[ad_1]

IR_Stone

My, how time flies! It looks like solely yesterday that I wrote an article a few pretty small firm by the identify of Utilized Optoelectronics (NASDAQ:AAOI). This agency gives area of interest know-how options to completely different finish markets like Web knowledge facilities, cable TV, telecommunications corporations, and fiber-to-the-home companies. Again at the moment, I discovered the corporate to be an attention-grabbing one. Specifically, the corporate appeared to make for an intriguing prospect for buyers banking on world knowledge middle development. However due to its combined monetary efficiency, I made the declare that the corporate would probably see a really binary end result that may be based mostly largely on how issues would in the end go in its operations in Asia.

Since then, the agency has not fallen in need of these expectations. Sadly, the inventory didn’t transfer the best way that many buyers would have wished. It took the opposite route, plunging 83.4% in comparison with the 97.9% enhance that the S&P 500 noticed over the identical window of time. To place this in perspective, $1,000 invested within the inventory at that second could be price solely $166 at the moment. By comparability, that very same quantity invested within the broader market could be price $1,979, or practically 12 occasions what the funding in Utilized Optoelectronics would have become.

Given how a lot the inventory has plummeted, you may assume that I’d contemplate the corporate alternative to purchase into. It’s true that the agency has some constructive elements to it that buyers ought to pay attention to. However when you think about its general monetary efficiency, notably its most up-to-date outcomes, I’d really argue that ranking the corporate a ‘promote’ makes for a great deal of sense.

Continued draw back is feasible

As I discussed already, Utilized Optoelectronics caters to 4 completely different finish markets. To those markets, it gives quite a lot of optical communications merchandise which are important for these markets to exist. As an illustration, it gives prospects with optical transceivers that plug into switches and servers in knowledge facilities. These enable the gadgets inside these facilities to transmit knowledge over fiber optic cables. The agency produces its personal lasers and different elements that go into these optical transceivers. To the cable TV market, it produces and sells issues like amplifiers that assist to amplify TV indicators earlier than they attain a receiver or different system. To the telecommunications trade, the corporate sells lasers and lasers subassemblies, to not point out transceivers, principally to community gear producers and different producers of optical transceivers. These gadgets are principally utilized in 5G cellular networks.

Utilized Optoelectronics

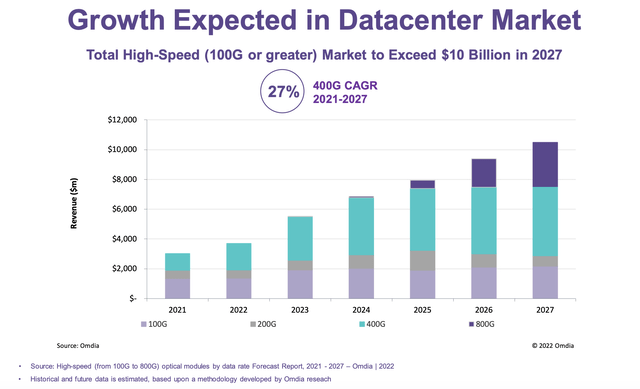

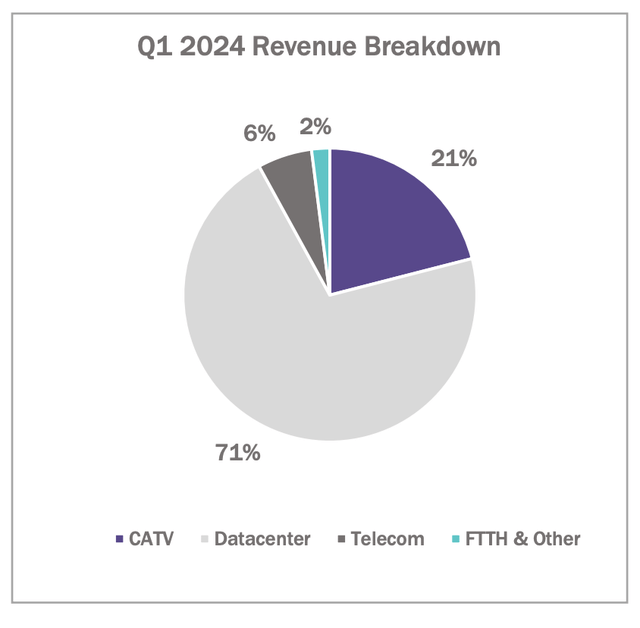

At first look, publicity to those markets may appear to supply important upside potential. However contemplating that 71% of the agency’s income within the newest quarter got here from gross sales to the info middle area and one other 21% of income concerned cable TV, the telecommunications market and the fiber-to-the-home market are each roughly insignificant. Once we give attention to the info middle market, there does appear to be optimism about what the longer term holds. As you may inform from the picture above, administration expects important development within the world knowledge middle area over the following few years. For the optical modules area, the expectation is for development from round $6.5 billion this 12 months to someplace simply north of $10 billion by 2027. That is centered solely on the excessive velocity, outlined as 100G and above, optical module area. At this time limit, there’s a massive shift occurring within the knowledge middle market from 100G and 200G items to 400G ones, with annualized development involving these anticipated to be round 27% from 2021 by 2027. Finally, it is anticipated that there will probably be an additional transfer larger for the 800G ones. However that will not start till someday subsequent 12 months.

Utilized Optoelectronics

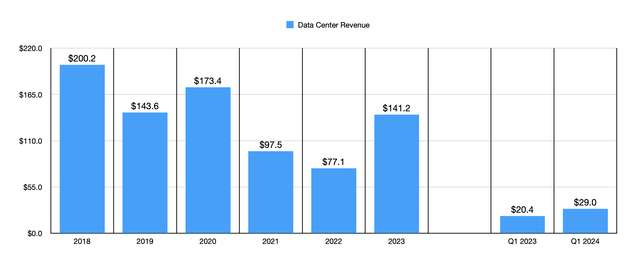

Over the previous couple of years now, administration has reported a pleasant enhance in gross sales to knowledge facilities. Again in 2021, the agency generated $97.5 million in income from that area. Income did find yourself dropping to $77.1 million in 2022 earlier than leaping to $141.2 million final 12 months. As spectacular as this development is, nonetheless, the agency has had a rocky working historical past in relation to gross sales to knowledge facilities. Again in 2018, as an illustration, the corporate generated $200.2 million in income from these actions. Regardless that administration was forecasting transceiver development from round $3 billion a 12 months in income that 12 months for the trade to $6.7 billion by 2022, income remains to be decrease at the moment than it was six years in the past. Administration additionally appears to have a fairly unhealthy observe report of understanding trade circumstances. After seeing income to knowledge facilities drop from $173.4 million in 2020 to $97.5 million in 2021, it forecasted a return to development in 2022. However as I detailed already, the agency noticed an additional contraction that 12 months.

Creator – SEC EDGAR Knowledge

Regardless that I feel buyers are in the correct to query whether or not or not Utilized Optoelectronics will really see a rise in demand for its merchandise, there occurred some constructive developments that buyers ought to pay attention to. Specifically, in the course of final 12 months, Utilized Optoelectronics introduced that it struck a five-year take care of Microsoft (MSFT) whereby Utilized Optoelectronics will present Microsoft with design providers and meeting providers of sure ‘items’. Final 12 months, 46.6% of the corporate’s income got here from Microsoft. So clearly, this could solely be thought of a welcomed improvement.

Creator – SEC EDGAR Knowledge

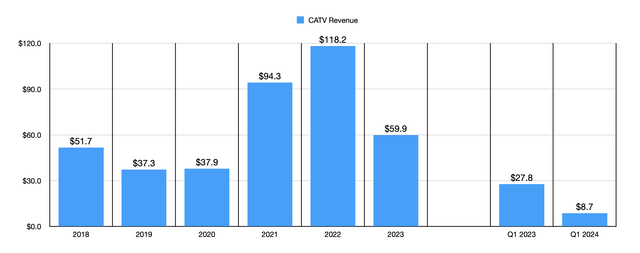

There appears to be loads of volatility for the corporate basically. Even in relation to the cable TV class, after seeing income climb from $37.3 million in 2019 to $118.2 million in 2022, there was a plunge to $59.9 million final 12 months. Administration attributed this to the choice of its prospects to move up on purchases of older technology DOCSIS 3.1 gear due to the discharge, for this 12 months, of newer DOCSIS 4.0 merchandise. For these not aware of this, DOCSIS 3.1 is a kind of know-how that helps to spice up cable excessive velocity knowledge to speeds generally as excessive as 10Gbps for the aim of downloads and for add speeds on sure networks to 1Gbps. By comparability, DOCSIS 4.0 permits permits downstream capability that’s primarily the identical because the 10Gbps that DOCSIS 3.1 has, nonetheless, with upstream capability of 6Gbps, DOCSIS 4.0 is between three and 6 occasions quicker van the older various. Up to now, with income within the first quarter of 2024 amounting to solely $8.7 million, which is properly beneath the $27.8 million reported for a similar finish market within the first quarter of 2023, we’ve got not seen this surge in orders simply but. However the expectation is that, in some unspecified time in the future, this transition from one know-how to the opposite will drive income development for the enterprise.

Creator – SEC EDGAR Knowledge

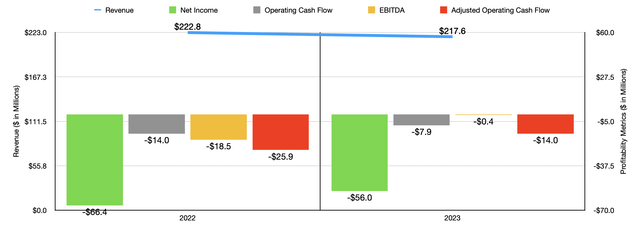

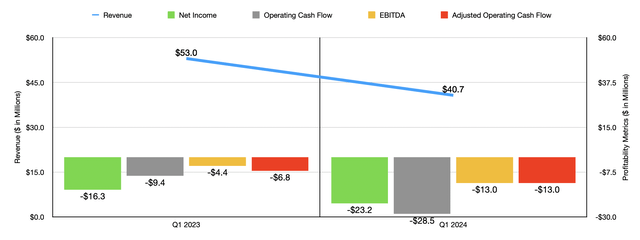

Regardless of the potential that Utilized Optoelectronics appears to have based mostly on the industries that it caters to, notably the info middle area, the general monetary well being of the enterprise is something however spectacular. Within the chart above, you may see monetary efficiency for 2022 and 2023. And within the chart beneath, you may see knowledge for the primary quarter of final 12 months and the primary quarter of 2024. Income has been principally falling, and the corporate’s backside line, whereas more healthy final 12 months than the 12 months prior, has proven indicators of additional weakening this 12 months.

Creator – SEC EDGAR Knowledge

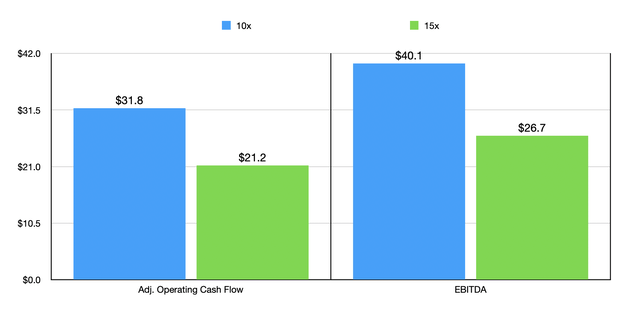

On the finish of the day, it is actually not attainable to worth a technology-oriented agency that fails to generate constructive earnings and/or earnings. However what we are able to do, as I confirmed within the chart beneath, is to take a look at what sort of money movement the enterprise would wish to generate to be able to commerce about both 10 occasions or 15 occasions on a value to working money movement foundation, or on an EV to EBITDA foundation. These numbers appear fairly a bit out of attain when you think about how the corporate has fared in recent times. Now, if income development was occurring at a speedy tempo, then the image may be completely different. However that’s not the type of scenario we’ve got on our fingers. What we’ve got as an alternative is a enterprise that sees excessive volatility in its main markets annually, and that’s producing web losses and money outflows.

Creator – SEC EDGAR Knowledge

Takeaway

As attention-grabbing as I discover Utilized Optoelectronics to be, the corporate does seem like problematic. Administration talks an enormous sport by declaring trade potential. Nonetheless, the corporate’s elementary previous has proven a distinct story. As tempting as it’s to present technique to hope concerning what the longer term holds, it is troublesome to be optimistic when the enterprise in query exhibits continued weak point and backside line ache. Given these elements, I feel that additional draw back might be warranted from right here. Due to that, I’ve determined to fee the agency a ‘promote’ presently.

[ad_2]

Source link