[ad_1]

Valuing Shares With Earnings

In the present day, we’ll enterprise slightly into the elemental evaluation nook, and we gives you a glimpse of an intriguing paper (Hillenbrand and McCarthy, 2024) that discusses the benefits of utilizing ‘Road’ earnings over conventional GAAP earnings. The paper means that ‘Road’ earnings present higher valuation estimates and improved monetary evaluation. Is that this a manner learn how to enhance the efficiency of the struggling fairness worth issue?

Road earnings include extra details about future fundamentals than GAAP earnings as a result of they exclude transitory gadgets. Additionally they don’t undergo from points with smoothing previous earnings and are unaffected by shifts in company payout insurance policies. When making use of the Campbell-Shiller decomposition to the Road price-earnings ratio, the outcomes align with the surplus volatility puzzle (Shiller, 1981): fluctuations within the Road price-earnings ratio are primarily pushed by future returns, with little clarification from future earnings progress.

This implies that inventory returns ought to exhibit predictable return variation, an important implication of the surplus volatility puzzle. Accordingly, they display that the Road price-earnings ratio can predict inventory returns each in-sample and out-of-sample. Their findings point out that the Road price-earnings ratio is good for finding out the surplus volatility puzzle and return predictability. It might additionally assist buyers time their market publicity extra successfully.

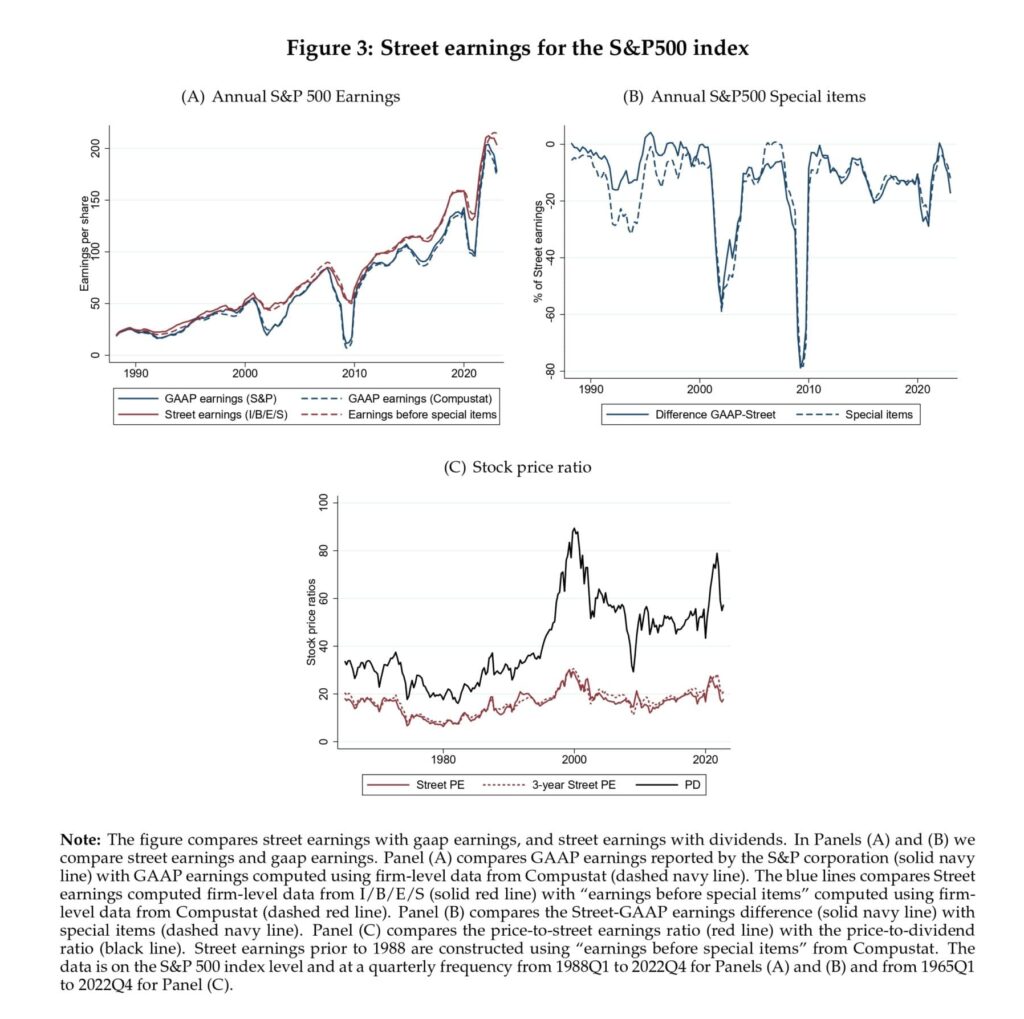

Regardless of the potential subjectivity, it’s proven in Determine 3 that combination “earnings can intently replicate combination Road earnings reported by I/B/E/S earlier than particular gadgets” utilizing Compustat. This suggests that subjectivity doesn’t play a major function since we will replicate the earnings numbers following a hard and fast algorithm.

An open query stays as to what drives extreme inventory value actions. The road price-earnings ratio reveals buyers’ expectations of returns and earnings can assist clarify the surplus volatility puzzle.

Authors: Sebastian Hillenbrand and Odhrain McCarthy

Title: Valuing Shares With Earnings

Hyperlink: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4892475

Summary:

To handle the surplus volatility puzzle – the extreme actions in inventory costs – researchers usually examine actions in valuation ratios. Nonetheless, we display that actions in valuation ratios primarily based on elementary measures with excessive transitory volatility, corresponding to generally used earnings measures, are uninformative about actions in inventory costs. To beat this, we suggest utilizing another elementary measure: Road earnings. Road earnings, calculated earlier than numerous transitory gadgets, don’t possess this transitory volatility and supply a extra informative measure of future fundamentals. Consequently, actions within the price-to-street earnings (Road PE) ratio replicate actions in inventory costs, making it extremely informative in regards to the extra volatility puzzle. Accordingly, we present that the Road PE has extra in- and out-of-sample explanatory energy for predicting returns than different valuation ratios. Moreover, it helps reconcile conflicting views on which subjective expectations drive inventory value actions, exhibiting that expectations of short-term earnings progress, long-term earnings progress, and returns can all assist clarify the surplus volatility puzzle.

As all the time, we current a number of thrilling figures and tables:

Notable quotations from the educational analysis paper:

“To validate the usage of Road earnings, we display that, on the combination degree, Road earnings are certainly a extra secure and informative measure of earnings than GAAP earnings. First, we present the massive distinction between combination Road and GAAP earnings arises because of revenue assertion gadgets labeled as “particular gadgets”. Particularly, combination (and industry-level) Road earnings (from I/B/E/S) are intently replicated by computing combination (and industry-level) earnings earlier than “particular gadgets” as reported in Compustat.2 Second, as a result of particular gadgets correspond to transitory gadgets (corresponding to one-off impairments, write-downs, and so on.), by eradicating these transitory gadgets, Road earnings are smoother and extra persistent than GAAP earnings. Third, as a result of transitory gadgets have little relevance for future earnings, previous Road earnings are extra informative about future combination earnings (each GAAP and Road), according to the firm-level proof documented in Rouen, So, and Wang (2021).

Utilizing the Road PE, we discover statistically and economically important proof for in-sample return predictability, for each quick and long-horizon returns. The bias-adjusted predictive coefficients of −0.68 (p = 0.067), −2.43 (p = 0.021), and −4.95 (p = 0.005) for 1-year, 3-year, and 5-year returns, respectively, point out important predictive energy. The rising magnitude of those coefficients over longer horizons not solely helps theories of imply reversion in anticipated returns (Fama and French, 1988; Campbell, 2001), but additionally gives robust proof that actions within the Road PE are intimately linked to long-run returns. For instance, a one-point improve within the Road PE predicts almost a 5% lower in returns over the following 5 years. On condition that Road PE ranges from 7 to twenty-eight, this means that when shares are at their least expensive, anticipated returns over the following 5 years are roughly 105% increased than when they’re at their most costly. Comparable outcomes are noticed when utilizing the 3-year Road PE. The Road PE persistently outperforms different valuation ratios – PD, CAPE, and GAAP PE – in predictive energy for returns. Actually, not one of the conventional measures are important on the 5% degree for the 1-year or 3-year horizon, and solely the PD is important on the 5% degree for the 5-year horizon.

We conclude that the variation in future returns induced by extra inventory value actions can certainly be predicted utilizing the Road PE. Thus, utilizing the Road PE ratio reconciles return predictability take a look at swith the surplus volatility puzzle. Our return predictability proof is all of the extra outstanding because it reveals strong in- and out-of-sample pattern predictive energy with out counting on “theory-motivated” regression frameworks (e.g., Lewellen, 2004; Cochrane, 2008; Campbell and Thompson, 2008) or complicated estimation strategies (e.g., Kelly, Malamud, and Zhou, 2024).3

[Authors] examine paperwork that Road earnings are an excellent elementary measure for valuing shares. We present that the Road price-earnings ratio is superior at predicting combination returns (each in- and out-of-sample) in addition to cross-sectional returns relative to conventional monetary ratios. Thus, it’s excellently fitted to asset pricing assessments aimed toward understanding inventory value and return variation (and therefore, the surplus volatility puzzle). We additionally present that its use can reconcile conflicting views in prior analysis.

[Authors] additionally assemble a measure of “earnings earlier than particular gadgets” on the S&P 500 degree utilizing Compustat. Panel (A) of Determine 3 reveals that this intently replicates the Road earnings report by I/B/E/S. “Earnings earlier than particular gadgets” are useful for the return prediction train since I/B/E/S started reporting realized earnings solely in 1983. We, subsequently, use the “earnings earlier than particular gadgets” within the prolonged pattern beginning in 1965 (we use annual Compustat for the interval 1965 and quarterly Compustat after 1970). [. . .] Panel (C) of Determine 3 reveals a extra pronounced improve within the PD ratio in comparison with the Road PE ratio over the previous many years.

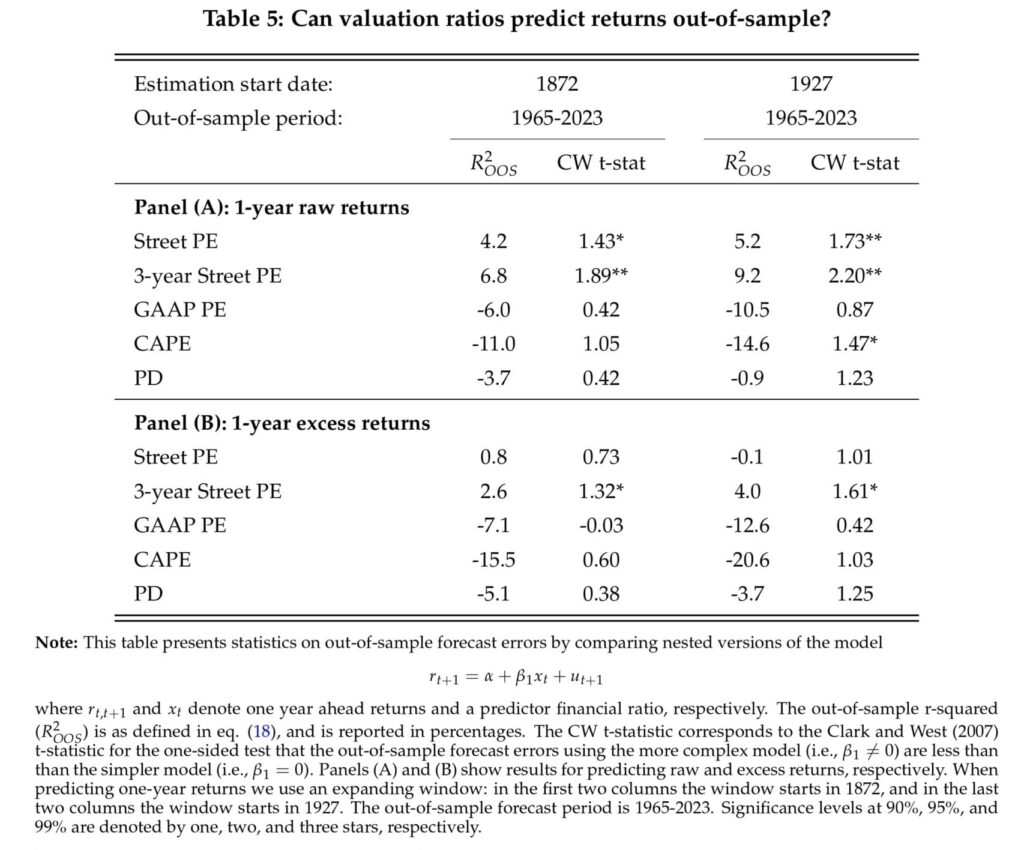

Desk 5 stories the outcomes the place we report each R2OOS statistic and the CW t-statistic for the null that Clark-West SPE Distinction is zero towards the choice that its constructive (i.e., the extra complicated mannequin adjusted for noise performs higher). Panel (A) demonstrates that the Road PE and 3-year Road PE ratio have important predictive energy, with R2OOS values of 4.2% and 6.8%, respectively, for the 1872 estimation begin date, and 5.2% and 9.2% for the 1927 begin date. The corresponding CW t-statistic verify the importance of those outcomes: all the outcomes are important on the 5% degree with the only real exception of Road PE for the 1872 estimation begin, which remains to be important on the 10% degree. This means that these two Road-based valuation ratios are strong predictors of future returns out-of-sample. [. . .] Panel (B) of Desk 5 additionally stories the outcomes for one-year extra returns as in Goyal and Welch (2008). The outcomes are much less favorable. Nonetheless, the Road PE and 3-year Road PE nonetheless handle to outperform the opposite valuation measures.”

Are you on the lookout for extra methods to examine? Join our e-newsletter or go to our Weblog or Screener.

Do you wish to be taught extra about Quantpedia Premium service? Verify how Quantpedia works, our mission and Premium pricing provide.

Do you wish to be taught extra about Quantpedia Professional service? Verify its description, watch movies, evaluation reporting capabilities and go to our pricing provide.

Are you on the lookout for historic information or backtesting platforms? Verify our checklist of Algo Buying and selling Reductions.

Or comply with us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookCheck with a buddy

[ad_2]

Source link