY development of 39%. 2025: OCF of $13.31E, YoY development of 19%. 2026: OCF of $16.70E, YoY development of 26%.

Past 2026, it is inherently dangerous to venture what is going to occur, however anticipating 15% – 20% annual OCF development is affordable, with out the concern that Amazon is being repriced downwards because of slowing development sooner or later.

In my perspective, there is no such thing as a cause why Amazon’s valuation ought to be depressed as it’s at the moment with the US financial system sturdy, supported by sturdy shopper spending and AWS benefiting from enterprise funding modernizing their workload with AI-enabled options to drive additional development.

Anticipating round 40-45% annual ROR from over the subsequent three years is totally possible, and Amazon’s depressed valuation is likely one of the the explanation why the inventory is my primary holding proper now.

AMZN Valuation (FAST Graphs)

Investor’s Takeaway

In abstract, Amazon presents one of many mega-cap-value-buys cash should buy at the moment amidst the effectivity period, with the corporate’s valuation depressed.

The US financial system continues to carry up properly, with shopper spending intact, a minimum of within the center and higher class, with Amazon’s main enterprise spending on cloud options to modernize workflows.

I took the chance throughout the August market droop, doubling down on my Amazon place at round $155/share, anticipating as much as 45% annual ROR over the subsequent few years.

[ad_2]

Source link