[ad_1]

Klaus Vedfelt

Article Thesis

Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) has not too long ago seen its shares come underneath stress resulting from authorized battles with regulators and resulting from worries about what ChatGPT would possibly imply for Alphabet’s search enterprise sooner or later. However I imagine that these dangers are overblown. On the identical time, Alphabet now trades at a really undemanding valuation whereas persevering with to ship extremely engaging enterprise progress. I imagine that this presents a pleasant shopping for alternative on this high-quality inventory — it is time to be grasping when others are fearful, as Warren Buffett has taught us.

Previous Protection

I’ve lined Alphabet right here on Searching for Alpha a number of occasions, most not too long ago in April. Near half a 12 months has handed since then, with Alphabet reporting quarterly earnings outcomes for Q2 within the meantime, whereas GOOG’s valuation has additionally come down. Final however not least, regulatory points have progressed, which is why it is time for an improve.

Why Being Grasping When Others Are Fearful Can Make Sense

The above phrase is utilized by Warren Buffett, one of many best-known and most profitable worth buyers on the planet. Markets are likely to overreact infrequently, each to the upside and to the draw back. Excellent news can lead to very substantial share worth positive aspects in some circumstances, however it might end up that these positive aspects have been overblown — suppose, for instance, concerning the COVID vaccine positive aspects for Moderna (MRNA), BioNTech (BNTX), and Pfizer (PFE). All of them have seen their shares fall considerably, as their valuations have been too excessive because the market was grasping. In the same method, markets will also be too fearful. Meta Platforms (META) noticed its shares crash not too way back when the market feared that the corporate was overspending on its metaverse investments. However the firm corrected its course, and earnings quickly soared once more. Those who used the panic to purchase shares on a budget when the chance arose have seen their investments develop by lots of of proportion factors in a brief time period. When markets are irrationally bearish on a high quality inventory, that may make for an excellent shopping for alternative. I imagine that this holds true for Alphabet right now.

What The Market Fears

Over the past two months or so, Alphabet has seen its shares pull again from a 52-week excessive of $193 to the $140s, making for a really substantial pullback. This was not pushed by weak outcomes — fairly the opposite, as Alphabet beat estimates simply when it reported its Q2 outcomes a few weeks in the past. The share worth pullback additionally wasn’t pushed by destructive analyst revisions. As Searching for Alpha explains, nearly all of revisions for each Alphabet’s high line and its backside line have been upwards during the last three months, with greater than 30 upwards revisions for each strains in that timeframe.

Alphabet’s weak share worth efficiency within the latest previous was thus neither pushed by weak leads to the current nor by expectations for weaker leads to the close to time period. As a substitute, it seems like buyers have some quite imprecise worries about competitors from Synthetic Intelligence-driven search, whereas political and regulatory worries exist as nicely. Let’s take a more in-depth look:

ChatGPT has made a giant splash round two years in the past. The Giant Language Mannequin has a weekly lively person base of round 200 million, which is a hit for OpenAI for certain. They do not appear to make use of the service fairly often, nevertheless, as month-to-month net hits whole round 2.4 billion, which pencils out to round 80 million per day. Google, in the meantime, is used for 22 billion searches per day. Once we evaluate to net hits that ChatGPT will get per day with the searches achieved through Google, the latter quantity is round 275x bigger. Whereas ChatGPT is a hit for OpenAI, it’s nonetheless abysmally small in comparison with Google Search. And Google Search is only one of Alphabet’s many enterprise items, with YouTube, cloud computing, and so forth offering further income.

Throughout the newest quarter, Alphabet’s income was up 15% in fixed currencies, with progress accelerating from the earlier 12 months when the expansion fee had been 9%. Google Search income was up 14% 12 months over 12 months throughout the newest quarter, exhibiting an in-line progress fee in comparison with the remainder of the corporate (company-wide reported income was up 14%, there was a small forex headwind). Regardless of the curiosity that some have in ChatGPT, it doesn’t appear to be ChatGPT is hurting Alphabet’s Search enterprise in any respect — Search is many occasions greater, and continues to develop. With progress even accelerating, there may be, I imagine, little cause to fret that Google Search will run into main issues. In a rising market, each ChatGPT and Google Search can develop, with the latter rising from a approach increased base.

Additionally, it is vital to notice that Alphabet has its personal Giant Language Mannequin. Even when LLMs have been to realize huge market share, Alphabet would seemingly not be not noted, as Alphabet’s Gemini would seemingly be among the many profitable LLMs ought to such a state of affairs happen.

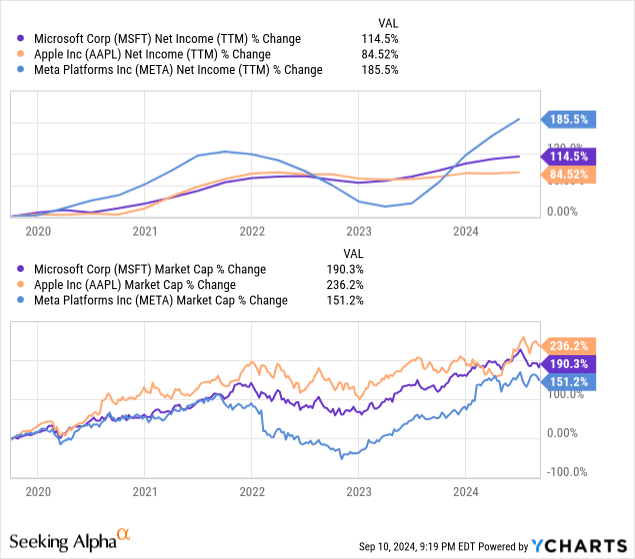

Some buyers are additionally fearful about regulatory points. Alphabet is being attacked by the DoJ over its Google promoting enterprise, with the DoJ claiming that Google is illegally working a monopoly. There have been many antitrust circumstances in opposition to Large Tech firms previously, together with Microsoft (MSFT), Meta Platforms, and Apple (AAPL), however these circumstances by no means damage these firms meaningfully in the long term. These firms didn’t get break up up, nor did earnings fall — fairly the opposite: Microsoft, Apple, and Meta Platforms are extra priceless and extra worthwhile than they’ve ever been:

Not less than previously, antitrust circumstances have been thus extra of a nuisance than an actual menace for Large Tech firms. I imagine that there’s a good probability that the identical will maintain true for the present antitrust case in opposition to Google. And even when the trial is profitable and the DoJ wins, I assume that there could be some minor concessions. Alphabet additionally may very well be compelled to pay fines, however even a multi-billion greenback superb wouldn’t be a difficulty in any respect — Alphabet sits on $101 billion of money. Would a superb of $1 billion, $5 billion, and even $10 billion be a destructive growth? Sure, that will be true. Nevertheless it would not be a menace for the corporate — Alphabet’s buyers would seemingly not even discover, in spite of everything, there is no such thing as a enormous distinction between a $101 billion money place and a $91 billion money place. Alphabet’s working money move totaled $105 billion during the last 12 months, thus even a hypothetical superb of $10 billion could be equal to simply a few weeks value of money flows.

Alphabet: A Nice Deal

Alphabet combines many positives: A wonderful market place within the money cow Search market, a robust place within the fast-growing cloud computing area, a fortress stability sheet, robust enterprise progress, and tight price controls that make its margins develop increased and better.

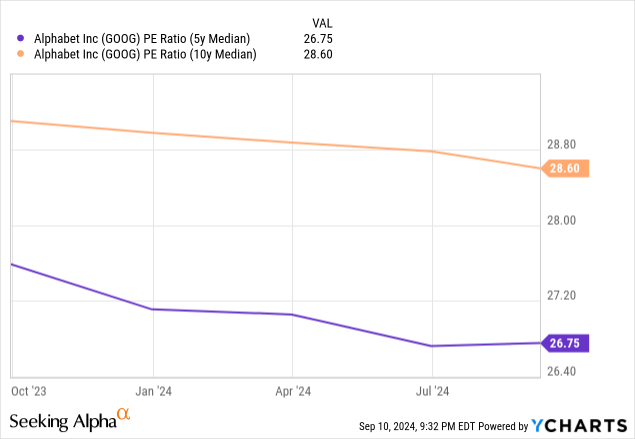

And but, Alphabet is a reasonably low-cost inventory, I imagine. Primarily based on present estimates for this 12 months, Alphabet trades for just under 20x ahead web earnings. Once we think about that the corporate has a transparent historical past of beating estimates with six earnings per share beats in a row, it could not be too shocking if the consensus earnings per share estimate for 2024 is just too low, which might lead to an excellent decrease valuation. Once we think about Alphabet’s sizeable web money place, the cash-adjusted earnings a number of is decrease as nicely. However even with out these changes, Alphabet trades at a sizeable low cost in comparison with the market and its personal historic valuation norm. The S&P 500 trades at round 26x 2024’s anticipated earnings proper now, which means Alphabet trades at a reduction of round 20%. By way of model energy, enterprise progress, margins and returns on capital, and so forth, Alphabet looks as if an above-average high quality firm for certain. The truth that it however trades at an enormous low cost to the broad market is thus shocking.

Within the above chart, we see that Alphabet was principally buying and selling with a mid to high-20s earnings a number of previously. The present sub-20 earnings a number of is thus traditionally low.

Total, I imagine that Alphabet’s very undemanding valuation, together with its numerous strengths and compelling progress outlook, makes shares look engaging.

Dangers To Think about

No funding is risk-free, and that additionally holds true for Alphabet. It’s doable that this antitrust case is totally different in comparison with different Large Tech antitrust circumstances and that there will likely be a serious impression, though I do not see this as very seemingly. Even when the corporate have been to be break up up, the sum of the components would nonetheless be extremely priceless, after all.

Throughout a possible recession, promoting budgets may get reduce, which might have a destructive impression on Alphabet’s promoting enterprise. Alphabet is thus not utterly resilient versus macro troubles, though its enormous money pile would provide a variety of safety in any downturn, I imagine.

Alphabet is spending massive sums of cash on its AI ventures, which incorporates the acquisition of NVIDIA’s (NVDA) AI knowledge middle chips. It’s doable that the return on this funding will in the end be unattractive. In that case, Alphabet would have burned a major sum of cash, though this could not be a company-threatening drawback in any respect.

These dangers should not be ignored, and it is sensible for buyers to regulate them. That being stated, I imagine that the potential rewards outweigh the dangers — when a high-quality progress firm is on sale and trades at an enormous low cost to its historic valuation norm and to the broad market, it is sensible to be grasping.

[ad_2]

Source link