[ad_1]

Up to date on August nineteenth, 2024 by Bob Ciura

Shares with low P/E ratios can provide engaging returns if their valuation multiples develop. And when a low P/E inventory additionally has a excessive dividend yield, traders get ‘paid to attend’ for the valuation a number of to extend.

On this analysis report, we focus on the prospects of 20 undervalued excessive dividend shares, that are at the moment buying and selling at P/E ratios underneath 15 and are providing dividend yields above 5.0%.

Now we have ranked the shares by P/E ratio, from lowest to highest. For REITs, we use P/FFO instead of the P/E ratio. And for MLPs, we use P/DCF (which is distributable money flows). These are comparable metrics much like earnings for widespread shares.

Moreover, the free excessive dividend shares checklist spreadsheet under has our full checklist of particular person securities (shares, REITs, MLPs, and many others.) with with 5%+ dividend yields.

Desk of Contents

Hold studying to see evaluation on these 20 undervalued excessive dividend shares.

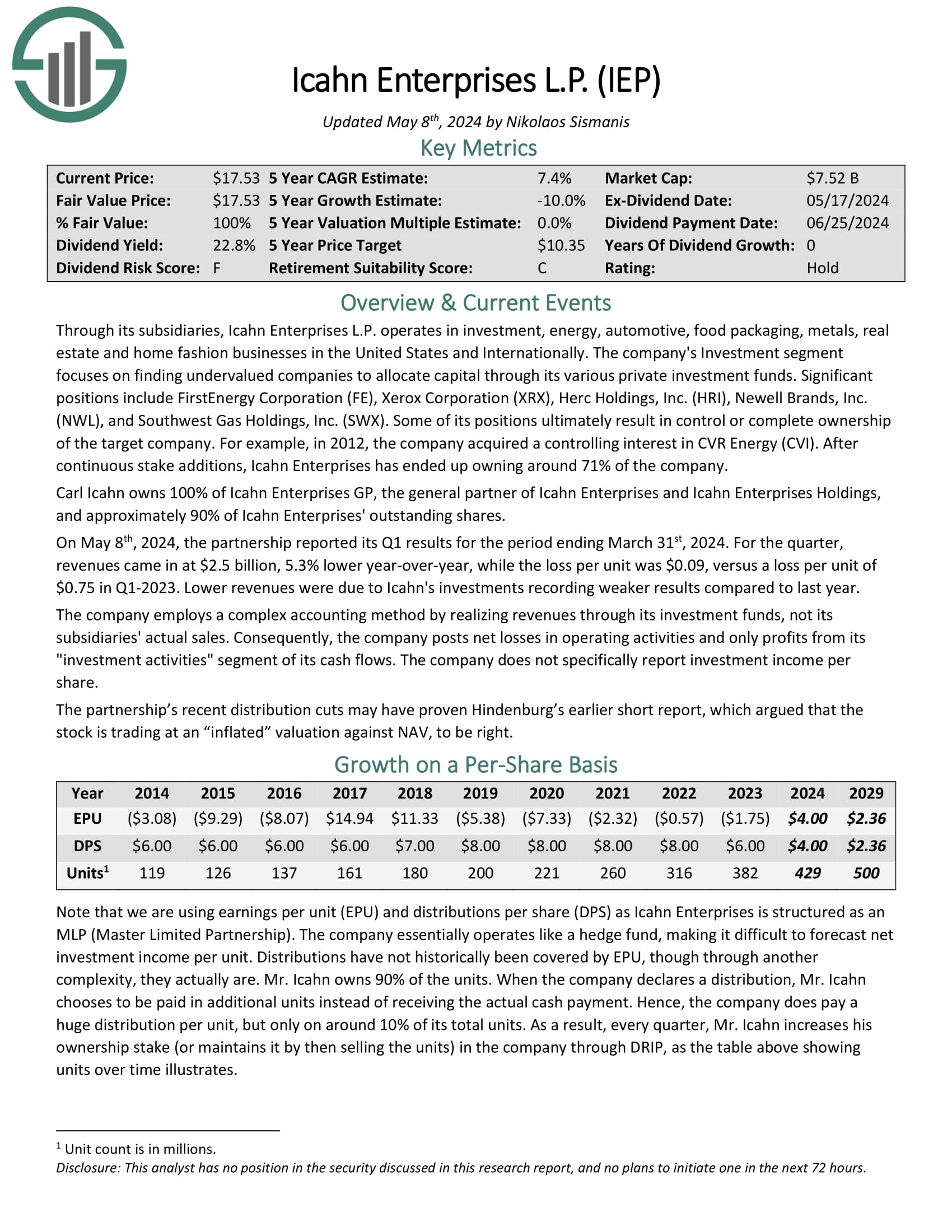

Undervalued Excessive Dividend Inventory #1: Uniti Group (UNIT) – P/E ratio of two.9

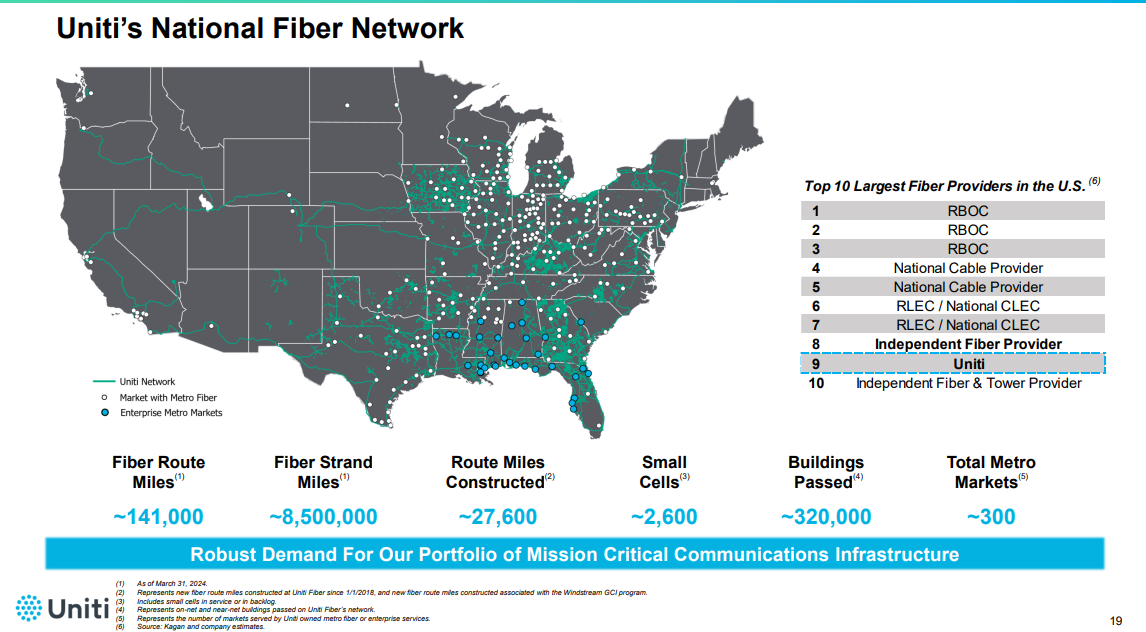

Uniti Group focuses on buying, establishing, and leasing out communications infrastructure in america.

Specifically, it owns thousands and thousands of miles of fiber strand together with different communications actual property.

Supply: Investor Presentation

Uniti Group reported stable outcomes for the primary quarter of 2024, with consolidated revenues reaching $286.4 million. Web revenue stood at $41.3 million, and adjusted EBITDA amounted to $228.6 million, reaching adjusted EBITDA margins of roughly 80%. The core recurring strategic fiber enterprise grew by 4% in comparison with the identical interval in 2023.

Uniti Fiber contributed $68.8 million in revenues and $23.8 million in Adjusted EBITDA for the quarter, whereas Uniti Leasing contributed $217.6 million in revenues and $210.7 million in Adjusted EBITDA.

Click on right here to obtain our most up-to-date Certain Evaluation report on UNIT (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #2: Japanese Bancshares (EBC) – P/E ratio of three.6

Japanese Bankshares, Inc. operates because the financial institution holding firm for Japanese Financial institution that gives banking services primarily to retail, industrial, and small enterprise prospects. The corporate supplies deposit accounts, curiosity checking accounts, cash market accounts, financial savings accounts, and time certificates of deposit accounts.

It additionally provides industrial and industrial, industrial actual property and building, small enterprise, residential actual property, and residential fairness loans.

On July fifteenth, 2024 Cambridge Bancorp (CATC) merged with Japanese Bankshares, Inc. (EBC).

Undervalued Excessive Dividend Inventory #3: Walgreens Boots Alliance (WBA) – P/E ratio of three.8

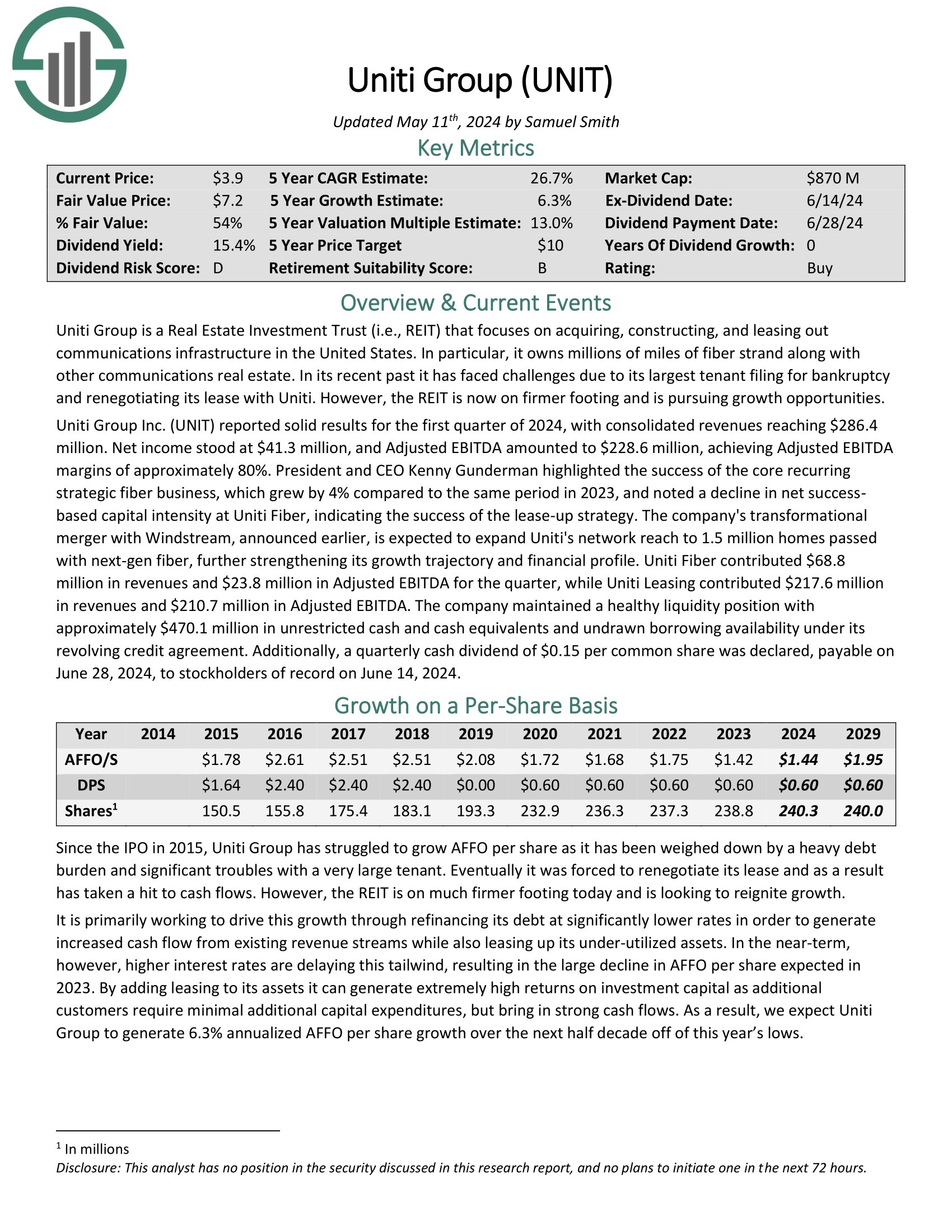

Walgreens Boots Alliance is the most important retail pharmacy in each america and Europe. By its flagship Walgreens enterprise and different enterprise ventures, the $13 billion market cap firm has a presence in 9 nations, employs greater than 330,000 folks and has about 12,500 shops within the U.S., Europe, and Latin America.

On June twenty seventh, 2024, Walgreens reported outcomes for the third quarter of fiscal 2024. Gross sales grew 3% however earnings-per share decreased 36% over final 12 months’s quarter, from $0.99 to $0.63, as a result of intense competitors, which has eroded revenue margin.

Supply: Investor Presentation

Earnings-per-share missed the analysts’ consensus by $0.08. Walgreens has exceeded the analysts’ estimates in 13 of the final 16 quarters.

Nevertheless, because the pandemic has subsided and competitors has heated within the retail pharmaceutical business, Walgreens is going through powerful comparisons. It lowered its steering for earnings-per-share in 2024 from $3.20-$3.35 to $2.80-$2.95. Accordingly, now we have lowered our forecast from $3.28 to $2.87.

Click on right here to obtain our most up-to-date Certain Evaluation report on WBA (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #4: Medical Properties Belief (MPW) – P/E ratio of 4.1

Medical Properties Belief is the one pure-play hospital REIT right now. It owns a portfolio of over 400 properties that are leased to over 30 totally different operators.

The vast majority of the belongings are normal acute care hospitals, but in addition embrace inpatient rehabilitation and long-term acute care.

The portfolio of belongings can be diversified throughout totally different geographies with properties in 29 states, in addition to Germany, the UK, Italy, and Australia.

Supply: Investor Presentation

Medical Properties Belief, Inc. (MPW) introduced its monetary and operational outcomes for the primary quarter. The corporate executed whole liquidity transactions of $1.6 billion year-to-date, reaching 80% of its preliminary FY 2024 goal.

Regardless of recording a web lack of ($1.23) per share and Normalized Funds from Operations (NFFO) of $0.24 per share within the first quarter of 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on MPW (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #5: Icahn Enterprises LP (IEP) – P/E ratio of 4.2

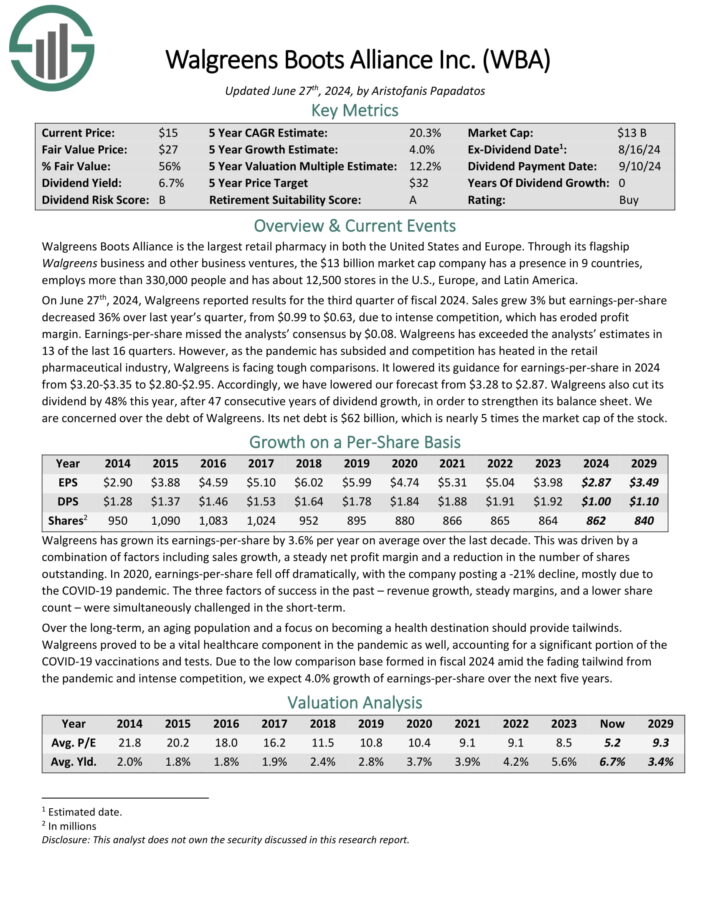

Icahn Enterprises L.P. operates in funding, vitality, automotive, meals packaging, metals, actual property, and residential vogue companies in america and Internationally.

The corporate’s Funding section focuses on discovering undervalued corporations to allocate capital via its varied non-public funding funds.

Vital positions embrace FirstEnergy Company (FE), Xerox Company (XRX), Herc Holdings, Inc. (HRI), Newell Manufacturers, Inc. (NWL), and Southwest Gasoline Holdings, Inc. (SWX).

Carl Icahn owns 100% of Icahn Enterprises GP, the overall associate of Icahn Enterprises and Icahn Enterprises Holdings, and roughly 95% of Icahn Enterprises’ excellent shares.

On Might eighth, 2024, the partnership reported its Q1 outcomes for the interval ending March thirty first, 2024. For the quarter, revenues got here in at $2.5 billion, 5.3% decrease year-over-year, whereas the loss per unit was $0.09, versus a loss per unit of $0.75 in Q1-2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on IEP (preview of web page 1 of three proven under):

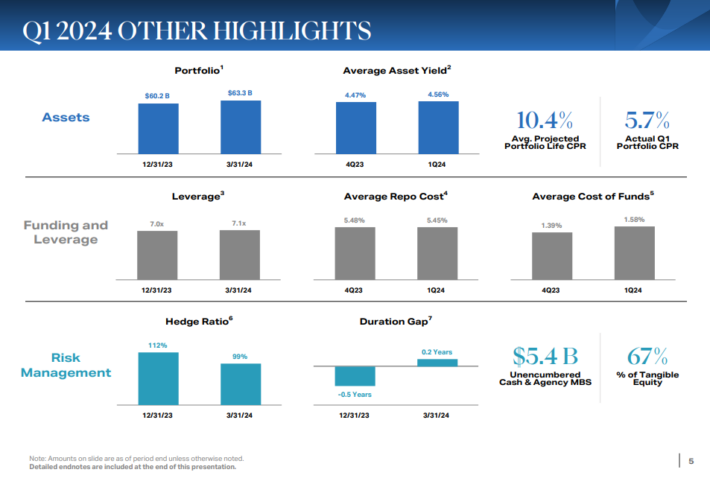

Undervalued Excessive Dividend Inventory #6: AGNC Funding Company (AGNC) – P/E ratio of 4.6

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage cross–via securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

AGNC Funding’s first-quarter non-GAAP earnings continued their downward pattern amid the corporate’s operation in a better rate of interest atmosphere.

Supply: Investor Presentation

Q1 web unfold and greenback roll revenue per share of $0.58, barely surpassing expectations, declined from earlier quarters.

The quarter’s earnings excluded an estimated “catch-up” premium amortization profit. Tangible web e book worth per widespread share elevated to $8.84, though the financial return on tangible widespread fairness declined.

Click on right here to obtain our most up-to-date Certain Evaluation report on AGNC Funding Corp (AGNC) (preview of web page 1 of three proven under):

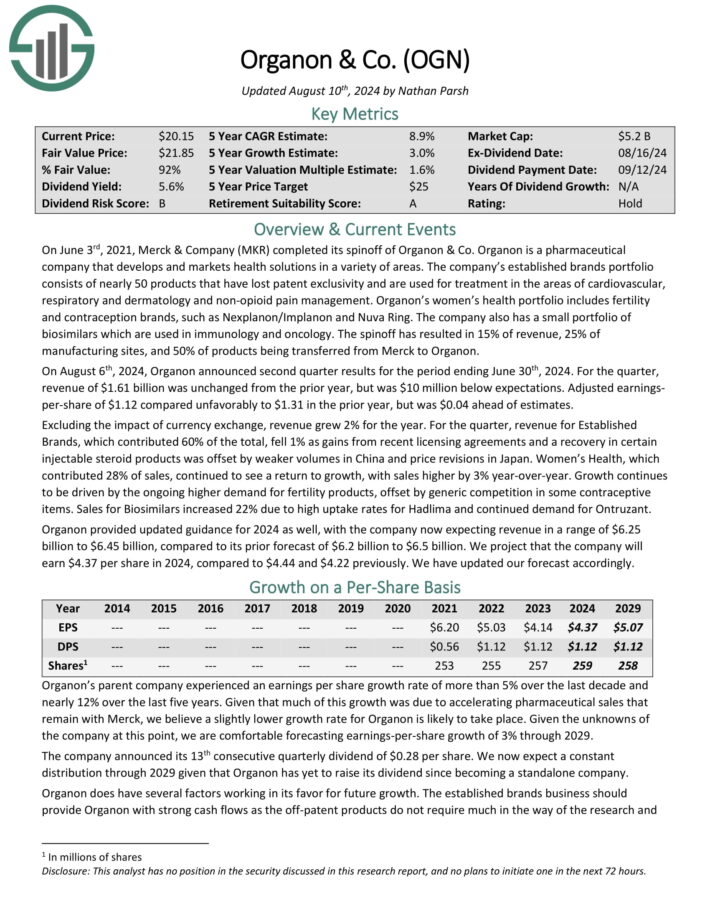

Undervalued Excessive Dividend Inventory #7: Organon & Co. (OGN) – P/E ratio of 4.7

Supply: Investor Displays

On August sixth, 2024, Organon introduced second quarter outcomes for the interval ending June thirtieth, 2024. For the quarter, income of $1.61 billion was unchanged from the prior 12 months, however was $10 million under expectations.

Adjusted earnings per-share of $1.12 in contrast unfavorably to $1.31 within the prior 12 months, however was $0.04 forward of estimates. Excluding the affect of foreign money change, income grew 2% for the 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on Organon (preview of web page 1 of three proven under):

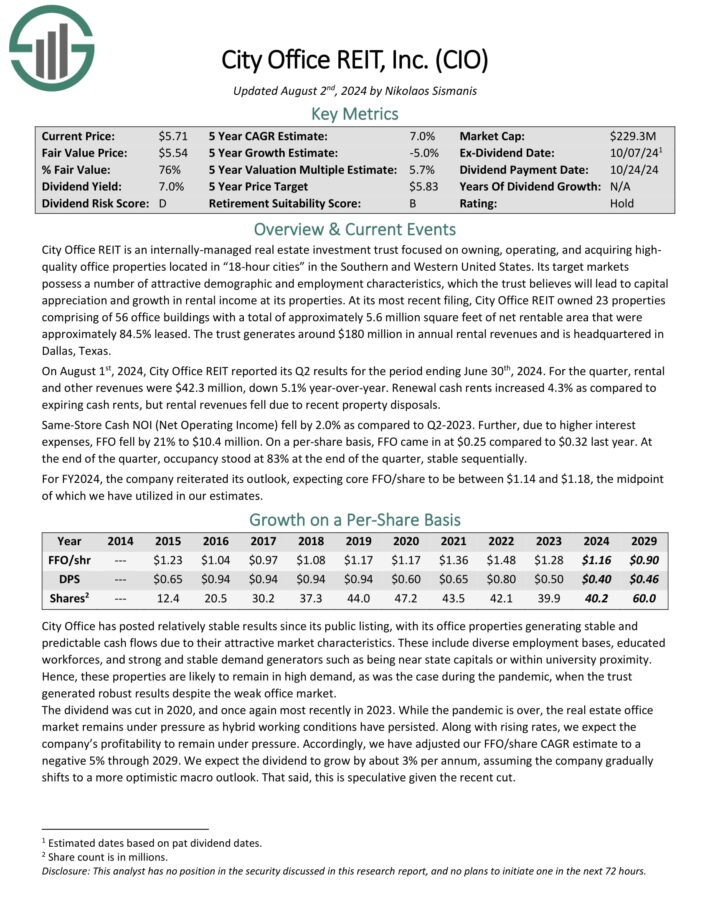

Undervalued Excessive Dividend Inventory #8: Metropolis Workplace REIT (CIO) – P/E ratio of 4.7

Metropolis Workplace REIT is an internally-managed actual property funding belief centered on proudly owning, working, and buying prime quality workplace properties positioned in “18-hour cities” within the Southern and Western United States.

Its goal markets possess a variety of engaging demographic and employment traits, which the belief believes will result in capital appreciation and progress in rental revenue at its properties.

At its most up-to-date submitting, Metropolis Workplace REIT owned 23 properties comprising of 56 workplace buildings with a complete of roughly 5.6 million sq. ft of web rentable space that had been roughly 84.5% leased.

On August 1st, 2024, Metropolis Workplace REIT reported its Q2 outcomes for the interval ending June thirtieth, 2024. For the quarter, rental and different revenues had been $42.3 million, down 5.1% year-over-year. Renewal money rents elevated 4.3% as in comparison with expiring money rents, however rental revenues fell as a result of latest property disposals.

Identical-Retailer Money NOI (Web Working Earnings) fell by 2.0% as in comparison with Q2-2023. Additional, as a result of greater curiosity bills, FFO fell by 21% to $10.4 million. On a per-share foundation, FFO got here in at $0.25 in comparison with $0.32 final 12 months. On the finish of the quarter, occupancy stood at 83% on the finish of the quarter, steady sequentially.

Click on right here to obtain our most up-to-date Certain Evaluation report on CIO (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #9: ARMOUR Residential REIT (ARR) – P/E ratio of 4.8

ARMOUR Residential invests in residential mortgage-backed securities that embrace U.S. Authorities-sponsored entities (GSE) akin to Fannie Mae and Freddie Mac.

It additionally consists of Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate house loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different varieties of investments.

ARMOUR’s first-quarter 2024 outcomes confirmed GAAP web revenue out there to widespread stockholders of $11.5 million or $0.24 per widespread share, with web curiosity revenue amounting to $5.3 million.

Distributable Earnings out there to widespread stockholders stood at $40.4 million, representing $0.82 per widespread share. The corporate paid widespread inventory dividends of $0.24 per share per thirty days or $0.72 per share for the primary quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #10: Power Switch LP (ET) – P/E ratio of 5.3

Power Switch owns and operates one of many largest and most diversified portfolios of vitality belongings in america.

Operations embrace pure gasoline transportation and storage together with crude oil, pure gasoline liquids, refined product transportation, and storage totaling 83,000 miles of pipelines.

Power Switch operates with a primarily fee-based mannequin, which considerably mitigates the sensitivity of the MLP to commodity costs.

Supply: Investor Presentation

In early Might, Power Switch reported (5/8/24) monetary outcomes for the primary quarter of fiscal 2024. It grew its volumes in all of the segments and achieved document crude oil transportation volumes.

Consequently, distributable money movement grew 17% over the prior 12 months’s quarter. Power Switch posted a wholesome distribution protection ratio of two.2x for the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on ET (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #11: TriplePoint Enterprise Progress BDC (TPVG) – P/E ratio of 5.3

TriplePoint Enterprise Progress BDC Corp focuses on offering capital and guiding corporations throughout their non-public progress stage, earlier than they ultimately IPO to the general public markets.

Supply: Investor Presentation

On Might 1st, 2024, the corporate posted its Q1 outcomes. For the quarter, whole funding revenue of $29.3 million in comparison with $33.6 million in Q1-2023.

The lower in whole funding was primarily as a result of a decrease weighted common principal quantity excellent on the BDC’s income-bearing debt funding portfolio. The variety of portfolio corporations fell from 59 final 12 months to 49.

The corporate’s weighted common annualized portfolio yield got here in at 15.4% for the quarter, up from 14.7% within the prior-year interval.

Additionally throughout Q1, the corporate funded $13.5 million in debt investments to 3 portfolio corporations with a 14.3% weighted common annualized yield at origination.

Click on right here to obtain our most up-to-date Certain Evaluation report on TPVG (preview of web page 1 of three proven under):

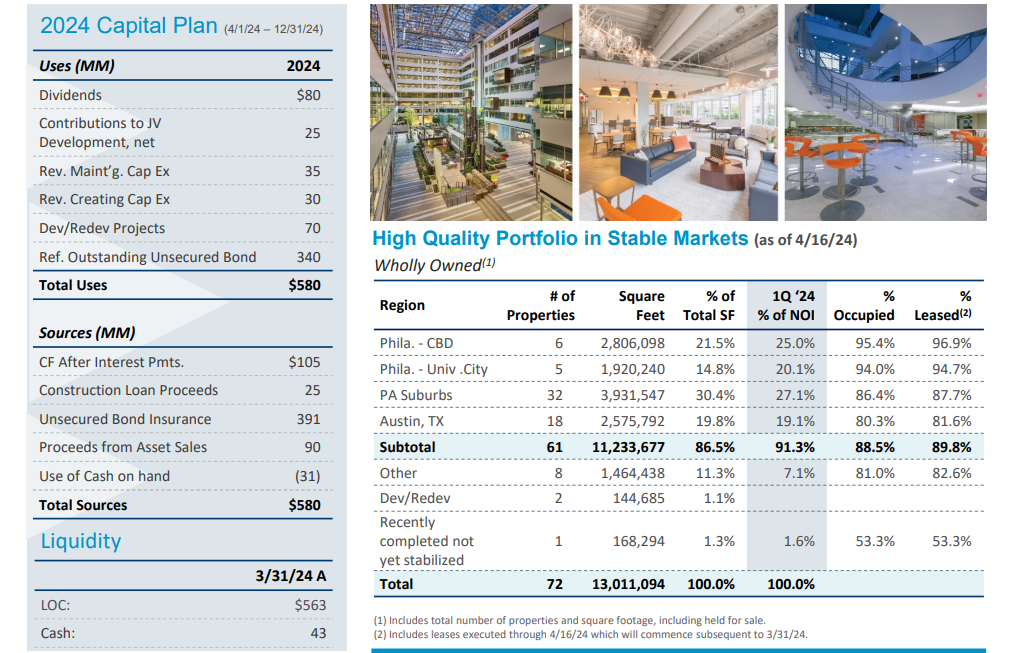

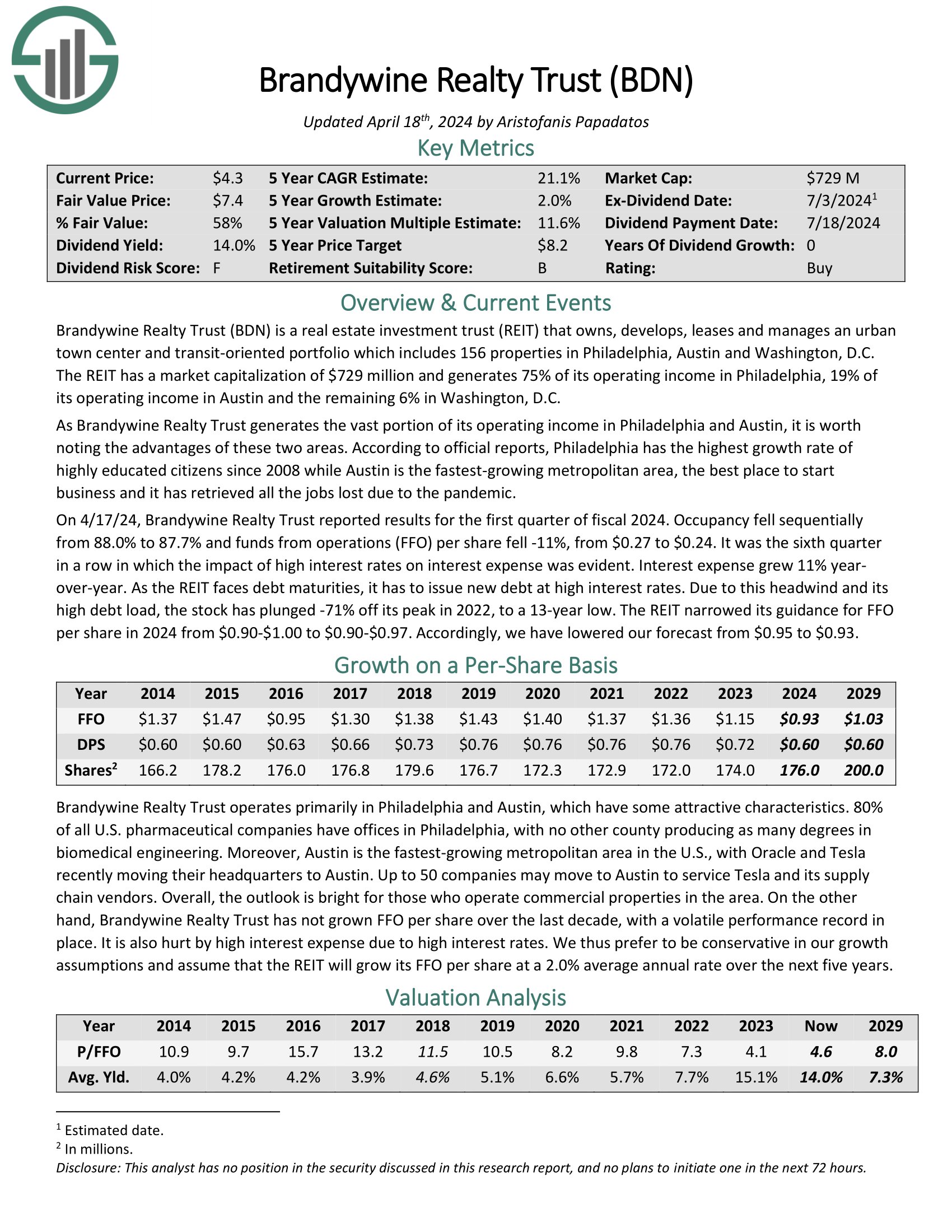

Undervalued Excessive Dividend Inventory #12: Brandywine Realty Belief (BDN) – P/E ratio of 5.4

Brandywine Realty owns, develops, leases and manages an city city middle and transit-oriented portfolio which incorporates 163 properties in Philadelphia, Austin, and different cities.

The REIT generates most of its working revenue in Pennsylvania, with the rest in Austin, TX and varied different markets.

Supply: Investor Presentation

On 4/17/24, Brandywine Realty Belief reported outcomes for the primary quarter of fiscal 2024. Occupancy fell sequentially from 88.0% to 87.7% and funds from operations (FFO) per share fell -11%, from $0.27 to $0.24.

It was the sixth quarter in a row through which the affect of excessive rates of interest on curiosity expense was evident. Curiosity expense grew 11% year-over-year. Because the REIT faces debt maturities, it has to subject new debt at excessive rates of interest.

Click on right here to obtain our most up-to-date Certain Evaluation report on BDN (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #13: Lincoln Nationwide Corp. (LNC) – P/E ratio of 5.4

Lincoln Nationwide Company provides life insurance coverage, annuities, retirement plan companies and group safety. The company was based in 1905.

Lincoln Nationwide reported second quarter 2024 outcomes on August 1st, 2024, for the interval ending June thirtieth, 2024. The corporate generated web revenue of $5.11 per share within the quarter, which in contrast favorably to $2.94 within the second quarter of 2023. Adjusted revenue from operations equaled $1.84 per share in comparison with $2.02 in the identical prior 12 months interval.

Moreover, annuities common account balances rose by 6.8% to $158 billion and group safety insurance coverage premiums grew 2.8% to $1.3 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on LNC (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #14: Ford Motor Co. (F) – P/E ratio of 5.5

Ford Motor Firm was first included in 1903 and prior to now 120 years, it has turn out to be one of many world’s largest automakers. It operates a big financing enterprise in addition to its core manufacturing division, which produces a preferred assortment of vehicles, vans, and SUVs. Ford may produce $170+ billion in income this 12 months and it trades with a $40 billion market capitalization.

Ford posted second quarter earnings on July twenty fourth, 2024, and outcomes had been considerably weaker than anticipated. Adjusted earnings-per-share got here to 47 cents, which was 21 cents worse than anticipated. Automotive income was $44.81 billion, which was up 5.6% year-on-year, however $70 million decrease than anticipated.

The corporate’s margins eroded within the second quarter as elevated guarantee prices and losses related to its unsuccessful EV division. Administration famous the corporate is working to enhance high quality and cut back complexity, which ought to assist over time to rebuild margins.

Industrial gross sales had been up 2.9%, however adjusted EBIT plummeted from $2.8 billion to $1 billion year-over-year. Adjusted free money movement was up $300 million to $3.2 billion. Gross sales of hybrid automobiles rose 34% year-over-year, or 9% of whole quantity globally.

Click on right here to obtain our most up-to-date Certain Evaluation report on Ford Motor (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #15: Nice Elm Capital (GECC) – P/E ratio of 5.8

Nice Elm Capital Company is a enterprise growth firm that makes a speciality of mortgage and mezzanine, center market investments.

It seeks to create long-term shareholder worth by constructing its enterprise throughout three verticals: Working Firms, Funding Administration, and Actual Property.

The corporate favors investing in media, healthcare, telecommunication companies, communications tools, industrial companies and provides.

Supply: Investor Presentation

Within the 2024 first quarter, Nice Elm Capital reported whole funding revenue of $1.03 per share. Nevertheless, GECC additionally reported web realized and unrealized losses of roughly $3.7 million, or $0.42 per share, throughout this era.

GECC deployed roughly $64.2 million into 29 investments at a weighted common present yield of 12.5% throughout the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on GECC (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #16: Piedmont Workplace Realty Belief (PDM) – P/E ratio of 5.9

Piedmont Workplace Realty Belief, Inc. owns, manages, develops, redevelops, and operates high-quality workplace properties positioned primarily in sub-markets inside seven main Japanese U.S. workplace markets.

The corporate derives most of its revenues from U.S. authorities entities, enterprise companies corporations, and monetary establishments within the Sunbelt area. PDM is absolutely built-in and self-managed. The corporate has native administration places of work in every of their markets.

On July twenty sixth, 2023, Piedmont Workplace Realty slashed its quarterly dividend by 41% to $0.125, as elevated curiosity expense weighed closely on its outcomes.

On July thirty first, 2024, Piedmont reported second quarter 2024 outcomes. The corporate reported core funds from operations (FFO) of $0.37 per share for the quarter, an 18% lower in comparison with final 12 months’s ends in the second quarter, principally as a result of a rise in curiosity expense.

PDM noticed a 3.7% improve in identical retailer web working revenue on an accrual foundation throughout Q2. The corporate leased 1.04M sq. ft within the quarter, together with 404K sq. ft of recent tenant leasing. As of June thirtieth, 2024, roughly 1.6 million sq. ft of executed leases had been but to start or underneath rental abatement.

Click on right here to obtain our most up-to-date Certain Evaluation report on Piedmont Workplace (PDM) (preview of web page 1 of three proven under):

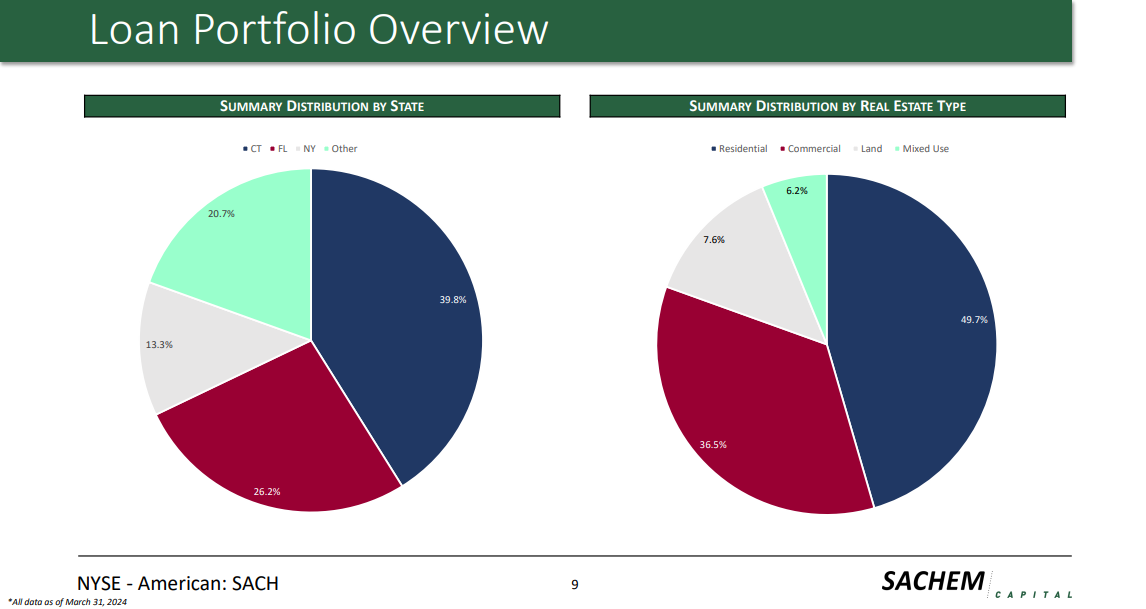

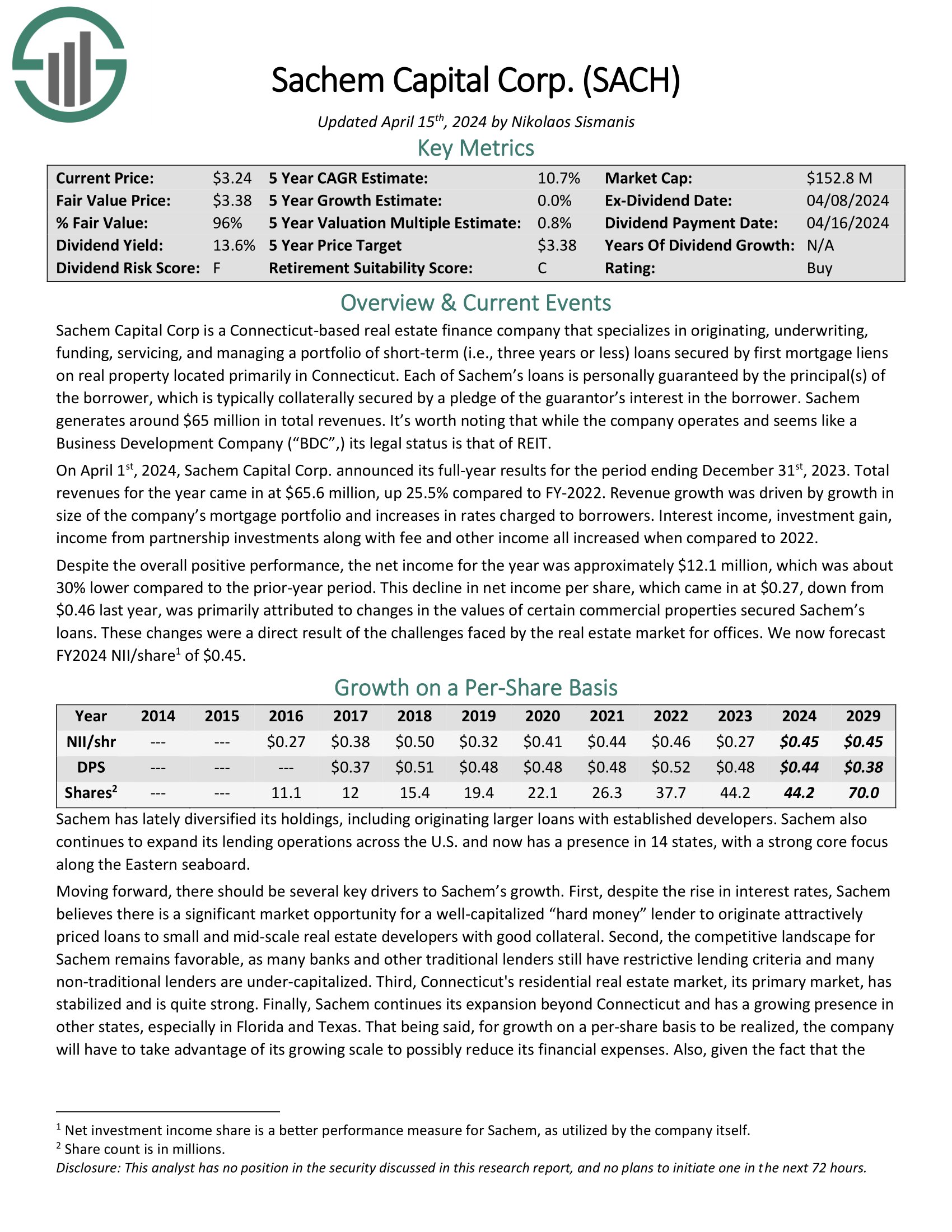

Undervalued Excessive Dividend Inventory #17: Sachem Capital (SACH) – P/E ratio of 5.9

Sachem Capital Corp is a Connecticut-based actual property finance firm that makes a speciality of originating, underwriting, funding, servicing, and managing a portfolio of short-term (i.e., three years or much less) loans secured by first mortgage liens on actual property positioned primarily in Connecticut.

Every of Sachem’s loans is personally assured by the principal(s) of the borrower, which is often collaterally secured by a pledge of the guarantor’s curiosity within the borrower. Sachem generates round $65 million in whole revenues.

Supply: Investor Presentation

On April 1st, 2024, Sachem Capital Corp. introduced its full-year outcomes for the interval ending December thirty first, 2023. Whole revenues for the 12 months got here in at $65.6 million, up 25.5% in comparison with FY-2022.

Income progress was pushed by progress in measurement of the corporate’s mortgage portfolio and will increase in charges charged to debtors.

Click on right here to obtain our most up-to-date Certain Evaluation report on SACH (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #18: Alliance Useful resource Companions LP (ARLP) – P/E ratio of 6.0

Alliance Useful resource Companions is the second–largest coal producer within the jap United States. Its major operations are producing and advertising and marketing coal to main home and worldwide utility customers.

Nevertheless, the corporate additionally owns mineral and royalty pursuits in premier oil & gasoline areas, just like the Permian, Anadarko, and Williston Basins.

Lastly, the corporate supplies terminal companies, together with transporting and loading coal and know-how services.

Supply: Investor Presentation

On April twenty seventh, 2024, Alliance Useful resource Companions reported its Q1 and full 12 months outcomes. For the quarter, revenues declined by 1.7% year-over-year to $651.7 million.

Decrease revenues had been primarily the results of decrease common coal gross sales costs, partially offset by greater oil & gasoline royalties and different revenues. Web revenue got here in at $158.1 million, or $1.21 per unit, in comparison with $191.2 million, or $1.45 per unit final 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on ARLP (preview of web page 1 of three proven under):

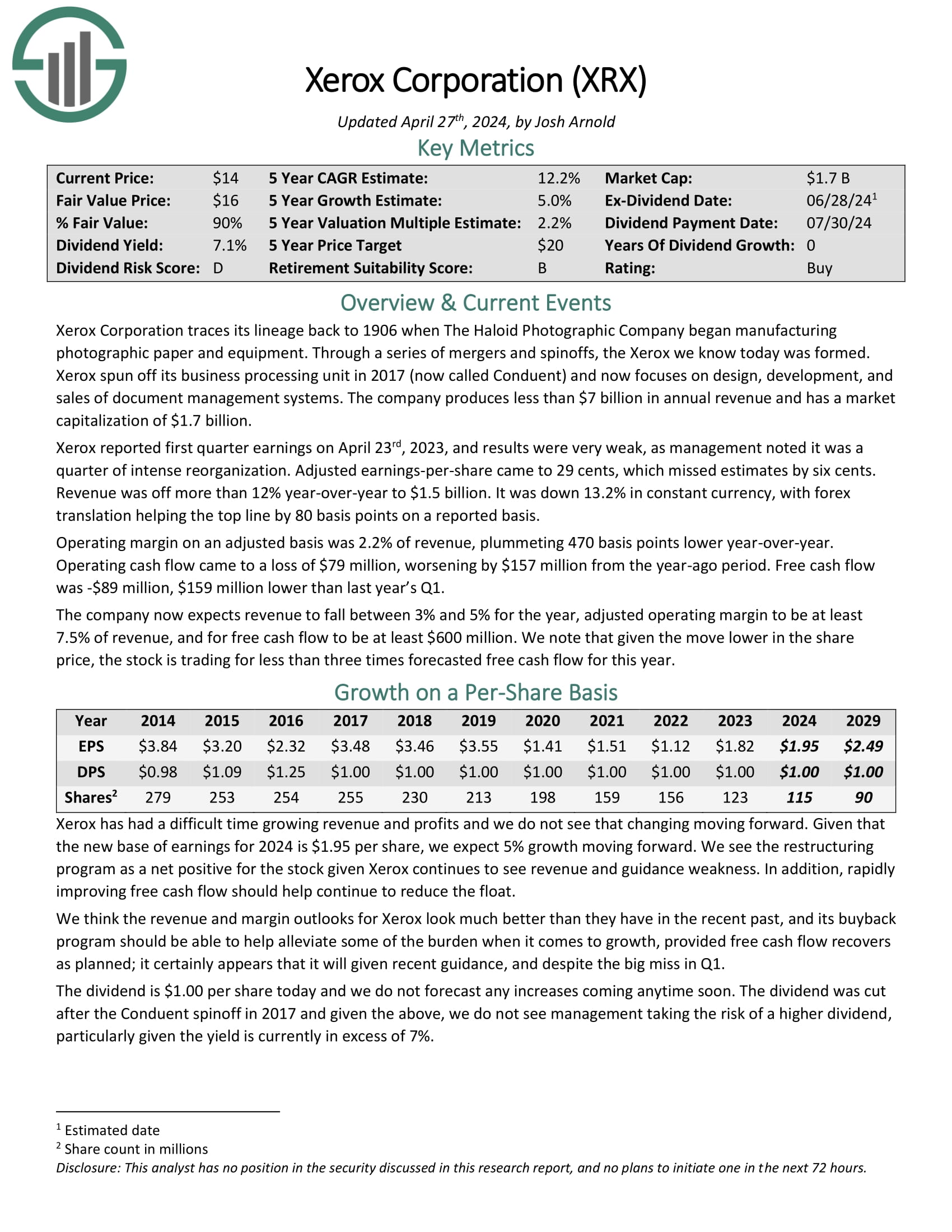

Undervalued Excessive Dividend Inventory #19: Xerox Holding (XRX) – P/E ratio of 6.0

Xerox is a know-how firm that designs, develops, and sells a variety of enterprise options in america and around the globe.

Its choices embrace shade and multi-function printers, digital printing presses, digital companies for workflow automation, content material administration options, and extra.

From a comparatively hardware-focused firm, Xerox has developed right into a extra diversified enterprise over time, including software program and companies segments through natural enlargement and acquisitions.

Consequently, non-equipment income contributes most of Xerox’s gross sales right now:

Supply: Investor Presentation

In the newest quarter, Xerox reported revenues of $1.5 billion, which was a 12.4% lower year-over-year and decrease by 13.2% in fixed foreign money. Overseas change translations helped the top-line by 80 foundation factors on a reported foundation.

Click on right here to obtain our most up-to-date Certain Evaluation report on XRX (preview of web page 1 of three proven under):

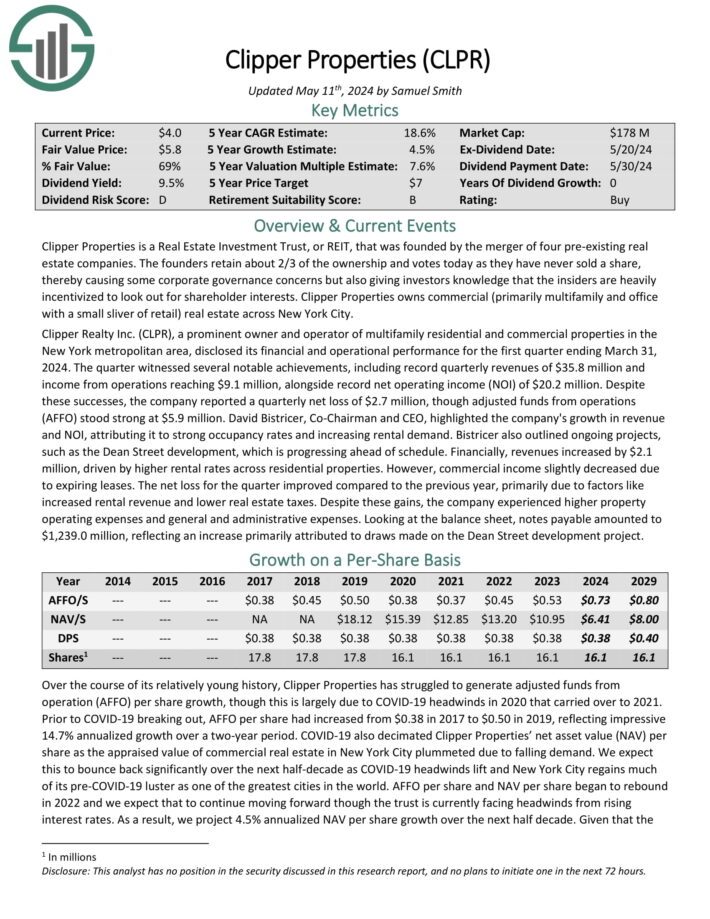

Undervalued Excessive Dividend Inventory #20: Clipper Realty (CLPR) – P/E ratio of 6.2

Clipper Properties owns industrial (primarily multifamily and workplace with a small sliver of retail) actual property throughout New York Metropolis.

For the primary quarter ending March 31, 2024, CLPR reported document quarterly income of $35.8 million and revenue from operations reaching $9.1 million, alongside document web working revenue (NOI) of $20.2 million.

Regardless of this, the corporate reported a quarterly web lack of $2.7 million, although adjusted funds from operations (AFFO) stood sturdy at $5.9 million.

Income elevated by $2.1 million, pushed by greater rental charges throughout residential properties. Nevertheless, industrial revenue barely decreased as a result of expiring leases.

The online loss for the quarter improved in comparison with the earlier 12 months, primarily as a result of components like elevated rental income and decrease actual property taxes.

Click on right here to obtain our most up-to-date Certain Evaluation report on CLPR (preview of web page 1 of three proven under):

Closing Ideas

All of the above shares are buying and selling at remarkably low cost valuation ranges as a result of some enterprise headwinds. A few of them have been harm by excessive inflation or the newest financial slowdown whereas others are going through their very own particular points.

Furthermore, all of the above shares are providing dividend yields above 5%. Thus, they make it a lot simpler for traders to attend patiently for the enterprise headwinds to subside.

If you’re curious about discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Certain Dividend assets will likely be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link