[ad_1]

wwing/iStock Unreleased by way of Getty Photographs

Again in early October of 2023, I wrote an article discussing the separation of the corporate that was often called Kellogg. Finally, the agency cut up up into two separate companies. One in every of these is now recognized as WK Kellogg Co (KLG), which is the enterprise that now serves because the North American cereal operations of the previous conglomerate. The opposite enterprise to separate off from this got here to be often called Kellanova (NYSE:Okay). And it emphasizes the worldwide snack operations, in addition to sure key progress markets, of the manufacturers that was owned by Kellogg.

In that article, I mentioned why Kellanova made for an attention-grabbing alternative for buyers. Sure key manufacturers that the enterprise owns have been experiencing enticing progress. Along with this, the worldwide snack market is interesting in and of itself. Shares of the enterprise, whereas not precisely low cost, have been buying and selling close to the low finish of the dimensions in comparison with related corporations. On the finish of the day, this led me to charge the enterprise a ‘purchase’. In some respects, issues have turned out fairly nicely. Shares are up 16.2% since then. However relative to the broader market, the corporate has fallen quick, as evidenced by the truth that the S&P 500 is up 26.1% over the identical window of time.

As disappointing as this underperformance has been, the corporate is beginning to present some actual indicators of progress. It nonetheless has loads of room for enchancment. However with administration now trying to the long run and in search of methods to seize further worth shifting ahead, and with shares nonetheless buying and selling close to the low finish of the spectrum in comparison with comparable corporations, I believe that holding the enterprise rated a delicate ‘purchase’ solely is sensible at this time limit.

Getting tastier

The aim of this text is to not rehash the small print of my October 2023 article. Nevertheless, I do suppose a short description of Kellanova and its operations is so as. Operationally talking, the corporate is a really international participant, however its emphasis is on two major varieties of merchandise. Primarily, it focuses on catering to the worldwide snacks market. Utilizing knowledge from the latest quarter, about 63% of complete income got here from snack associated merchandise. Examples embody Pringles, Cheez-It, Parati, and extra. The remainder of its income is cut up between worldwide cereal operations, frozen meals, noodles, and different associated merchandise. All mixed, round 80% of its income comes from both the worldwide snacks house or all of its miscellaneous merchandise which are offered to rising markets. The wonder behind this type of enterprise mannequin is that each the snacks market and just about something to do with rising markets ought to expertise enticing progress in comparison with most different areas within the meals business.

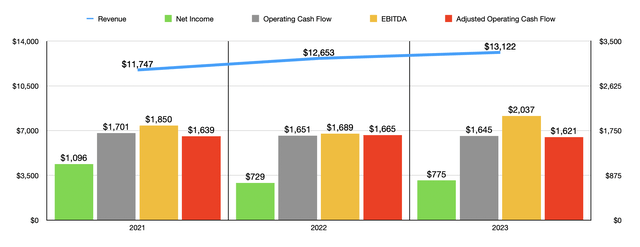

Creator – SEC EDGAR Information

Over the previous few years, administration has seen some enticing progress on the highest line. From 2021 to 2023, income achieved by Kellanova managed to develop from $11.75 billion to $13.12 billion. That is an annualized enhance of about 5.7%. Apparently, income progress would have been much more spectacular had it not been for international forex fluctuations. There would have been no change to gross sales again in 2021. Nevertheless, on an natural foundation, income for 2023 got here in at $13.64 billion. That brings the annualized progress charge of the enterprise as much as about 7.7%. A lot of this growth appears to have come from the snacks market. In North America, as an illustration, natural snacks associated gross sales jumped by 4.7% from 2022 to 2023. However in Europe, the place the corporate will get about 16% of its income, snacks associated gross sales skyrocketed by 17%. In Latin America, the corporate benefited from an natural progress charge on this class of 6.8%. And within the AMEA (Asia, Center East, and Africa) areas, income jumped by 15.6%. This isn’t to say that the corporate did not profit from different classes. In Latin America, as an illustration, natural cereal income shot up by 9.4%. And within the AMEA areas, natural gross sales popped larger by 24.4%.

As a lot as I want I might say that earnings and money flows have adopted an identical trajectory, that will not be an accurate assertion. Even when we strip out revenue from discontinued operations, we’d have seen internet revenue fall from $1.10 billion to $775 million over this window of time. To be completely honest, that is due partially to rising curiosity expense, however it’s additionally due to different miscellaneous revenue and expense gadgets which have altered profitability over time. If we take a look at simply working revenue, then we’d have seen a rise from $1.38 billion to $1.51 billion throughout this window of time. Different profitability metrics have largely didn’t impress. Working money stream fell from $1.70 billion to $1.65 billion. Even when we regulate for adjustments in working capital, we’d have gotten a drop from $1.70 billion to $1.62 billion. The one actual enchancment got here when taking a look at EBITDA. It managed to develop from $1.85 billion to $2.04 billion.

Creator – SEC EDGAR Information

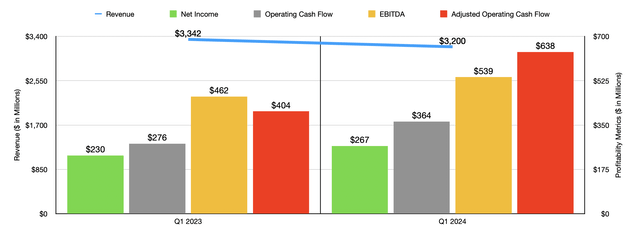

After we take a look at knowledge masking the 2024 fiscal 12 months, we solely have outcomes for the primary quarter. And at first look, this may appear uninspiring as nicely. Income for the corporate truly fell 12 months over 12 months, dropping from $3.34 billion to $3.20 billion. However even this requires some changes. If we regulate for a divestiture that the corporate made final 12 months, the bottom could be barely decrease at $3.32 billion. And if we regulate for international forex fluctuations, gross sales this 12 months would have been just below $3.50 billion. That is an natural progress charge of 5.4% 12 months over 12 months. In keeping with administration, whilst the amount of merchandise declined, the agency benefited from an 8.5% enhance attributable to a mixture of pricing adjustments and adjustments in product combine.

On the underside line, that’s the place we see the actual enhancements. Despite the fact that official income fell, profitability for the corporate improved, with internet revenue climbing from $230 million to $267 million. That is after adjusting for the aforementioned discontinued operations. That is largely the results of an growth of the corporate’s working revenue. In keeping with the information supplied, the corporate’s gross revenue margin rose from 29.4% final 12 months to 32.2% this 12 months. If we use that disparity with the income achieved within the first quarter of 2024, that means an additional pre-tax revenue for shareholders of $89.6 million. This is sensible when you think about the affect that larger pricing sometimes has on low margin companies.

On high of this, it is price noting that working earnings for the corporate would have been even larger had it not been for another elements. Most notably, within the first quarter of this 12 months, the corporate spent $101 million on community optimization actions. That is basically restructuring operations following the spin-off so as to cut back prices in the long term. As a substitute of the 16.1% enhance in profitability that I calculated, had the corporate been in a position to report the adjusted working revenue figures, we’d have seen an working revenue rise of 29.5% 12 months over 12 months. Different profitability metrics for the corporate additionally improved. Working money stream, for starters, jumped from $276 million to $364 million. If we regulate for adjustments in working capital, we get a surge from $404 million to $638 million. And lastly, EBITDA for the enterprise expanded from $462 million to $539 million.

Administration expects natural income to develop by about 3% this 12 months. So it doesn’t seem as if the primary quarter by itself would be the solely time throughout which ends up for the corporate are higher 12 months over 12 months. Adjusted earnings per share are anticipated to return in at between $3.55 and $3.65. That is above the $3.23 per share reported for 2023. This is able to suggest adjusted revenue of about $1.24 billion. Administration additionally stated that working money stream must be round $1.7 billion this 12 months. This could translate to EBITDA of someplace round $2.14 billion.

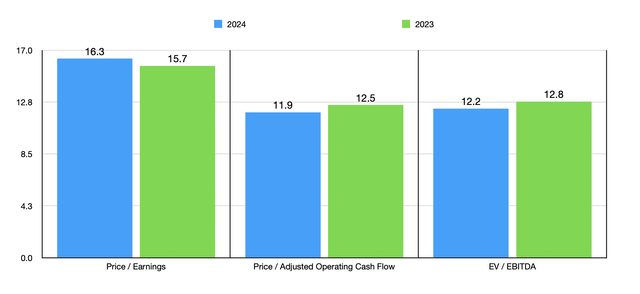

Creator – SEC EDGAR Information

Within the chart above, you may see how these estimates for 2024 and historic outcomes for 2023 give some thought as to what the valuation of the corporate is. This isn’t precisely low cost, however for a high-quality meals operator, that is interesting. Within the desk beneath, I then in contrast Kellanova to 5 related corporations. On a value to working money stream foundation, two of the 5 have been cheaper than it. However when it got here to the opposite two profitability metrics, solely one of many 5 corporations was cheaper than our prospect.

Firm Worth / Earnings Worth / Working Money Circulation EV / EBITDA Kellanova 15.7 12.5 12.8 Tyson Meals (TSN) 54.9 9.1 23.6 McCormick & Firm (MKC) 26.4 14.7 18.2 Hormel Meals (HRL) 21.9 13.2 14.5 Conagra Manufacturers (CAG) 14.7 7.7 12.2 Mondelez Worldwide (MDLZ) 21.5 18.8 13.4 Click on to enlarge

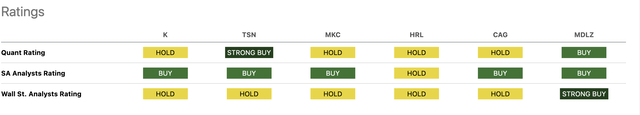

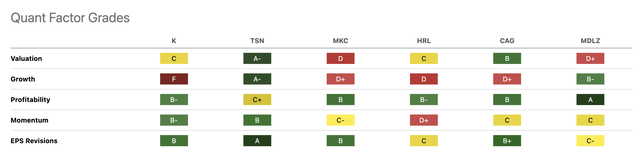

Earlier than I wrap up this text, I want to contact briefly on what different sources consider Kellanova. Within the picture beneath, you may see the score of the inventory in line with not solely the analysts that write for Searching for Alpha and Wall Avenue analysts, but in addition for the Quant Ranking system that Searching for Alpha has established. In comparison with different gamers, the general evaluation of Kellanova is respectable, however removed from nice. Definitely, the chief of the pack could be Mondelez Worldwide, adopted by Tyson Meals. Kellanova, in the meantime, could be tied with McCormick & Firm and Conagra Manufacturers in third place.

Searching for Alpha

Within the subsequent picture beneath, you may see how completely different features of the corporate are weighted by the Quant Ranking system. On valuation, the corporate is respectable, however not nice. And it is truly fairly good when it entails profitability, momentum, and EPS revisions. However the place it actually exhibits up weak is on the expansion facet of issues. If it weren’t for that, it seems to be as if solely Tyson Meals could be rated larger than Kellanova at present is. As I demonstrated, nonetheless, it’s important to dig below the hood for this progress. Precise natural income has been overshadowed by international forex fluctuations and different elements. While you regulate for this, you see that progress for the corporate is sort of stable. That is very true on the underside line, with revenue figures rising at double-digit charges.

Searching for Alpha

Takeaway

From what I can inform, Kellanova is doing a fairly good job at this time limit. Is there room for enchancment? Most definitely there’s. However with how shares are priced in comparison with related corporations and the way nicely the corporate is doing whenever you take away the entire noise, I believe {that a} delicate ‘purchase’ score is completely logical at this time limit.

[ad_2]

Source link