[ad_1]

JHVEPhoto

ServiceNow, Inc. (NYSE:NOW) launched its Q2 outcomes on July twenty fourth after the market closed, beating the market expectations and elevating the subscription revenues and working margin steering for FY24. I offered my “Robust Purchase” thesis in my earlier protection printed in March 2024, highlighting its future platforms powered by AI. Benefiting from the megatrend of cloud computing and AI coaching/inference, ServiceNow is prone to ship 20%+ income progress within the close to future, pushed by its market growth into mid-office and back-office platforms. I reiterate a “Robust Purchase” ranking with a one-year value goal of $920 per share.

Now Help Powers ServiceNow’s Platforms

My largest takeaway from the earnings name is ServiceNow’s robust progress in its Now Help, with internet new annual contract worth (ACV) doubling quarter-over-quarter. Administration has disclosed that the corporate signed 11 Now Help Offers with $1 million+ ACV in Q2, two of which have been over $5 billion.

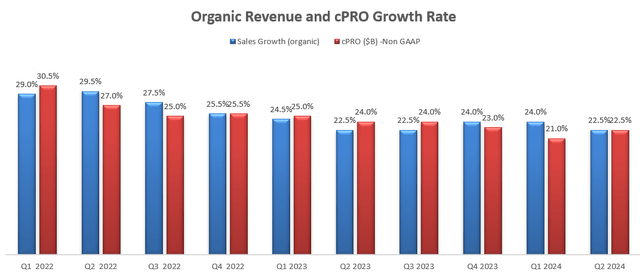

As mentioned in my earlier protection, ServiceNow has been making use of its AI expertise to its platforms, which fuels the natural income and order progress. As depicted within the chart under, ServiceNow delivered 22.5% progress in each natural income and present remaining efficiency obligations (cPRO).

ServiceNow quarterly earnings

I anticipate Now Help and different AI applied sciences will proceed to propel the expansion of ServiceNow’s main platforms for the next causes:

ServiceNow has launched Now Help for IT Service Administration, Buyer Service Administration, HR Service Supply and Creators. By incorporating AI expertise, ServiceNow has been increasing its complete addressable markets (TAM), offering extra runway for future progress. Enterprise prospects can leverage ServiceNow’s AI platform to enhance the working effectivity for his or her back-office and mid-office operations. As an illustration, with the AI expertise, ServiceNow’s personal IT assist desk may save 45 minutes per case and customer support. It’s inevitable that the mixture of AI and ServiceNow’s platforms may enhance the effectivity for enterprise prospects. Throughout the earnings name, the administration indicated an acceleration within the variety of giant offers. Their deal with the great IT options may assist its gross sales group shut bigger offers.

FY24 and Valuation Replace

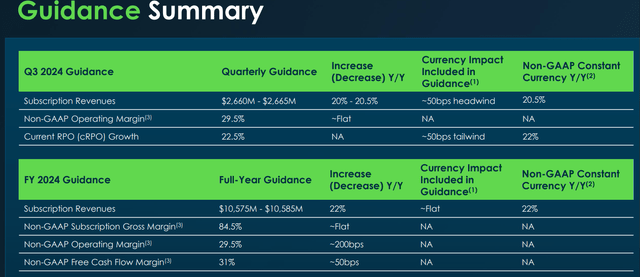

ServiceNow raised its steering for each prime line and margin growth, as detailed within the desk under.

ServiceNow Quarterly Presentation

It’s spectacular that ServiceNow can ship such excessive progress in enterprise software program, amid a difficult macro surroundings. I’m contemplating the next elements for its near-term progress:

cPRO is a number one indicator of ServiceNow’s future income progress. It’s notable that ServiceNow has been rising its cPRO by 20%+ over the previous few quarters. The excessive progress of present remaining efficiency obligations may translate into income progress within the close to future. On July twenty fourth, ServiceNow introduced the acquisition of Raytion to reinforce its AI-powered search and data administration capabilities. I favor this deal, as the mixture of Raytion’s platform and ServiceNow’s Now Help may probably increase the adoption of AI-powered ServiceNow platforms.

I anticipate ServiceNow will obtain 23.8% progress in income for FY24, assuming 20% progress in its core platforms together with IT administration, Buyer Service Administration and HR Service Administration; 2% progress from AI add-ons; 0.8% progress from acquisitions.

For the expansion from FY25 onwards, I anticipate the corporate will develop its income by 20.8% assuming:

Core platform progress: 15%. The expansion price presumes ServiceNow will proceed to penetrate the large enterprise buyer base. New platform progress from TAM growth: 5%. ServiceNow has a protracted observe report of increasing its main platforms throughout mid-office and back-office markets. Assuming the corporate will allocate 3% of complete income in direction of acquisitions, contributing 0.8% to topline progress.

I forecast ServiceNow will increase its margin by 250bps per yr, reaching 33.5% by FY33, assuming:

100bps growth from gross earnings, pushed by new product launch and enormous offers 100bps working leverage from R&D bills, as the corporate scales its companies 50bps working leverage from SG&A, pushed by operation efficiencies.

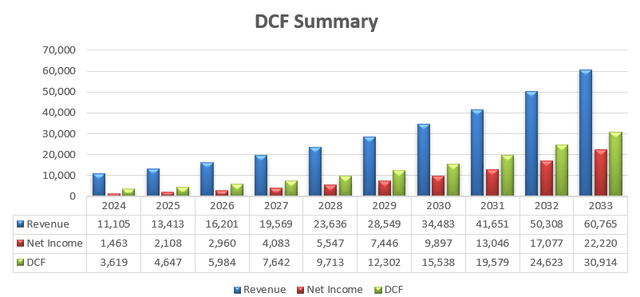

The discounted money circulate (“DCF”) abstract might be discovered as follows:

ServiceNow DCF – Writer’s Calculations

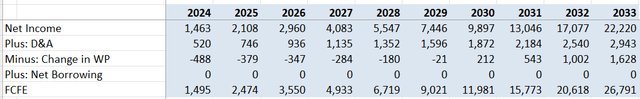

I calculate the free money circulate from fairness as follows:

ServiceNow DCF – Writer’s Calculations

The price of fairness is calculated to be 15% assuming: risk-free price of 4.2% (US 10Y Treasury Yield); beta of 1.65 (SA); and an fairness threat premium of seven%.

Discounting all the long run free money circulate, the one-year value goal is calculated to be $920 per share.

Key Dangers

Throughout the earnings name, ServiceNow introduced that CJ Desai, the President and COO, would provide his resignation from the corporate efficient instantly. This was on account of a coverage violation associated to a authorities contract and the hiring of a former US Military official. The investigation signifies that ServiceNow has an inner administration subject with hiring insurance policies. Whereas ServiceNow handled the incident significantly, the administration change may probably create some disruptions in its inner operations and exterior gross sales actions with the general public sector.

Conclusion

Now Help has turn out to be a strategic expertise for ServiceNow, because the AI expertise may energy ServiceNow’s core platforms, accelerating its income and cPRO progress. I reiterate a “Robust Purchase” ranking with a one-year value goal of $920 per share.

[ad_2]

Source link