[ad_1]

Revealed on July 2nd 2024 by Nathan Parsh

Excessive-yield shares might be very useful in producing sufficient revenue to cowl bills in retirement.

For instance, a $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

With this in thoughts, we now have created a spreadsheet of shares (and carefully associated REITs and MLPs, and many others.) with dividend yields of 5% or extra.

You’ll be able to obtain your free full record of all excessive dividend shares with 5%+ yields (together with vital monetary metrics reminiscent of dividend yield and payout ratio) by clicking on the hyperlink under:

TFS Monetary Company (TFSL) is a part of our ‘Excessive Dividend 50’ sequence, the place we cowl the 50 highest yielding shares within the Positive Evaluation Analysis Database.

Shares of the corporate are down 15% year-to-date, which has pushed the yield larger to greater than 9%, making TFS Monetary Company one of many highest yielding shares in our protection universe.

On this article, we’ll check out TFS Monetary Company’s prospects as a possible funding.

Enterprise Overview

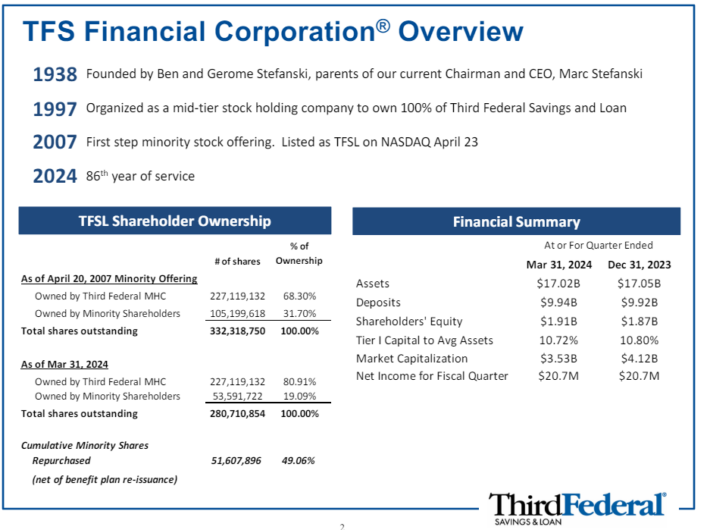

TFS Monetary Company is the holding firm of Third Federal Financial savings and Mortgage Affiliation of Cleveland. The corporate has been in enterprise for 86 years and has a market capitalization of $3.5 billion at the moment.

Supply: Investor Relations

TFS Monetary Company gives a variety of retail shopper banking providers throughout the U.S., together with financial savings accounts, cash market accounts, checking accounts, particular person retirement accounts, certified plan accounts, and certificates of deposit.

Moreover, the corporate extends residential actual property mortgage loans, residential development loans, house fairness loans, strains of credit score, buy mortgages, and first mortgage refinance loans.

TFS Monetary Company reported second quarter earnings outcomes on April thirtieth, 2024 that topped what the market had anticipated. Income grew 3.1% to $71.4 million, which was $2.75 million greater than anticipated. Earnings-per-share totaled $0.07, which in contrast favorably to $0.06 within the prior yr and was $0.02 above estimates.

Web curiosity revenue improved 3.3% to $71.4 million because of larger yields on money equivalents and loans. Because of this, the web curiosity margin expanded 3 foundation factors to 1.71%.

Web loans declined 0.4% to $15.1 billion on a sequential foundation, however allowances for credit score losses on loans fell 1.3% to $68.2 million.

TFS Monetary Company is projected to earn $0.24 this yr, which might be a 7.7% lower from the prior yr.

Progress Prospects

TFS Monetary Company doesn’t have the scale and scale of the biggest names within the banking business. The corporate has 21 full-service branches in Ohio and one other 16 such branches in Florida.

The corporate’s service choices are just like its bigger friends, which doesn’t present extra profit to the enterprise.

TFS Monetary Company does present financial savings merchandise to clients in all 50 U.S. states and first mortgage refinances loans in 26 states and the District of Columbia.

This offers the corporate a barely extra pronounced attain than the everyday neighborhood financial institution.

Nevertheless, TFS Monetary Company has carried out poorly over the long-term. Earnings-per-share have barely budged over the past decade, with the corporate incomes $0.22 per share in 2014 and simply $0.26 per share final yr.

We consider the corporate to be able to 4% earnings development over the subsequent 5 years.

Aggressive Benefits

We don’t consider that TFS Monetary Company has any vital aggressive benefit, although it does have extra of a presence than many neighborhood banks.

The truth that the corporate gives some providers to 26 U.S. states exhibits that it has extra attain than many banks its measurement.

Whereas many monetary establishments have seen web curiosity margin contract as the price of larger yields have elevated, TFS Monetary Company did see some enlargement in its most up-to-date quarter.

The corporate additionally has a really robust mortgage portfolio, as provisions for credit score losses declined quarter-over-quarter. TFS Monetary Company’s PCLs characterize simply 0.5% of your entire mortgage portfolio, exhibiting that the corporate’s mortgage ebook may be very wholesome.

The corporate has additionally taken steps to decrease its total bills. Complete bills have held largely regular over the past two quarters.

Lastly, TFS Monetary Company has greater than $17 billion in complete belongings, a sizeable determine for a corporation of its measurement.

Dividend Evaluation

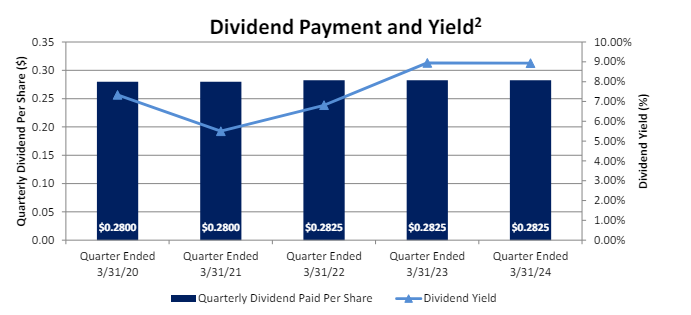

TFS Monetary Company’s dividend yield may be very enticing at 9.1%, which is seven instances the common yield of the S&P 500 Index.

Supply: Investor Relations

Previous to 2022, TFS Monetary Company had an eight-year dividend development streak, however the firm paused its will increase at the moment. Shareholders have obtained the identical fee of $0.2825 for 14 consecutive quarters.

Even with the dividend pause, the expansion charge has ben 32% yearly for the 2014 to 2023 interval as the corporate aggressively raised its dividend in the course of the final decade. We don’t count on greater than nominal raises over the subsequent 5 years.

The present yield has not often been this excessive over the past decade, however this has turn into extra of its typical yield for the inventory for the previous few years.

Excessive yields can typically be a warning sign that one thing is flawed with the underlying enterprise. This might be the case for TFS Monetary Company. With an annualized dividend of $1.13, TFS Monetary Company is anticipated to have a payout ratio of 481% for 2024.

That is an extremely excessive payout ratio and one the is unstainable long-term. We word that the inventory has a median payout ratio of 400% over the past 5 years so an especially excessive payout ratio has but to end in a dividend discount.

That stated, we consider that earnings development must be vital going ahead for the corporate to have the ability to preserve its present dividend quantity.

Due to this fact, shareholders must be weary of TFS Monetary Company’s means to proceed to pay a really excessive yield.

Last Ideas

There are some enticing traits of TFS Monetary Company. First, its dividend yield may be very beneficiant and properly above what the common inventory within the S&P 500 Index gives.

Second, for a neighborhood financial institution, it has a sizeable presence and greater than $17 billion in complete belongings. The corporate has additionally seen its web curiosity revenue and margin broaden in the latest quarter.

Nevertheless, the dividend payout ratio may be very excessive and the corporate has additionally saved its funds stagnant after an aggressive interval of development.

These are each warning indicators that the dividend might be in danger for being lower. Revenue traders will probably wish to look elsewhere if they’re looking for safe sources of revenue.

If you’re desirous about discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Positive Dividend sources shall be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link