[ad_1]

Kwanchanok Taen-on

As a lot of my loyal followers and readers know, I’m an enormous fan of the online lease juggernaut often known as Realty Revenue (O).

I’ve been a shareholder within the San Diego-based REIT for over a decade, and I’ve witnessed the evolution of the corporate – from a small landlord to Taco Bell to a big web lease consolidator with over 15,500 properties in all 50 states and Europe.

Based mostly on fundamentals, there may be little doubt that Realty Revenue deserves area in an clever REIT portfolio.

The stalwart REIT has paid and elevated its dividend for over 30 years in a row and has achieved 4.3% annualized dividend progress since 1994.

But, regardless of these spectacular statistics, Realty Revenue has change into the subject of debate over its dimension.

Some pundits argue that Realty Revenue is simply too large and that the corporate will not be capable to develop on the similar spectacular charge it has prior to now.

Whereas I disagree with this argument, I’ll save that for one more article.

As a substitute, I wished to deal with two terrific options that I’ve been allocating my hard-earned capital to.

Realty Revenue continues to be my largest REIT holding; nevertheless, these two REITs are gaining floor, and you will notice why primarily based on the analysis our workforce put collectively beneath.

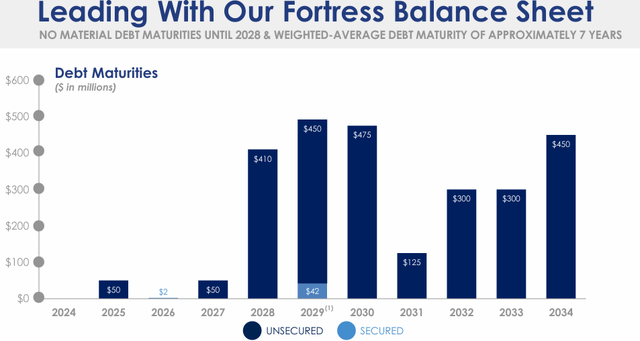

Agree Realty (ADC)

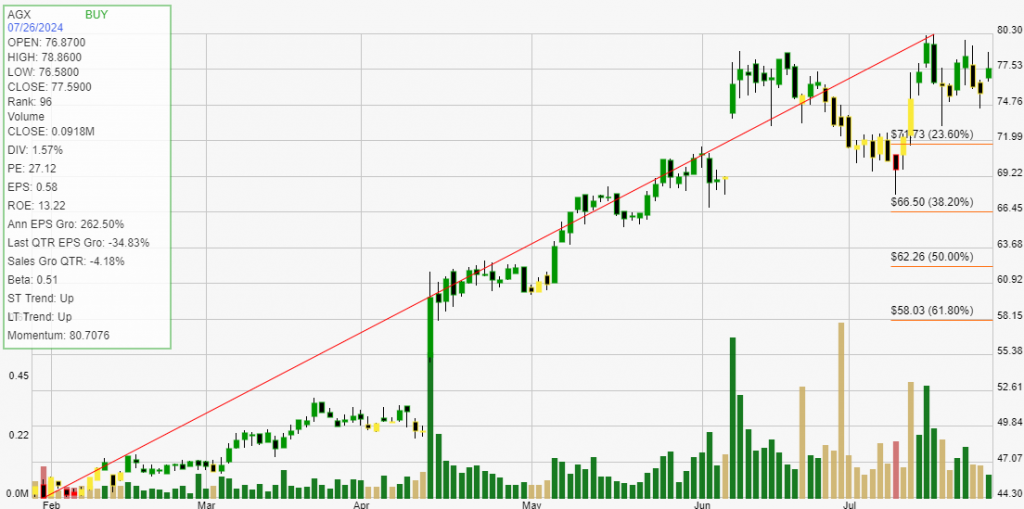

Agree Realty is an actual property funding belief (“REIT”) centered on the event and acquisition of freestanding industrial properties which might be web leased to main retailers.

ADC seems to be to develop and purchase properties utilized in retail industries which might be immune to e-commerce and resilient in opposition to recessions. To that finish, the corporate targets properties utilized by retailers that promote sturdy items, or that present necessity-based items & providers.

The corporate’s largest retail sector is grocers, which make up roughly 9.6% of its annualized base lease (“ABR”), adopted by house enchancment and auto service, which make up 9.2% and eight.0%, respectively.

Along with focusing on defensive retail industries, the corporate strategically seems to be for fungible properties that can be utilized throughout a number of retail sectors, somewhat than buying single-purpose belongings that require a specific sort of tenant, equivalent to a bowling alley or automobile wash.

The corporate additionally locations a considerable amount of emphasis on the standard of its properties and its tenants. The overwhelming majority of ADC’s tenants are nationwide or super-regional retailers, and roughly 68% of the corporate’s ABR is derived from tenants with an investment-grade credit standing.

ADC’s prime tenants are well-established and embrace high-quality firms equivalent to Kroger, TJX, Lowes, Dwelling Depot, Wawa, and 7-Eleven. The corporate’s largest tenant is Walmart, which makes up 5.8% of its ABR, adopted by Tractor Provide and Greenback Normal, which make up 4.9% and 4.7%, respectively.

Agree Realty has a market cap of roughly $6.8 billion and a forty five.8 million SF portfolio made up of two,202 retail properties positioned throughout 49 states.

On the finish of 2Q-24, the corporate’s portfolio was 99.8% leased and had a weighted common lease time period (“WALT”) of roughly 8.1 years.

ADC IR

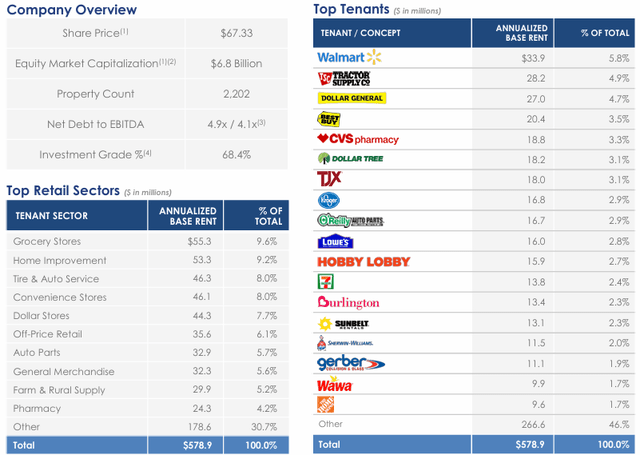

Along with its web lease portfolio, the corporate has a floor lease portfolio that consists of 223 leases positioned in 35 states that cowl roughly 6.1 million SF of gross leasable space.

Its floor lease portfolio is 100% occupied, has a WALT of roughly 10 years, and roughly 87.3% of the bottom lease ABR is generated by funding grade tenants. On the finish of 2Q-24, the corporate’s floor lease portfolio made up 11.3% of its complete portfolio ABR.

ADC IR

The corporate launched its 2Q-24 working leads to July and raised its full-year acquisition steering to roughly $700.0 million and its 2024 AFFO per share steering to $4.11 – $4.14.

Whole income throughout the quarter was reported at $152.6 million, in contrast with complete income of $130.0 million within the second quarter of 2023.

Core FFO throughout the second quarter was reported at $104.2 million, or $1.03 per share, in comparison with Core FFO of $91.4 million, or $0.98 per share in 2Q-23. On a per share foundation, the change in Core FFO represents a year-over-year improve of 5.7%.

AFFO in 2Q-24 got here in at $105.3 million, or $1.04 per share, in comparison with AFFO of $91.8 million, or $0.98 per share for the comparable interval in 2023. On a per share foundation, the change in AFFO represents a year-over-year improve of 6.4%.

2Q-24 acquisition quantity was roughly $185.8 million and consisted of 47 properties acquired at a weighted common cap charge of seven.7%. The acquisitions made within the second quarter have a WALT of ~9.3 years, and roughly 59% of the ABR acquired in 2Q-24 comes from funding grade tenants.

2Q-24 tendencies embrace 10 properties offered for roughly $36.9 million at a W.A. cap charge of 6.4%.

Capital market actions throughout the second quarter embrace a $450 million public bond providing the corporate accomplished with an efficient yield to maturity of 5.779%. ADC additionally obtained commitments to extend its credit score facility from $1.0 billion to $1.25 billion and entered into ahead sale agreements to promote 3.2 million shares of inventory for proceeds of $194.5 million.

On the finish of 2Q-24, Agree Realty had complete liquidity of greater than $1.4 billion which consisted of money, excellent ahead fairness, and undrawn capability underneath its revolving credit score facility.

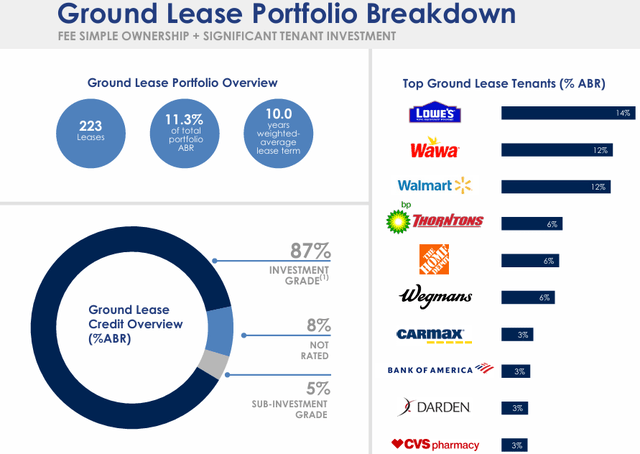

ADC supplied an replace on its monetary situation and reported web debt to EBITDA of 4.9x and a set cost protection ratio of 4.7x.

Moreover, the corporate has an funding grade steadiness sheet with a BBB credit standing and has no important debt maturities till 2028.

ADC IR

Agree Realty pays a month-to-month dividend and has a wonderful monitor document of consistency and progress.

From 1994 to 2020 the corporate paid dividends on a quarterly foundation and made 107 consecutive quarterly funds earlier than altering to a month-to-month dividend.

Because the change, ADC has made 42 consecutive month-to-month funds for a complete of 149 consecutive widespread dividends paid.

The corporate elevated its dividend annually between 2013 & 2023 and delivered a 10-year compound common dividend progress charge of roughly 6% over this era.

ADC managed to extend its dividend annually over the previous decade whereas sustaining a median AFFO dividend payout ratio of 76%, which is a conservative degree and simply covers the dividend.

ADC IR

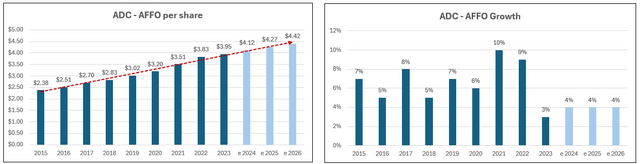

ADC’s dividend is supported by its investment-grade steadiness sheet and the consistency of its earnings. The corporate has delivered optimistic AFFO per share progress in annually between 2015 and 2023 and has achieved a blended common AFFO progress charge of 5.91% over this era.

Analysts anticipate AFFO per share to extend by 4% in 2024 after which improve by 4% in each 2025 & 2026.

FAST Graphs (compiled by iREIT)

Agree Realty has arguably the best high quality portfolio and tenant base within the web lease area.

The corporate has a wonderful administration workforce with a transparent imaginative and prescient and outlined technique of proudly owning and leasing fungible industrial properties to prime retailers in defensive industries.

ADC has an funding grade steadiness sheet with wonderful debt metrics, and its month-to-month dividend is supported by the regular and reliable money flows generated by over 2,000 properties.

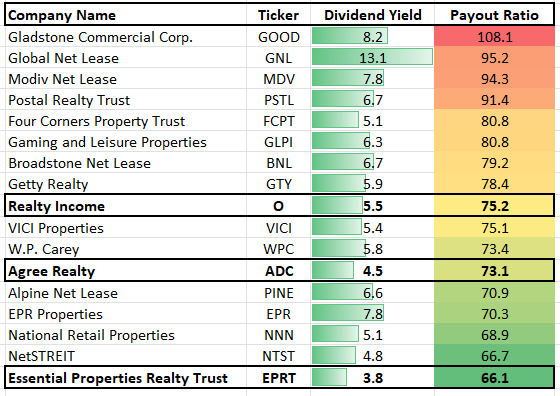

Agree Realty pays a 4.42% dividend yield that’s properly lined with a 2023 AFFO payout ratio of 73.90% and its inventory is presently buying and selling at a P/AFFO of 16.78x, in comparison with its common AFFO a number of of 18.52x.

We charge Agree Realty a Purchase.

FAST Graphs

Important Properties Realty Belief (EPRT)

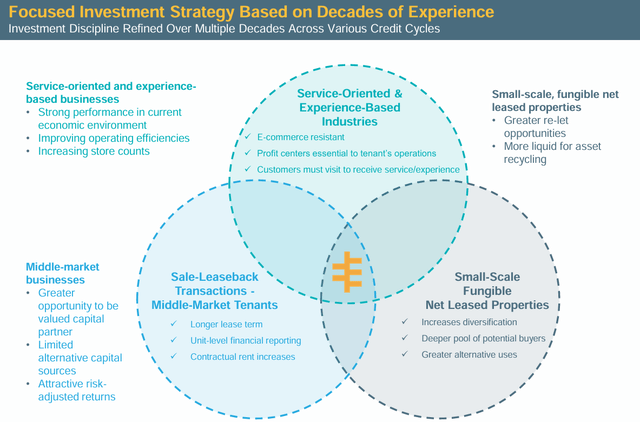

EPRT is a web lease REIT that makes a speciality of the acquisition, possession, and administration of single-tenant industrial properties that are leased to middle-market firms that function in service-oriented and experienced-based companies.

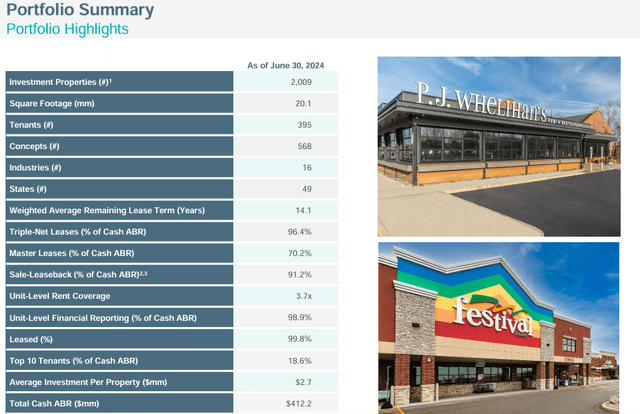

The corporate has a market cap of roughly $5.3 billion and a 20.1 million SF portfolio made up of two,009 properties which might be leased to 395 tenants working in 16 industries throughout 49 states.

EPRT focuses on middle-market firms that present a service or provide an expertise. A number of the industries it targets embrace eating places, each fast service and household eating, automobile washes, medical providers, dental providers, automotive providers, early childhood training, comfort shops, and well being & health.

The corporate’s largest trade is automobile washes which symbolize 15.1% of its portfolio, adopted by early childhood training and medical/dental places of work which symbolize 11.3% and 10.9%, respectively.

The online lease REIT believes that properties leased to service-oriented and experience-based operators are important for the success and viability of the tenant’s enterprise. instance of this can be a automobile wash operator. With out actual property, no automobiles might get washed.

Moreover, by their very nature, service-oriented and experienced-based sorts of companies are usually extra insulated from the specter of e-commerce. On the finish of 2023, roughly 93% of the corporate’s ABR was derived from tenants working in service or experienced-based companies.

As of the tip of the second quarter, the corporate’s portfolio was 99.8% leased and had a WALT of 14.1 years.

EPRT IR

Nearly all of EPRT’s investments are acquired via using a sale-leaseback construction, somewhat than whole portfolio purchases or new building.

The corporate’s sale-leaseback construction allows it to incorporate favorable phrases equivalent to base lease escalation, necessities for unit-level reporting, and in some circumstances, necessities for corporate-level monetary statements.

On the finish of 2023, 98.8% of EPRT’s investments had been made via a sale-leaseback construction.

Unit-level reporting is crucial to mitigate threat, as EPRT’s focus is on middle-market or smaller firms with out the identical credit score or sources as nationwide retailers. By together with necessities for unit-level reporting, EPRT is ready to higher entry the well being of its tenants.

On the finish of 2023, EPRT’s portfolio had a weighted common lease protection ratio of three.8x and 98.8% of its leases included the requirement to supply unit-level monetary reporting.

EPRT IR

Important Properties launched its 2Q-24 working leads to July and reported complete income throughout the quarter of $109.3 million, in comparison with complete income of $86.5 million within the second quarter of 2023.

Core FFO throughout 2Q-24 was reported at $84.2 million, or $0.47 per share, in comparison with Core FFO of $66.2 million, or $0.44 per share for the comparable interval in 2023. On a per share foundation, the change in Core FFO represents a year-over-year improve of seven%.

AFFO throughout the second quarter was reported at $77.1 million, or $0.43 per share, in comparison with AFFO of $61.9 million, or $0.41 per share in 2Q-23. On a per share foundation, the change in AFFO represents a year-over-year improve of 5%.

2Q-24 acquisition quantity was roughly $333.9 million and consisted of 83 properties acquired at a weighted common money cap charge of 8.0%.

The acquisitions made within the second quarter have a weighted common lease escalation of 1.9% and a WALT of 17.8 years.

76% of the 2Q investments are topic to a grasp lease, 100% of the investments had been made via sale-leaseback transactions, and 100% of the 2Q leases require monetary reporting.

2Q-24 tendencies embrace 6 properties offered for roughly $4.8 million at a W.A. money cap charge of seven.3%.

Important Properties supplied an replace on its monetary place and reported web debt to adjusted EBITDAre of 4.6x, or 3.6x on a professional forma foundation, a set cost protection ratio of 5.9x, and complete obtainable liquidity of $698.2 million, which incorporates money and equivalents, revolver capability, and unsettled ahead fairness.

EPRT has an funding grade steadiness sheet with a BBB- credit standing from S&P International. The corporate’s asset base is 100% unencumbered with no safe debt, and all of its debt is fastened charge.

The corporate’s debt carries a W.A. rate of interest of three.6% and has a W.A. time period to maturity of 4.7 years, with no debt maturities till 2027.

EPRT IR

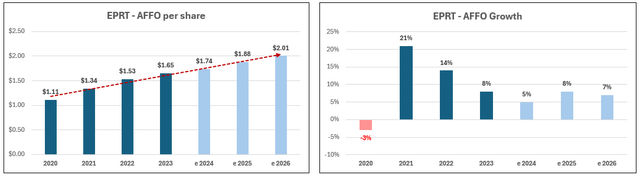

EPRT has delivered a blended common AFFO progress charge of 8.44% and a median dividend progress charge of 6.22% over the previous 5 years.

AFFO per share fell by -3% in 2020, however the firm generated optimistic AFFO per share progress annually since. In 2023, the corporate’s AFFO per share grew by 8% and analysts anticipate AFFO per share to extend by 5% in 2024, after which by 8% the next yr.

FAST Graphs (compiled by iREIT)

EPRT pays a 3.87% dividend yield that’s safe with a 2023 AFFO payout ratio of 67.88% and its inventory is buying and selling at a P/AFFO of 17.62x, in comparison with its common AFFO a number of of 18.70x.

We charge Important Properties Realty Belief a Purchase.

FAST Graphs

In Closing

I’m obese web lease REITs.

Which merely implies that I’ve positions in all of those REITs:

Realty Revenue Agree Realty Important Properties VICI Properties (VICI) Getty Realty (GTY)

Not directly I additionally personal shares in Broadstone Web Lease (BNL), Gaming and Leisure (GLPI), and NNN REIT (NNN) through my stake in my REIT ETF.

Given the extremely fragmented orientation throughout the Web Lease REIT sector, I imagine that this common earnings various will ship regular investor returns because of continued consolidation.

As well as, the bigger REITs will capitalize on the abundance of sale-leaseback alternatives that may be sourced off the steadiness sheets of bigger firms like Tractor Provide (TSCO) and 7-Eleven.

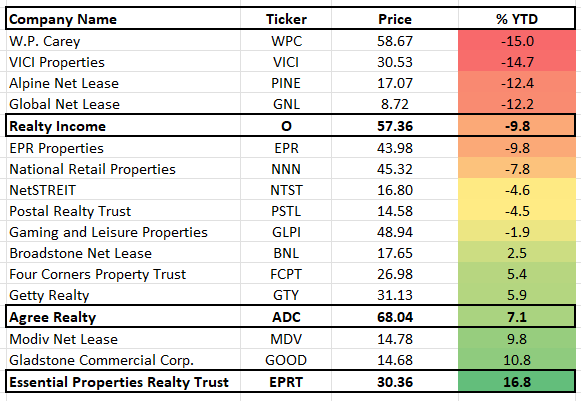

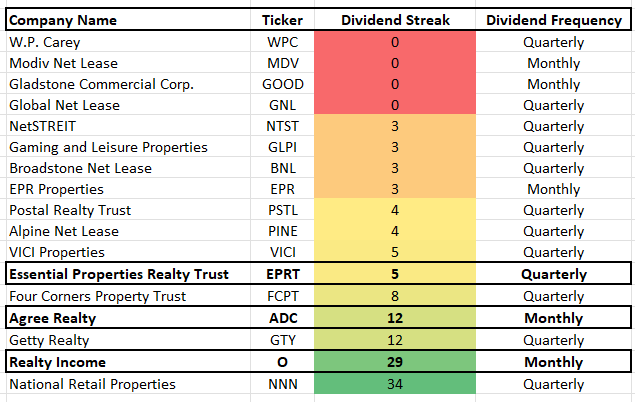

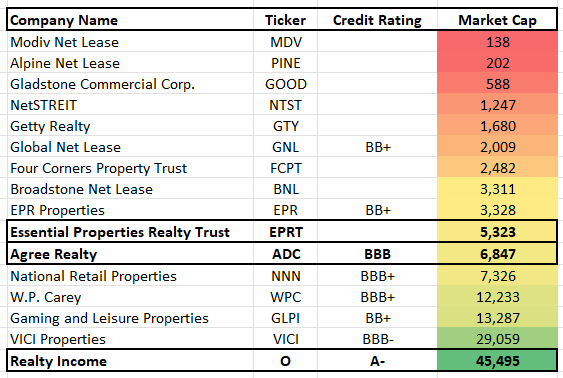

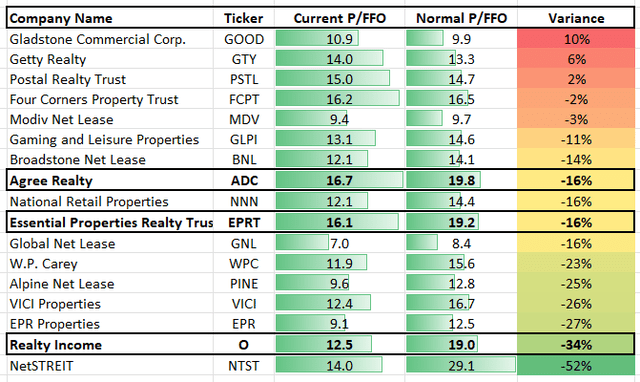

Now let’s study the Information Duel:

iREIT®

iREIT®

iREIT®

iREIT®

iREIT®

[ad_2]

Source link