[ad_1]

RiverNorthPhotography

Verizon Communications Inc. (NYSE:VZ) (NEOE:VZ:CA) is a well-managed telecommunications firm with a excessive, recurring degree of EBITDA and free money circulation.

The Telco earns its dividend with Free Money Stream on a full-year foundation and is poised to announce a dividend hike for the approaching 12 months.

Considering that Verizon Communications is promoting at an inexpensive earnings a number of and that the Telco continues to have subscriber tailwinds in its Broadband section, I feel that the danger/reward ratio for VZ stays fairly compelling.

A give attention to debt repayments might be a catalyst for Verizon Communications to re-rate to its intrinsic worth.

My Score Historical past

In my final piece on Verizon Communications, I highlighted the corporate’s Broadband momentum as one purpose why the inventory was interesting to passive earnings traders.

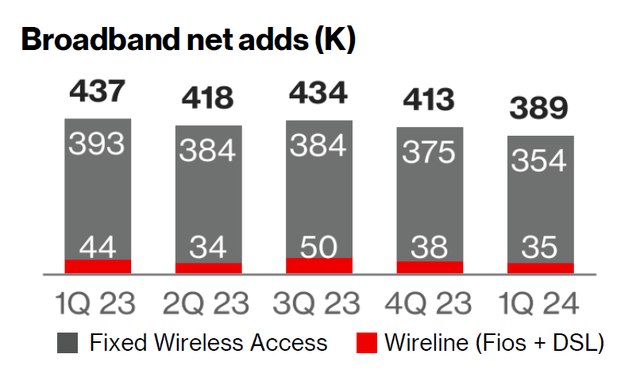

Within the first quarter, the Telco continued to make impression with its rising subscriber base and complete Broadband web additions amounting of 389K. I feel that Verizon Communications will select, as AT&T Inc. (T) did, to repay extra of its debt within the coming quarters.

Free Money Stream, Broadband Upside

Verizon Communications is primarily a ‘Sturdy Purchase’ for its sizable Free Money Stream. Telcos don’t are likely to have so much upside in gross sales, EBITDA or Free Money Stream, however the amount of money that giant telecommunications corporations rake in, is a minimum of guaranteeing a gradual circulation of dividend earnings to passive earnings traders.

Verizon Communications added 389K new subscribers to its Broadband community within the first quarter, which included greater than 50K Fios web web additions. Broadband Enterprise had 151K mounted wi-fi web additions in 1Q24.

Broadband is doing properly for Verizon Communications and the continued momentum in web additions, properly above 300K per quarter, is probably the most compelling purpose to personal a chunk of the Telco’s Broadband motion.

Broadband Web Provides (Verizon Communications)

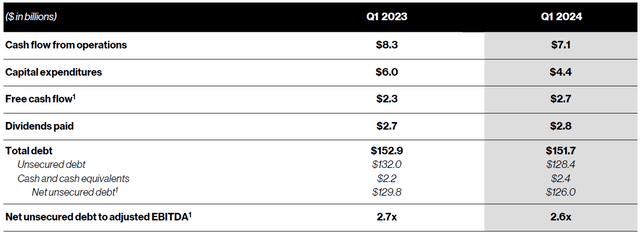

Verizon Communications produced $2.7 billion in Free Money Stream within the first quarter, which confirmed an enchancment of $400 million in contrast in opposition to 1Q23.

Free Money Stream was not adequate, nonetheless, to cowl the primary quarter dividend of $2.8 billion and the Telco fell $100 million wanting its fee obligation. The Free Money Stream dividend pay-out ratio was 103% in 1Q24.

With that mentioned, although, Verizon Communications’ Free Money Flows are likely to even out throughout the course of the enterprise 12 months and the Telco is broadly anticipated to greater than earn its dividend pay-out in 2024.

Within the prior 12 months, regardless of additionally under-earning its dividend with FCF in 1Q23, Verizon Communications ended up incomes $18.7 billion in Free Money Stream and paying out 59% of its Free Money Stream as dividends.

Free Money Stream (Verizon Communications)

A New Dividend Will Be Introduced In 3Q24

Within the case of Verizon Communications, and in a significant distinction to A&T, the Telco’s dividend is rising. The dividend is presently anchored at $0.665 per share per quarter, however Verizon Communications is anticipated to quickly announce its new dividend for the third quarter, which is when the Telco ordinarily raises its pay-out.

In my opinion, the dividend might rise to a variety of $0.675-0.680 per share in 3Q’24 if the corporate’s final dividend hike serves as a benchmark. Thus, I’m trying ahead to getting a 2% increase on my dividend earnings. The current yield for Verizon Communications is 7%.

Verizon Communications Underneath Strain To Do Extra About Its Debt

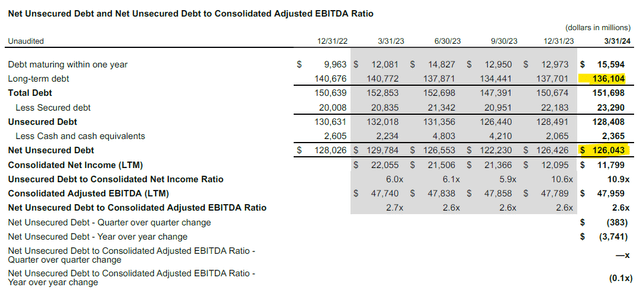

AT&T is transferring into the path of reducing its debt repayments, which I feel might put Verizon Communications below stress to do the identical. Each corporations have long-term debt manner north of $100 billion, and AT&T just lately paid $4.7 billion of its long-term debt maturities in 1Q24 and thereby diminished its complete web debt by $6.0 billion.

Verizon Communications is just not doing as a lot, the Telco lowered its long-term debt solely by $1.6 billion within the final quarter, however there may be room for enchancment, primarily due to the Telco’s Free Money Stream pay-out ratio that’s more likely to clock in someplace within the 50-percent vary in 2024 (because it did in 2023). This extra Free Money Stream might be utilized to the Telco’s monumental excellent long-term debt and decrease the corporate’s leverage.

Lengthy-Time period Debt (Verizon Communications)

Verizon Communications Is Nonetheless A Steal

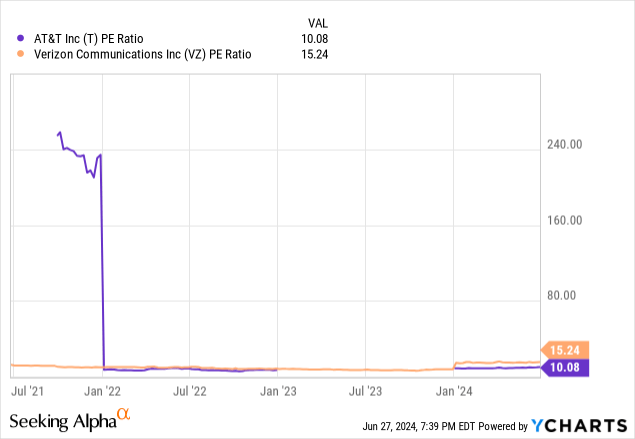

What can’t be argued about, in my opinion, is that Verizon Communications’ inventory remains to be a steal. Promoting for under 8.7x main earnings, whereas AT&T is promoting for 8.1x main earnings. Each Telcos are a cut price, so far as I’m involved as a result of each Verizon Communications and AT&T cowl their dividend pay-outs with Free Money Stream. Within the case of Verizon Communications, passive earnings traders get the additional benefit of really seeing a rising dividend.

I feel that VZ and T are each essentially undervalued, as each corporations produce a considerable quantity of Free Money Stream. I made the argument currently, within the case of AT&T that the Telco might be valued at 10-11x main earnings, which is similar argument I’m making right here (due to its extra FCF). This a number of vary leaves us with between 15% and 27% upside, or an intrinsic worth interval of $47 to $52.

Why The Funding Thesis Would possibly Disappoint

Passive earnings traders shouldn’t anticipate a lot by way of re-rating potential, in my opinion, except Verizon Communications strikes ahead with a concrete debt discount plan.

What has been holding again Verizon Communications’ inventory value is the Telco’s substantial debt burden that’s taking a chunk out of earnings and weighing on sentiment. If Verizon Communications fails to do one thing about its substantial debt, I don’t see a path for a better inventory valuation.

My Conclusion

Verizon Communications income from momentum in its Broadband section, and the corporate loved quantity of buyer web additions within the first quarter, because it did up to now couple of quarters.

Until one thing actually out of the odd occurs, I’d assume that this momentum has continued within the second quarter and I anticipate that the Telco added a quantity near 400K subscribers to its Broadband unit in 2Q24 additionally.

What makes Verizon Communications a present is its excessive Free Money Stream that’s accessible to passive earnings traders at a really low value, an 8.7x earnings a number of.

The dividend is poised to develop in 3Q24, and I’m trying ahead to receiving a 2% hike for my dividend earnings stream.

[ad_2]

Source link