[ad_1]

bymuratdeniz

Townsquare Media (NYSE:TSQ) is an “previous media” inventory providing the interesting mixture of a low valuation, excessive dividend yield, and far stronger long-term prospects than it appears on the floor.

That’s, at present costs, TSQ inventory sports activities a ahead dividend yield of seven.32%. The inventory additionally trades at a reduced valuation relative to its underlying belongings. To prime all of it off, whereas recognized primarily as a radio broadcasting firm, Townsquare’s essential enterprise is now digital, not terrestrial radio.

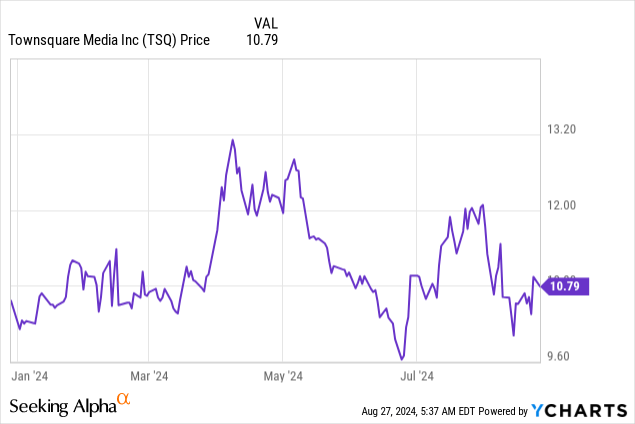

Admittedly, that is to not say that Townsquare is an ideal, problem-free enterprise. There is a good cause why TSQ inventory, after a robust run between late 2023 and early 2024, has delivered sideways worth efficiency in newer months.

Nevertheless, contemplating each company-specific and macro components, it’s possible you’ll need to take into account it one more stable purchase amongst undervalued microcap shares. Here is why.

Townsquare Media Inventory: Background and Current Efficiency

Headquartered in Buy, New York, Townsquare Media consists of three essential enterprise items:

Townsquare Interactive (a digital advertising and marketing companies supplier). Townsquare IGNITE (a programmatic promoting expertise platform operator). Townsquare Media (Townsquare’s portfolio of 349 native radio stations, in addition to its portfolio of digital media properties).

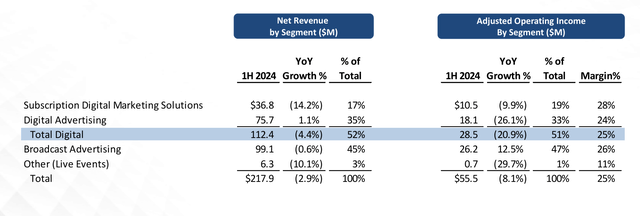

As talked about above, Interactive and IGNITE present are each bigger contributors to the highest and backside line than the corporate media properties. In accordance with Townsquare’s newest investor presentation, through the first half of 2024, the digital segments made up 52% and 51% of the corporate’s total income and adjusted working revenue, respectively.

Digital, not terrestrial radio, now makes up a majority of Townsquare Media’s (TSQ) income and working revenue (Townsquare Media Investor Presentation, August 2024)

That mentioned, whereas digital income has grown considerably because the mid-2010s, extra just lately the digital phase has additionally contended with declining income. Final quarter, as an example, Townsquare Interactive’s income declined 14.2% in comparison with the prior 12 months’s quarter. IGNITE reported year-over-year income development of simply 1.1%.

With this, once more, it is not shocking that buyers have taken a extra blended stance on TSQ inventory. As seen within the chart under, shares made a robust transfer increased through the early spring, however current working outcomes have weighed on efficiency.

Nonetheless, the current droop with Townsquare’s digital phase may show to be short-lived. A minimum of, when one compares Q2 outcomes to that of Q1, and takes under consideration the prospect of macro challenges like excessive inflation and excessive rates of interest easing within the quarters forward.

Undervalued In comparison with Friends, With a Path to Bridge the Hole

Though Townsquare Media final quarter reported year-over-year declines in total income and adjusted working revenue, it is essential to notice that, on a sequential, or quarter-over-quarter foundation, Townsquare’s working efficiency improved throughout Q2 2024.

As mentioned within the firm’s Q2 earnings press launch, the corporate’s Interactive phase is rising once more. Townsquare’s administration did make some slight changes to steerage, but it surely’s kind of the place it was when the corporate final up to date it.

Within the Q1 2024 earnings launch, Townsquare guided for full-year 2024 income of between $440 million and $460 million, and adjusted EBITDA of between $100 million and $110 million. Now, steerage requires income of between $440 million and $455 million, and adjusted EBITDA of between $100 million and $105 million. Assembly this steerage could also be inside attain, as macro circumstances proceed to normalize.

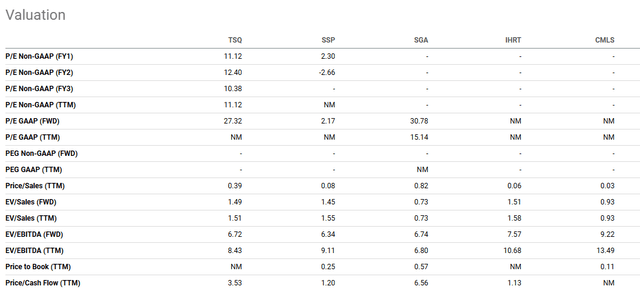

Talking of EBITDA, the aforementioned steerage means that TSQ inventory is undervalued. At present costs, shares commerce at a ahead EV-to-EBITDA ratio of between 6.5 and 6.7 (primarily based on Townsquare’s enterprise worth of round $677.2 million).

Whereas this valuation is in keeping with the ahead EBITDA a number of of one other micro-cap radio inventory, Saga Communications (SGA), this represents a premium to different radio shares, akin to iHeartMedia (IHRT) and Cumulus Media (CMLS).

On a ahead EV/EBITDA foundation, TSQ inventory trades at a reduction to most of its friends (In search of Alpha TSQ inventory key stats comparability)

Even when we had been to worth TSQ at an EBITDA a number of on par with IHRT relatively than the extra richly priced CMLS, utilizing the low finish of forecasted 2024 EBITDA, Townsquare’s true enterprise worth could also be nearer to round $750 million to $760 million. Subtracting $536.6 million in complete debt, and including again $28.5 million in money, brings us to a web valuation of round $251.9 million, or $16.36 per share.

For now, it might show difficult for shares to bridge this valuation hole. Impairment prices in current quarters have masked the corporate’s profitability. Nevertheless, given sell-side consensus calling for TSQ to report annual GAAP earnings of $1.01 per share in 2025, fairly quickly market members may turn into extra conscious of the corporate’s underlying worth, and re-rate the inventory accordingly.

Further Upside Might Even be Inside Attain

Even higher than the prospect of this inventory climbing again as much as costs simply over 50% above current worth ranges, is the truth that there could also be even larger upside potential with TSQ inventory.

It might take time, however within the years forward, the corporate’s shareholder-friendly method may unlock vital worth. Apart from paying out a big quarterly dividend to buyers, the corporate has, and intends to proceed to, use its free money stream to repurchase shares. In simply the final two quarters alone, Townsquare Media has decreased its share rely by 7.23%, from 16.6 million to fifteen.4 million.

As Boyar Analysis, which can also be bullish on TSQ because of its low valuation and aggressive return-of-capital efforts, famous in its March 2023 write-up on the inventory, Townsquare can also be utilizing free money stream to pare down debt. Over a multi-year time-frame, this deleveraging, coupled with the decreased share rely, may present an extra enhance to long-term upside.

In Boyar’s view, these components, plus larger consciousness by the market of TSQ’s digital transformation, may finally result in the inventory buying and selling for as a lot as $25 per share. I would not essentially purchase TSQ with the expectation that it will definitely hits $25 per share, however a transfer to $15-$20 per share could possibly be inside attain if extra catalysts emerge.

Particularly, one thing main akin to an asset sale, or an outright sale of the corporate. Given how a lot Townsquare IGNITE is tied into the legacy radio enterprise, it is arduous to see this phase being break up off or offered off. Nevertheless, Townsquare Interactive could also be a salable enterprise unit.

Per the investor presentation, 58% of its total income comes from subscribers outdoors markets by which Townsquare owns radio stations. Therefore, promoting it might not have a considerable influence on the efficiency of the remainder of the corporate.

Based mostly on the above-mentioned phase knowledge, Townsquare Interactive has an annual EBITDA of round $21 million. Moreover, this phase could also be worthy of a better EBITDA a number of.

Thryv Holdings (THRY) is a publicly-traded firm additionally working within the small-to-medium sized enterprise (SMB) cloud-based advertising and marketing options enterprise. Though THRY at present trades at the same ahead EV/EBITDA ratio as TSQ, an organization like Thryv could also be prepared to pay up for Townsquare Interactive, given potential development and price synergies.

As for the prospects of TSQ being acquired outright, quite a few strategic and monetary consumers could also be , given the worth proposition, and the potential with Townsquare’s digital belongings.

Who is aware of, perhaps Entravision (EVC), one other “old style” media firm that has made a pivot in direction of digital promoting/media that I’ve written about just lately, may make for a stable merger companion.

Dangers to Contemplate

Past the apparent potential macro threat (“tender touchdown” fails to happen, digital and radio promoting markets stay beneath stress) that might influence the bull case. An sudden worsening of working efficiency may additionally severely have an effect on the inventory in one other means.

Worsening outcomes may name into query the sustainability of TSQ’s excessive dividend. Chances are high, a full-on dividend reduce or suspension would seemingly severely have an effect on the inventory worth.

As Boyar identified in its evaluation, whereas seemingly manageable, Townsquare is high-levered, and its excellent debt comes due in 2026. The corporate does plan to refinance subsequent 12 months, however a number of potential components, like worsening efficiency, an sudden financial downturn, and even the potential for rates of interest to not come down as a lot as at present anticipated, might re-heighten debt-related issues about TSQ.

Atop these extra explicitly financial-related dangers, there’s one other issue that will or might not have an effect on future efficiency. Townsquare Media’s co-founders, Government Chairman Steven Value, and CFO Stuart Rosenstein, management 98.9% of TSQ’s excellent Class B super-voting shares.

Whereas these super-voting shares don’t give them majority voting management, and super-voting shares are par for the course with broadcasting shares, this issue may restrict the probabilities a shareholder activist emerges to assist velocity up the value-unlocking course of.

Nonetheless, given the dividend and buyback insurance policies, plus the truth that Townsquare hasn’t engaged in “empire-building,” or expensive, questionable acquisitions, the truth that TSQ’s founders stay on the helm is not essentially one thing that might get in the best way of the bull case enjoying out.

Backside Line on TSQ Inventory

It is seemingly going to take a while, however within the years forward, TSQ inventory might finally bridge the valuation hole. Strategic options like an asset sale or buyout may get it there. So, too, may slow-and-steady strikes, like the corporate’s return-of-capital and debt discount efforts.

Admittedly, TSQ was a fair stronger deep worth alternative late final 12 months when it traded for sub-$10 per share costs. Nevertheless, even at present ranges, and even after Boyar, together with different analysts and commentators, have made the market considerably conscious of the worth alternative right here, it is not too late to purchase.

[ad_2]

Source link