[ad_1]

hapabapa

Telco companies have traditionally been seen as a sexy revenue car for dividend-oriented returns, usually in comparison with bond-like investments.

At the same time as the key gamers’ top-line progress usually peaked, with analysts now anticipating sluggish 2% to 4% annual progress, the businesses nonetheless provide enticing funding profiles, notably with their secure, excessive single-digit dividend yields.

Value Improvement (Searching for Alpha)

Regardless of that, following the Fed’s 525 foundation factors fee hikes to fight inflation, buyers turned bitter as different funding alternate options, akin to treasuries or high-yield money financial savings accounts, turned as soon as once more viable alternate options with much less danger for yield-hungry buyers after a decade of low rates of interest.

Moreover, telcos require important CAPEX spending within the infrastructure to maintain up with new know-how, e.g., the swap from 4G to 5G, piling up debt, which acts as an anchor on future progress and profitability, notably if the debt is refinanced at curiosity excessive charges.

That is to say, the economic system strikes in cycles, with rates of interest rising and falling, making dividend-paying firms extra enticing at sure instances and fewer enticing at different instances.

Because the US economic system is slowing down, with the unemployment fee rising from 4.1% to 4.3%, maybe greater than some economists wish to see, JPMorgan and Citigroup analysts expect to see the next fee cuts from the Fed this yr:

September: 50 foundation factors lower. November: 50 foundation factors lower. December: 25 foundation factors lower.

Maybe too aggressive expectations, in the event you ask me, but as charges fall, bonds, treasuries, and high-yield money accounts will grow to be much less enticing, and high-quality, high-yielding firms like Verizon Communications Inc. (NYSE:VZ) ought to profit because of easy provide/demand dynamics.

To make it even higher, Verizon shares commerce round $40. That is solely 8.8x its FY24 ahead earnings, and the corporate at the moment provides a well-covered 6.6% dividend yield.

Since my final protection, the overall return has solely been 4.1%. But, it’s nonetheless beating the market with considerably much less danger, and anticipating double-digit returns over the subsequent twelve months is totally possible.

Final Protection (Searching for Alpha)

Q2 2024 Earnings

Following Verizon’s Q2 earnings report launch, the inventory plummeted by 6% on the day.

Let’s take a look on the numbers and what buyers didn’t like.

Verizon reported marginal topline progress of 0.6% YoY, with income reaching $32.8B, lacking analysts’ estimates of $33.04B. Increased pricing helped drive the income progress, whereas income from Enterprise fell from the identical quarter final yr.

But, we see a optimistic progress of two.8% in Adjusted EBITDA, with its margin now at 37.5%, because the cellphone improve cycle plummets, boosting profitability, which I’ll return to later.

The underside line got here at $1.15 EPS, down 5% YoY, matching the consensus and reaffirming the stagnating development of the last few quarters that’s elevating considerations on Wall Avenue.

Through the quarter, buyers weren’t glad with the wi-fi buyer numbers, the pacing of the free money circulation, and the brand new wave of cellphone upgrades probably hitting later this yr pushed by Apple’s (AAPL) anticipated improve super-cycle because of new AI options within the telephones.

From my standpoint, none of those factors are a cause for real concern, and the dip from $42 presents a shopping for alternative for buyers.

Verizon is well-known for decreasing its workforce to optimize prices. In Q2, the corporate introduced it was shedding 1.4% of its workforce, with potential value financial savings hitting the P&L in This fall 2024.

Monetary Abstract (VZ IR)

Verizon’s foremost asset within the {industry} is its broad protection and most intensive buyer base within the US. Due to its scale, Verizon’s profitability outperforms its friends.

At the same time as successful over new prospects would possibly show troublesome at Verizon’s measurement, the wi-fi service income grew 3.5% YoY in Q2, touchdown on the higher finish of administration’s 2% to three.5% vary.

Verizon has misplaced 8K postpaid cellphone prospects this quarter. Nonetheless, with out counting low-cost second cellphone prospects, the loss is nearer to 120K. Administration nonetheless expects to report optimistic buyer progress this yr, considerably higher than the 132K internet loss reported final yr.

One may simply assume that attracting new prospects would come at a value to Verizon, but the corporate’s pricing is definitely wholesome. Income per client account is up 5% up to now this yr, pushed predominantly by way of value will increase.

Whereas administration has guided just for sequential progress in H2, I count on top-line progress for the total yr between 0.5% and a pair of%.

Though income progress was solely 0.6% in Q2, with the discharge of AI-enabled purposes on iPhone 16 later this yr, I’m anticipating accelerating top-line progress in This fall for Verizon and different telcos because the cellphone improve cycle, a ache level of the last few years, reverses.

Nonetheless, the reversal of the cellphone improve cycle is a double-edged sword for telcos. It drives top-line progress however pressures profitability as telcos provide promotions on the brand new gadgets, requiring working capital upfront to fund future receivables.

To place the numbers into perspective, throughout Q2, solely 2.9% of wi-fi prospects upgraded their gadgets, the bottom studying on file.

Working Metrics (VZ IR)

Verizon’s core enterprise is the wi-fi phase, and the corporate stays in a stable place to defend its market share, buying wi-fi spectrum to enhance efficiency and community capability whereas increasing its fiber in key areas.

Analysts expect fairly lackluster progress of round 1%-2% yearly over the subsequent few years, which is honest given Verizon’s measurement and the mature state of the {industry}, competing in opposition to well-established gamers like AT&T and T-Cellular.

If you’re anticipating important progress, you would possibly need to skip one, but Verizon is a good revenue play and potential valuation reversal alternative.

Income Progress Projections (Searching for Alpha)

Verizon’s steady funding in wi-fi and fixed-line know-how, mixed with its community high quality and scale, positions it very nicely to retain industry-leading profitability and proceed delivering nicely above the {industry}’s common ROE (5Y common at 24.5%) as the corporate holds roughly 40% of the postpaid market, nicely forward of AT&T and T-Cellular.

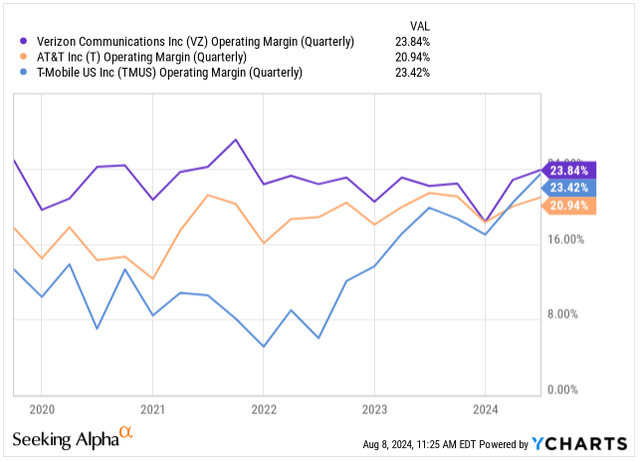

Working Margin (Searching for Alpha)

At the same time as I count on T-Cellular and AT&T to maintain investing in their very own networks as nicely, ultimately benefiting from scale, all three firms are set to draw related numbers of consumers sooner or later with out jeopardizing earnings by underpricing the choices of the opponents.

Debt Load & Dividends

Telco is an inherently capital-intensive {industry}, the place operators of the networks have to take care of and construct new infrastructure, requiring important CAPEX spending to retain their market share.

The web monetary debt graph beneath reveals that each one three main telcos have considerably elevated their debt ranges following the investments within the 5G community. In reality, solely a portion of the debt is ever paid again, except for AT&T Inc. (T) decreasing its debt meaningfully load following the spin-off of Warner Media again in 2022.

Then again, we see T-Cellular US (TMUS), the place the debt load remains to be comparatively small, which is able to permit the corporate to develop quicker sooner or later, primarily because it improves its revenue margins.

Internet Monetary Debt (Searching for Alpha)

Debt is not an issue by itself so long as it is financed by way of issued bonds with low coupons or borrowed at low, mounted rates of interest.

Verizon’s Q2 curiosity expense was $1.7B, a rise from $1.3B within the earlier yr. This pressured the EPS considerably however didn’t threaten the enterprise, as Verizon had $2.4B of money on the stability sheet on the finish of the interval.

The corporate’s internet unsecured debt to adjusted EBITDA stood at 2.5x after Verizon decreased its internet debt by $3.4B in H1 in comparison with the earlier yr.

Administration has beforehand flagged that after the online unsecured to adjusted EBITDA falls beneath 2.25x, which I count on to occur by the tip of 2025, the corporate will begin repurchasing its shares as a part of its capital allocation technique. But, I would favor to see a extra aggressive debt reimbursement program to strengthen its stability sheet and supply flexibility throughout future CAPEX cycles.

Talking of dividends, Verizon at the moment provides essentially the most enticing yield amongst its friends:

VZ: Dividend yield of 6.6% T: 5.8% TMUS: 1.4%

The free money circulation throughout H1 hit $8.5B, a rise from $8.0B the earlier yr. The corporate has paid $5.6B in dividends up to now this yr, placing the payout ratio at a really comfy 66%.

Money Movement Abstract (VZ IR)

Though Verizon’s dividend progress has been fairly lackluster within the final 5 years, rising in whole by solely 8.1%, hardly offsetting double-digit inflation, the comfy free money circulation payout ratio, coupled with potential share buybacks sooner or later, which is able to end in fewer whole dividends paid, places the corporate in a wholesome place to develop its dividends as soon as once more within the vary of three% to five% yearly.

Dividend Per Share (Searching for Alpha)

Filth Low-cost Valuation

As a result of unfavourable sentiment in the direction of closely leveraged companies throughout a interval of elevated rates of interest and with risk-free alternate options to earn yield exterior of equities, Verizon has discovered itself in a downward spiral, with shares down 35% from its all-time excessive of $62, reached again in 2019.

The lackluster efficiency took a big toll on its valuation, with the shares now buying and selling at a P/E of 8.8x its FY24 earnings.

Intervals like these are those the place shopping for shares of Verizon can present buyers with double-digit returns because the inventory valuation reverses probably in the direction of its 15Y P/E common of 13x.

All whereas being paid a quarterly dividend of $0.665 per share whereas ready.

To be completely clear, I’d not be eager about investing in Verizon if the inventory had been buying and selling close to its historic valuation stage, pricing it at round $60 in FY24 earnings.

Since I don’t depend on dividend distributions, being paid 6.6% on high of a minor 2%-3% EPS progress yearly just isn’t my cup of tea. I’m at all times on the lookout for alpha over the market’s efficiency; in any other case, I’d purchase the market as a complete.

For income-oriented buyers, maybe being paid a 6.6% dividend yield is sufficient, however that is not my case.

Nonetheless, Verizon is a top quality enterprise that’s nonetheless anticipated to ship some progress, and the valuation reversal is totally possible, particularly because the attractiveness of its dividend will increase as soon as the Fed cuts charges:

2024: EPS of $4.58E, YoY progress of -3% 2025: EPS of $4.71E, YoY progress of three% 2026: EPS of $4.87E, YoY progress of three%

I realized by way of my funding profession that purchasing stalwarts like Verizon or dollar-cost-averaging into their inventory just isn’t value it if the inventory is absolutely priced.

As an alternative, shopping for the inventory at a deep low cost, so long as the basics don’t deteriorate, can generate important alpha and outperformance whereas sustaining an inexpensive margin of security, notably in at the moment’s dear markets.

Buyers shopping for the shares at the moment can count on as much as 25% whole annual returns if the valuation reverses, mixed with the enticing dividend.

VZ Valuation (Quick Graphs)

Takeaway

In abstract, telcos weren’t enticing investments, even for income-oriented buyers, following the 525 foundation level Fed rate of interest hikes as different risk-free alternate options turned extra viable.

JPMorgan and Citigroup analysts at the moment are anticipating as a lot as 125 foundation factors of fee cuts this yr to strengthen the weakening economic system, which ought to drive a significant rotation towards high quality dividend-paying shares.

With its 6.6% dividend yield, Verizon is about to be one of many main beneficiaries of the good rotation and, because of its essentially robust enterprise, which retains delivering even because the {industry} reaches its mature section.

The valuation is grime low cost, with sufficient margin of security, probably setting buyers for as much as 25% annual whole returns over the subsequent three years.

[ad_2]

Source link