[ad_1]

J Studios

Rubrik, Inc. (NYSE:RBRK) reported Q2 ’25 earnings with exceptionally robust top-line progress paired with improved working margins because the agency rotates extra closely into subscription-based income streams. Administration was exceptionally optimistic regarding their forecast at some stage in eFY25, with a complete income progress charge of 31-32%. Modeling the agency’s progress primarily based on identified figures, administration set the tone of 31-32% progress for Q3 ’25, which can end in This autumn ’25 coming in at roughly 26-30% progress. Given the robust progress trajectory and being in the precise market on the proper time for knowledge resiliency, I like to recommend RBRK shares with a BUY score with a worth goal of $45.27/share at 7.92x eFY26 worth/gross sales.

Rubrik Operations

Rubrik’s core focus is comparatively area of interest in a high-growth market, knowledge resiliency. The driving issue behind Rubrik’s merchandise is making certain that when, not if, a breach happens, firms can get their operations again on-line as shortly as potential. This has pushed main partnerships with firms like Microsoft (MSFT), Mandiant, an Alphabet firm (GOOG) (GOOGL), CrowdStrike (CRWD), and Salesforce (CRM), amongst others. As administration acknowledged of their q2’25 earnings name, Rubrik was boots on the bottom with CrowdStrike after the July 19, 2024, IT outage.

Given the agency’s subscription-based choices targeted on cyber resilience, a differentiated product that caters to knowledge safety, I imagine Rubrik has the flexibility to succeed in these progress targets, particularly as enterprises transition to leveraging extra AI/ML purposes.

Rubrik’s area of interest isn’t essentially competing with the massive platforms like CrowdStrike (CRWD) or Palo Alto Networks (PANW) by which these companies’ major focus is stopping the risk earlier than a breach happens. Rubrik’s focus primarily pertains to what occurs post-breach, offering know-how that enables for a quicker restoration. This issue has led Rubrik to accomplice with firms who one would possibly assume can be opponents, corresponding to CrowdStrike, Cisco Programs (CSCO), and Microsoft (MSFT), amongst others. As CrowdStrike’s Falcon platform supplies 98% protection and a time to detection of 4 minutes, Rubrik’s platform has demonstrated a time to restoration of 35 seconds, considerably decrease than an unnamed competitor’s 5-hour time to restoration.

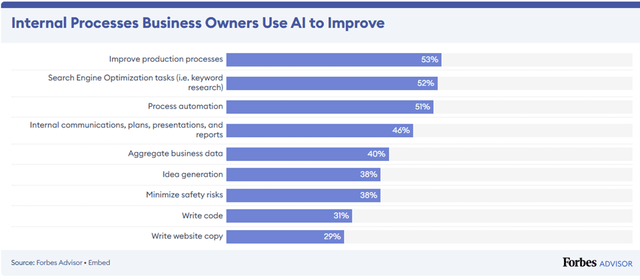

These options are exceptionally essential when contemplating the transition to machine studying and synthetic intelligence for enterprise purposes. Based on a Forbes report issued in April 2024, 53% of companies leverage AI to enhance enterprise manufacturing processes and 51% of companies use AI for course of automation.

Forbes

These figures are prone to proceed rising as GPU availability turns into extra widespread for enterprises. Accordingly, Nvidia (NVDA) reported that 60% of deployed AI infrastructure in q1’25 was pushed by non-hyperscaler clients. This will likely recommend extra enterprises are enhancing their non-public knowledge facilities to help AI/ML testing and inferencing. Given the extent of curiosity in using AI/ML purposes, I imagine Rubrik has an extended runway for progress, properly past their $919mm subscription-based ARR reported in Q2 ’25.

I believe the final word query an investor has to ask is whether or not Rubrik will preserve its independence or place itself to be acquired. Arguably, one of many bigger cybersecurity distributors would make for a first-rate facilitator for such an acquisition; nevertheless, an acquisition by a CrowdStrike or a Palo Alto Networks might create some challenges given Rubrik’s common strategy to cloud safety. A possible acquirer could possibly be Snowflake (SNOW) given the agency’s want for cyber resilience. Arguably, Microsoft can be a powerful acquirer given the 2 companies’ relationship and buyer overlap; nevertheless, given {that a} deal hasn’t already occurred, I don’t imagine it is going to be doubtless that one will happen sooner or later given the chance of a better buyout premium.

Although there have been no acquisition talks, a minimum of which can be public, the chance is there given the drive for platformization throughout cybersecurity departments. For instance, CrowdStrike acquired Circulate Safety in CYq1’24 to increase its cloud safety features with DSPM. Palo Alto Networks acquired Dig Safety on the finish of CY23, an organization that additionally supplies DSPM options.

Equally, Rubrik acquired Laminar in August 2023. Laminar introduced Rubrik DSPM into the platform to couple cyber restoration with cyber posture throughout enterprises, cloud, and SaaS platforms.

Dangers Associated To Rubrik

Bull Case

Rubrik is in the precise market on the proper time, with knowledge restoration being on the top-of-mind post-IT incident because of the CrowdStrike replace in July. One of many best challenges IT faces proper now could be making certain knowledge safety, and within the occasion of a breach, restoration. This could push progress for Rubrik additional alongside as investments in AI/ML purposes proceed to develop.

Bear Case

Bigger cybersecurity platforms corresponding to CrowdStrike and Palo Alto Networks have comparable choices as a part of their respective built-in platforms. This will likely make Rubrik deprived when contemplating the platformization development in cybersecurity. Rubrik can be within the early phases of progress, posing a danger to share decline is hints of a slowdown present.

Rubrik Financials

Company Studies

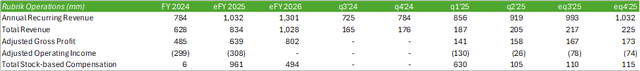

Provided that some info shouldn’t be publicly accessible, historic financials is not going to be totally offered. Do notice that Q3 ’24 & This autumn ’24 are estimates primarily based on administration’s income forecast for Q3 ’25’s progress charge of 31-32%.

Rubrik has realized robust income progress since going public in April 2024. Wanting on the quarterly financials, Rubrik’s income has grown sequentially each quarter, with no expectation of this development letting up in eFY25. I’m forecasting income to develop by 31% in eq3’25 with eFY25 income rising 33% to $834mm. Along with this, I’m forecasting ARR to develop by 32% on a year-over-year foundation for eFY25 to $1,032 mm and 26% in FY26.

I imagine subscription progress might be pushed by the adoption of AI/ML purposes. Many cybersecurity companies, together with CrowdStrike and Palo Alto Networks, have acknowledged a number of instances that these giant language fashions present a major hole for extremely valued knowledge that must be secured. As Mr. Bipul Sinha, CEO, Chairman, and Co-Founding father of Rubrik mentioned on the earnings name, it’s now not about “if” however “when.” Given the expectation of an information breach inevitably occurring, enterprises being able to convey methods again on-line at a quicker charge could be thought of a cost-saving measure. I imagine that this enterprise resolution supplies a sturdy case for enterprises adopting Rubrik’s knowledge integrity platform.

Valuation & Shareholder Worth

Company Studies

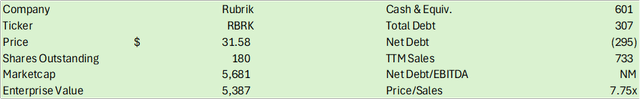

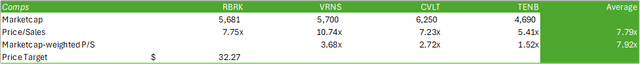

RBRK shares at the moment commerce at 7.75x TTM worth/gross sales. RBRK is at the moment buying and selling on par with its peer cybersecurity cohort, which holds a market cap-weighted common worth/gross sales a number of of seven.92x.

In search of Alpha

Utilizing my monetary forecast for eFY26 gross sales progress paired with its peer common buying and selling a number of, I imagine RBRK shares can worth at $45.27/share at 7.92x eFY26 worth/gross sales. Given the corporate’s robust presence in knowledge resiliency and being in the precise market on the proper time, I like to recommend RBRK shares with a BUY.

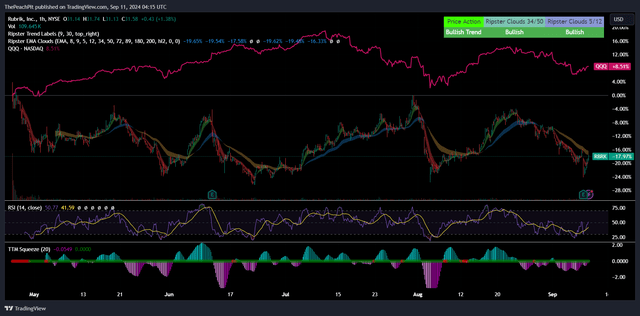

RBRK shares have important underperformed the NASDAQ Index (COMP:IND) since going public, suggesting that buyers have not but purchased into the corporate’s outlook. Now that the lock-up has expired, buyers could have the chance to purchase into new positions.

TradingView

[ad_2]

Source link