[ad_1]

AEKKARAT DOUNGMANEERATTANA

When a administration is cautious in making claims about a greater 12 months forward regardless of a wholesome stability sheet, we take it as a optimistic signal {that a} backside within the inventory value is lurking across the nook. Huntsman Company (NYSE:HUN) is a type of corporations which will appear to be performing poorly on the floor, however in our view has a superb return potential as a cyclical inventory.

A Diversified Product Portfolio

The corporate’s merchandise are utilized by a wide range of industries as uncooked materials, which might be why the gross sales decline has by some means stabilized at present ranges, and we imagine the development will proceed not less than for a while. Its merchandise are utilized in a variety of industries, listed as follows;

adhesives, aerospace, automotive, building merchandise, sturdy and non-durable shopper merchandise, electronics, insulation, packaging, coatings and building, energy era, and refining; elastomers, insulation, footwear, furnishings, industrial, oil and gasoline, liquid pure gasoline transport, printed circuit boards, shopper, home equipment, electrical energy transmission and distribution, leisure sports activities tools, and medical home equipment markets.

The product combine catering to each the buyer discretionary in addition to non-discretionary sectors helps make sure the demand is secure throughout a harder macro-environment, with an upside when the economic system picks up once more.

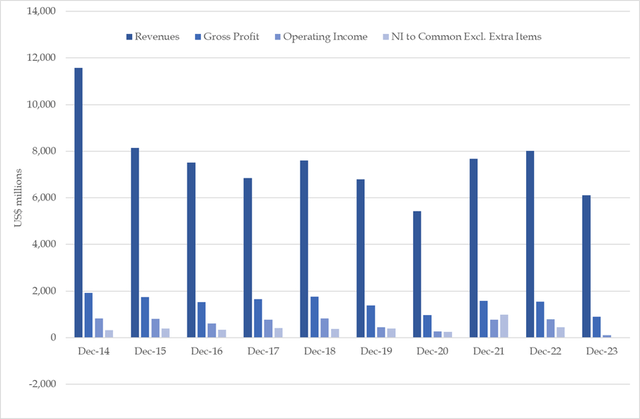

A Secular Decline in Income Since 2014

Though Huntsman has a comparatively secure capex and inorganic progress program, the gross sales have constantly declined during the last decade. The equipment worth on the stability sheet has stagnated round present ranges and the variety of full-time workers has come down by almost 63% to six,000 from 16,000 in 2014. The revenues in 2014 reached US$11.58bn and appear to have bottomed out at US$5.4bn throughout 2020 even if the corporate spent a median 1.8% of annual revenues in R&D, US$340m in common annual capex and likewise made a couple of comparatively small acquisitions. These initiatives haven’t helped in arresting the secular decline, and barring the Covid associated progress throughout 2021-22, the downward spiral has returned not too long ago, and it’s certainly a reason for some concern.

It’s clear that the enterprise is affected by the systemic cyclical turbulence, and it’s troublesome to name the precise trough particularly because the financial progress continues to be robust. One could even argue that there may very well be extra draw back than upside potential, with the potential delicate touchdown which has been anticipated for such a very long time now.

Administration Outlook

Throughout the earnings name for 1Q’2024 earnings, the administration was cautious in making any claims on having reached a cyclical trough. All of the remarks on any efficiency enchancment have been laced with a warning in regards to the sustainability of the uptrend. It was good to see higher numbers and the corporate seemed to be treading water fastidiously, with a selected comment on their method sooner or later. “We won’t jeopardize our investment-grade score for short-term features.”

Let’s take a look at the feedback made by the administration throughout earnings name for the 4Q’2023 and 1Q’2024.

to get better misplaced volumes – make some modest features whereas anticipating extra all through 2024, however issues stay over the sustainability of such features want to enhance cashflows – seeing enhancements on this space as properly, however it could face headwinds in working capital later with gross sales quantity and pricing choosing up deal with the prices within the face of world inflationary and regulatory pressures repeatedly assess the portfolio, ensure the worth of the belongings the corporate owns is maximized and the way the capital is deployed for progress. The EBITDA or Curiosity protection necessities would possibly make them promote a few of the belongings. It’s doubtless and shouldn’t be dominated out, however one would positively query the rationale to promote at a reduced value. deal with the environmental and security efficiency – it’s comforting to know that the administration appears to imagine within the long-term imaginative and prescient and never compromising on that for short-term features.

One other attention-grabbing remark made by the administration on the expansion within the EV house and firm’s place as it’s affected.

As we take into consideration EVs, we basically provide every thing that goes into an ICE car goes into an EV car in our polyurethanes division, which is our largest division with car purposes. However we even have quite a few purposes that we’re creating proper now which can be within the pipeline, a few of them which can be merging into EVs which can be coming from the opposite divisions as properly, round construction, energy, light-weighting, adhesion, insulation, and so forth.

There may be some advantage to their feedback round progress in EV volumes from China and its optimistic impression on the polyurethanes volumes, however it’s higher to not pre-maturely assume a bullish outlook till we see some enchancment within the pricing energy. The corporate is anticipating approx. US$150-200m in further EBITDA to be unlocked primarily based on the above, however the proof of the pudding is within the consuming. Due to this fact, we wish to first see some stable gross sales quantity progress and not using a compromise on pricing.

Having mentioned that, we’re optimistic in regards to the firm’s prospects in the long term on account of the industrial scale Miralon challenge (building to start in 2025-26), MDI splitter in Geismar, amines enlargement, and urethane catalyst expansions. Most significantly, any discount in mortgage charges ought to spur housing begins, which ought to assist the present volumetric progress in North America last more.

Monetary Efficiency & Valuation

If we take a look at the present cycle post-covid, there’s a persistent decline in revenues and EBITDA throughout all of the enterprise segments, however the encouraging half was the uptick in North American gross sales volumes within the current quarter. Though it’s not excellent to see the corresponding unfavorable impression on costs because it was fairly sizable for the quantity progress achieved. The corporate confronted related sorts of margin headwinds through the 12 months 2023 and if the present development continues, there’s a robust risk that the annual ends in 2024 might push the inventory value decrease in direction of higher accumulation ranges.

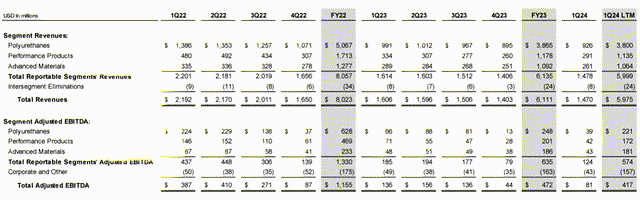

Huntsman Company – 1Q’24 Earnings

The attention-grabbing half right here although is that between 2014 and 2022, the revenues declined by 31%, however the gross income have been down by solely 20% with a 270bps enchancment in gross margin. We imagine any enchancment within the macro surroundings would assist carry the EPS from persevering with operations again to the long-term development, as the corporate’s stability sheet appears fairly wholesome even through the present stress on the P&L aspect.

Looking for Alpha Looking for Alpha – Analyst Calculations

Looking for Alpha – Analyst Calculations

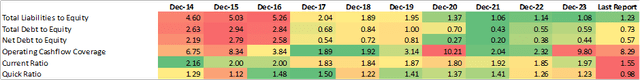

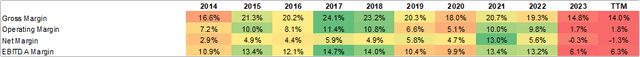

Primarily based on the cautious administration outlook on the margin enchancment for the remainder of the 12 months, we might even see a greater value zone for accumulation (if not already there). As you may see from the desk above, the corporate’s revenue margins have a tendency to maneuver in a cycle and for such an organization, it could be necessary to think about a cross cycle efficiency to reach at an affordable valuation vary.

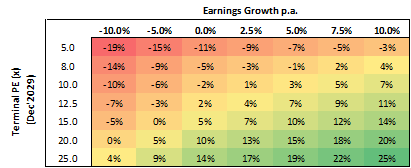

We took a median of the final 10 years EPS and ran sensitivity evaluation on the anticipated annual returns, primarily based on varied earnings progress charges and the terminal P/E multiples utilizing the shut value ($21.46) on July 9, 2024. As it’s clear from the desk beneath, it could take a extremely good earnings efficiency for the subsequent 5 years and better than common P/E a number of for a stable out-performance on returns.

Analyst Calculations

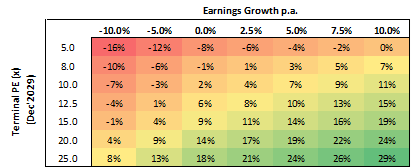

We ran one other sensitivity evaluation utilizing the identical elements however the one change being a decrease inventory purchase value (e.g. $18), which leads to the next sensitivity desk. As you may see, at $18 as the acquisition value, the required earnings progress and the terminal P/E a number of are lowered considerably for a a lot better return profile. So as to add some related context to the dialogue, the historic 5Y common FWD P/E a number of for Huntsman has been 14.87x.

Analyst Calculations

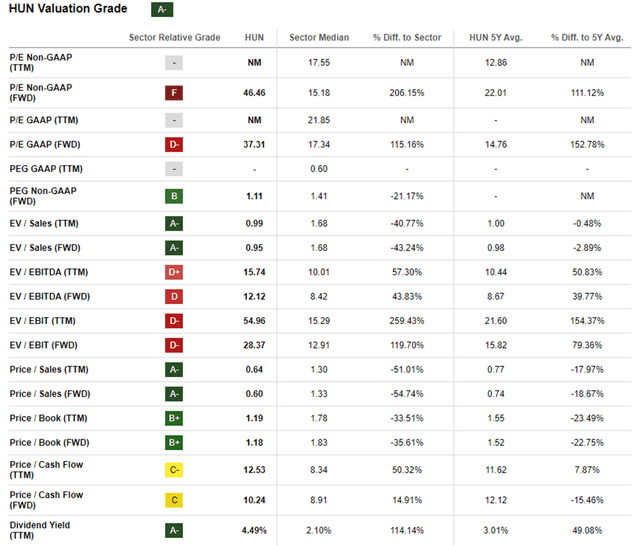

When you think about the Huntsman’s valuation rankings, it’s apparent that the corporate is already low cost on the premise of dividend yield and P/B a number of. The opposite multiples such P/E and EV/EBITDA might additionally come inside historic vary in case of any additional downtrend within the inventory value, and profitability enchancment with a cyclical upturn within the stock buildup and subsequently greater product pricing.

Looking for Alpha

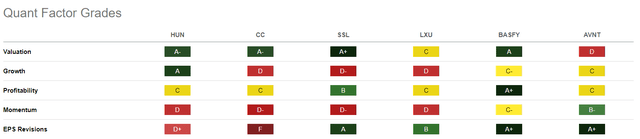

That is additional confirmed by the quant rankings on a comparative foundation as proven beneath. If the profitability begins choosing up, the momentum and EPS revisions would doubtless be upgraded as properly, however it is extremely doubtless that the inventory value would have bottomed out lengthy earlier than that in our view.

Looking for Alpha

Draw back Dangers

We have now primarily based our optimistic outlook on the important thing assumption of a delicate touchdown and faster restoration in combination demand. Regardless of a decently rising US economic system, the corporate is going through challenges in elevating their product costs, which isn’t very encouraging. If this depressed market situation is prevalent for an extended interval, the inflection in inventory value might take longer and the development is likely to be choppier than most popular. As well as, the manufacturing volumes is likely to be adversely affected on account of sudden plant closures, greater commerce obstacles and tariff amongst different elements.

Conclusion

We’re optimistic in regards to the firm’s prospects in the long run primarily based on enterprise fundamentals and first rate sufficient levered free money movement. If there’s a additional deterioration in profitability because of margin pressures within the subsequent 12 months, there may very well be some downward motion within the inventory value and that must be taken as a possibility to build up the inventory, offered the long-term enterprise fundamentals are intact, and the stability sheet continues to be robust.

[ad_2]

Source link