[ad_1]

Have you ever ever shopped on the on-line low cost meals retailer Martie.com? I just lately found it and LOVE it! Plus, they’re providing our readers an unique $10 coupon to avoid wasting in your Martie grocery order!

Unique Martie Coupon: $10 Off!

Martie — an internet low cost meals retailer that provides nice offers on pure, natural, and gluten-free merchandise — is providing my followers a $10 off coupon on any order $35 or over if you use coupon code MSM at checkout. Plus, you may get free transport on any $50+ order!*

That is the BEST Martie low cost you’ll discover on-line and it’s an incredible alternative to stack their offers with this $10 coupon and free transport to attain some improbable reductions on pure and natural merchandise!

Simply load up your cart with $50 price of offers and use coupon code MSM at checkout to get this deal in your Martie grocery order!

And should you’re occupied with my expertise with Martie, maintain studying beneath about my first order with this new-to-me on-line meals low cost retailer!

What’s Martie?

In case you’ve adopted for any size of time, you understand how a lot of a fan I’m of low cost meals shops. Each time I point out the low cost meals retailer we like to go to once we’re touring by Missouri, folks will attain out and say they need they may discover one thing comparable of their space.

Whereas some areas do have comparable low cost meals shops, I do know many don’t. So when my sister texted me to ask if I’d heard of this firm known as Martie, an internet low cost grocery retailer, I knew I needed to test it out and probably do a evaluation!

Is every part a superb deal?

I positioned an order inside just a few days and was so impressed with the choice on the Martie web site. They promote that almost all of their costs are 40-70% off retail and I discovered that to be fairly true.

There are some issues that aren’t nice offers in comparison with what you may discover on sale in-store, however should you usually purchase natural, gluten-free, dairy-free, or allergen-friendly objects, you’ll seemingly discover some actually nice offers on the positioning. I like to recommend sorting by value to see the bottom priced offers!

Is there a catch?

Since that is an internet low cost retailer, you’ll by no means know for certain what they’ll have in inventory, they do restrict some purchases, and all objects are normally expiring inside just a few weeks to a couple months.

However should you’re like me and don’t essentially see expiration dates on shelf secure objects as arduous and quick guidelines and/or you should use objects up or stick them within the freezer, you’ll love digging by what’s on the Martie website!

They provide every day offers and final probability offers. In addition they have labels on a variety of objects telling you the way a lot the low cost is off the retail value.

Take a look at every part I obtained in my first order!

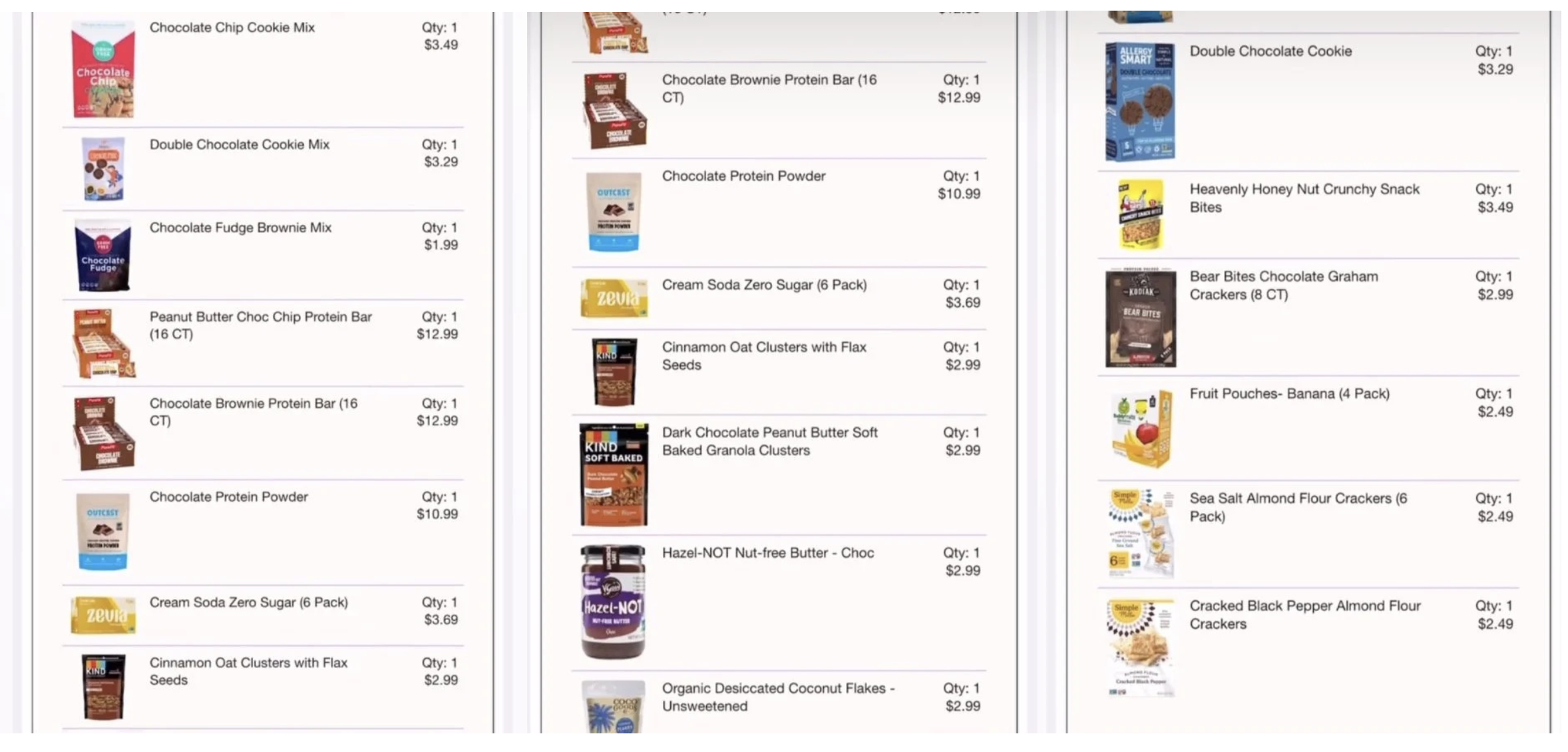

In case you’re interested in what I obtained in my first order and among the costs, try the screenshots above! I obtained SO many nice objects!

Save $10 in your Martie grocery order!

Don’t overlook! Proper now, you should use unique coupon code MSM to get $10 off any order of $35 or extra. Plus, purchase $50 or extra and also you’ll get free transport, too!

*Transport is free on any $50+ order, although you might have to pay a $1.99 dealing with payment and/or an extra delivery fee should you stay far-off from one in all their transport facilities.

Go right here to order from Martie.

[ad_2]

Source link