[ad_1]

SPX refers back to the S&P 500 Index.

Consider an index as a quantity.

A quantity tells you the worth of one thing. On this case, it tells you the worth of the S&P.

The extra generally identified abbreviation “S&P” comes from the monetary companies firm named Customary & Poor’s Company.

Contents

The S&P 500 is commonly used as a benchmark for the general U.S. inventory market.

It contains 500 of the most important publicly traded corporations in the US chosen from numerous sectors, together with expertise, healthcare, financials, shopper discretionary, and so on.

The index is weighted by the market capitalization of its constituent corporations.

Which means that bigger corporations with bigger market capitalization can have a higher impression on the index’s efficiency than smaller corporations.

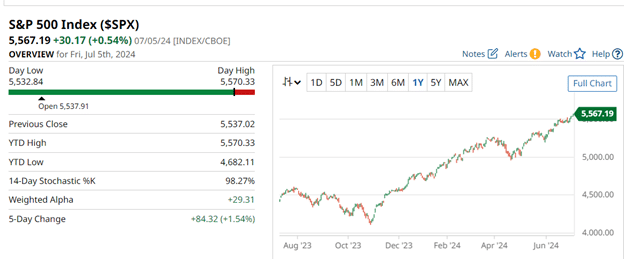

In case you sort within the image “SPX” into your charting software program, you will note the graphical illustration of the S&P 500 index:

It is a screenshot of barchart.com displaying the SPX worth on the shut of Friday, July fifth, 2024. SPX is at 5567.19.

This isn’t a greenback quantity.

It’s only a quantity.

As a result of an index is a quantity and never shares of an organization, you cannot purchase shares of the SPX.

Nonetheless, numerous monetary devices are primarily based on this quantity, together with exchange-traded funds, choices contracts, and futures contracts.

SPY is the ticker image representing the exchange-traded fund (ETF) referred to as the “S&P 500 Depository Receipts” or “SPDR”.

When talking, folks simply say “spiders” for brief.

The SPY ETF is predicated on the S&P index.

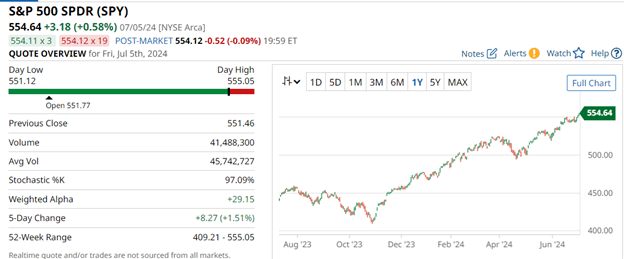

In case you sort the image SPY right into a charting software program:

You will notice that the SPY chart seems the identical because the SPX chart.

We are saying that the SPY tracks the S&P index.

It’s a by-product product of the S&P index.

The worth of the SPY, as proven, is $554.64.

This quantity does characterize a greenback quantity.

You should buy shares of an ETF similar to shopping for shares of inventory in an organization.

For the time being, it prices $554.64 for one share of SPY.

Word that the value of SPY is about one-tenth the dimensions of the SPX; this can turn into essential later.

Whereas we can’t purchase shares of the SPX, we will purchase and promote name and put choices on the SPX like we will purchase and promote choices on SPY.

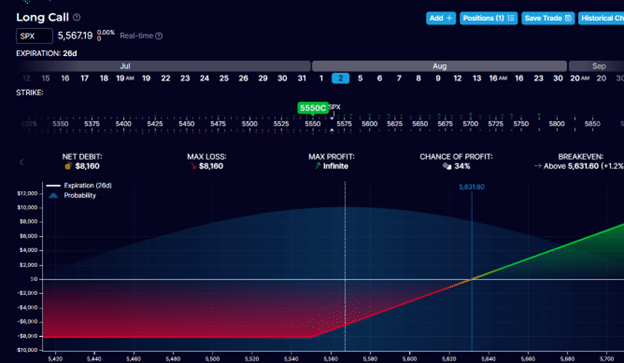

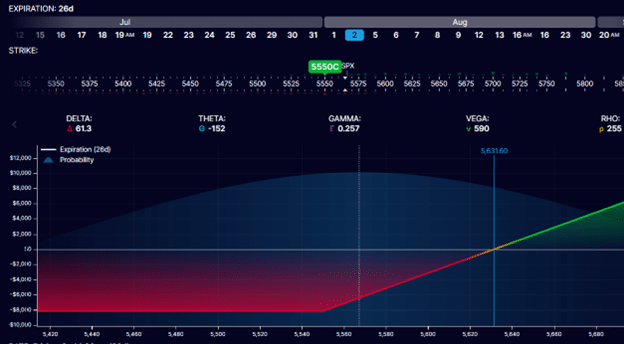

Shopping for one contract of a name on SPX that’s a few month to expiration would price hundreds of {dollars}.

Right here, OptionStrat.com exhibits the value of an extended name on SPX with a strike worth of $5550 (a near-the-money strike).

Free Coated Name Course

The value is $8160 as of shut on July fifth, 2024, with the choice expiring on August 2nd, 2024.

The danger graph exhibits that the choice worth will improve if the value of SPX will increase.

So, traders speculating on the upward motion of SPX would possibly buy such an possibility contract.

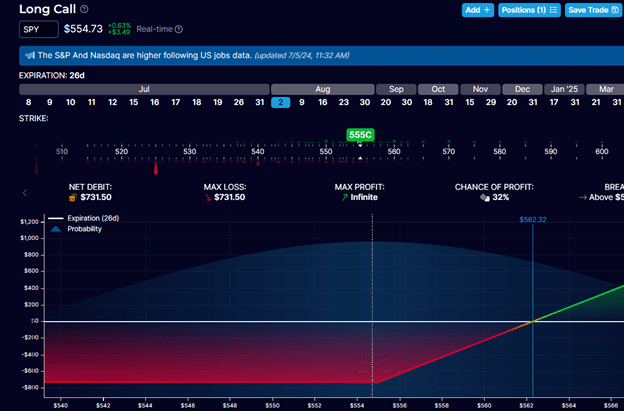

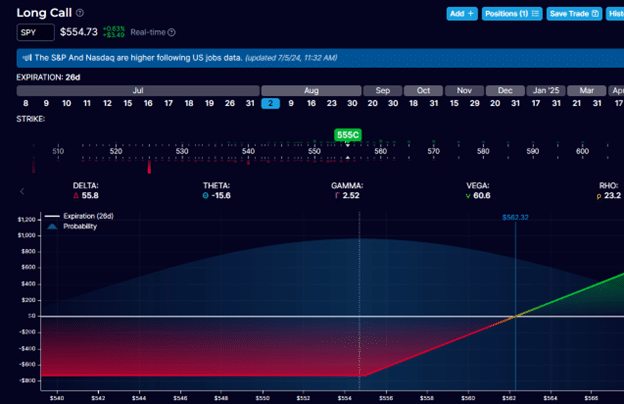

If the value tag of $8160 is an excessive amount of, then some traders would possibly buy the name possibility on SPY as an alternative.

The danger graph seems the identical.

However the worth of the $555 strike name possibility on SPY is just $731.50 (about one-tenth as a lot) – for a similar August 2nd expiry.

Delta is the primary Greek that one would possibly study when buying and selling choices.

It’s only a monetary metric that tells you the way the choice’s worth would possibly change as the value of the underlying asset modifications.

So, a delta of 0.75 signifies that the worth of the SPY possibility will increase by $0.75 if the SPY worth strikes $1 up in worth.

OptionStrat exhibits that our instance lengthy name in SPY has a delta of 55.8.

Different choices embrace analytical software program, which might additionally present this, however they might calculate these numbers barely in another way (so don’t anticipate them to point out actual numbers).

This means that if the SPY worth goes up one greenback, the decision possibility worth ought to improve by $55.8 if all different components stay the identical.

The choice worth is affected by many different components moreover the value of SPY.

The delta of our instance SPX possibility can be about the identical at 61 delta:

Which means if SPX goes up by 1, the choice’s worth would improve by $61.

Although the delta is about the identical, the investor with one name possibility on SPX would have about ten occasions the market publicity because the investor with one name possibility on SPY.

One other method to take a look at it’s that one Delta in SPY is like proudly owning one share of SPY.

One Delta in SPX is like proudly owning one share of SPX.

Since SPX is ten occasions the dimensions of SPY, one delta in SPX is ten occasions the publicity as one delta in SPY.

If SPX goes up 10 factors (from 5550 to 5560), SPY would go up 1 level (from 555 to 556).

The SPX possibility investor would make about $610. And the SPY possibility investor would make $56.

The purpose I’m making an attempt to make is that the delta doesn’t characterize an investor’s publicity to the market.

The delta and the underlying measurement characterize the investor’s publicity to the market.

That is the place Delta {Dollars} come in useful.

Delta {Dollars} is the delta multiplied by the value of the underlying.

Within the instance of the SPY investor, the Delta {Dollars} is 55.8 x 555 = $30,969

The SPX investor’s Delta {Dollars} is 61.3 x 5550 = $340,215.

SPX is an index.

SPY is an ETF.

As such, you cannot buy shares of SPX.

However you possibly can SPY.

Each of them have choices, and each are very liquid.

SPY has tighter bid/ask spreads and is alleged to be essentially the most liquid of all.

At possibility expiration, SPX is cash-settled.

SPY has the potential of being assigned shares.

SPX is ten occasions bigger than the SPY.

Contemplate the Greeks and the Delta {Dollars} when deciding whether or not to purchase or promote choices on SPX or SPY.

We hope you loved this text on the distinction between SPX and SPY.

When you’ve got any questions, please ship an e mail or depart a remark under.

Commerce secure!

Disclaimer: The data above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who aren’t acquainted with alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link