[ad_1]

Key Takeaways

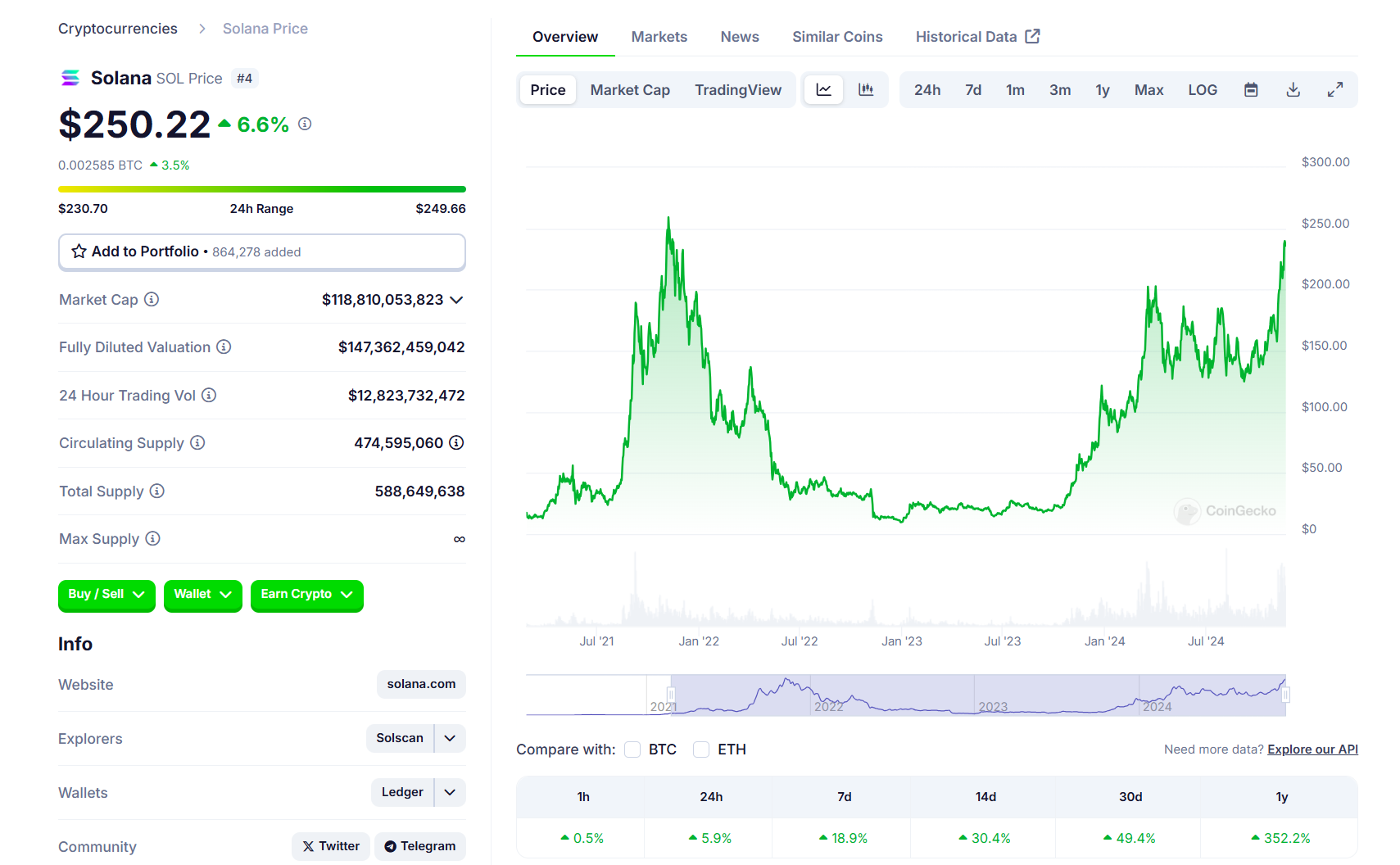

Solana’s SOL token value surged to $250, nearing its all-time excessive amid SEC discussions with ETF issuers.

The SEC has initiated talks with Solana ETF issuers like VanEck and 21Shares on S-1 kinds.

Share this text

Solana’s SOL token surged to $250, its highest stage since November 2021, on Thursday morning. The surge comes as discussions between SEC employees and Solana ETF issuers are making progress.

The fourth-largest crypto asset is now simply 4% away from its all-time excessive of $260 set in November 2021, primarily based on knowledge from CoinGecko. If the present bullish momentum continues, Solana will quickly surpass its document excessive earlier than Ethereum does.

The SEC has initiated talks with Solana ETF issuers concerning their S-1 registration kinds, based on FOX Enterprise journalist Eleanor Terrett, citing “two folks aware of the matter.”

VanEck, 21Shares, and Canary Capital submitted S-1 purposes for Solana ETFs earlier this yr. Each VanEck and 21Shares plan to checklist their merchandise on the Cboe trade if authorised.

“There’s a ‘good likelihood’ we’ll see some 19b4 filings from exchanges on behalf of potential issuers — the subsequent step within the ETF approval course of — within the coming days,” Terrett mentioned. These filings would provoke a 240-day SEC assessment interval.

Earlier 19b4 filings from VanEck and 21Shares had been faraway from the Cboe’s web site in August, although issuers now report elevated engagement from SEC employees. Mixed with an incoming pro-crypto administration, this has led to optimism about potential Solana ETF approval in 2025.

The potential for Solana ETF approval is linked to shifts within the American political panorama. A Donald Trump re-election may result in new SEC management which may be extra receptive to new monetary merchandise.

“We might count on the SEC to approve extra crypto merchandise than they’ve up to now 4 years,” mentioned Matthew Sigel, head of crypto analysis at VanEck. “I believe the chances are overwhelmingly excessive that there will likely be a Solana ETF buying and selling by the top of subsequent yr.”

Following VanEck and 21Shares, Bitwise filed to ascertain a belief entity for its proposed Solana ETF in Delaware on November 20.

Other than Solana ETFs, asset managers have additionally filed for comparable funds that make investments immediately in different crypto property, like XRP and Litecoin.

Furthermore, the latest launch of choices buying and selling on spot Bitcoin ETFs alerts a rising development amongst fund managers to diversify funding choices tailor-made to purchasers’ particular wants and threat tolerances.

Share this text

[ad_2]

Source link