[ad_1]

Up to date on September twenty sixth, 2024 by Bob Ciura

Buyers searching for corporations that generate sturdy income and pay dividends ought to take a more in-depth have a look at the main alcohol shares. These are corporations that manufacture and distribute a wide range of alcoholic drinks, together with beer, wine, and liquor.

The highest corporations on this business have many engaging qualities. They’ve fashionable manufacturers, which give them pricing energy and powerful money circulation. This permits them to pay dividends to shareholders.

Alcohol shares additionally are likely to carry out effectively in periods of financial downturns, that means they will present diversification and recession-resistance to a portfolio.

To the purpose, one alcohol inventory even makes the unique Dividend Aristocrats record, an elite group of S&P 500 shares with 25+ years of rising dividends.

There are at present 66 Dividend Aristocrats. You’ll be able to obtain an Excel spreadsheet of all 66 Dividend Aristocrats (with metrics that matter comparable to dividend yields and payout ratios) by clicking the hyperlink under:

Extra info might be discovered within the Positive Evaluation Analysis Database, which ranks shares based mostly upon the mix of their dividend yield, earnings-per-share development potential and valuation modifications to compute whole returns.

This text will rank the highest alcohol shares proper now.

Desk of Contents

The highest alcohol shares are listed right here. Shares are ranked in line with their 5-year anticipated returns. Shares are listed so as of attractiveness, from lowest to highest.

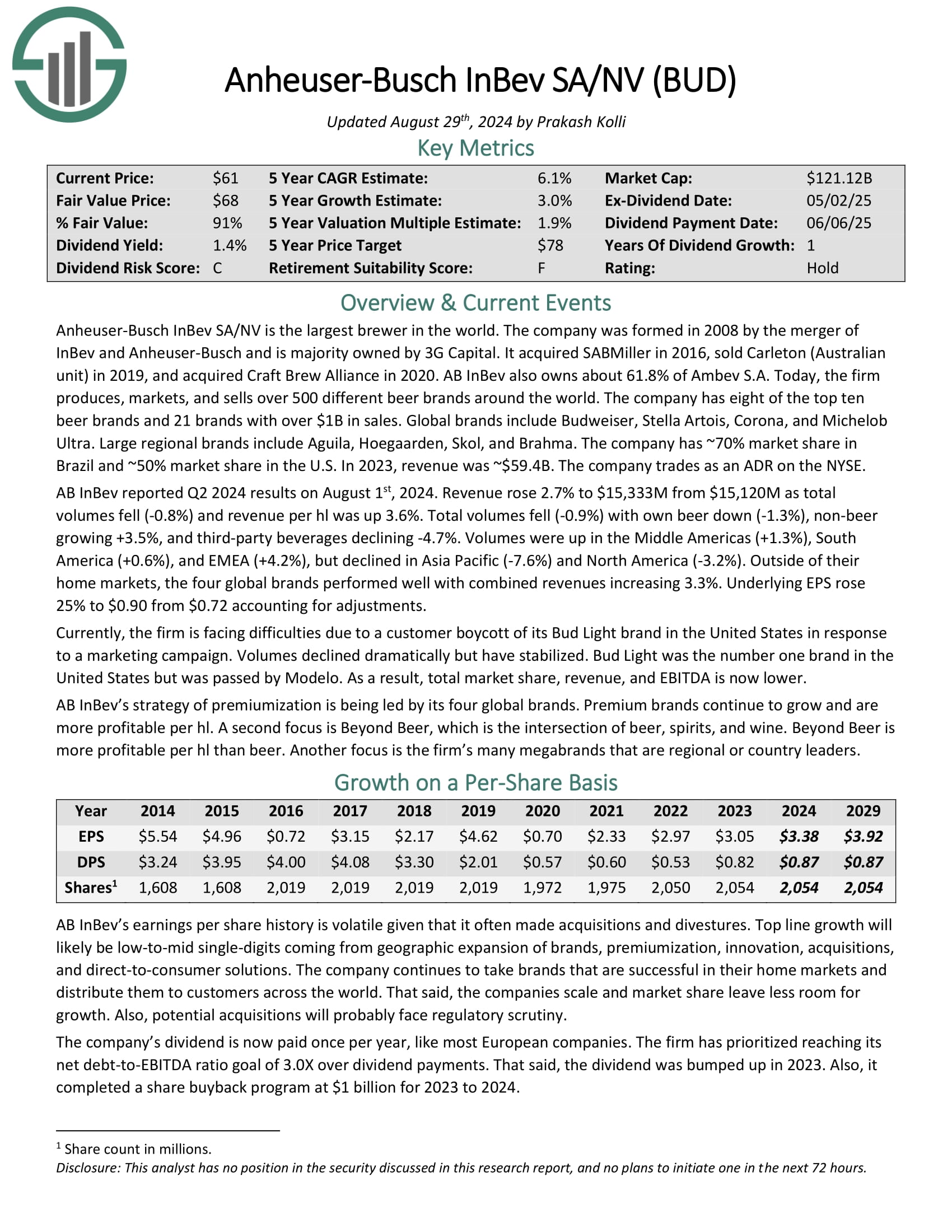

Alcohol Inventory #5: Anheuser-Busch InBev (BUD)

5-year anticipated annual returns: 5.1%

AB-InBev is the most important beer firm on the planet. In its present type, it’s the results of the 2008 merger between InBev and Anheuser-Busch. At the moment, it sells greater than 500 beer manufacturers, in additional than 150 nations world wide. A few of its hottest manufacturers embrace Budweiser, Bud Gentle, Corona, Stella Artois, Beck’s, Fort, and Skol.

AB InBev reported Q2 2024 outcomes on August 1st, 2024. Income rose 2.7% to $15,333M from $15,120M as whole volumes fell (-0.8%) and income per hl was up 3.6%. Whole volumes fell (-0.9%) with personal beer down (-1.3%), non-beer rising +3.5%, and third-party drinks declining -4.7%.

Volumes have been up within the Center Americas (+1.3%), South America (+0.6%), and EMEA (+4.2%), however declined in Asia Pacific (-7.6%) and North America (-3.2%). Outdoors of their house markets, the 4 world manufacturers carried out effectively with mixed revenues growing 3.3%. Underlying EPS rose 25% to $0.90 from $0.72 accounting for changes.

Click on right here to obtain our most up-to-date Positive Evaluation report on BUD (preview of web page 1 of three proven under):

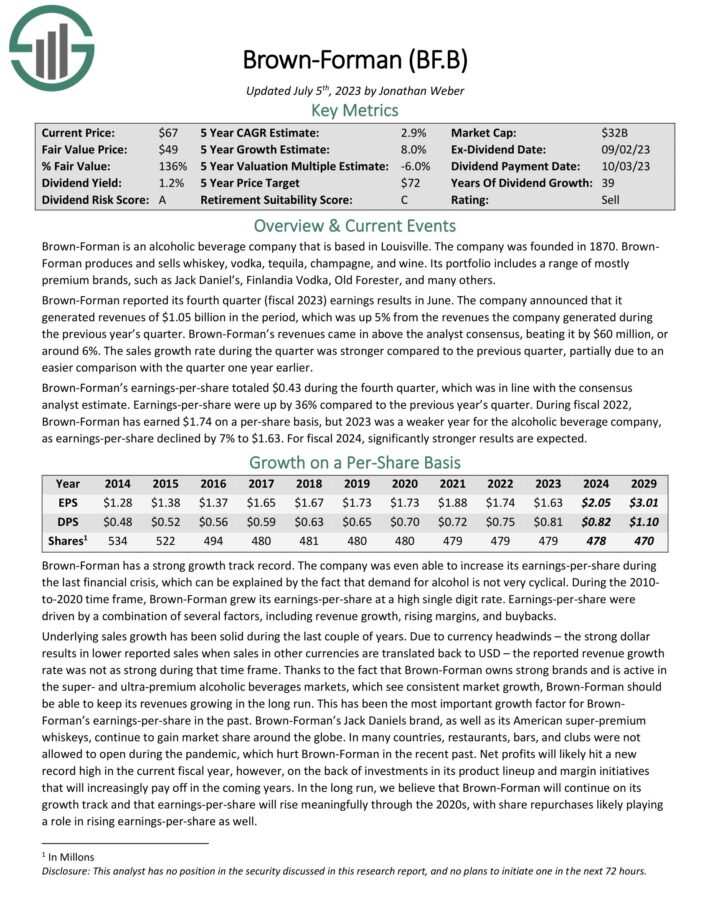

Alcohol Inventory #4: Brown-Forman (BF.B)

5-year anticipated annual returns: 7.8%

Brown-Forman has a formidable historical past of dividend development. The corporate has elevated its dividend for over 30 years in a row, making it a Dividend Aristocrat.

Brown-Forman’s lengthy dividend development historical past is because of its sturdy manufacturers and recession resiliency. It has a big product portfolio, which is concentrated on whiskey, vodka, and tequila. Its most well-known model is its flagship Jack Daniel’s. Different fashionable manufacturers embrace Herradura, Woodford Reserve, El Jimador, and Finlandia.

Click on right here to obtain our most up-to-date Positive Evaluation report on Brown-Forman (preview of web page 1 of three proven under):

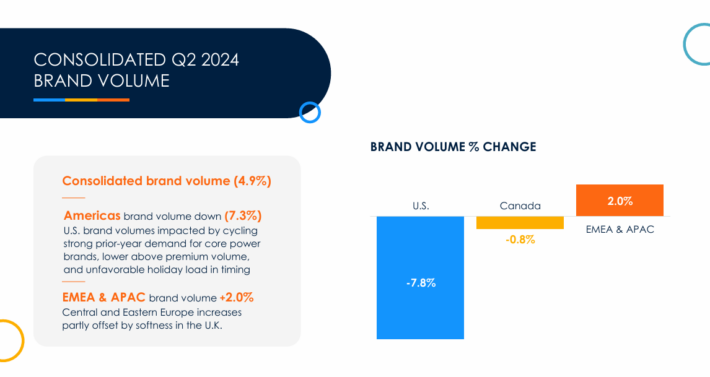

Alcohol Inventory #3: Molson Coors (TAP)

5-year anticipated annual returns: 10.6%

Molson Coors Brewing Firm was based in 1873. Since then, it has grown into one of many largest U.S. brewers. It has a wide range of manufacturers together with Coors Gentle, Coors Banquet, Molson Canadian, Carling, Blue Moon, Hop Valley, Crispin Cider, and the Miller beer manufacturers.

On August sixth, 2024, Molson Coors reported second quarter 2024 outcomes for the interval ending June thirtieth, 2024. For the quarter, the corporate generated internet gross sales of $3.25 billion, a 0.4% lower in comparison with Q2 2023.

Supply: Investor Presentation

Internet gross sales declined 1.7% in Americas, however improved 5.3% in Europe, the Center East and Africa, and Asia-Pacific.

Reported internet earnings equaled $560 million or $2.03 per share in comparison with $441 million or $1.57 per share in Q2 2023. On an adjusted foundation, earnings-per-share equaled $1.92 versus $1.78 prior. The corporate repurchased $375 million of its shares in H1 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on Molson Coors (preview of web page 1 of three proven under):

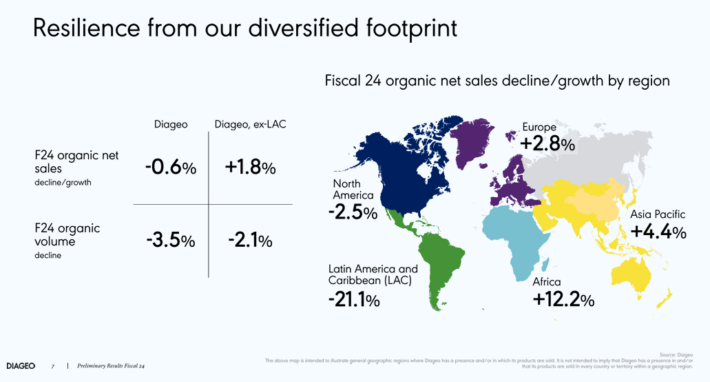

Alcohol Inventory #2: Diageo PLC (DEO)

5-year anticipated annual returns: 10.8%

Diageo traces its roots all the best way again to the seventeenth century and the Haig household, the oldest household of Scotch whiskey distillers.

At the moment, Diageo producers a few of the hottest spirits and beer manufacturers on the planet, comparable to Johnnie Walker, Smirnoff, Captain Morgan, Baileys, Tanqueray, Guinness, Crown Royal, Ketel One, and lots of extra.

In all, Diageo has 20 of the world’s prime 100 spirits manufacturers.

On July thirtieth, 2024, Diageo launched earnings outcomes for fiscal yr 2024 for the interval ending June thirtieth, 2023. For the yr, the corporate earned $6.91 per share, which was 5% above the prior yr’s end result, however effectively under estimates. Internet gross sales decreased 1.4% whereas natural development was decrease by 0.6%.

Supply: Investor Presentation

A small profit from pricing and blend was greater than offset by a 3.5% lower in quantity. Most areas carried out effectively. Natural income development for Africa, Asia Pacific, and Europe totaled 12%, 4%, and three%. North America was down 3% whereas Latin American and Caribbean was down 21%.

The lower in North America was because of a cautious shopper market and hard comparable intervals. Whole market share grew or held regular in 75% of the portfolio, which in comparison with 70% in fiscal yr 2023. Premium-plus manufacturers accounted for almost all of internet gross sales.

Click on right here to obtain our most up-to-date Positive Evaluation report on Diageo (preview of web page 1 of three proven under):

Alcohol Inventory #1: Constellation Manufacturers (STZ)

5-year anticipated annual returns: 11.2%

Constellation Manufacturers was based in 1945, and at this time, it produces and distributes beer, wine, and spirits. It has over 100 manufacturers in its portfolio, together with beer manufacturers comparable to Corona.

As well as, Constellation’s wine manufacturers embrace Robert Mondavi and Clos du Bois. Its liquor manufacturers embrace SVEDKA Vodka, Casa Noble Tequila, and Excessive West Whiskey.

One of many largest causes for Constellation Manufacturers’ spectacular development in recent times, is its deal with the premium phase, which continues to develop.

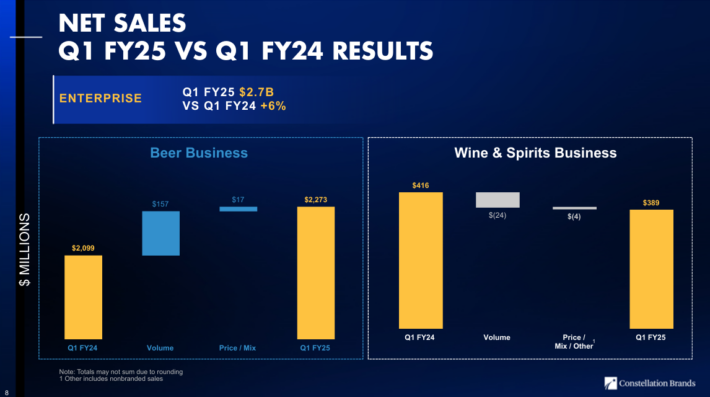

On July third, 2024, Constellation Manufacturers reported first quarter fiscal 2025 outcomes for the interval ending Might thirty first, 2024.

Supply: Investor Presentation

For the primary quarter, the corporate recorded $2.66 billion in internet gross sales, a 6% improve in comparison with the identical prior yr interval. Beer gross sales improved by 8% year-over-year, whereas wine and spirits gross sales declined by 7%.

Comparable earnings-per-share equaled $3.57 for the quarter, which was a 17% improve in comparison with Q1 2024, and 12 cents forward of analyst estimates.

Click on right here to obtain our most up-to-date Positive Evaluation report on STZ (preview of web page 1 of three proven under):

Last Ideas

Many alcohol shares have been hit arduous because the coronavirus disaster unfolded, however some have come again considerably in latest months. For worth and earnings traders, the restoration in alcohol shares has decreased the variety of shopping for alternatives because of rising valuations and declining dividend yields.

Nonetheless, the world’s finest alcohol producers have sturdy manufacturers, and generate excessive money circulation that’s used for development funding in addition to money returns to shareholders.

It is usually priceless for traders that alcohol shares are more likely to be among the many best-performers if a recession does happen. Consumption of alcoholic drinks will keep regular–and will even improve–in a recession. A sustained restoration from the coronavirus can be a significant profit for the most important alcohol producers.

In case you are interested by discovering high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases will likely be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link