[ad_1]

champpixs

We expressed our bearishness on the PIMCO Dynamic Earnings Fund (NYSE:PDI) three months in the past attributable to its 12.41% premium on the time, which appeared fairly wealthy. Furthermore, Howard Marks of Oaktree had warned that the loans by which PDI primarily invests are most likely on the lowest high quality they’ve seen in a few years. In the meantime, Ares Capital’s (ARCC) CEO had simply warned that defaults within the trade had been seemingly going to extend this 12 months with liquidity getting tighter and tighter. The fund’s excessive leverage and its 1.92% administration charge mixed to make it a possible catastrophe ready to occur. Since then, the fund has held up pretty effectively, delivering a complete return of two.52%. Whereas this has trailed the S&P 500’s 4.18% return over that interval and lagged our personal portfolio’s efficiency significantly, it’s nonetheless a greater return than our promote ranking would have implied.

Nevertheless, our name was based mostly on a a lot longer-term outlook, and by and huge, the financial system has hung powerful over these three months. We expect that over the subsequent a number of years, the risk-reward outlook for the financial system’s well being is way weaker, as we are going to define on this article. Because of this, provided that its premium to NAV has solely elevated over that interval to now 13.28%, and its portfolio composition stays extraordinarily dangerous with a heavy weighting on sub-investment grade and even non-rated loans which can be closely leveraged at 38.56%, we expect that it’s a very unattractive funding on a risk-adjusted foundation.

Why PDI Is Dealing with Extreme Macroeconomic Headwinds

The macroeconomic alerts that suggest bother forward for a portfolio full of low-quality, junk, and non-rated loans embody the next:

1. The yield curve mannequin signifies a really excessive threat of recession.

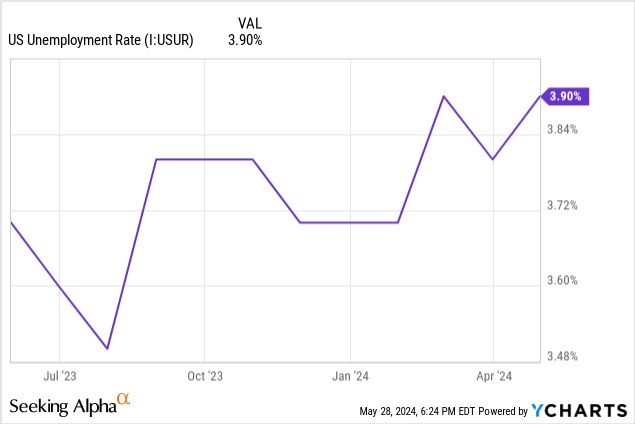

2. The US unemployment fee has ticked up considerably over the previous 12 months, significantly since final August, rising from about 3.5% to three.9%.

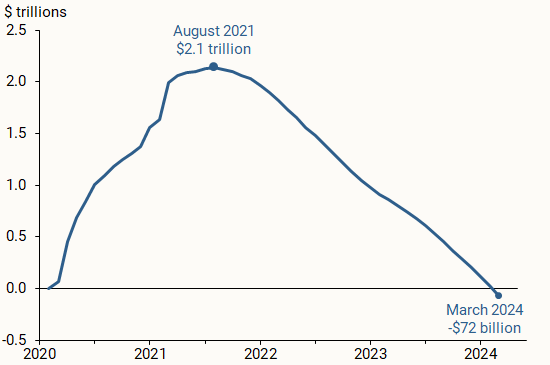

3. Inflation has remained stubbornly excessive, stopping the Fed from having the pliability to chop rates of interest. The longer rates of interest stay excessive, the extra middle-market firms and different smaller, lower-quality companies to which PDI tends to lend can have a tough time assembly their curiosity obligations, particularly with their revenue margins being pinched by persistent inflation. Because of this PDI might very effectively start to see a spike in defaults within the close to future. Moreover, these firms will seemingly have a tough time rising as they’ve up to now, for the reason that $2.1 trillion pandemic-era extra financial savings in August 2021 have now turned damaging to $72 billion.

Cumulative pandemic-era extra financial savings (San Francisco Fed)

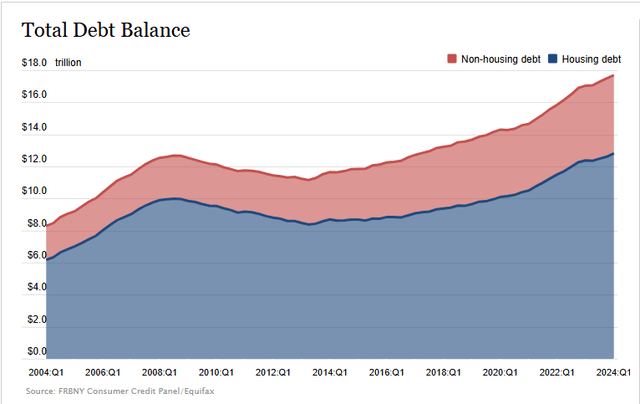

4. Furthermore, each non-housing and housing debt proceed to push to new highs, with non-housing debt quickly approaching $18 trillion and housing debt at practically $13 trillion.

FRBNY

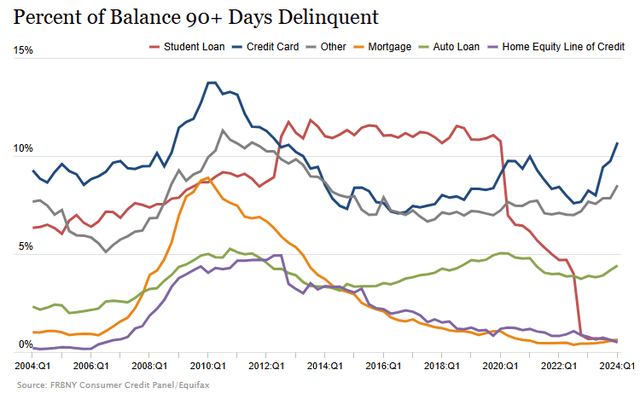

5. Moreover, the % of balances 90 days plus delinquent have spiked larger throughout a number of classes, together with bank card debt, which is now effectively over 10% delinquencies, auto mortgage debt, which is quickly approaching 5%, and different classes that are pushing north of 8%.

FRBNY

Because the San Francisco Fed places it, shopper spending, which has till just lately been a robust driving drive for the US financial system, might face main headwinds from the excessive ranges of shopper debt mixed with the shortage of extra financial savings and better for longer rates of interest. That is particularly regarding when mixed with the rising unemployment fee. Because of this, whereas family debt elevated by a whopping $184 billion in Q1 and delinquency transition charges have elevated throughout all debt sorts just lately in line with the Federal Reserve Financial institution of New York, this might simply be an indication of issues to come back, probably resulting in an ideal storm for the financial system.

On condition that PDI already trades at a big premium to NAV and through instances of extra bearish sentiment, together with even within the final 52 weeks, it might probably commerce at significant reductions to NAV, which it most actually would within the occasion of an financial downturn the place defaults spike and its NAV plunges, we see PDI at a excessive threat of considerably underwhelming buyers from a complete return standpoint. Once you think about its very excessive leverage, the dangers are even higher. In the meantime, the upside potential is pretty weak as we see few catalysts that will immediate its valuation a number of to increase from right here, and its expense ratio will even weigh on returns.

Investor Takeaway

On account of these macro headwinds and the valuation headwinds and excessive leverage and charges on the fund stage, we fee PDI a Promote and like to avoid the low-quality lending area in the intervening time. If we had been to put money into it, we would favor investing in BDCs which have high quality underwriting groups, supply even higher dividend yields, and commerce at steep reductions to NAV, reminiscent of FS KKR (FSK).

[ad_2]

Source link