[ad_1]

Proper on the entrance web page of their web site, QuantConnect claims to be the “world’s main algorithmic buying and selling platform.”

What does that imply?

An algorithmic buying and selling platform is a software-based resolution that permits merchants to develop, take a look at, and execute buying and selling methods utilizing their very own particular algorithms.

Contents

The standard workflow of somebody utilizing QuantConnect is perhaps:

Write a buying and selling algorithm utilizing Python and C# programming language.

Backtest the algorithm by working it on historic market information.

Ahead take a look at the algorithm by simulating runs on stay information.

Analyze outcomes and refine the algorithm.

Repeat steps 1 to 4 till you’re happy with the algorithm

Combine with varied brokerages comparable to Interactive Brokers, Oanda, Tradier, and others to execute the algorithm with stay cash.

Within the case of QuantConnect, the software program platform is cloud-based, which implies that when you enroll and log in, you need to use the software program through your net browser.

Nothing to obtain.

Nothing to put in.

The sign-up is free.

The free plan consists of limitless backtesting.

Nonetheless, something stay and automated buying and selling would require a paid plan whose pricing is dependent upon the variety of customers, options, and assets used.

Assets used within the cloud are priced by the variety of compute nodes you utilize.

You’ll be able to customise the variety of backtesting, analysis, and stay buying and selling nodes.

QuantConnect permits neighborhood sharing of algorithms.

You’ll be able to browse varied methods that different members have created.

And in case you discover one that you just like, you’ll be able to shut that technique and modify it to make it your personal.

The QuantConnect Group created many methods.

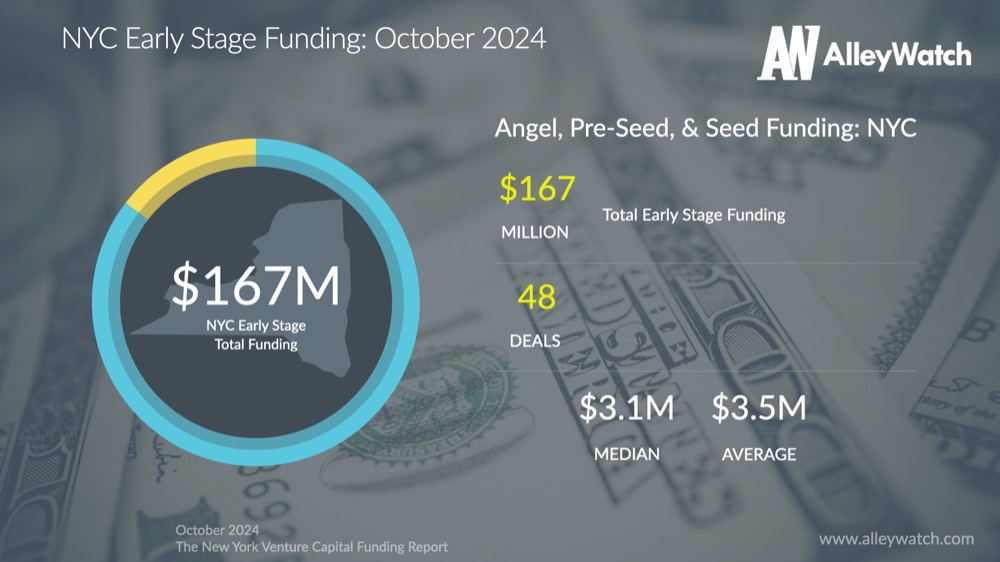

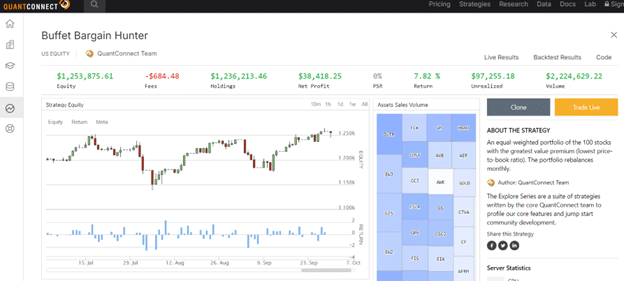

Right here is an instance that I discovered within the Technique Explorer:

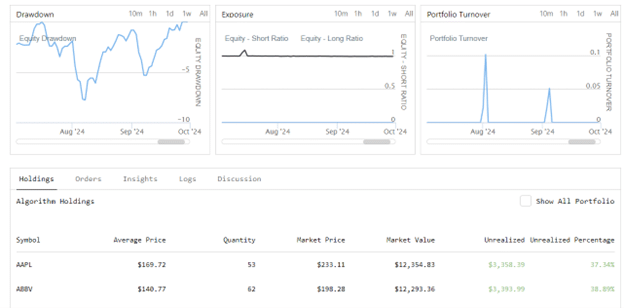

Figuring out the drawdown of a method is vital, and you may see a chart of it:

Trying on the backtest outcomes of this technique, you’ll be able to see helpful statistics just like the Sharpe Ratio, and many others:

Free Wheel Technique eBook

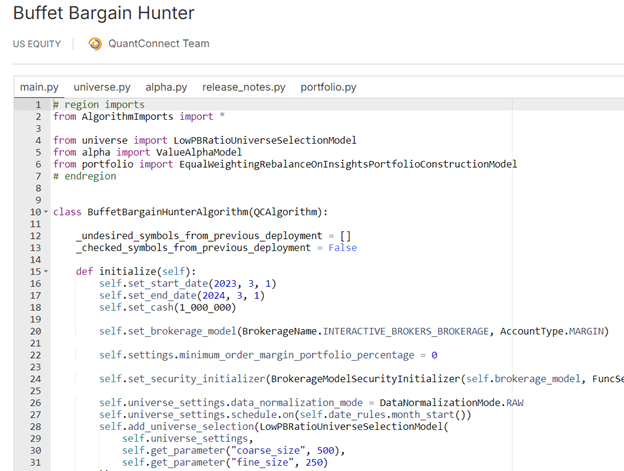

The code for this algorithm seems like this:

In case you are not a programmer acquainted with the Python programming language, then this is perhaps a bit obscure.

QuantConnect is designed for quantitative analysts (quants) within the buying and selling business, and it might write methods in Python and C#.

I assume that’s why the common wage of a quantitative analyst in the US is round $150,000 per yr.

A pc science pupil with a summer season internship with a buying and selling agency can earn between $75 and $100 per hour [YouTube reference].

This isn’t to say {that a} motivated retail dealer can’t study the subject material and make the most of the ability and dataset obtainable within the QuantConnect platform.

However the studying curve and time dedication could be steep, in my humble opinion.

Nonetheless, for these keen to dedicate the time to study, QuantConnect has in depth documentation that is excellent.

Simply inside the “Writing Algorithms” part, it has a dozen sub-sections…

The documentation just isn’t for the informal person.

You actually ought to already know learn how to program earlier than trying to learn this.

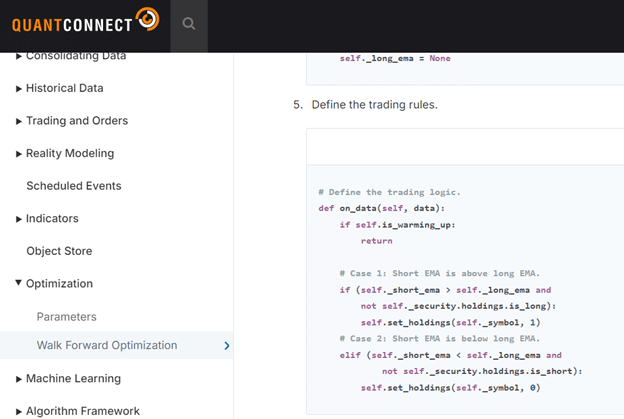

Right here is an instance from their documentation on implementing a walk-forward optimization for an exponential transferring common (EMA) crossover technique.

That is simply step 5 out of 11 and is written in Python.

Nonetheless, some examples exist within the C# (pronounced C-sharp) programming language.

Python and C# are the 2 programming languages you need to use within the QuantConnect platform.

Those that are expert sufficient to code up and take a look at their very own algorithms can doubtlessly discover a worthwhile technique in that they will have QuantConnect execute stay trades mechanically through a reference to their brokerage account.

QuantConnect would certainly be a helpful software in that case.

It could even be, as they are saying, “the world’s main algorithmic buying and selling platform.”

I can’t substantiate this declare by hook or by crook, as I’m neither a quantitative analyst nor a programmer.

I’ve no motive to doubt that declare from what I’ve seen.

We hope you loved this text on QuantConnect.

You probably have any questions, please ship an electronic mail or go away a remark beneath.

Commerce secure!

Disclaimer: The data above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who should not acquainted with change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link