[ad_1]

Maxxa_Satori

The world of REITs is huge, with all types and sizes of firms for buyers to select from. One of many largest gamers on the market, nonetheless, is undoubtedly Realty Revenue (NYSE:O), a various REIT with property that cater to grocery shops, comfort shops, greenback shops, eating places, well being and health facilities, automotive service firms, and extra. About 79.6% of the corporate’s annualized contractual lease is devoted to the retail house. Nonetheless, the corporate additionally has publicity to the economic house, in addition to gaming. Many of the agency’s income comes from The US market. However it’s really various from a geographical perspective, with 11.1% of annualized contractual lease, as an illustration, coming from the UK.

The final article that I wrote about Realty Revenue was revealed in the midst of March of this 12 months. At the moment, I identified the multi-trillion greenback alternative that existed for buyers. To be exact, the full addressable marketplace for the US alone for the enterprise was estimated to be value about $5.4 trillion. And in Europe, the chance is about $8.5 trillion. In that article, I acknowledged that shares weren’t precisely the most affordable. However they had been priced much like different comparable enterprises, and the top quality of the corporate justified a ‘purchase’ score. Given the time that has handed, in addition to some new developments that popped up, I believe it is solely applicable to revisit the image. And what I discovered confirms that I used to be not flawed in my prior evaluation of the enterprise, despite the fact that shares have marginally underperformed the broader market for the reason that publication of that article.

Issues are trying good

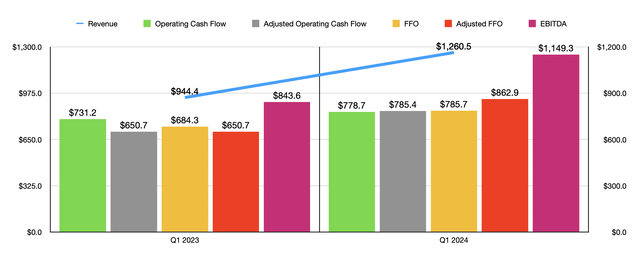

Essentially talking, issues are going very well for Realty Revenue and its buyers. Income within the first quarter of the 2024 fiscal 12 months, as an illustration, got here in at $1.26 billion. That is 33.5% greater than the $944.4 million reported one 12 months earlier. A small portion of this development got here from identical retailer rental income development that was pushed by lease escalators that the corporate has, in addition to by new lease contracts being signed by prospects. International foreign money fluctuations additionally helped barely. However the largest contributor to the $316.1 million year-over-year development in income for the corporate, by far, was a $265.7 million improve attributable to properties acquired throughout 2023 and 2024. This included the properties that the corporate acquired in early January of this 12 months when the enterprise accomplished its merger with Spirit Realty Capital in a transfer that dropped at the enterprise 2,018 extra properties.

Writer – SEC EDGAR Information

With income rising, profitability metrics for the enterprise additionally improved. Working money movement, for instance, elevated from $731.2 million to $778.7 million. If we regulate for adjustments in working capital, the rise was much more important, from $650.7 million to $785.4 million. There are, in fact, different profitability metrics to concentrate to. One in all these is FFO, or funds from operations. This metric elevated from $684.3 million to $785.7 million. The adjusted determine for this grew much more, from $650.7 million to $862.9 million. And lastly, EBITDA for the enterprise expanded from $843.6 million to $1.15 billion.

To date, issues are going very well for buyers. That is evidenced by a few components. For starters, in Could of this 12 months, the corporate introduced that it was growing its widespread inventory dividend by 2.1%. This was adopted up by one other modest improve within the agency’s dividend in June of this 12 months. This marked the 126th dividend improve for the reason that firm grew to become listed on the New York Inventory Trade. It is also the fourth dividend improve that the corporate has seen this 12 months, and it marked the 648th consecutive month-to-month dividend all through the corporate’s 55-year working historical past.

Realty Revenue

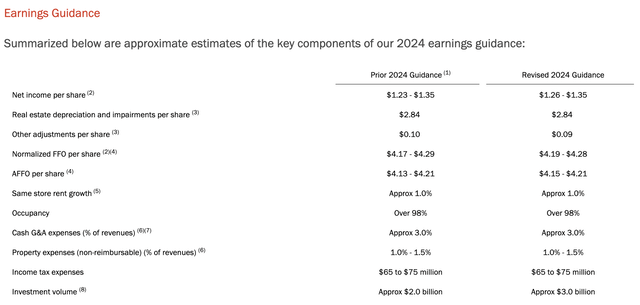

As nice as that is to see, it pales compared to administration’s announcement on June 4th of this 12 months that the corporate is growing steering for 2024. There are various working components to this steering, so as an alternative of detailing out each, I’d refer you to the picture above. It exhibits prior steering in comparison with the revised steering that we should always depend on now. Most notably, adjusted FFO per share ought to now are available between $4.15 and $4.21. On the midpoint, that is a bit greater than the $4.17 beforehand anticipated. Much more important, to me, is the truth that the corporate introduced plans to spend $3 billion on funding alternatives this 12 months. That is 50% greater than the $2 billion administration was beforehand anticipating. And none of this contains the aforementioned merger that occurred in January.

Writer – SEC EDGAR Information

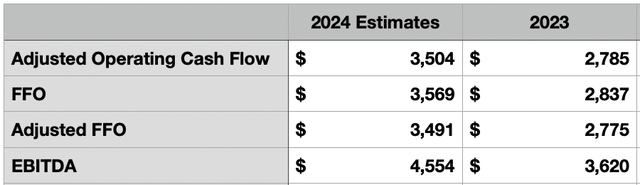

If we assume the corporate’s share depend doesn’t change from the place it’s proper now, then the rise in steering ought to lead to adjusted FFO of about $3.49 billion. FFO ought to be round $3.57 billion if that is so. If we assume that different profitability metrics ought to rise on the identical price, this could translate to adjusted working money movement of about $3.50 billion and EBITDA of roughly $4.55 billion. Within the desk above, you possibly can see these figures and the way they evaluate in opposition to outcomes seen for 2023.

Writer – SEC EDGAR Information

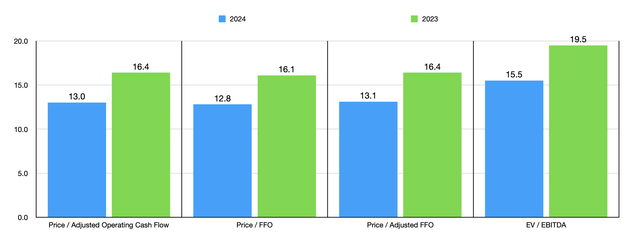

With this information considered, I then determined to worth the inventory. This may be seen within the chart above. As you possibly can see, the inventory appears rather more enticing on a ahead foundation than if we had been to make use of 2023 figures. However in all equity, that is extra of an apples to oranges comparability for the reason that 2023 figures don’t consider any money flows from the aforementioned merger. As a part of my evaluation, I then determined to check Realty Revenue to 5 related companies, as proven within the desk under. I did this utilizing solely two of the 4 valuation metrics in order that I may reduce complexity. On a value to working money movement foundation, three of the 5 firms had been cheaper than Realty Revenue. However when it comes all the way down to the EV to EBITDA strategy, this quantity drops to 2 of the 5.

Firm Value / Working Money Circulate EV / EBITDA Realty Revenue 13.0 15.5 Simon Property Group (SPG) 12.9 13.7 Kimco Realty (KIM) 12.9 16.8 Regency Facilities (REG) 15.0 17.2 Federal Realty Funding Belief (FRT) 14.9 17.5 NNN REIT (NNN) 12.2 14.9 Click on to enlarge

Takeaway

As issues stand, Realty Revenue does look to be kind of pretty valued in comparison with related enterprises. However this does not imply that buyers should not be bullish. Administration continues to make massive investments targeted on the long run and, for such a high-quality firm, its buying and selling multiples are usually not unrealistic. Administration appears very bullish, as evidenced by the continued dividend will increase and the uptick in steering. The large investments being made this 12 months ought to do effectively to additional create worth for buyers down the highway. Given these components, I don’t suppose that score the corporate a ‘purchase’ was a foul resolution. Moderately, I believe that the corporate will simply want extra time to understand the upside it ought to take pleasure in.

[ad_2]

Source link