[ad_1]

andresr

Introduction

In continuation with our protection of Frontdoor (NASDAQ:FTDR), we had ascribed a ‘Sturdy Purchase’ score on the again of its sturdy model resonance, buyer stickiness driving up its retention numbers and relative undervaluation. With the inventory reaching its goal value since the publication, we’d revisit the thesis following its latest outcomes.

Funding Thesis

FTDR has been the chief in residence service plan enterprise, effectively positioned to ship sustained progress leveraging its vital scale and community. The corporate has overwhelmed consensus estimates since a number of quarters and have delivered sturdy earnings pushed by its pricing initiatives and operational effectivity. In its latest quarter, the corporate delivered a report 56% gross margin and additional raised its full 12 months EBITDA steering by ~7% to $390 mn (at mid-point) from $365 mn beforehand. Its versatile steadiness sheet with low leverage and up to date foray into new residence warranties enterprise via its 2-10 acquisition bodes effectively for the corporate’s future. Given its sturdy operational resiliency, strategic synergies and relative undervaluation, we reiterate our Purchase score with a goal value of $60.

One other Sturdy Quarter

FTDR posted one other sturdy quarter with income progress of 4% YoY to $542 mn, topping the estimates and above its quarterly information of $530 – $540 mn. This was largely pushed by pricing affect, up 7% YoY, partially offset by quantity decline of three% over the prior interval. Renewals which contributes ~80% of the overall income jumped 6% YoY pushed by increased common costs partially offset by declining volumes. The true property and direct-to-consumer segments proceed to face vital headwinds within the aftermath of a turmoil in the actual property market, with revenues down 14% for every section. Different income jumped 46% YoY to $35 mn primarily because of sturdy HVAC gross sales on the again of its continued offtake of its initiative launched final 12 months.

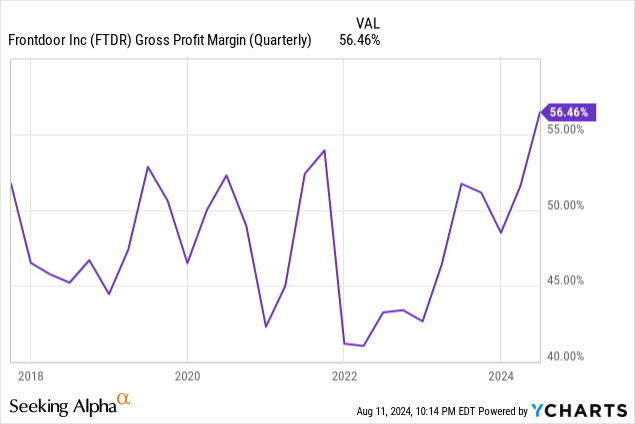

Gross margins expanded 470 bps YoY to a report 56%, its highest ever quarterly gross margin because it grew to become public in 2018. This was on the again of 1) decrease than anticipated HVAC service requests regardless of a comparatively cool climate 2) course of enhancements leveraging buying energy for suppliers resulting in a report 85% utilization of its most popular service community and three) claims price adjustment from prior intervals

Nevertheless, this quarter or the primary half (which noticed gross margin of 54%) is an anomaly primarily because of decrease than anticipated enhancements on YoY foundation on pricing affect as a consequence of increased base together with increased anticipated service name requests as that remained below-average in H1 2024. Adjusted EBITDA jumped 31% YoY with margins increasing by 570 bps YoY pushed by gross margin enlargement together with SG&A leverage on the again of gross sales optimization. Adj. EPS jumped 47% YoY to $1.27 beating estimates pegged at $1.00 on the again of sturdy operational efficiency and share repurchases.

Stability sheet place continues to be sturdy as its sturdy money producing potential permits them to decrease its debt load. Internet Debt to Trailing 12M EBITDA has fallen from 1.5x to 0.85x amidst the corporate’s deal with deleverage amidst present robust macroeconomic situations. It additionally introduced a brand new 3-year share repurchase plan value a large $650 mn whereas FTDR having already purchased again $83 mn on a YTD foundation.

Future Outlook

FTDR maintained its 2024 income steering of $1.81 – $1.84 bn, albeit barely altering the income contribution from the channels. It elevated its different revenue from $100 mn to $110 mn pushed by continued sturdy efficiency of HVAC gross sales whereas barely tweaking its actual property progress outlook down 15% from down 15 – 20% beforehand. DTC revenues is anticipated to be down 15% from down 10% beforehand.

Difficult Actual Property Market

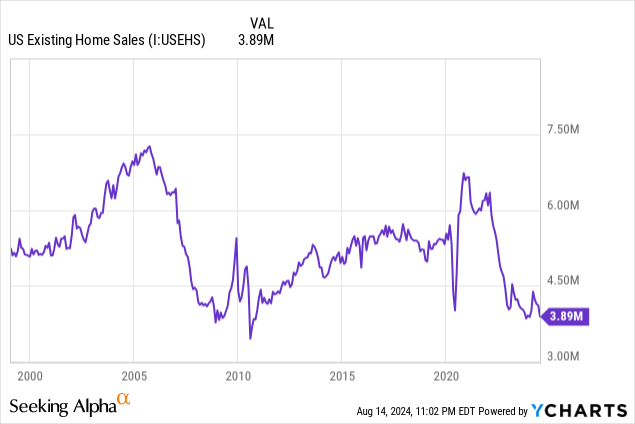

US Present residence gross sales has been down with Actual Property Business dealing with recessionary pressures. This comes amidst the report rate of interest will increase by the US Fed and extra so in direction of the anticipated fee minimize which has not but materialized prolongs the ache for the business.

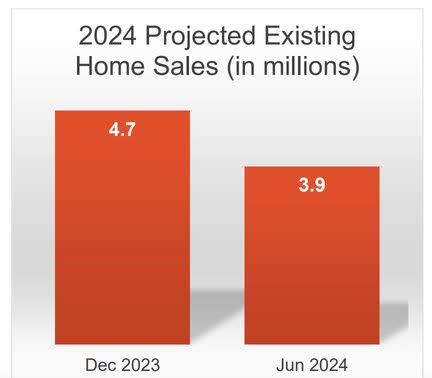

In consequence, home costs proceed to stay elevated with stock being sluggish, additional placing strain on the housing market. The expectation for 2024 present residence gross sales has additional lowered from 4.7M initially of the 12 months to three.9M at the moment, demonstrating the numerous turmoil available in the market.

NAR, Firm presentation

Nevertheless, the corporate has been capable of witness inexperienced shoots, with Q2 RE revenues down 14% (increased than 15 – 20% decline anticipated and in addition increased than ~20% decline noticed in Q1). With the flip in actual property business as demand stabilizes and worst to be probably behind together with optimistic developments, slight improve of income is encouraging and seems achievable given its sturdy foothold.

Steerage Raised

FTDR has raised its steering for gross margins to be above 51% from 50% beforehand, pushed by its strongest H1 efficiency since itemizing. The gross margins are anticipated to be down in H2 because it expects increased variety of service name requests, modest value affect as a consequence of base impact together with declare price inflation which might put downward strain on the margins. It additionally raised EBITDA information from $360-$370 mn to $385-$395 mn on the again of gross margin uplift. We imagine this might probably be conservative because the inexperienced shoots in actual property together with community optimization and buyer initiatives may probably level in direction of a better margin profile.

Positives from 2-10 Acquisition

FTDR introduced acquisition of 2-10 Dwelling Patrons Guarantee for a consideration of $585 mn. 2-10 is a number one supplier of latest residence structural guarantee safety plans overlaying one in 5 new residence builds within the US, in addition to conventional residence guarantee plans. Frontdoor doesn’t provide new residence plans, and thus 2-10 brings an adjoining line of enterprise complementary to Frontdoor’s warranties, which gives protection to present residence home equipment and techniques. We imagine this gives a greater diversification into new residence gross sales with the acquisition being margin accretive (EBITDA margin of 2-10 was 21.7% in 2023 in comparison with FTDR’s 19.4% on standalone foundation) whereas additionally offering additional room for margin enchancment as a consequence of synergistic advantages. The transaction was carried out at ~13.5x EV/ EBITDA which is at a premium to FTDR’s buying and selling a number of, with the corporate probably leaning in direction of debt to finance the transaction. We’re optimistic on the 2-10 Acquisition, underscoring administration’s dedication to drive progress via natural (having raised the margin profile over the previous a number of quarters) and inorganic routes.

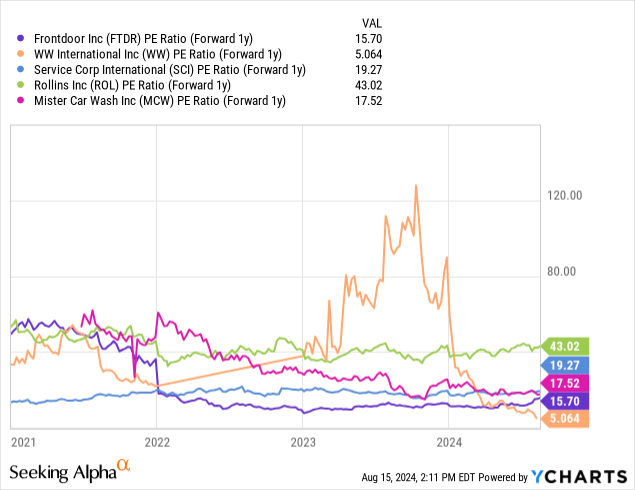

Valuation

Given FTDR doesn’t have any direct listed peer inside residence repairs section, we proceed to match it with service-oriented consumer-facing companies. Regardless of the latest run-up, the corporate continues to commerce at 15.7x, at a reduction to its friends in addition to to its long-term common of ~22.8x. We imagine the muted actual property outlook continues to weigh on the corporate’s inventory, nonetheless, its operational resilience, margin profile and shopper stickiness as demonstrated by sturdy retention numbers warrants a rerating. As well as, the closing of the 2-10 acquisition, bringing in operational synergies, in addition to cross-selling skills, would additional result in an uplift in its margin profile. We worth the inventory at 20x, in step with its long-term common, and lift our goal value to $60. Reiterate Purchase.

Dangers to Score

Dangers to score embody

1) Fed’s incapability to chop rates of interest for a chronic period of time would have an hostile affect on the actual property market and would result in additional ache within the business.

2) Gross margins have witnessed sturdy outperformance on the again of pricing motion and decrease service requests. The gross margins may face downward pressures as service requests leap up and pricing profit wanes.

3) HVAC gross sales have jumped considerably up to now couple of quarters, with the corporate anticipating an incremental $10M in revenues for the 12 months in comparison with their earlier steering. If the gross sales don’t materialize, that will have a unfavourable affect on the topline.

Remaining Ideas

FTDR has carried out exceptionally effectively, beating estimates for the eighth straight quarter amidst difficult macroeconomic situations. We imagine its continued outperformance pushed by its operational effectivity and model resilience backed by a strong steadiness sheet and administration functionality to drive progress permits them to generate sturdy money flows. As well as, its relative undervaluation warrants a rerating, and we reiterate our Purchase score, ascribing a goal value of $60.

[ad_2]

Source link