[ad_1]

August 5, 2024, was a nasty day for promoting choice premium.

I don’t care how they have been promoting premiums or what methods they have been utilizing.

They probably took a loss if that they had trades on that day that bought premium.

After I say “purely promoting premium,” I imply that the commerce’s primary function is to promote choices premium with out directional bias.

I’m not speaking about directional trades with some premium promoting part.

Some took a considerable loss.

And others took smaller losses.

There could be an exception the place a really small minority did okay as a result of that they had some hedges or some peculiar factor with their technique.

Contents

Let’s first clarify who these choice premium sellers are.

Their main objective is to promote choices (both name choices or put choices or each) after which purchase them again at a cheaper price to shut the commerce.

The distinction between the sale worth and the buy-back worth is the revenue that they preserve.

The concept is that choices are priced in a time issue in order that their sale worth is greater than the intrinsic worth of that choice.

This additional worth is named the extrinsic worth of the choice.

The extra time the choice has until expiration, the higher the extrinsic worth is.

The extrinsic worth normally decreases as time passes (except volatility modifications have an effect on it).

Therefore, in concept, the choice’s worth ought to lower with time (if all different issues go as regular).

That is what the choice premium vendor is betting on – that he/she will be able to promote an choice at a excessive worth, wait some time, and purchase it again at a cheaper price when the choice worth decreases.

As a result of the worth of the choice is also referred to as the premium of the choice, we generally refer to those choice sellers as premium sellers.

These premium sellers will not be actually within the recreation of making an attempt to foretell the directional transfer of an asset.

They’re simply within the choice decaying in worth with time.

The strangle is an instance of such a non-directional premium promoting technique.

It entails promoting a name choice and a put choice that opposes one another to keep away from directional bias.

For instance:

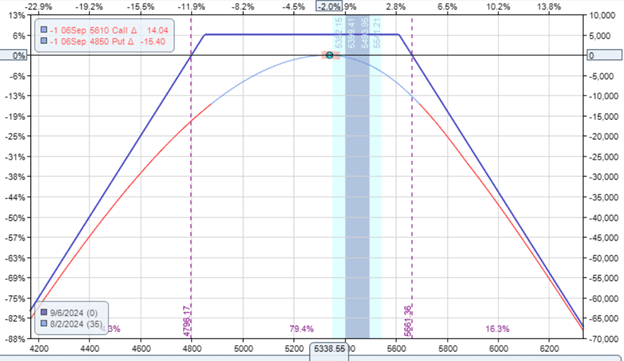

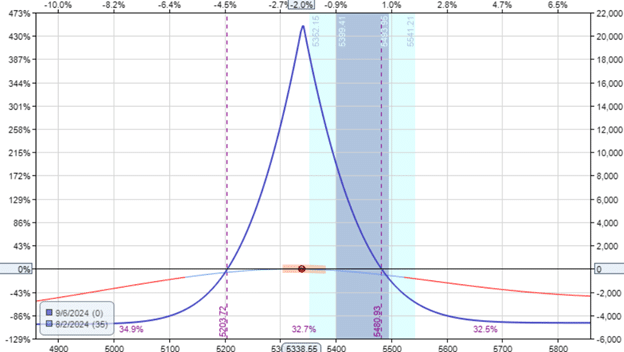

Date: August 2, 2024

Worth: SPX @ 5338

Promote one September 6 SPX 4850 put @ $27.45Sell one September 6 SPX 5610 put @ $23.05

Credit score: $5,050

The commerce initially collects a credit score of $5050.

If all goes effectively, the dealer hopes to purchase again to shut the commerce at a worth of lower than $5050.

The following day, SPX dropped to 5186.

From market shut Friday to market shut Monday, there was an enormous 160-point drop.

Supply: tradingview.com

Not solely this, however the volatility elevated, with VIX going from 23.38 to 38.56 (shut to shut).

Throughout Intraday on August 5, the VIX even spiked to over 60.

That is partly as a result of Financial institution of Japan deciding to tighten its financial coverage to stabilize a weak Yen, which triggered the Japanese market to fall 12 p.c.

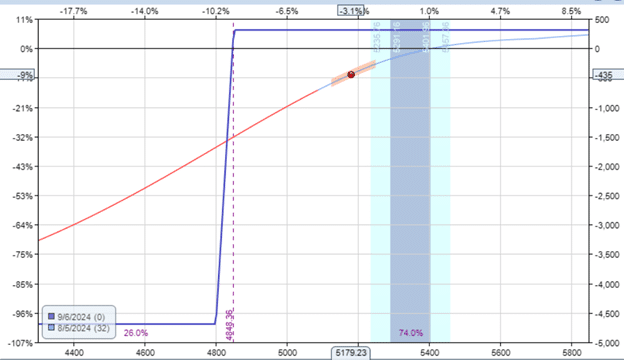

Consequently, the strangle misplaced $4540, a 5.7% loss on margin:

Based mostly on the modeling of the primary danger graph, we see that if there was not a volatility change, a drop of 160 factors would have resulted in a lack of about -$1440.

So, a big a part of the loss ($3100) is as a result of rise in volatility.

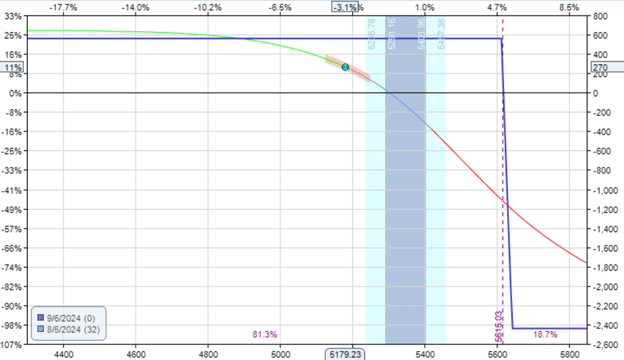

You may as well see within the second danger graph that the T+0 line had dropped – exhibiting that the commerce misplaced cash.

That is when volatility rises in a commerce with unfavorable vega.

The strangle is a unfavorable vega commerce.

Additionally it is referred to as a brief volatility commerce as a result of it desires volatility to lower.

This instance illustrates how non-directional premium sellers can lose cash.

They lose cash when worth makes a giant transfer and when there’s a rise in implied volatility.

By way of each elements, they skilled a giant loss on August 5, 2024.

A dealer who will not be comfy taking a $4500 loss in someday shouldn’t be buying and selling non-defined danger strangle trades on the SPX index – not even one contract.

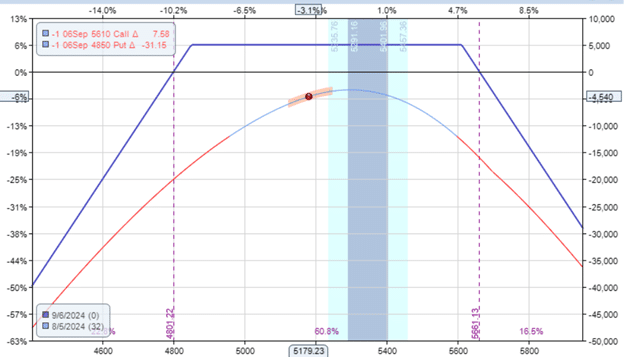

A tamer commerce can be the outlined danger iron condor.

On this instance, we promote the identical 15-delta out-of-the-money quick name and quick put as earlier than. However this time, we purchase protecting long-term put and protecting long-term calls to restrict the chance.

For instance,

Date: August 2, 2024

Worth: SPX @ 5338

Purchase one September 6 SPX 4800 put @ $24.35Sell one September 6 SPX 4850 put @ $27.45Sell one September 6 SPX 5610 put @ $23.05Buy one September 6 SPX 5640 put @ $17.45

Credit score: $870

This time, we get a smaller credit score.

Receiving a smaller credit score signifies that this commerce has much less danger than the earlier one.

Wanting on the danger graph, we see that it has a max danger of $4130:

Free Wheel Technique eBook

It’s an uneven iron condor with a smaller name unfold than the put unfold.

That is in order that we will get the general delta nearer to zero.

The delta on this commerce is -0.78.

Sooner or later later, the commerce is down $165, or down 4% on the capital in danger:

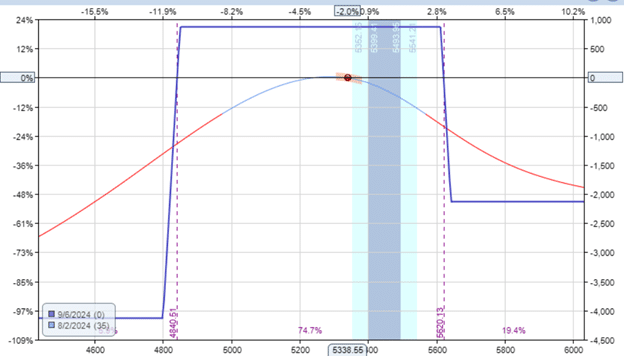

The iron condor consists of a bull put unfold and a bear name unfold.

Wanting on the bull put unfold, we see from the modeling that it misplaced -$435, or -9%, on its capital in danger:

Any bull put spreads took a beating on that day, August 5, 2024, as a result of the route and volatility had gone considerably in opposition to the commerce.

If bull put spreads take such losses, cash-secured quick put trades will take equal or higher losses.

Money-secured quick places are used within the Wheel commerce and the 1-1-2 trades.

The loss within the bull put unfold of the iron condor is partially offset by the good points within the bear name unfold.

The bear name unfold did earn a living as a result of the worth went in the identical route that the commerce needed it to go:

It profited $270 to assist compensate for the lack of the bull put unfold.

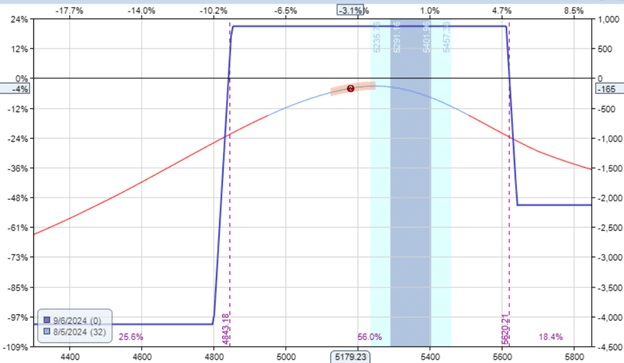

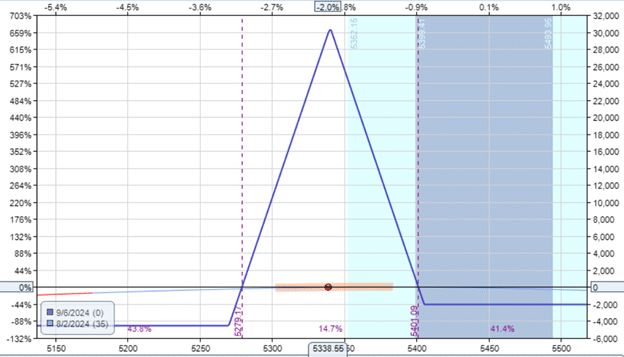

How a couple of non-directional butterfly with the identical expiration because the earlier examples – 35 days until expiration?

Date: August 2, 2024

Worth: SPX @ 5338

Purchase 5 September 6 SPX 5270 put @ $93.45Sell ten September 6 SPX 5340 put @ $116.85Buy 5 September 6 SPX 5405 put @ $144.35

Debit: -$2050

We did 5 contracts to make the max danger of $4550 considerably near that of the iron condor instance:

It, too, took an identical lack of -$200, or -4.4%:

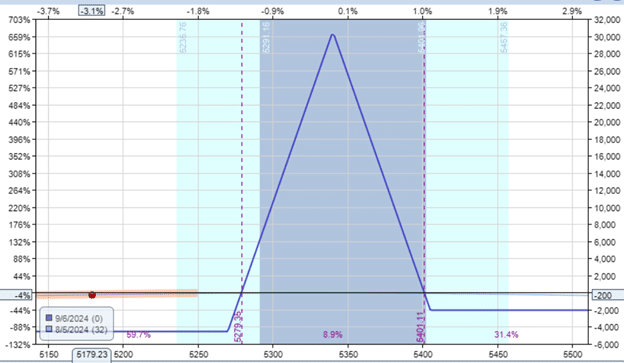

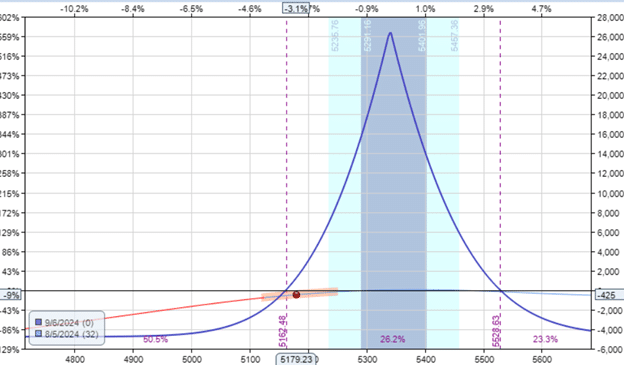

In contrast to the earlier instance, the calendar has optimistic vega.

Let’s see the way it does.

Date: August 2, 2024

Worth: SPX @ 5338

Promote 5 September 6 SPX 5340 put @ $116.85Buy 5 September 13 SPX 5340 put @ $126.15

Debit: -$4650

BEFORE:

AFTER:

Ouch. It misplaced 9%, or -$425, regardless of VIX going up.

This highlights the truth that calendars generally don’t behave as their total vega leads us to consider.

It’s because the volatility of the quick and lengthy choices can change at completely different charges as a result of their completely different expiration dates.

This impact is much less outstanding in commerce buildings the place each choice has the identical expiration date.

The story’s ethical is that in the event you promote choices premium – and there’s nothing fallacious with that – you’ll want to preserve your place dimension small.

“Small” means various things to completely different folks relying on their account dimension, disposable money, and danger tolerance.

However you can’t know what’s small for you except you understand how large of a loss your technique can encounter in someday.

You will have a superb plan. Your technique may fit effectively month after month till the market decides to hit again someday.

Because the boxer Mike Tyson says, “Everybody has a plan till they get punched within the mouth.”

Sure, you want a plan and comply with it.

You could must adapt your plan over time.

You additionally must know the way arduous the market can hit so as to dimension your positions sufficiently small.

Some YouTubers pleasure themselves on full transparency and publish their choices buying and selling outcomes.

They may publish some wonderful good points month after month after which publish this loss.

I don’t wish to level out any particularly as a result of some “took a very nice large large drawdown” – quoting from YouTube movies.

One other had stated, “manic Monday unbelievable slaughterhouse that it was within the markets … it was ugly.”

A couple of of them had talked about that they need to have shrunk their place dimension.

We hope you loved this text on promoting choice premium.

When you’ve got any questions, please ship an e-mail or depart a remark under.

Commerce secure!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who will not be accustomed to alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link