[ad_1]

luoman/E+ by way of Getty Photographs

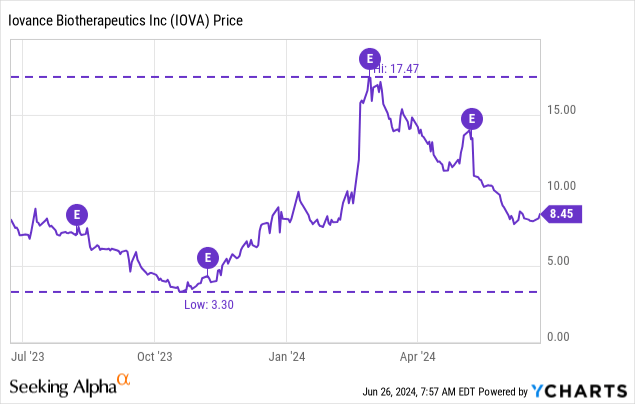

Again in March, I wrote about Iovance Biotherapeutics (NASDAQ:IOVA), score it a maintain because the approval of Amtagvi (lifileucel) had produced a rally however I felt some success may already be mirrored within the value. On this article I have a look at some up to date numbers from the Amtagvi launch, think about timelines for future updates on the launch and have a look at a few of IOVA’s different trials.

Amtagvi launch and earnings updates

Information stream from IOVA has been somewhat quiet these days, however whereas the launch of Amtagvi (authorized on February 16, 2024) is a current growth, the corporate has reported on the variety of sufferers enrolled (ie about to be or being handled with Amtagvi). For instance, as of Q1’24 earnings, reported on Might 9, the corporate reported it already had 100+ sufferers enrolled (for remedy with Amtagvi, we’re not speaking about enrolled for a scientific trial).

Since approval, greater than 100 sufferers have enrolled for Amtagvi remedy. The primary sufferers have been efficiently handled and the steadiness are transferring via the levels of the journey, which incorporates surgical procedure for cell assortment, manufacturing, and the Amtagvi remedy routine.

Feedback from IOVA, Might 9, 2024, earnings press launch.

As such, IOVA had 100 or extra sufferers enrolled for remedy within the 83 days (February 16 to Might 9) since approval. Seeing if the speed of sufferers enrolled for remedy grows, as the corporate brings extra Licensed Remedy Facilities (ATCs) onboard, might be vital to gauge the power of the launch.

In any case whereas there have been scant revenues in Q1’24, simply $0.7M coming from gross sales of Proleukin, that is not shocking given it takes time to go from making the choice to deal with a affected person with Amtagvi, at which level they’d be mirrored within the 100+ quantity reported above, to then procuring tissue to organize the product, to then infusing the product and many others. Q2’24 revenues nevertheless may begin to replicate some Amtagvi gross sales.

…ATCs have enrolled greater than 100 sufferers for Amtagvi remedy. A affected person enrollment is outlined as an Amtagvi remedy determination by the supplier and affected person. The affected person enrollment is adopted by industrial payer, prior authorization and a scheduled tumor procurement for manufacturing. Based mostly on the affected person journey timeline Amtagvi infusion for at present enrolled sufferers would seemingly happen throughout the second quarter and early third quarter.

Jim Ziegler, Govt Vice President, industrial, IOVA, Q1’24 earnings name.

Nonetheless, given the delays between enrolling a affected person for remedy and recognizing revenues, wanting on the variety of sufferers enrolled for remedy will stay a extra delicate metric to trace the launch in its early days.

There is no such thing as a assure nevertheless, of needing to attend for Q2’24 earnings (Q2’23 earnings got here on August 8 final yr) for a cloth replace on the Amtagvi launch that would transfer the inventory. As a substitute we might see additional updates on sufferers enrolled for remedy earlier than then, and even a preliminary Q2’24 income quantity following the tip of the Q2’24.

IOVA pipeline updates

Outdoors of updates on the launch of Amtagvi within the US, progress in the direction of approval ex-US is a possible catalyst for IOVA. For instance, the corporate is planning to submit for approval of Amtagvi in superior melanoma within the EU in Q2’24, which represents a near-term catalyst. I do suppose nevertheless that on the regulatory entrance, a extra main catalyst would relate to approval of Amtagvi in ex-US territories, reasonably than merely submitting for approval.

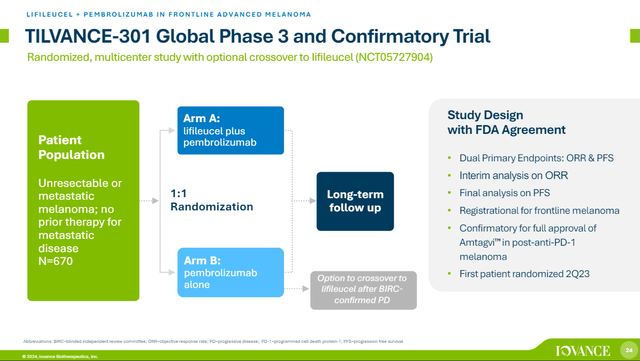

Outdoors of the present indication, IOVA’s part 3 TILVANCE-301 research appears at Amtagvi with pembrolizumab in frontline superior melanoma, and represents a bigger market. That research hadn’t accomplished enrolment but however the announcement of enrolment updates or completion would supply an apparent catalyst.

Overview of TILVANCE-301 research. (IOVA Company Presentation, Might 2024.)

For the reason that trial has been enrolling for over a yr now, the concept of some type of replace on progress with future earnings studies does not appear out of the image. That being stated, 670 sufferers is not a small research so I am not anticipating to listen to completion of enrollment in 2024.

In non-small cell lung most cancers (NSCLC), IOVA’s IOV-LUN-202 research of lifileucel will not full enrolment of key cohorts till 2025, and a research of lifileucel in endometrial most cancers is barely set to provoke this quarter. As such updates from these research in all probability aren’t a near-term catalyst.

Monetary Overview

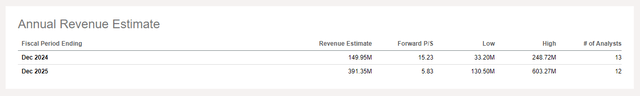

IOVA had money, money equivalents, short-term investments of $356.2M as of March 31, 2024. The corporate additionally had $6.4M in restricted money on the finish of Q1’24. R&D bills had been $79.8M in Q1’24 and SG&A bills had been $31.4M. IOVA reported a web lack of $113M for Q1’24 with web money utilized in working actions of $122.3M in the identical quarter. On the present charge of burn then, IOVA can be out of money in slightly below three quarters, or by the tip of 2024. After all with the launch of Amtagvi, the corporate has the potential to usher in substantial revenues, effectively past the $0.7M seen in Q1’24. Certainly analyst estimates put IOVA’s 2024 revenues at about $150M at present (vary $33.2M to $248.7M)

Income estimates for IOVA for 2024 and 2025. (In search of Alpha Earnings tab for IOVA.)

In consequence, I do not see one other elevate of money as a certainty for IOVA, and the corporate could possibly push in the direction of breakeven earlier than money runs down if the Amtagvi launch goes effectively. For instance, 100 sufferers in remedy at $515K per remedy, even when a remedy is barely ready efficiently for 90% of sufferers, might yield $46.4M in revenues. Certainly IOVA’s Might company presentation (slide 37) notes it expects money to final “effectively into” H2’25 taking into consideration Amtagvi/Proleukin revenues.

As of Might 2, 2024, there have been 279,832,722 shares excellent and a market cap of $2.36B at present ($8.45 per share).

Conclusions, ratting and dangers

On the time of my earlier article IOVA was buying and selling with a market cap of $4.2B and had reported 20+ sufferers in course of. Now IOVA studies 100+ sufferers enrolled for remedy, a market cap of $2.4B, an enterprise worth of about $2B, and an EV/gross sales (2025) a number of of 5.1 (utilizing the present 2025 income estimate of $391M). The valuation right here appears a bit extra palatable now though these income estimates might change fairly a bit given the early stage of this drug launch. Nonetheless the pattern for IOVA has been down these days, and there’s nonetheless room to fall if subsequent updates on the Amtagvi launch disappoint.

I can not assist however suppose it is likely to be attainable to get IOVA even cheaper than present costs, though I hardly view IOVA as a compelling brief, and so I nonetheless charge the identify a maintain.

The dangers of holding IOVA are a number of fold, a number of of which I will point out right here. Firstly, if IOVA does not meet timelines for submitting for Amtagvi approval within the EU, after which the UK and Canada, the inventory might fall. Delays in launching in new markets transfer potential revenues additional out.

Secondly, if IOVA’s updates on the Amtagvi launch do not recommend development from preliminary charges of enrollment for remedy, and even recommend a slowing, then the inventory might dump.

Lastly, if there are delays in enrolling any of IOVA’s research, or initiating research such because the endometrial most cancers research of lifileucel, then IOVA’s inventory might commerce down.

[ad_2]

Source link