[ad_1]

Olivier Le Moal

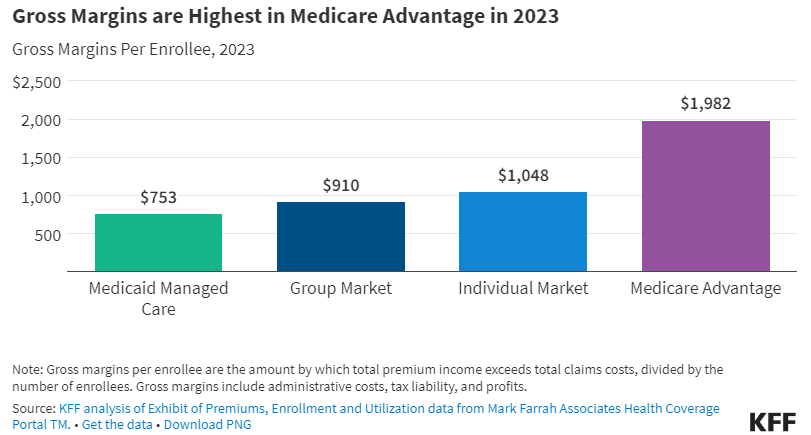

The Medicare Benefit market recorded the strongest gross margins within the medical insurance business final yr, based on the impartial healthcare coverage group KFF.

Following an evaluation of the sector’s monetary efficiency in 2023, the non-profit mentioned this week that non-public payers serving the federally funded program generated a gross margin of $1,982 per member in 2023.

In distinction, the Medicaid program, collectively funded by the states and the federal authorities, recorded the bottom gross margin of $753 per enrollee, whereas particular person and employer markets posted per-member gross margins of $1,048 and $910, respectively.

Medicare Benefit is a rising managed care market served by publicly traded well being insurers comparable to UnitedHealth (NYSE:UNH), Humana (NYSE:HUM), CVS Well being (NYSE:CVS), Alignment Healthcare (NASDAQ:ALHC), and Clover Well being (CLOV).

Main operators within the Medicaid market embrace Centene (CNC), Elevance Well being (ELV), and Molina Healthcare (MOH), whereas Cigna (CI) primarily serves business insurance coverage.

KFF used information from the Well being Protection Portal, a well being plan efficiency database run by healthcare analytics agency Mark Farrah Associates, for its evaluation. Nevertheless, its evaluation had sure limitations, because it didn’t embrace information from the U.S. territories and solely partially included Medicaid information from Arizona, California, Delaware, New York, and Oregon.

The report signifies how non-public well being insurers carry out financially as they play an more and more dominant position in Medicare and Medicaid.

In accordance with federal information, non-public Medicare Benefit plans serve greater than half of eligible Medicare beneficiaries, whereas Medicaid managed care plans (sometimes non-public insurers) cowl about three-quarters of this system’s membership.

Regardless of issues over a current spike in demand for medical care amongst Medicare enrollees, KFF mentioned the gross margin within the Medicare Benefit market remained largely much like that in 2022.

In January, Humana (HUM) shares offered off after the corporate reduce its outlook twice early this yr, citing larger than anticipated medical prices in its Medicare Benefit enterprise.

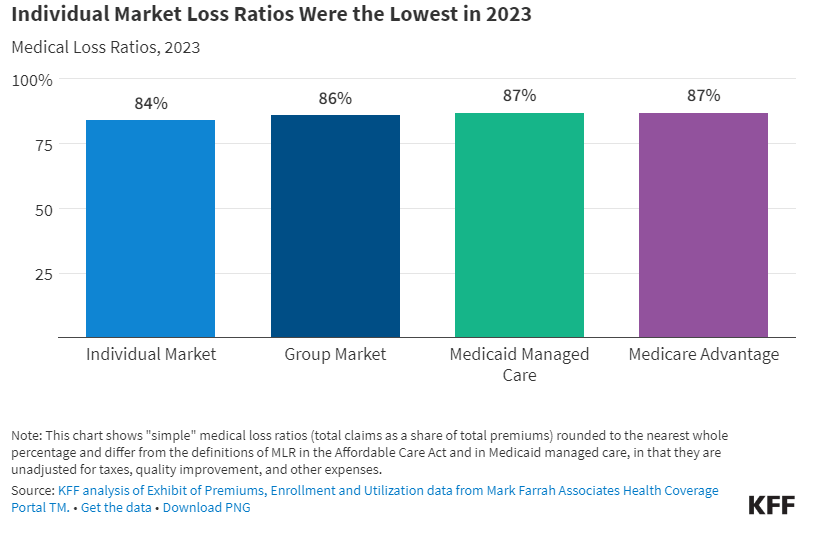

The report additionally sheds mild on a key business efficiency metric known as the medical loss ratio, which measures the share of premiums well being insurers pay for members’ medical prices.

In accordance with KFF, particular person insurance coverage recorded the bottom medical loss ratio of 84% in 2023, whereas Medicare Benefit and Medicaid managed care markets recorded 87%, the business’s highest. Employer plans fell in between, recording 86%.

Nevertheless, based on the evaluation, medical loss ratios continued a current development of stability, remaining broadly related throughout segments following spikes in 2020 on account of COVID-driven demand for medical care.

Extra on CVS Well being, UnitedHealth, and many others.

[ad_2]

Source link