[ad_1]

AM-C

Whereas United Parcel Service, Inc. (UPS) and FedEx Company (FDX) normally get much more consideration, competitor DHL Group (OTCPK:DPSTF), which modified its identify to Deutsche Put up AG a few 12 months in the past, is quite pushed to the background, though all three rivals are producing kind of the same quantity of income yearly.

I coated DHL Group the final time in January 2024 and was cautiously optimistic, however nonetheless rated the inventory as a “Maintain”. In my final article, I wrote:

We might make the argument that DHL Group is pretty valued at this level and even barely undervalued. Nonetheless, the situation above does not likely consider the chance of one other main recession or melancholy. And as I lean quite in direction of the aspect of warning and as we do not know what’s going to occur, I’ll charge the inventory quite as a “Maintain”

Within the meantime, the inventory declined from nearly €45 (the worth it was buying and selling for when my final article was printed) to barely under €40 proper now. It is a decline of 11% and isn’t solely an enormous underperformance of the S&P 500 (SPY), which gained about 15% in the identical timeframe, however appears additionally sufficient to take one other have a look at DHL Group and ask the query if it’s a good funding now.

Newest Outcomes

When taking a look at an organization and inventory and making an attempt to evaluate if it’s a good funding or not, I normally begin with the final quarterly outcomes, which inform us a bit bit about how the enterprise is performing. Within the case of DHL Group, we see the same image as within the final fiscal 12 months, with the highest and backside line quite declining.

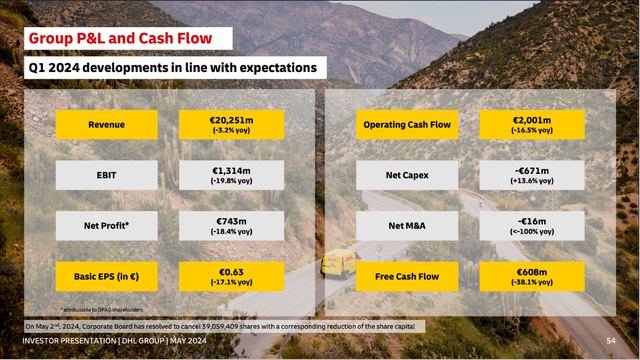

Within the first quarter of fiscal 2024, DHL Group generated €20,251 million in income and in comparison with €20,918 million in income, it is a decline of three.2% year-over-year. Revenue from working actions (EBIT) additionally declined from €1,638 million in the identical quarter final 12 months to €1,314 million this quarter – leading to a 19.8% year-over-year decline. And at last, diluted earnings per share additionally declined 17.1% year-over-year from €0.76 in Q1/23 to €0.63 in Q1/24.

DHL Group Roadshow Presentation Might 2024

And whereas the revenue assertion is characterised by double-digit declines for many gadgets, the money circulation assertion is exhibiting the same image. In our case, it’s particularly the free money circulation, which declined from €983 million in Q1/23 to €608 million in Q1/24 – leading to a 38.1% year-over-year decline.

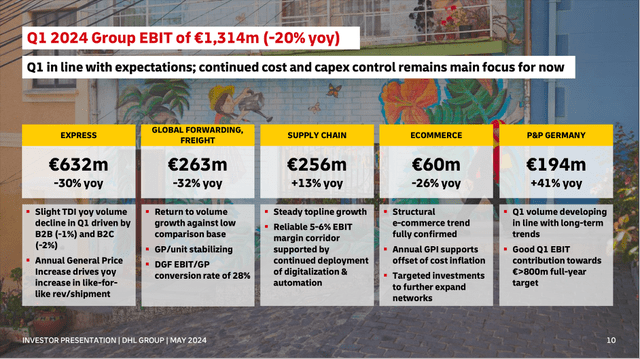

We are able to additionally have a look at the totally different segments and see not all of the 5 totally different segments contributing to declining income and/or declining EBIT. An important section for DHL Group is the Specific section, which generated a complete income of €6,006 million within the first quarter of fiscal 2024. Not solely is the section answerable for nearly 30% of whole income, it generated €632 million in EBIT and was subsequently answerable for 48% of whole EBIT. Nonetheless, the section needed to report declining income (4.4% YoY decline) in addition to declining EBIT (30.0% YoY decline).

Except for the Specific section, DHL Group has three segments, producing between €4 billion and €4.7 billion within the first quarter. This consists of the segments Freight, which generated €4,617 million in income, Provide Chain, which generated €4,333 million in income, in addition to Put up & Parcel Germany, which generated €4,266 million in income. And whereas Provide Chain (13% year-over-year development to €256 million in EBIT) in addition to P&P Germany (41% year-over-year development to €194 million) might develop, the Freight section needed to report declining EBIT (32% YoY decline to €263 million).

DHL Group Roadshow Presentation Might 2024

The final section, which is rising at a quite excessive tempo, is eCommerce. In Q1/24, this section generated €1,633 million in income, leading to 8.5% year-over-year development. However whereas the highest line was growing, EBIT declined 26% year-over-year to €60 million.

Return On The Path Of Development?

Though DHL Group needed to report declining income and declining EPS in the previous couple of quarters, administration confirmed its steerage for fiscal 2024. EBIT remains to be anticipated to be between €6.0 billion and €6.6 billion – and at the very least €5.7 billion will stem from DHL (together with all segments apart from P&P Germany) and at the very least €0.8 billion in EBIT will stem from Put up & Parcel Germany. Free money circulation for 2024 is anticipated to be round €3.0 billion (in keeping with the corporate’s personal mid-term steerage).

DHL Group Roadshow Presentation Might 2024

DHL Group additionally points a short-to-mid-term steerage for the fiscal years 2024 till 2026. In whole, the anticipated free money circulation is ranging between €9 billion and €10 billion for these three years cumulated.

DHL Group Roadshow Presentation Might 2024

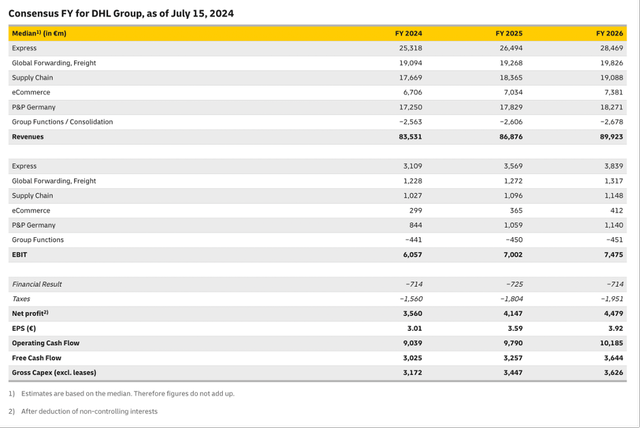

And when taking a look at consensus estimates of analysts, they’re comparable optimistic as administration – or perhaps even a bit extra optimistic. In case of free money circulation, analysts expect quite high-growth charges and the estimates vary on the higher finish of administration’s steerage vary.

DHL Group Investor Relations

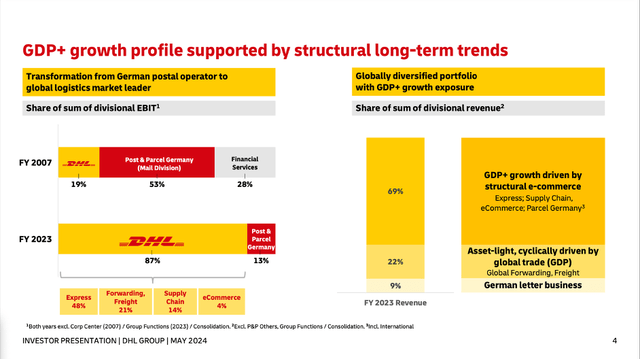

Total, I feel we will count on DHL Group to develop at the very least within the low-to-mid-single digits. When trying on the efficiency within the final ten years, income elevated with a CAGR of 4.03% whereas working revenue elevated with a CAGR of seven.98% and eventually, earnings per share elevated with a CAGR of 6.24%. And in keeping with In search of Alpha, analysts expect income to extend with a CAGR of three.07% within the subsequent 9 years till fiscal 2033. When combining the top-line development with barely enhancing margins and persevering with share buybacks, 5% development definitely appears sensible.

And when taking a look at totally different research for the worldwide logistics and freight market, anticipated development charges vary between 4% CAGR for the freight forwarding market to five.11% CAGR for the freight and logistics market. One other research sees development charges round 4.5% yearly for the years to come back.

International Crash Getting Nearer?

For the long run, I feel we will count on the market to develop with a strong tempo within the low to mid-single digits. Nonetheless, for the following few years the image would possibly look a bit bit totally different and as I’ve defined in my final article about Morningstar, Inc. (MORN), I see the image slowly getting worse and the U.S. financial system is headed for a recession.

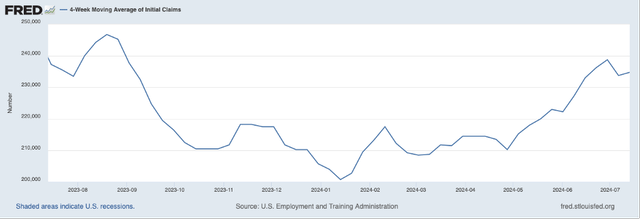

One of many numbers we’re taking a look at are the preliminary claims for unemployment insurance coverage and since January 2024, we see the quantity creeping larger, which might be a warning signal. Nonetheless, we should be very cautious in decoding these numbers as fluctuations are regular and in 2023, we see the same rise and not using a recession occurring, and we’re already seeing the quantity declining once more a bit bit. However, it’s not simply the preliminary claims growing in the previous couple of months, the unemployment charge can be continuously growing from 3.4% in April 2023 to 4.1% in June 2024.

FRED

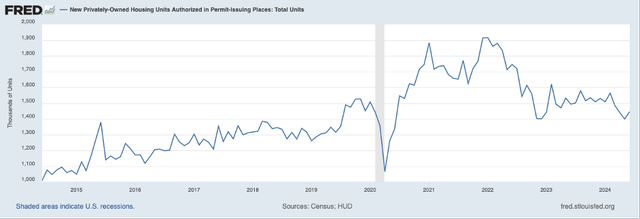

A second metric value mentioning listed here are the brand new privately owned housing models approved in permit-issuing locations. When trying on the housing market, this metric is likely one of the finest early warning indicators, as permits are among the many first steps folks must take when constructing a home. This metric already began declining in 2022 and after declining for one 12 months, it was stabilizing at a decrease stage and remained in a slim hall in 2023 and early 2024. Now, the quantity began declining once more in the previous couple of months; nevertheless, the final reported quantity was a slight enchancment once more.

FRED

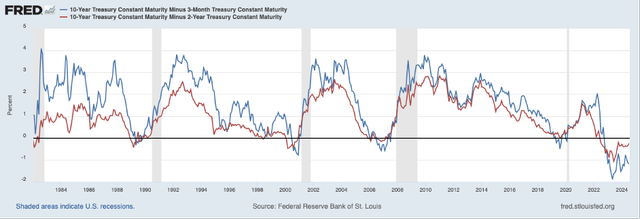

And at last, the yield curve itself can be fascinating. As talked about above, the yield curve is giving us an early warning signal a few potential recession when the yield curve is inverting. Nonetheless, the yield curve isn’t just giving us one sign – we regularly get a second sign earlier than the recession really happens. Not solely does the yield curve invert earlier than the recession happens, the yield curve normally additionally will get again to regular earlier than the financial system enters the recession.

FRED

In my article Why The Yield Curve Is Not Damaged I argued in additional element what I count on within the coming quarters and why I nonetheless suppose we’re headed for a recession regardless of the yield curve being inverted for a very very long time.

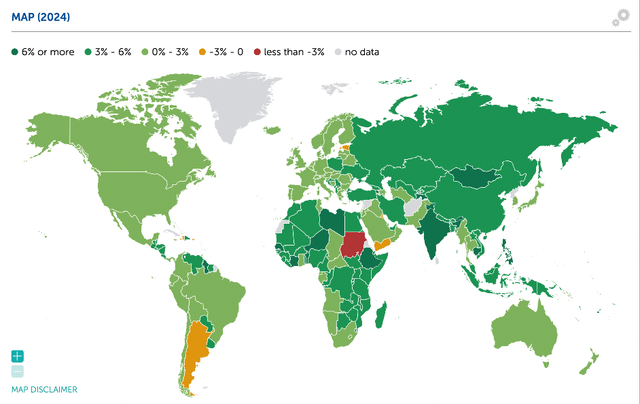

We also needs to level out that we’re principally speaking about america right here, however DHL Group can be working in Europe and has an enormous market share in lots of European nations. Based on the IMF, america will develop GDP nonetheless 2.7% in 2024. Nonetheless, most European nations are anticipated to develop a lot decrease – Germany for instance is anticipated to develop 0.2%, France is anticipated to develop 0.7% and the UK is anticipated to develop 0.5%.

GDP Development Charges Fiscal 2024 (IMF)

And when trying on the final three recessions, we see DHL Group declining steeply in each single one. In 2020, DHL Group additionally declined steeply, however recovered rapidly (much like many different shares) – particularly because it grew to become apparent that DHL Group is perhaps one of many corporations benefiting from the pandemic. Within the different two recessions – Dotcom Bubble crash and Nice Monetary Disaster – the inventory declined extraordinarily steep, and it took years earlier than it recovered. Particularly in the course of the Nice Monetary Disaster, the inventory misplaced 75% of its earlier worth.

Intrinsic Worth Calculation

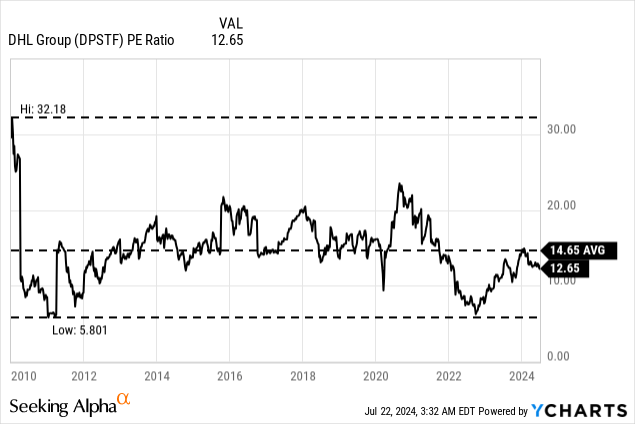

A ultimate step – as at all times – is figuring out an intrinsic worth for a inventory. For starters, we will have a look at the price-earnings ratio. Proper now, DHL Group is buying and selling for 12.6 occasions earnings, which doesn’t appear so costly and is under the common P/E ratio of 14.65 since 2010 (the timeframe for which we’ve got information). Particularly when preserving in thoughts that DHL Group ought to be capable to develop at the very least within the low-to-mid-single digits within the years to come back and the corporate additionally having an financial moat round its enterprise (as defined in a earlier article), the P/E ratio of 12.6 appears quite low-cost. And the extensive financial moat can not stop the enterprise declining throughout recessions, however it would shield DHL Group from shedding market shares to new rivals. After all, DHL Group has to compete with UPS and FedEx, and we even have to observe Amazon (AMZN) if the corporate will be capable to take market shares away from rivals. However as a result of mandatory distribution community, this can be very tough for small corporations to enter the market.

One other manner to take a look at DHL Group and decide an intrinsic worth is by utilizing a reduction money circulation calculation. In such a calculation, we’re utilizing the final reported variety of excellent shares (1,173 million in case of DHL Group) and a ten% low cost charge (as at all times). As foundation for our calculation, we will use €3.0 billion in free money circulation and in my view, we will argue for at the very least 4% development till perpetuity as a practical assumption for DHL Group. When calculating with these assumptions, we get an intrinsic worth of €42.63 for DHL Group, and the inventory could be barely undervalued at this level.

Nonetheless, we will additionally make the case for assumptions being a bit extra optimistic. In my final article, I calculated with 5% development, and I feel assuming 5% development once more isn’t unreasonable. Moreover, we will use the free money circulation assumptions by analysts for the years 2024 till 2026 (see chart above). When calculating with these assumptions, we get an intrinsic worth of €55.99, and the inventory could be clearly undervalued at this level and a “Purchase”.

Conclusion

I feel we will name DHL Group a “Purchase” at this level. The inventory appears to be undervalued and might be a great long-term funding. Nonetheless, we must always not ignore the chance of decrease inventory costs within the subsequent few quarters as I see the chance of a worldwide recession on the horizon and such a situation would clearly have an effect on DHL Group. The enterprise is in some methods depending on the state of the financial system, and in earlier recessions we noticed the inventory declining steeply.

When shopping for the inventory proper now, we must always maintain the inventory for the long run (at the very least ten years) and be ready for inventory value fluctuations within the subsequent few years. Within the meantime, we will acquire dividends and with a present dividend yield of 4.6% for DHL Group, the inventory is definitely fascinating for dividend traders.

On August 01, 2024, Deutsche Put up will report its half-year outcomes for fiscal 2024 and the earnings launch in addition to earnings name will present some details about DHL Group in addition to the financial system. International transport and freight are sometimes among the many first industries to get into hassle when the financial system is in decline and UPS, which reported quarterly outcomes just a few days in the past, which quite disenchanted traders. However, FedEx generated optimism amongst its traders and will beat income in addition to EPS estimates at the very least barely. It stays to be seen what outcomes DHL Group will report on Thursday.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.

[ad_2]

Source link