[ad_1]

hapabapa

Amazon.com, Inc. (NASDAQ:AMZN) has trailed the S&P 500 since its earnings launch on 4/30. I imagine traders are overlooking some key drivers of Amazon’s long-term efficiency and have left it buying and selling beneath its historic averages. I wish to hold this quick and candy since Amazon articles are a dime a dozen, however there are a couple of necessary factors to be made about Amazon’s valuation, and I imagine visualizing them in charts is very instructive.

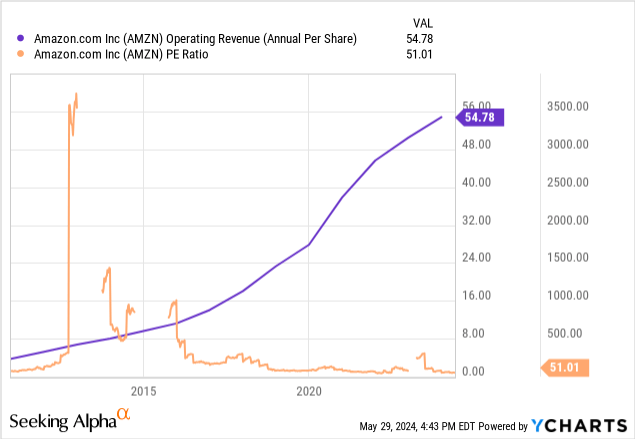

Firstly, the P/E ratio for Amazon doesn’t present plenty of details about the valuation, and I don’t imagine it must be used as a software at this stage.

As proven by the regular income development, Amazon is a reasonably constant grower. What can we study from the P/E ratio, although? It hovers across the 70-200 vary more often than not, typically within the 1000’s, and typically would not exist in any respect. The constant factor is that it doesn’t precisely predict future inventory efficiency. Earnings are a particular monetary measure that doesn’t swimsuit a inventory like Amazon that’s continually rising and reinvesting into itself. Till about 2016, Amazon had nearly no earnings in any respect, though it was an exquisite enterprise to personal.

Valuation

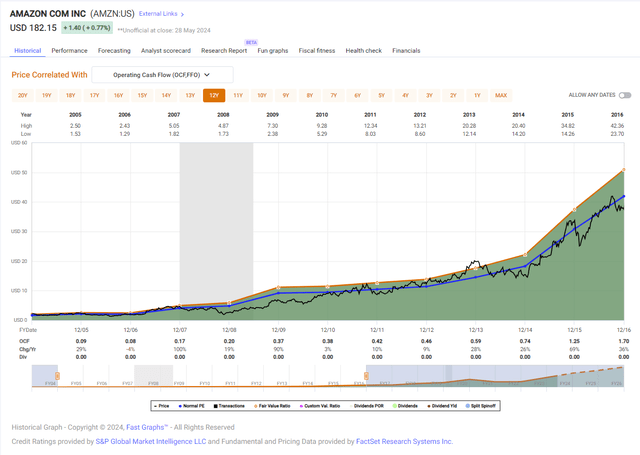

The true measure of Amazon’s valuation comes from its money stream, particularly working money stream. That is how a lot cash Amazon’s enterprise is definitely making. The correlation of working money flows to cost holds very tightly over lengthy durations of time. FAST Graphs present this nicely, first trying means again from 2004-2016 to determine the historic correlation:

FAST Graphs

The blue line is the typical P/OCF a number of, 24.70 for that point interval. And now we take a look at 2016-2026 (estimates):

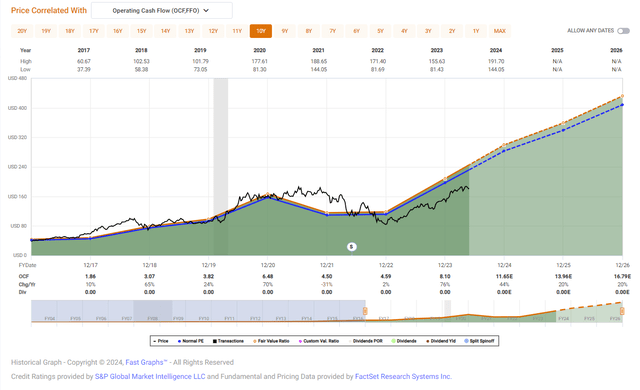

FAST Graphs

The correlation holds right here, and the typical P/OCF a number of is 24.33, very near the prior interval.

Nonetheless, there are two issues that stand out. First, Amazon is buying and selling nicely beneath its historic P/OCF a number of, at at present a little bit over 19x on a blended foundation. That suggests a near 30% upside primarily based on returning to its historic valuation alone. And once more, this has been a really tight correlation all through Amazon’s historical past as an organization.

Extra importantly, although, is the robust upward trajectory of estimated OCF. What’s going on? Why is the projected development so robust? To reply these questions, I wish to present some charts aggregating information about Amazon’s revenues.

Income High quality

Shoutout to LasVegasInvestor for pounding the desk on Amazon and particularly its OCF correlation, and shoutout to Joseph Carlson for growing Qualtrim which made it simple to show the uncooked information into the visuals I needed to indicate.

All details and figures are taken from Amazon’s most up-to-date quarterly report, which you’ll find right here on In search of Alpha or right here on Amazon’s web site itself.

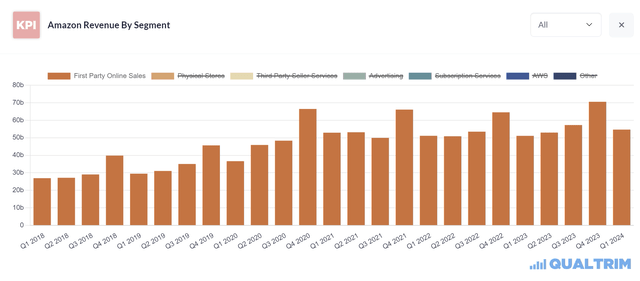

Amazon breaks down its income into a number of segments. The income combine is what we wish to concern ourselves with. First, right here is first-party on-line gross sales, the standard Amazon retail enterprise:

Qualtrim

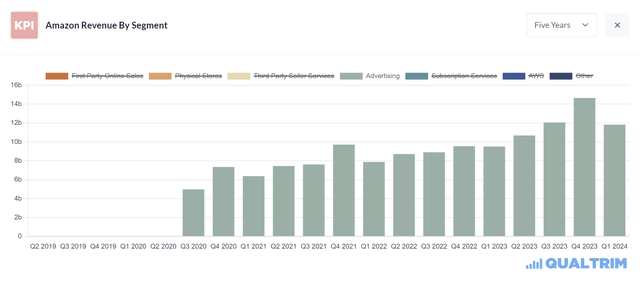

You possibly can see right here that these conventional gross sales have plateaued a bit in recent times, however that is one in every of Amazon’s lowest margin segments. Subsequent is the third-party companies enterprise, a better margin enterprise the place sellers use Amazon’s community and logistics to promote their very own merchandise:

Qualtrim

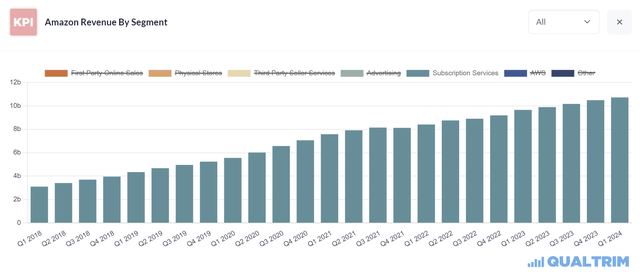

The expansion right here has been extra regular in recent times. There are two extra related high-margin enterprise segments which have additionally been rising. First is subscription companies:

Qualtrim

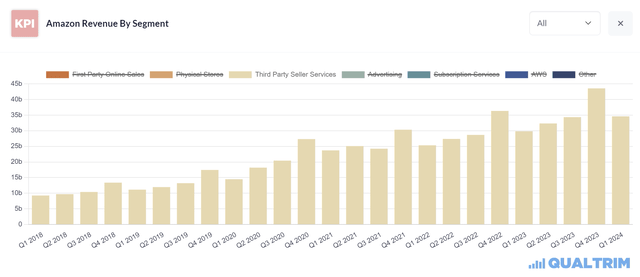

That’s the sort of trajectory you wish to see. Second is promoting, which was value nothing in 2020 and now offers over $45 billion a yr with regular development, once more at larger margins than the legacy retail enterprise:

Qualtrim

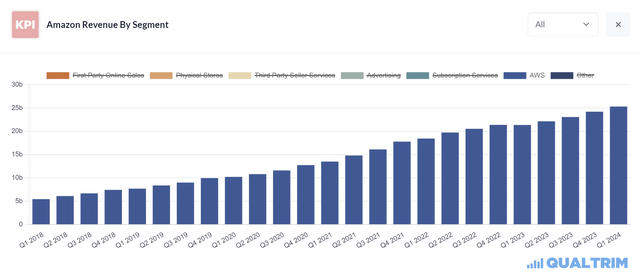

The true crown, jewel, although, is, in fact, AWS:

Qualtrim

AWS was solely 18% of complete income for the quarter, however 61% of the overall working revenue. That is the section that issues probably the most, and the place the actual earnings are.

AWS Development

AWS remains to be the biggest cloud supplier on the earth, so its development in proportion phrases could not look as spectacular at this stage in its growth. In latest quarters, development had plateaued round 12-13%, which was not overly spectacular. The encouraging information in Q1, nonetheless, was that income development was as much as 17.2% yr over yr, which is a big step up in the fitting path. That is the metric to look at shifting ahead, however Amazon is now on target and all indicators level to this accelerated development persevering with.

With Alphabet Inc. (GOOG), (GOOGL) just lately initiating a dividend in April and Meta Platforms, Inc. (META) initiating its personal in February, hopes for Amazon in prior years have been that it might mature, enhance profitability, and begin returning capital to shareholders. With all of the high-margin development that it has been seeing, although, Amazon now has higher makes use of for its capital, specifically investing in future AWS development.

CEO Andy Jassy had quite a bit to say about this within the latest convention name, the place he notes that “we do not spend the capital with out very clear indicators that we will monetize it.” The CFO continues in a while with a pleasant abstract (emphasis mine):

Proper now, in Q1, we had $14 billion of CapEx. We count on that to be the low quarter for the yr. As Andy stated earlier, we’re seeing robust demand indicators from our clients and longer offers and bigger commitments, many with generative AI parts. So these indicators are giving us confidence in our growth of capital on this space. And as he additionally talked about, we have finished this for 18 years. We make investments capital and assets upfront, we create capability very fastidiously for our clients, after which we see the income, working revenue, and free money stream profit for years to return after that, with robust returns on invested capital.

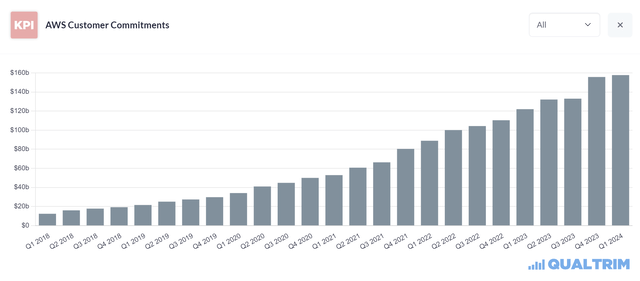

Analysts are anticipating large expenditures in future quarters on AWS, and this was confirmed on the convention name. The cash is coming in, and the demand is there for cloud computing area. Here’s a chart of income that has not but been booked, however dedicated from cloud clients:

Qualtrim

We see development accelerating right here as nicely, and that is what’s spurring Amazon to be again in capex development mode, the place most of their working revenue will probably be refunneled again into the enterprise to additional develop their highest margin section. The chance right here is very large, and we must always be glad about the dearth of buybacks and dividends. The extra Amazon spends in the present day the extra it can make tomorrow.

Correct Worth Goal

I imagine the market isn’t correctly accounting for this development in larger margin companies. Already Amazon achieved a ten.78% working margin this final quarter, smashing their earlier excessive of 8.17% popping out of the pandemic.

I’ve already identified that Amazon is buying and selling beneath its historic P/OCF a number of, which is certainly the easiest way to worth the enterprise. Nonetheless, I might argue that as extra of the income combine comes from larger high quality sources and working margin continues to climb larger, Amazon must be buying and selling above its historic a number of, which was primarily based on extra conventional retail gross sales. Greater development and better margins will compound collectively to equal larger working money stream and will point out a better a number of on that money stream.

Because it stands, even at its historic a number of and utilizing analyst estimates out to year-end 2026 we get a good worth of 428, or near 40% annual returns from right here. I definitely suppose that sort of upside is achievable, given what we now have seen in previous quarters and learn about future capex demand.

Potential Dangers

After all, nothing is assured, and any funding with a 40% return potential comes with threat. Fortunately with an organization the scale and energy (AA credit standing) of Amazon, there’s little existential threat. The draw back of their scale is the potential for presidency intervention and the potential breaking apart of their companies for aggressive causes, however this appears unlikely and never in anybody’s finest curiosity.

The extra affordable threat is that AI seems to not be what we thought it might be, and nobody makes cash on it. Or, much more plausibly, it takes longer to realize actual earnings utilizing AI than at present projected, and the increase cools off.

There was an attention-grabbing remark in NVIDIA Company’s (NVDA) latest convention name the place they famous that “For each $1 spent on NVIDIA AI infrastructure, cloud suppliers have a chance to earn $5 in GPU prompt internet hosting income over 4 years.” In different phrases, there’s an especially fast payback time for an funding in cloud computing. Provided that NVIDIA is frequently bought out of their highest-performing chips, the demand for cloud computing and AI coaching is seemingly insatiable.

I’m assured that AMZN wouldn’t be investing a lot into their AWS platform in the event that they weren’t extraordinarily assured that it might end in excessive returns. Their clients are additionally assured in their very own skills to earn a living from their investments.

So whereas there’s an AI threat right here, Amazon is extra of a pick-and-shovel fashion funding case and can in the end be a beneficiary of any AI developments that their infrastructure helps to supply.

I wish to point out as nicely that within the quick time period, the market could not react nicely to the quantity of capex that Amazon is investing in future income streams. After all, I view these investments as constructive, but when the market doesn’t then the inventory could transfer decrease from right here. I might see this as a present and a chance so as to add extra.

Conclusion

Briefly, I see Amazon as a house run right here. The FAST Graph on the prime of this text reveals the thesis visually. You have got a mature enterprise making huge quantities of cash and buying and selling beneath its regular money stream a number of. Add on prime of this the chance to develop at a excessive charge and enhance margins considerably, and also you get all of the substances of a profitable funding.

The protection profile is fantastic whereas additionally that includes the potential upside of far riskier investments. I see no cause to chase unproven tech shares whereas the cloud market chief stays on sale. The mixture of security, worth, and development makes Amazon a superb portfolio cornerstone, and one in every of my largest private holdings.

[ad_2]

Source link