[ad_1]

Initially revealed on January fifth, 2023 by Jonathan Weber

Up to date on November twenty first, 2024 by Bob Ciura

Many buyers search to generate revenue from their fairness holdings, and a few buyers need common month-to-month funds.

There are a lot of shares that pay month-to-month dividends. Twelve dividend payouts per yr is probably the most evenly distributed revenue stream one can go for.

To that finish, we’ve got created a listing of 77 month-to-month dividend shares.

You possibly can see our full record of month-to-month dividend shares, with necessary monetary metrics like dividend yields, price-to-earnings ratios, and payout ratios, by clicking on the hyperlink under:

In an ideal world, buyers would get their revenue distributed in a really even method, e.g. by getting paid as soon as per day.

However in the true world, that doesn’t work, which is why there are not any every day dividend shares.

We’ll discover why and can showcase some examples of shares that come closest to that, by paying month-to-month dividends.

What Form Of Dividend Funds Exist?

Some corporations don’t make dividend funds in any respect, or a minimum of not usually. Amongst these corporations that provide common dividend funds, quarterly funds are the commonest.

Many US-based corporations supply one dividend cost each three months.

There are additionally some that provide annual dividend funds or semi-annual dividend funds. These are extra widespread with worldwide shares, as many European corporations make annual or semi-annual dividend funds.

Typically, when an organization makes semi-annual funds, these funds are uneven, e.g. with the spring dividend being bigger than the autumn dividend throughout most years.

Dividends: The Extra Common, The Higher?

When a inventory makes a sure dividend cost per yr, can we are saying that it’s higher when that complete annual dividend is distributed in lots of smaller funds which might be evenly distributed over the yr? There are some arguments that counsel that that is certainly higher.

First, for retirees and different revenue buyers that dwell off the dividends they obtain, it’s simpler to match their money flows with their money wants when dividend funds are made very usually, e.g. month-to-month.

When dividends are, however, solely made yearly, that requires much more planning, as buyers should match the once-per-year revenue proceeds with their common weekly or month-to-month bills.

With month-to-month dividend funds, that’s simpler, and with (hypothetical) every day dividends, that may be even simpler.

For revenue buyers that don’t but dwell off their dividends, dividend reinvesting is necessary. Over time, reinvestment of dividends performs an enormous position in an investor’s complete returns, as the whole inventory holdings develop over time.

Since this leads to larger dividend proceeds down the street, which results in extra shares being bought, all else equal, the compounding impact could make an enormous distinction over time.

When a inventory gives extra common dividend funds, e.g. month-to-month versus once-per-year, then there are extra alternatives for dividend reinvestment and an funding compounds at a barely sooner tempo.

If an organization had been to pay a $5 per share dividend per yr and if that firm’s share worth is $100, that leads to a $105 funding after one yr if there’s a single dividend cost on the finish of the yr and if the share worth doesn’t transfer upwards or downwards.

The next desk reveals the compounding impact of month-to-month dividend reinvestment over time:

Supply: Creator’s Calculation

If that $5 per share dividend is distributed evenly over twelve months, which might make for a month-to-month dividend of $0.417, then the dividends compound (barely) all year long, and the funding can be price $105.12 on the finish of the yr.

We see that there’s a small benefit to reinvesting dividends extra usually, though month-to-month dividends versus quarterly or annual dividend funds don’t make for an absolute game-changer.

Nonetheless, all else equal, the extra common dividend stream is advantageous.

Why Are There No Day by day Dividend Shares?

Whereas we are able to say that extra common dividend funds have some benefits from the investor’s viewpoint, there are nonetheless no every day dividend shares.

That is because of the truth that every dividend cost comes with work and bills for the corporate, and making these dividend funds too usually can be too pricey.

In any case, each dividend cost needs to be processed, and firms and brokers have some work to do in relation to maintaining monitor of who’s eligible to obtain dividends.

If that needed to be accomplished day by day, probably for tens of millions of particular person shareholders per firm, that may be an amazing effort that may not be definitely worth the bills and private assets.

The benefit of a every day dividend cost wouldn’t be particularly massive, relative to a month-to-month dividend cost. our instance from above, every day dividend funds would enable for a slightly larger compounding impact, however the distinction can be fairly slim.

After one yr, a $100 funding would have changed into $105.13 as an alternative of $105.12 for a month-to-month dividend payer.

That’s why no firm has opted for making greater than twelve dividend funds per yr — the executive burden is simply too massive.

It’s probably that this may stay the case, as making much more common dividend funds would probably not be definitely worth the extra work and price of doing so.

Month-to-month Dividend Payers As An Different

Whereas no every day dividend shares exist, buyers that desire a very common revenue stream could wish to go for month-to-month dividend shares. These nonetheless enable retirees to match their month-to-month money move with their month-to-month payments, which makes budgeting simpler.

And so they even have some compounding advantages, as proven above. Final however not least, there are some psychological benefits, as buyers by no means really feel that they’ve to attend for a protracted time period earlier than receiving their subsequent dividend cost.

A few of these month-to-month dividend payers supply compellingly excessive dividend yields. Among the many most well-known ones are Realty Earnings (O), Principal Road Capital (MAIN), and Gladstone Funding (GAIN).

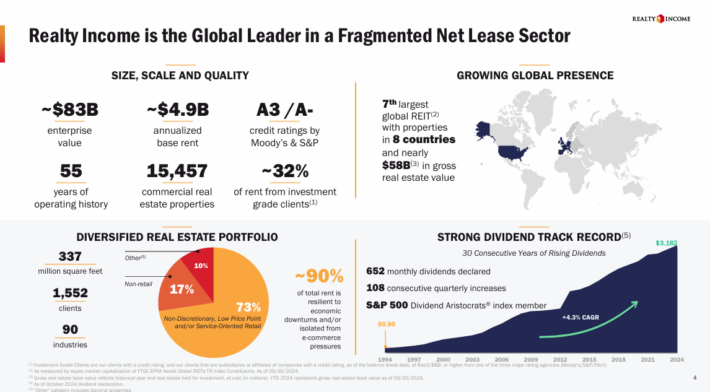

Realty Earnings is an actual property funding belief that primarily invests in triple-net leased retail properties. Its tenants are typically resilient and secure from the Amazon (AMZN) menace, as Realty Earnings leases its properties to grocers, publish places of work, drug shops, and so forth.

That is why the corporate has managed to generate very resilient and steadily rising funds from operations over the yr. Over the past decade, its FFO has elevated throughout yearly, even on a per-share foundation.

The corporate has made month-to-month dividend funds for greater than 650 months in a row:

Supply: Investor Presentation

Mixed with its monitor document of accelerating its dividend for 27 years in a row, this has made Realty Earnings a favourite amongst revenue buyers that desire a very regularly-paid revenue stream.

The mixture of repeated dividend will increase by Realty Earnings and the compounding impact of month-to-month dividend reinvestment has allowed buyers to develop their revenue considerably over time.

Realty Earnings is a member of the unique Dividend Aristocrats record, a bunch of simply 66 corporations within the S&P 500 Index, with a minimum of 25 consecutive years of dividend will increase.

Remaining Ideas

Buyers shouldn’t purchase shares solely because of extra common dividend funds. Different components, equivalent to valuation, dividend security, dividend yield, complete return potential, underlying enterprise high quality, and so forth needs to be thought of as nicely.

Nonetheless, dividends being distributed extra evenly all year long has benefits, e.g. in relation to budgeting for retirees and in relation to the compounding impact of dividend reinvestment.

Day by day dividend shares don’t exist, as this might be an organizational nightmare for directors. However these buyers that desire to obtain many dividend funds per yr could wish to go for month-to-month dividend payers equivalent to Realty Earnings, as these come closest to the thought of an ever-flowing revenue stream.

However even these corporations that make quarterly, semi-annual, or annual dividend funds may be good investments, though retirees and others that dwell off their dividends could have extra planning on doing to be able to match their money move with their bills each month.

In case you are desirous about discovering extra high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases can be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link